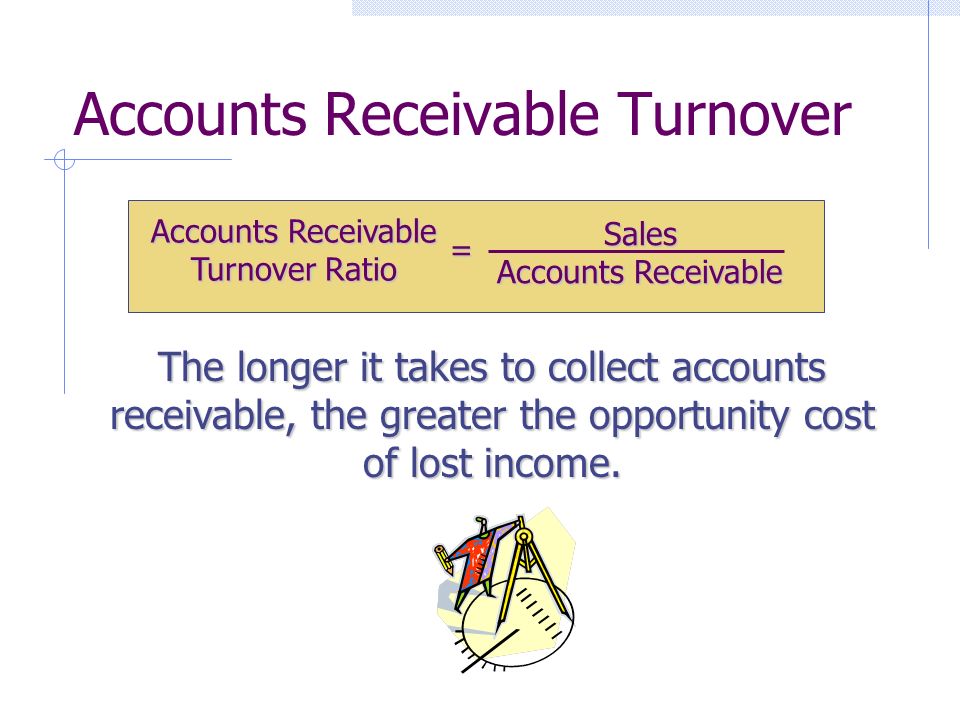

Accounts Receivable Turnover Ratio Meaning

Accounts Receivable Turnover Ratio Meaning - Accounts receivable (ar) turnover measures how many times in a given period a company turns its receivables into cash. What is the accounts receivable turnover ratio? This value may also be referred to as. It is a quantification of a. The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance. The accounts receivable turnover ratio, or receivables turnover, is used in business accounting to quantify how well companies are managing the credit that they extend to their. The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures how efficiently a company is. The receivable turnover ratio, otherwise known as the debtor’s turnover ratio, is a measure of how quickly a company collects its outstanding accounts receivables. What is accounts receivable turnover?

The accounts receivable turnover ratio, or receivables turnover, is used in business accounting to quantify how well companies are managing the credit that they extend to their. The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures how efficiently a company is. What is the accounts receivable turnover ratio? The receivable turnover ratio, otherwise known as the debtor’s turnover ratio, is a measure of how quickly a company collects its outstanding accounts receivables. It is a quantification of a. This value may also be referred to as. The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance. Accounts receivable (ar) turnover measures how many times in a given period a company turns its receivables into cash. What is accounts receivable turnover?

What is the accounts receivable turnover ratio? The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures how efficiently a company is. This value may also be referred to as. Accounts receivable (ar) turnover measures how many times in a given period a company turns its receivables into cash. The receivable turnover ratio, otherwise known as the debtor’s turnover ratio, is a measure of how quickly a company collects its outstanding accounts receivables. The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance. It is a quantification of a. The accounts receivable turnover ratio, or receivables turnover, is used in business accounting to quantify how well companies are managing the credit that they extend to their. What is accounts receivable turnover?

