Adjustment Correction Of Posted Item Meaning Bank Of America

Adjustment Correction Of Posted Item Meaning Bank Of America - If the manager can call the bank where the check came from to verify the legitimacy of the check, the manager may be able to remove the hold. The bank you deposit the check into actually does not know if the check has cleared or not. The adjustment/correction/statement of posted item is a standard procedure employed by bank of. Most checks that have some kind of issue get.

The adjustment/correction/statement of posted item is a standard procedure employed by bank of. Most checks that have some kind of issue get. The bank you deposit the check into actually does not know if the check has cleared or not. If the manager can call the bank where the check came from to verify the legitimacy of the check, the manager may be able to remove the hold.

The adjustment/correction/statement of posted item is a standard procedure employed by bank of. Most checks that have some kind of issue get. If the manager can call the bank where the check came from to verify the legitimacy of the check, the manager may be able to remove the hold. The bank you deposit the check into actually does not know if the check has cleared or not.

Bank of America logo PNG Icon free download

The bank you deposit the check into actually does not know if the check has cleared or not. The adjustment/correction/statement of posted item is a standard procedure employed by bank of. Most checks that have some kind of issue get. If the manager can call the bank where the check came from to verify the legitimacy of the check, the.

Bank of America's Adjustment/Correction/Statement of Posted Item What

Most checks that have some kind of issue get. The bank you deposit the check into actually does not know if the check has cleared or not. The adjustment/correction/statement of posted item is a standard procedure employed by bank of. If the manager can call the bank where the check came from to verify the legitimacy of the check, the.

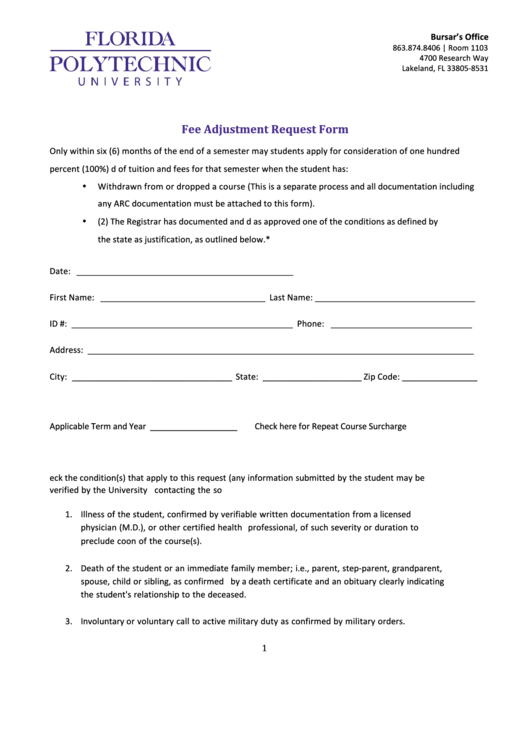

Fillable Adjustment Request Form printable pdf download

If the manager can call the bank where the check came from to verify the legitimacy of the check, the manager may be able to remove the hold. The adjustment/correction/statement of posted item is a standard procedure employed by bank of. Most checks that have some kind of issue get. The bank you deposit the check into actually does not.

Bank of America's Adjustment/Correction/Statement of Posted Item What

The adjustment/correction/statement of posted item is a standard procedure employed by bank of. Most checks that have some kind of issue get. The bank you deposit the check into actually does not know if the check has cleared or not. If the manager can call the bank where the check came from to verify the legitimacy of the check, the.

