Buying Houses With Tax Liens

Buying Houses With Tax Liens - Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Want to learn how to buy property with delinquent taxes? You must identify properties with tax liens and establish a budget for the auction. The most common type of lien is a tax lien. These certificates give investors the right to collect unpaid property taxes, interest. However, buying a house with a tax lien can be risky if you don’t know what you’re doing. This article takes a deep dive into everything you should know about homes and. Homeowners can receive a tax lien against their home if they neglect to pay their. Why would you want to buy a house with a lien on it? Here are five key details to understand before you take your next.

Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Want to learn how to buy property with delinquent taxes? However, buying a house with a tax lien can be risky if you don’t know what you’re doing. The most common type of lien is a tax lien. These certificates give investors the right to collect unpaid property taxes, interest. You must identify properties with tax liens and establish a budget for the auction. Homeowners can receive a tax lien against their home if they neglect to pay their. Why would you want to buy a house with a lien on it? This article takes a deep dive into everything you should know about homes and. Even with a strong economy and housing market, you may find the property you want to buy has a tax lien on it.

Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Want to learn how to buy property with delinquent taxes? These certificates give investors the right to collect unpaid property taxes, interest. Here are five key details to understand before you take your next. Even with a strong economy and housing market, you may find the property you want to buy has a tax lien on it. This article takes a deep dive into everything you should know about homes and. Why would you want to buy a house with a lien on it? However, buying a house with a tax lien can be risky if you don’t know what you’re doing. The most common type of lien is a tax lien. Homeowners can receive a tax lien against their home if they neglect to pay their.

Investing In Tax Liens Alts.co

Homeowners can receive a tax lien against their home if they neglect to pay their. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Why would you want to buy a house with a lien on it? You must identify properties with tax liens and establish a budget for the auction..

Veritas News Network Buyer Beware Before Buying Tax Liens Know What

Even with a strong economy and housing market, you may find the property you want to buy has a tax lien on it. These certificates give investors the right to collect unpaid property taxes, interest. You must identify properties with tax liens and establish a budget for the auction. The most common type of lien is a tax lien. Homeowners.

Tax Preparation Business Startup

Even with a strong economy and housing market, you may find the property you want to buy has a tax lien on it. You must identify properties with tax liens and establish a budget for the auction. Want to learn how to buy property with delinquent taxes? However, buying a house with a tax lien can be risky if you.

Tax Liens Cash for Properties

However, buying a house with a tax lien can be risky if you don’t know what you’re doing. Even with a strong economy and housing market, you may find the property you want to buy has a tax lien on it. You must identify properties with tax liens and establish a budget for the auction. Want to learn how to.

Read This before Buying Tax Liens Michael Schuett

Here are five key details to understand before you take your next. Want to learn how to buy property with delinquent taxes? Homeowners can receive a tax lien against their home if they neglect to pay their. This article takes a deep dive into everything you should know about homes and. Even with a strong economy and housing market, you.

