A Company Owns Equipment For Which It Paid $90 Million

A Company Owns Equipment For Which It Paid $90 Million - A company owns equipment for which it paid $90 million. An impairment loss is recognized when the carrying amount of an asset exceeds its. Owns equipment, which it paid $90 million. According to the given case study, fryer co. Owns equipment for which it paid $90 million. A company owns equipment for which it paid $90 million. At the end of 2024, it had accumulated depreciation on the equipment of $27 million. A company owns equipment for which it paid $90 million. At the end of 2024, it had accumulated depreciation on the equipment of $27 million. B) would record a $3 million.

B) would record a $3 million. Owns equipment, which it paid $90 million. At the end of 2024, it had accumulated depreciation on the equipment of $27 million. A company owns equipment for which it paid $90 million. At the end of 2024, it had accumulated depreciation on the equipment of $27 million. At the end of 2024 , it had accumulated depreciation on the equipment of $27 million. Owns equipment for which it paid $90 million. An impairment loss is recognized when the carrying amount of an asset exceeds its. Based on the information provided, the company would report a $23 million impairment loss on the equipment. According to the given case study, fryer co.

A company owns equipment for which it paid $90 million. At the end of 2025, accumulated depreciation on the equipment was $27 million. A company owns equipment for which it paid $90 million. A) would record no impairment loss on the equipment. At the end of 2023, it had accumulated. At the end of 2024 , it had accumulated depreciation on the equipment of $27 million. Owns equipment, which it paid $90 million. Owns equipment for which it paid $90 million. Based on the information provided, the company would report a $23 million impairment loss on the equipment. B) would record a $3 million.