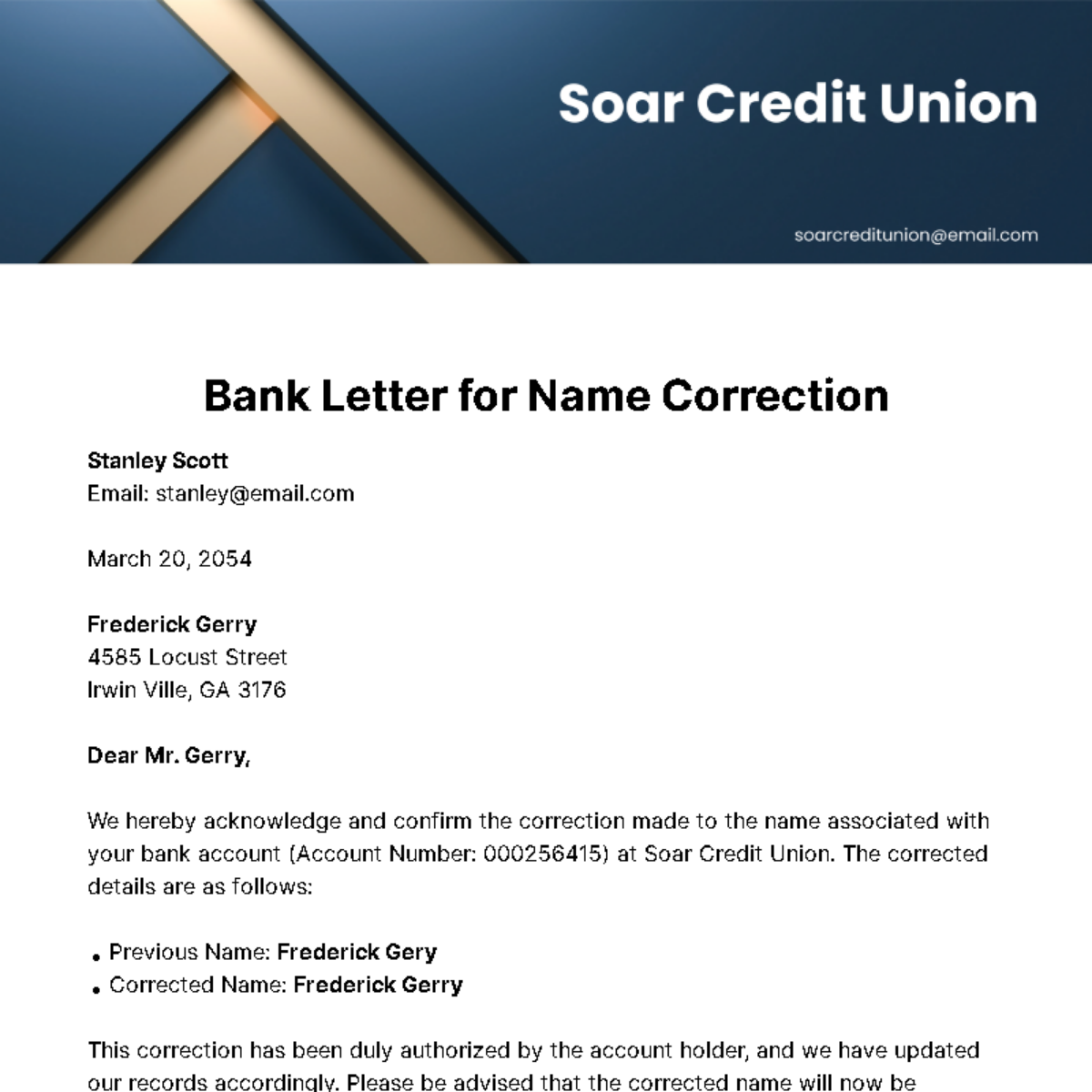

Bank Account Name Correction Letter Format In Word

The adjustment/correction/statement of posted item is a standard procedure employed by bank of. If the manager can call the bank where the check came from to verify the legitimacy of the check, the manager may be able to remove the hold. The bank you deposit the check into actually does not know if the check has cleared or not. Most.

