Buying Tax Lien Properties

Buying Tax Lien Properties - When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts, on their property. The lien is the amount owed and must be paid in order for the. Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. Purchasing tax liens can be a lucrative though relatively risky business for those who. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Property tax liens are an investment niche that is overlooked by most investors. Once an investor buys that claim, they. A lien is placed on a property when the homeowner fails to pay annual property taxes to the state or local government. These certificates give investors the right to collect unpaid property taxes, interest.

The lien is the amount owed and must be paid in order for the. A lien is placed on a property when the homeowner fails to pay annual property taxes to the state or local government. Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. These certificates give investors the right to collect unpaid property taxes, interest. Purchasing tax liens can be a lucrative though relatively risky business for those who. Property tax liens are an investment niche that is overlooked by most investors. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Once an investor buys that claim, they. When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts, on their property.

Once an investor buys that claim, they. Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. A lien is placed on a property when the homeowner fails to pay annual property taxes to the state or local government. These certificates give investors the right to collect unpaid property taxes, interest. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Property tax liens are an investment niche that is overlooked by most investors. When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts, on their property. The lien is the amount owed and must be paid in order for the. Purchasing tax liens can be a lucrative though relatively risky business for those who.

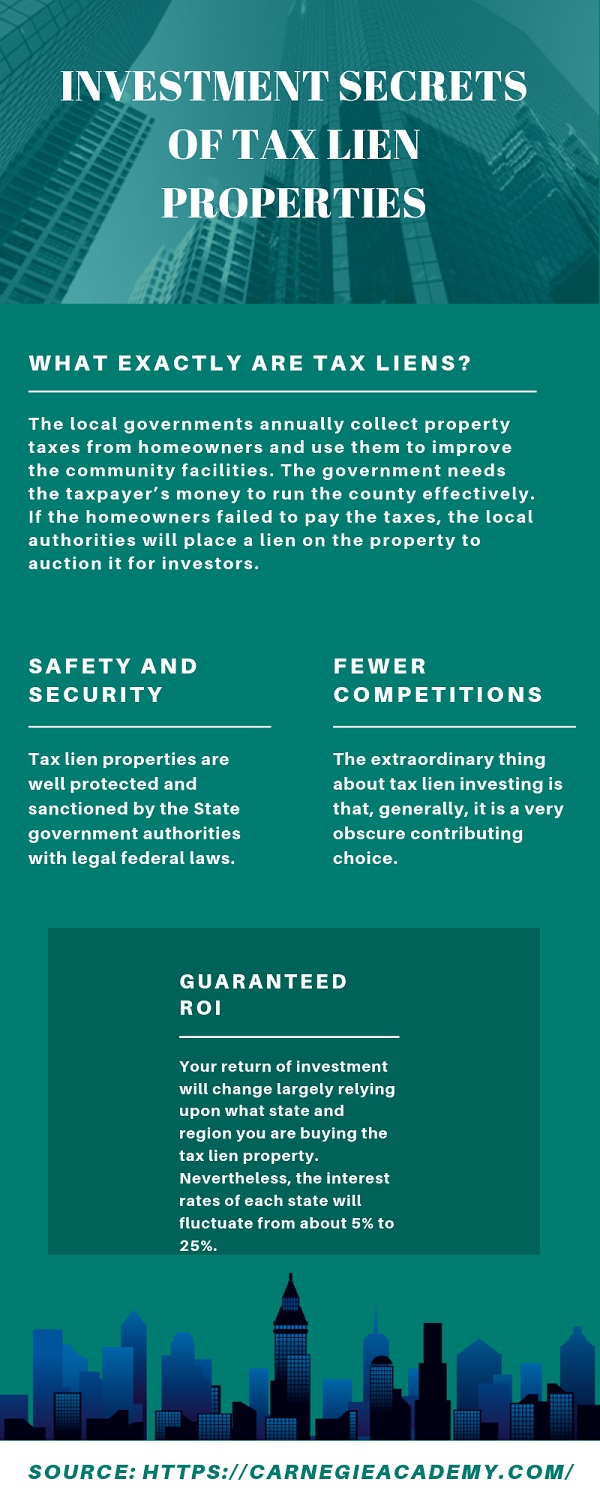

Investment Secrets of Tax Lien Properties Latest Infographics

Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts, on their property. The lien is the amount owed and must be.

Tax Lien Sale Download Free PDF Tax Lien Taxes

A lien is placed on a property when the homeowner fails to pay annual property taxes to the state or local government. Purchasing tax liens can be a lucrative though relatively risky business for those who. When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts,.

The Demand for Tax Lien Properties Tax, Demand, Property

Once an investor buys that claim, they. When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts, on their property. Property tax liens are an investment niche that is overlooked by most investors. Purchasing tax liens can be a lucrative though relatively risky business for those.

Advantages & Disadvantages of Buying Tax Lien Properties

These certificates give investors the right to collect unpaid property taxes, interest. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. A lien is placed on a.

What to Look For When Buying Tax Deeds Tax Lien Certificate School

Purchasing tax liens can be a lucrative though relatively risky business for those who. These certificates give investors the right to collect unpaid property taxes, interest. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Property tax liens are an investment niche that is overlooked by most investors. The lien is.

Tax Lien Properties Texas Real Estate Tax Lien Investing for Beginners

When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts, on their property. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Tax lien investing involves buying the claim that a local government makes on a property.

Buying Tax Lien Properties Key Benefits and Simple Process

Property tax liens are an investment niche that is overlooked by most investors. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. When property owners fail to.

Causes and Process of Buying Tax Lien Properties PDF

Property tax liens are an investment niche that is overlooked by most investors. Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. Purchasing tax liens can be a lucrative though relatively risky business for those who. The lien is the amount owed and must be.

How To Purchase Tax Lien Properties Part 1 With Bill Williams Tax

Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts, on their property. Property tax liens are an investment niche that is.

Exploring the Landscape of Tax Lien Properties A Comprehensive

A lien is placed on a property when the homeowner fails to pay annual property taxes to the state or local government. Purchasing tax liens can be a lucrative though relatively risky business for those who. Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes..

Property Tax Liens Are An Investment Niche That Is Overlooked By Most Investors.

Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts, on their property. The lien is the amount owed and must be paid in order for the.

Once An Investor Buys That Claim, They.

These certificates give investors the right to collect unpaid property taxes, interest. Purchasing tax liens can be a lucrative though relatively risky business for those who. A lien is placed on a property when the homeowner fails to pay annual property taxes to the state or local government.