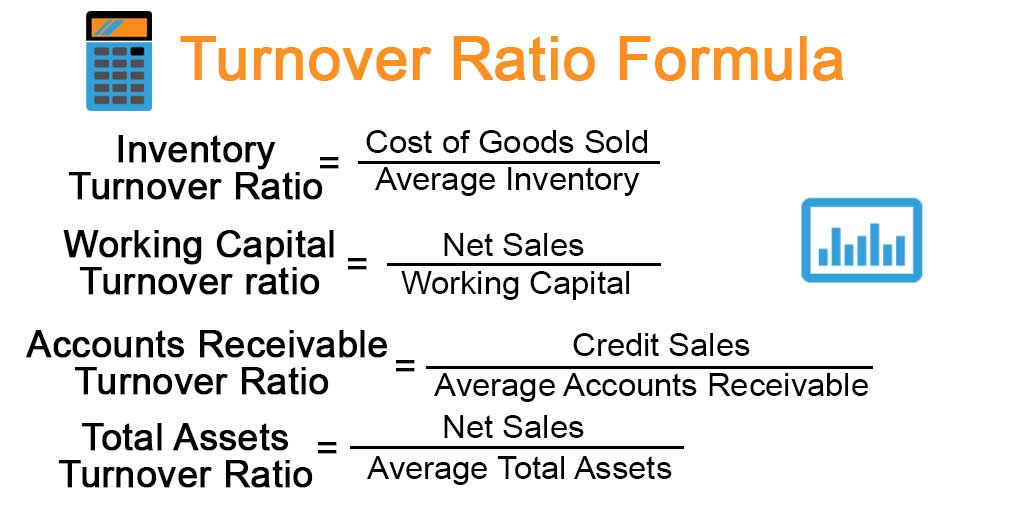

Turnover Ratio Formula Example with Excel Template

This value may also be referred to as. The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance. What is the accounts receivable turnover ratio? It is a quantification of a. Accounts receivable (ar) turnover measures how many times in a given period a company turns its receivables into cash.

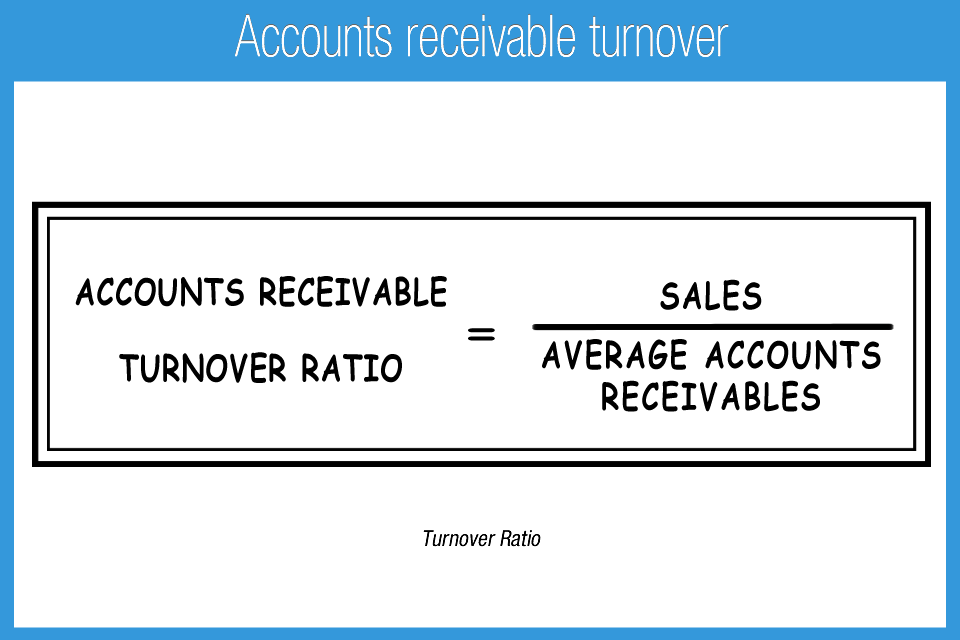

Accounts Receivable Turnover Ratio Accounting Play

The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures how efficiently a company is. The receivable turnover ratio, otherwise known as the debtor’s turnover ratio, is a measure of how quickly a company collects its outstanding accounts receivables. What is the accounts receivable turnover ratio? It is a quantification of a..