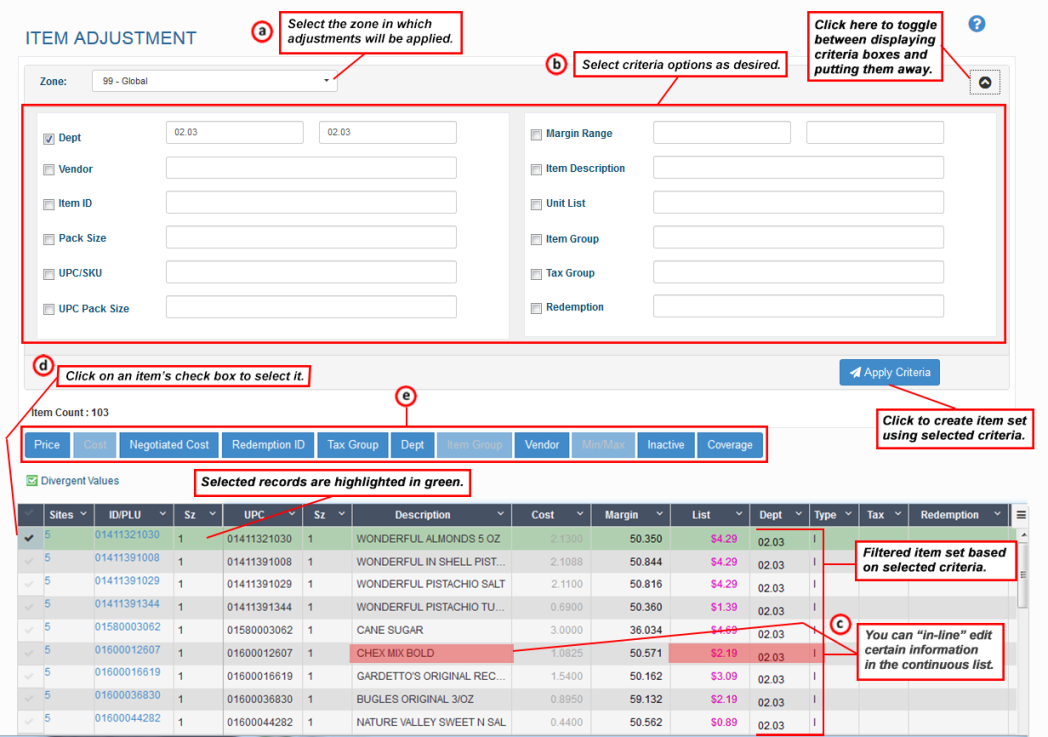

Item Adjustment

The adjustment/correction/statement of posted item is a standard procedure employed by bank of. If the manager can call the bank where the check came from to verify the legitimacy of the check, the manager may be able to remove the hold. Most checks that have some kind of issue get. The bank you deposit the check into actually does not.

Bank of America's Adjustment/Correction/Statement of Posted Item What

The bank you deposit the check into actually does not know if the check has cleared or not. The adjustment/correction/statement of posted item is a standard procedure employed by bank of. Most checks that have some kind of issue get. If the manager can call the bank where the check came from to verify the legitimacy of the check, the.