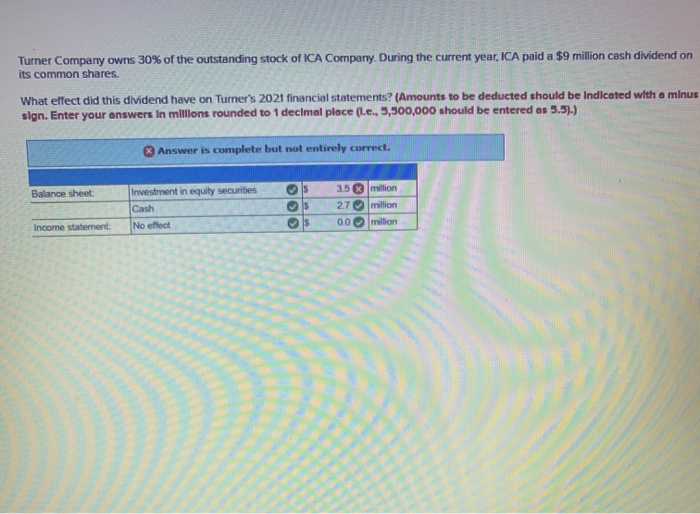

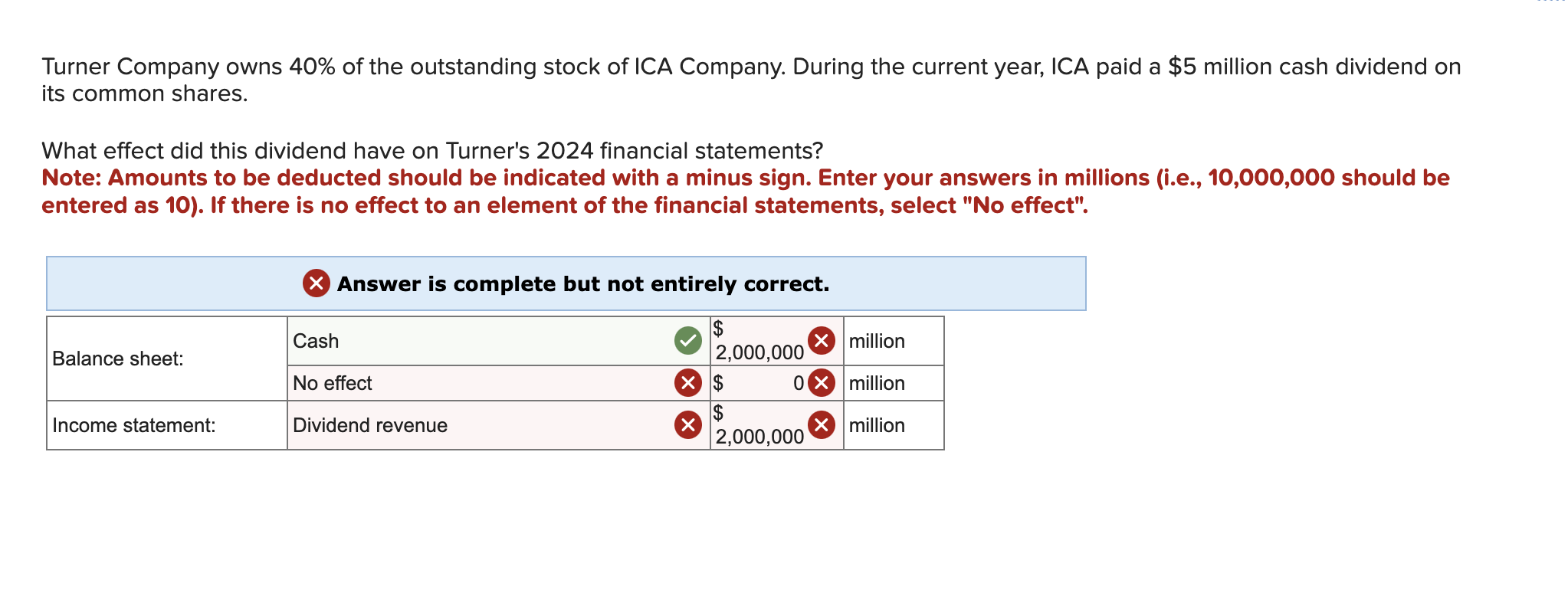

Solved Turner Company owns 30 of the outstanding stock of

According to the given case study, fryer co. A $23 million impairment loss on the equipment. At the end of 2024, it had accumulated depreciation on the equipment of $27 million. At the end of 2024, it had accumulated depreciation on the equipment of $27 million. Owns equipment, which it paid $90 million.

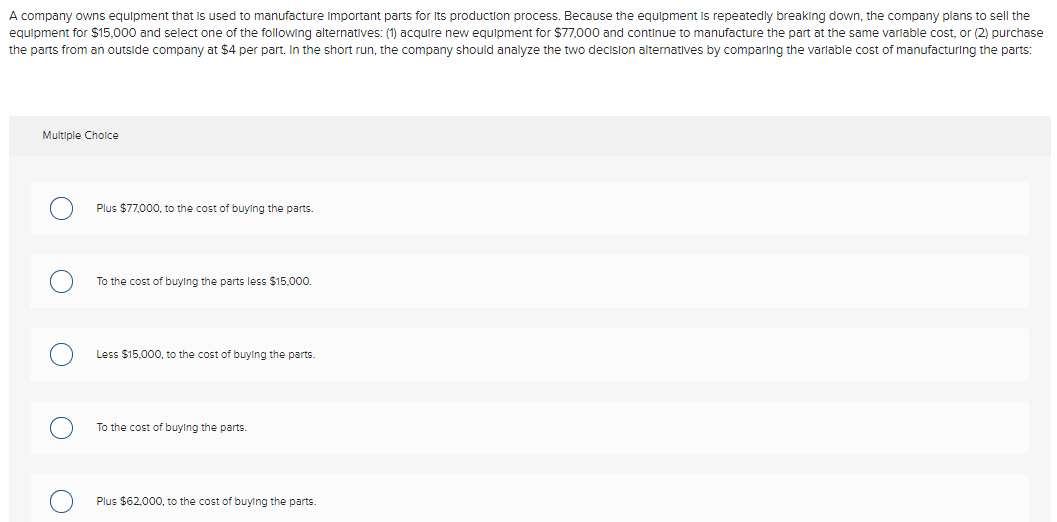

Solved A company owns equipment that is used to manufacture

According to the given case study, fryer co. An impairment loss is recognized when the carrying amount of an asset exceeds its. Owns equipment for which it paid $90 million. A) would record no impairment loss on the equipment. At the end of 2023, it had accumulated.

Solved Swifty Company owns specialized equipment that was

At the end of 2025, accumulated depreciation on the equipment was $27 million. A company owns equipment for which it paid $90 million. Owns equipment, which it paid $90 million. According to the given case study, fryer co. At the end of 2024 , it had accumulated depreciation on the equipment of $27 million.