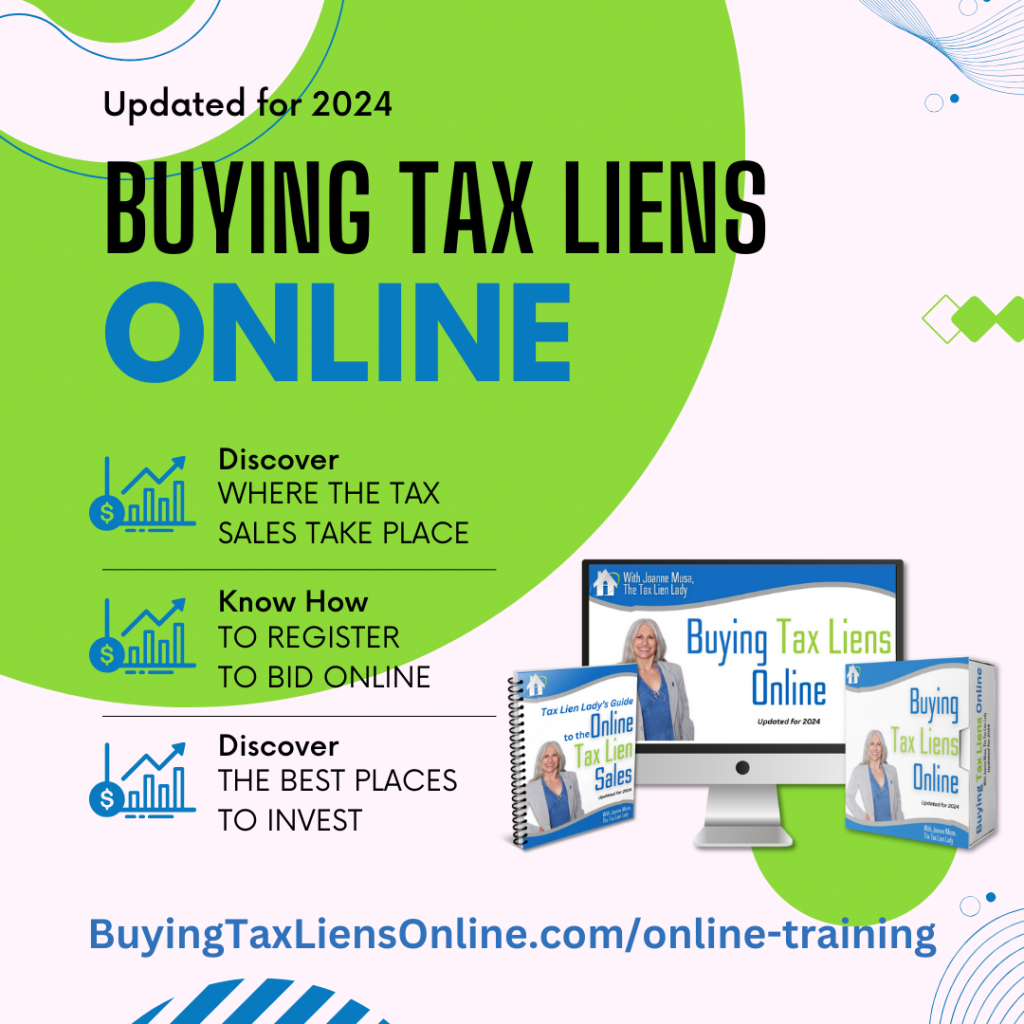

Buying Tax Liens Online 2024 Social Media

Even with a strong economy and housing market, you may find the property you want to buy has a tax lien on it. Here are five key details to understand before you take your next. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. You must identify properties with tax liens.

Sell your tax lien houses in Cash 4 Houses

Even with a strong economy and housing market, you may find the property you want to buy has a tax lien on it. Homeowners can receive a tax lien against their home if they neglect to pay their. These certificates give investors the right to collect unpaid property taxes, interest. Tax lien investing is a type of real estate investing.

5 Tax Benefits to Buying a Home Ginger Easley

Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. This article takes a deep dive into everything you should know about homes and. Want to learn how to buy property with delinquent taxes? Why would you want to buy a house with a lien on it? Even with a strong economy.

Sparks Tax and Accounting Services Topeka KS

This article takes a deep dive into everything you should know about homes and. You must identify properties with tax liens and establish a budget for the auction. The most common type of lien is a tax lien. Want to learn how to buy property with delinquent taxes? Homeowners can receive a tax lien against their home if they neglect.

Things to Know about Buying a House with Tax Liens Tax Lien Code

You must identify properties with tax liens and establish a budget for the auction. These certificates give investors the right to collect unpaid property taxes, interest. Homeowners can receive a tax lien against their home if they neglect to pay their. However, buying a house with a tax lien can be risky if you don’t know what you’re doing. Tax.

Homeowners Can Receive A Tax Lien Against Their Home If They Neglect To Pay Their.

You must identify properties with tax liens and establish a budget for the auction. This article takes a deep dive into everything you should know about homes and. The most common type of lien is a tax lien. Even with a strong economy and housing market, you may find the property you want to buy has a tax lien on it.

Tax Lien Investing Is A Type Of Real Estate Investing Where You Purchase Tax Lien Certificates At Auctions.

These certificates give investors the right to collect unpaid property taxes, interest. Want to learn how to buy property with delinquent taxes? Here are five key details to understand before you take your next. However, buying a house with a tax lien can be risky if you don’t know what you’re doing.