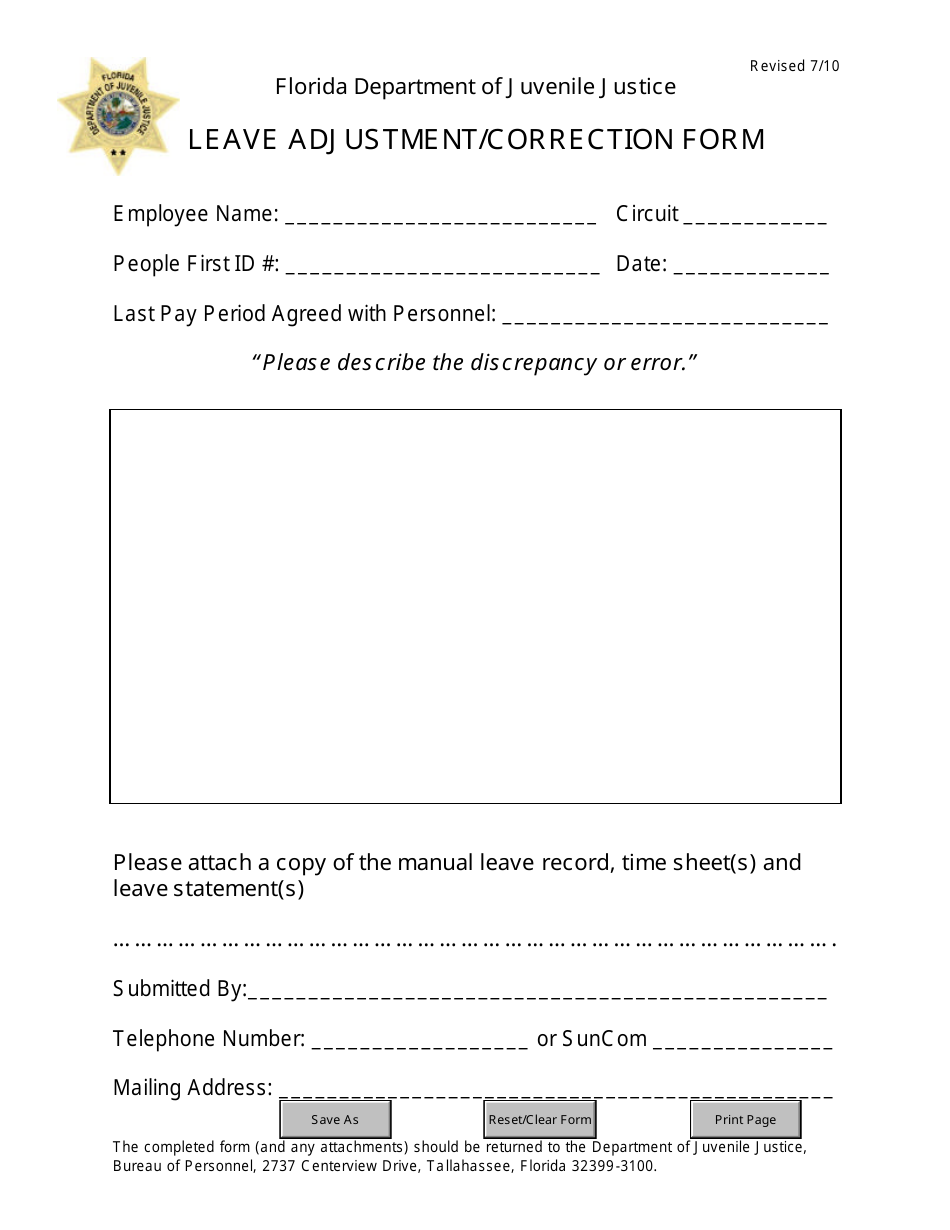

Florida Leave Adjustment/Correction Form Fill Out, Sign Online and

Most checks that have some kind of issue get. The bank you deposit the check into actually does not know if the check has cleared or not. The adjustment/correction/statement of posted item is a standard procedure employed by bank of. If the manager can call the bank where the check came from to verify the legitimacy of the check, the.

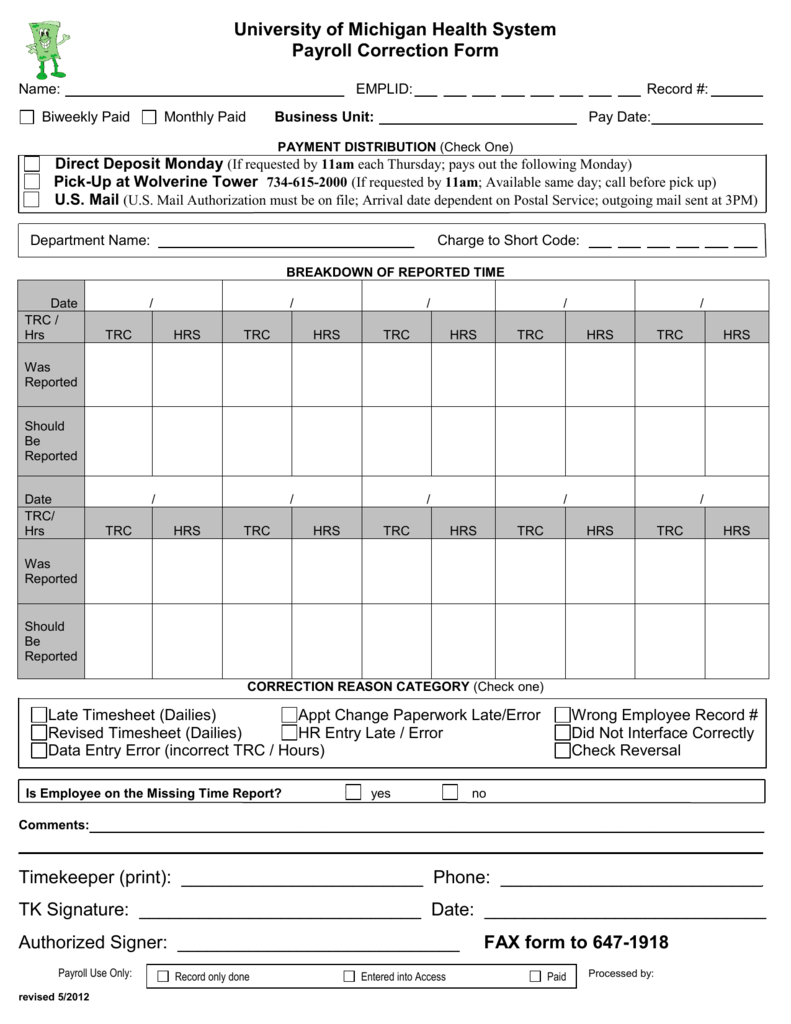

UMHS Payroll Adjustment/Correction Form

Most checks that have some kind of issue get. The bank you deposit the check into actually does not know if the check has cleared or not. The adjustment/correction/statement of posted item is a standard procedure employed by bank of. If the manager can call the bank where the check came from to verify the legitimacy of the check, the.

Bank of America's Adjustment/Correction/Statement of Posted Item What

The bank you deposit the check into actually does not know if the check has cleared or not. Most checks that have some kind of issue get. The adjustment/correction/statement of posted item is a standard procedure employed by bank of. If the manager can call the bank where the check came from to verify the legitimacy of the check, the.

If The Manager Can Call The Bank Where The Check Came From To Verify The Legitimacy Of The Check, The Manager May Be Able To Remove The Hold.

Most checks that have some kind of issue get. The adjustment/correction/statement of posted item is a standard procedure employed by bank of. The bank you deposit the check into actually does not know if the check has cleared or not.