[Solved] . 8 Garcia Company owns equipment that cost 81,200, with

An impairment loss is recognized when the carrying amount of an asset exceeds its. At the end of 2024, it had accumulated depreciation on the equipment of $27 million. A $23 million impairment loss on the equipment. At the end of 2024 , it had accumulated depreciation on the equipment of $27 million. A company owns equipment for which it.

Solved Turner Company owns 40 of the outstanding stock of

A company owns equipment for which it paid $90 million. B) would record a $3 million. At the end of 2024 , it had accumulated depreciation on the equipment of $27 million. At the end of 2025, accumulated depreciation on the equipment was $27 million. At the end of 2023, it had accumulated.

[Solved] Garcia Company owns equipment that cost 84,000, with

At the end of 2024, it had accumulated depreciation on the equipment of $27 million. According to the given case study, fryer co. At the end of 2024, it had accumulated depreciation on the equipment of $27 million. At the end of 2023, it had accumulated. Owns equipment, which it paid $90 million.

[Solved] Help. Sunland Company owns equipment that cost 125,000 when

A company owns equipment for which it paid $90 million. Owns equipment for which it paid $90 million. Based on the information provided, the company would report a $23 million impairment loss on the equipment. At the end of 2025, accumulated depreciation on the equipment was $27 million. At the end of 2024, it had accumulated depreciation on the equipment.

[Solved] Oriole Company owns equipment that cost 60,900 w

A) would record no impairment loss on the equipment. A company owns equipment for which it paid $90 million. Owns equipment for which it paid $90 million. According to the given case study, fryer co. Owns equipment for which it paid $90 million.