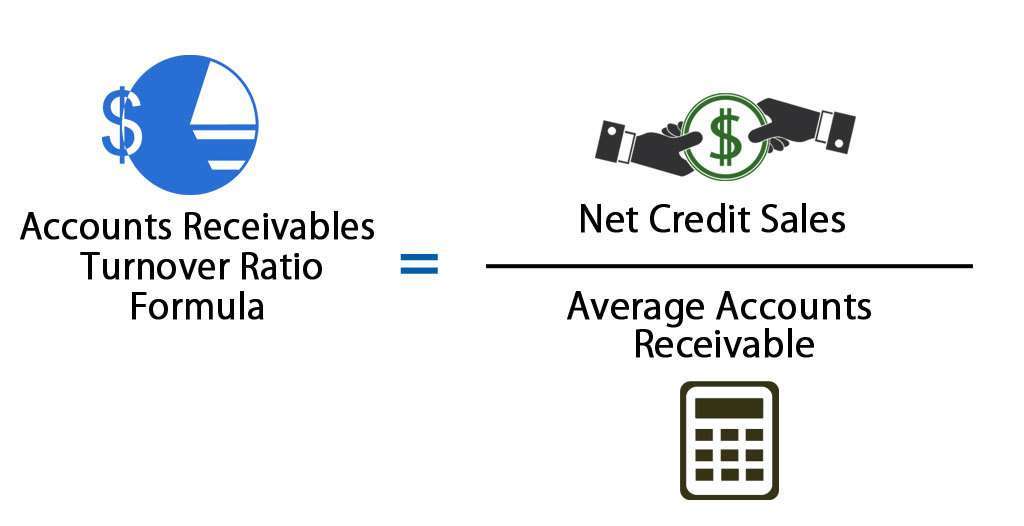

Accounts receivable turnover Accounting Play

The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance. The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures how efficiently a company is. What is the accounts receivable turnover ratio? Accounts receivable (ar) turnover measures how many times in a given period.

Accounts receivable turnover ratio What you need to know Billtrust

This value may also be referred to as. The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures how efficiently a company is. The receivable turnover ratio, otherwise known as the debtor’s turnover ratio, is a measure of how quickly a company collects its outstanding accounts receivables. Accounts receivable (ar) turnover measures.

Receivable Turnover Ratio Definition, and Formula Finance Strategists

What is the accounts receivable turnover ratio? The accounts receivable turnover ratio, or receivables turnover, is used in business accounting to quantify how well companies are managing the credit that they extend to their. It is a quantification of a. The receivable turnover ratio, otherwise known as the debtor’s turnover ratio, is a measure of how quickly a company collects.

Receivable Turnover Ratio Definition and Calculation BooksTime

The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance. The accounts receivable turnover ratio, or receivables turnover, is used in business accounting to quantify how well companies are managing the credit that they extend to their. Accounts receivable (ar) turnover measures how many times in a given period a company turns.

Receivable Turnover

Accounts receivable (ar) turnover measures how many times in a given period a company turns its receivables into cash. This value may also be referred to as. What is the accounts receivable turnover ratio? The receivable turnover ratio, otherwise known as the debtor’s turnover ratio, is a measure of how quickly a company collects its outstanding accounts receivables. It is.

change in working capital formula investopedia Provide A Good Blogger

What is the accounts receivable turnover ratio? This value may also be referred to as. It is a quantification of a. The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures how efficiently a company is. Accounts receivable (ar) turnover measures how many times in a given period a company turns its.

Understanding Accounts Receivables Turnover Ratio

This value may also be referred to as. What is accounts receivable turnover? What is the accounts receivable turnover ratio? The receivable turnover ratio, otherwise known as the debtor’s turnover ratio, is a measure of how quickly a company collects its outstanding accounts receivables. It is a quantification of a.

Accounts Receivable Turnover Get the allImportant Details Here!

The accounts receivable turnover ratio, or receivables turnover, is used in business accounting to quantify how well companies are managing the credit that they extend to their. It is a quantification of a. What is accounts receivable turnover? The receivable turnover ratio, otherwise known as the debtor’s turnover ratio, is a measure of how quickly a company collects its outstanding.

What Is Accounts Receivable Turnover?

The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures how efficiently a company is. What is the accounts receivable turnover ratio? The accounts receivable turnover ratio, or receivables turnover, is used in business accounting to quantify how well companies are managing the credit that they extend to their. Accounts receivable (ar) turnover measures how many times in a given period a company turns its receivables into cash.

This Value May Also Be Referred To As.

It is a quantification of a. The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance. The receivable turnover ratio, otherwise known as the debtor’s turnover ratio, is a measure of how quickly a company collects its outstanding accounts receivables.

:max_bytes(150000):strip_icc()/receivableturnoverratio-final-803376348e8642b1a50c7b422dce27b5.png)