Refunds Received For State/Local Tax Returns Meaning

Refunds Received For State/Local Tax Returns Meaning - If you transferred last year’s tax data to this year's return, your state and local refunds are automatically brought over with your other tax. If you claimed the standard deduction last year on your federal tax return, any state or local refund you received is not taxable and you don’t have. If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include.

If you transferred last year’s tax data to this year's return, your state and local refunds are automatically brought over with your other tax. If you claimed the standard deduction last year on your federal tax return, any state or local refund you received is not taxable and you don’t have. If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include.

If you claimed the standard deduction last year on your federal tax return, any state or local refund you received is not taxable and you don’t have. If you transferred last year’s tax data to this year's return, your state and local refunds are automatically brought over with your other tax. If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include.

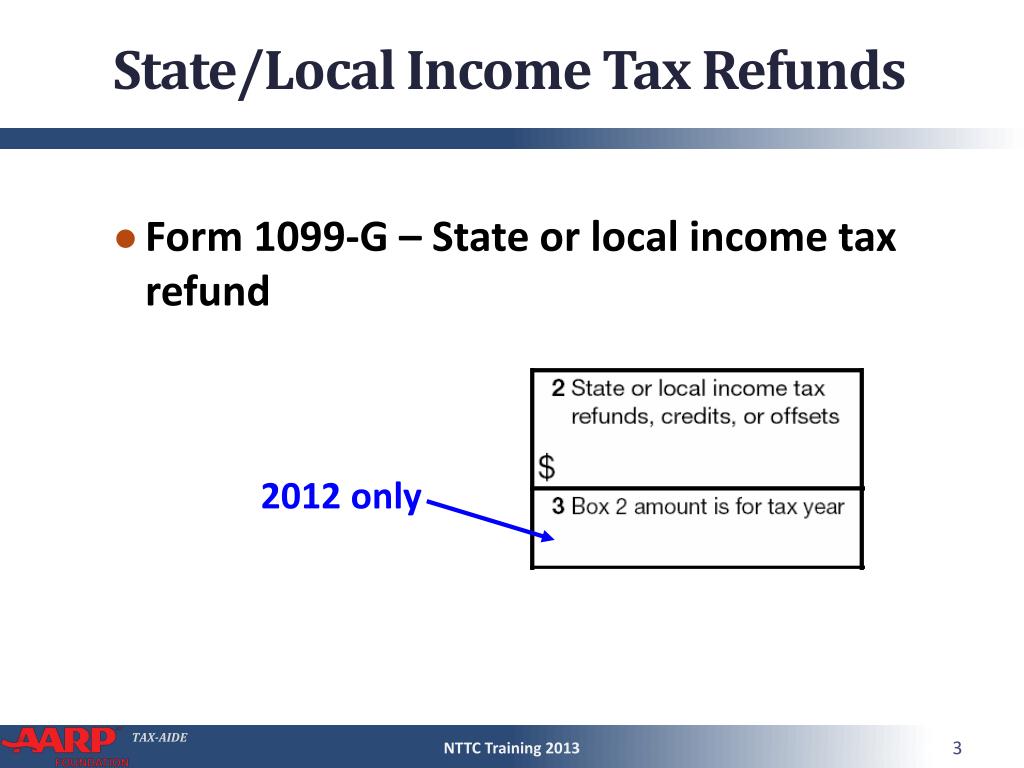

PPT State/Local Tax Refunds PowerPoint Presentation, free

If you claimed the standard deduction last year on your federal tax return, any state or local refund you received is not taxable and you don’t have. If you transferred last year’s tax data to this year's return, your state and local refunds are automatically brought over with your other tax. If you receive a refund of (or credit for).

When Will Tax Returns Be Sent Out 2025 Alene Karina

If you transferred last year’s tax data to this year's return, your state and local refunds are automatically brought over with your other tax. If you claimed the standard deduction last year on your federal tax return, any state or local refund you received is not taxable and you don’t have. If you receive a refund of (or credit for).

Hello! I don't understand why is " Refunds received for state/local tax

If you transferred last year’s tax data to this year's return, your state and local refunds are automatically brought over with your other tax. If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include. If you claimed the standard deduction.

PPT State/Local Tax Refunds PowerPoint Presentation, free

If you transferred last year’s tax data to this year's return, your state and local refunds are automatically brought over with your other tax. If you claimed the standard deduction last year on your federal tax return, any state or local refund you received is not taxable and you don’t have. If you receive a refund of (or credit for).

PPT State/Local Tax Refunds PowerPoint Presentation, free

If you transferred last year’s tax data to this year's return, your state and local refunds are automatically brought over with your other tax. If you claimed the standard deduction last year on your federal tax return, any state or local refund you received is not taxable and you don’t have. If you receive a refund of (or credit for).

Chart How Americans Spend Their Tax Refunds Statista

If you claimed the standard deduction last year on your federal tax return, any state or local refund you received is not taxable and you don’t have. If you transferred last year’s tax data to this year's return, your state and local refunds are automatically brought over with your other tax. If you receive a refund of (or credit for).

Tax refunds 2019 Here’s why yours may be smaller, or why you may owe

If you claimed the standard deduction last year on your federal tax return, any state or local refund you received is not taxable and you don’t have. If you transferred last year’s tax data to this year's return, your state and local refunds are automatically brought over with your other tax. If you receive a refund of (or credit for).

Accounting For Refunds Received PurchaseControl Software

If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include. If you claimed the standard deduction last year on your federal tax return, any state or local refund you received is not taxable and you don’t have. If you transferred.

UNITED WAY VITA PROGRAM BRINGS 6.5 MILLION IN TAX REFUNDS CapeStyle

If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include. If you transferred last year’s tax data to this year's return, your state and local refunds are automatically brought over with your other tax. If you claimed the standard deduction.

How Do I Know If IRS Received My Tax Returns? XOA TAX

If you transferred last year’s tax data to this year's return, your state and local refunds are automatically brought over with your other tax. If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include. If you claimed the standard deduction.

If You Transferred Last Year’s Tax Data To This Year's Return, Your State And Local Refunds Are Automatically Brought Over With Your Other Tax.

If you claimed the standard deduction last year on your federal tax return, any state or local refund you received is not taxable and you don’t have. If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include.