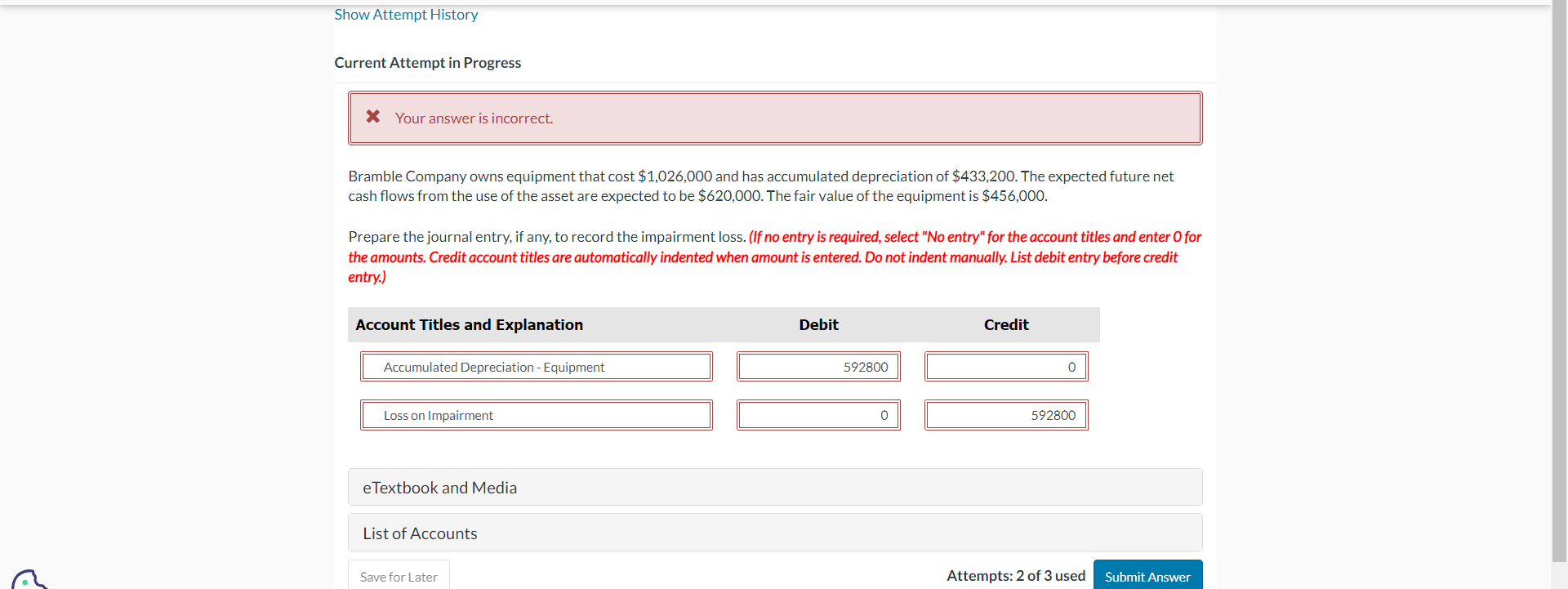

Solved Bramble Company owns equipment that cost 1,026,000

At the end of 2025, accumulated depreciation on the equipment was $27 million. According to the given case study, fryer co. B) would record a $3 million. A company owns equipment for which it paid $90 million. Owns equipment for which it paid $90 million.

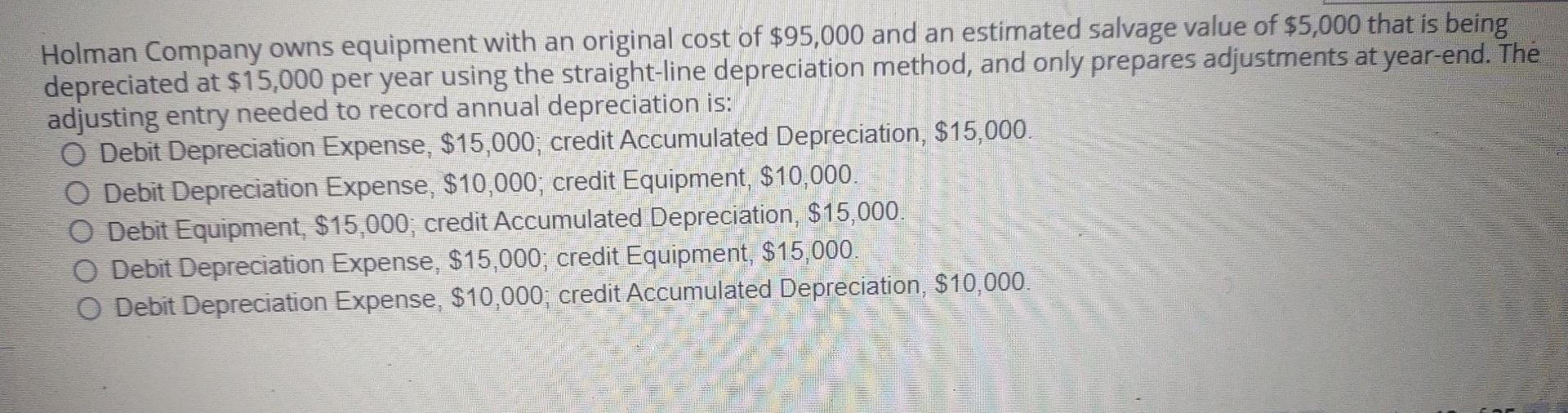

Solved Holman Company owns equipment with an original cost

Based on the information provided, the company would report a $23 million impairment loss on the equipment. At the end of 2025, accumulated depreciation on the equipment was $27 million. At the end of 2024, it had accumulated depreciation on the equipment of $27 million. A company owns equipment for which it paid $90 million. According to the given case.

Owns Equipment, Which It Paid $90 Million.

A company owns equipment for which it paid $90 million. A company owns equipment for which it paid $90 million. A) would record no impairment loss on the equipment. At the end of 2025, accumulated depreciation on the equipment was $27 million.

At The End Of 2024, It Had Accumulated Depreciation On The Equipment Of $27 Million.

Owns equipment for which it paid $90 million. Owns equipment for which it paid $90 million. At the end of 2023, it had accumulated. According to the given case study, fryer co.

A Company Owns Equipment For Which It Paid $90 Million.

Based on the information provided, the company would report a $23 million impairment loss on the equipment. At the end of 2024 , it had accumulated depreciation on the equipment of $27 million. A $23 million impairment loss on the equipment. An impairment loss is recognized when the carrying amount of an asset exceeds its.

B) Would Record A $3 Million.

At the end of 2024, it had accumulated depreciation on the equipment of $27 million.

![[Solved] Oriole Company owns equipment that cost 60,900 w](https://media.cheggcdn.com/study/d0d/d0d29f31-cc79-4a62-95cd-3c4a5a40e58b/image)