Car Loan Tax Form

Car Loan Tax Form - Interest paid on a loan to purchase a car for personal use. You cannot deduct a personal car loan or it's interest. While typically, deducting car loan interest is not allowed there is one. Learn if car loan interest is tax deductible, who can deduct car loan interest and how to claim this deduction on your taxes. Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers. Enter the amount of the deduction — either using the standard. You can deduct car loan interest on irs form 1040 schedule c. Credit card and installment interest incurred for personal expenses.

Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers. You cannot deduct a personal car loan or it's interest. You can deduct car loan interest on irs form 1040 schedule c. Learn if car loan interest is tax deductible, who can deduct car loan interest and how to claim this deduction on your taxes. Enter the amount of the deduction — either using the standard. Credit card and installment interest incurred for personal expenses. While typically, deducting car loan interest is not allowed there is one. Interest paid on a loan to purchase a car for personal use.

Learn if car loan interest is tax deductible, who can deduct car loan interest and how to claim this deduction on your taxes. While typically, deducting car loan interest is not allowed there is one. Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers. Enter the amount of the deduction — either using the standard. Credit card and installment interest incurred for personal expenses. You can deduct car loan interest on irs form 1040 schedule c. Interest paid on a loan to purchase a car for personal use. You cannot deduct a personal car loan or it's interest.

Loan Options Need Money? Let's Take a Look at 7 Loans That Are

Credit card and installment interest incurred for personal expenses. While typically, deducting car loan interest is not allowed there is one. Learn if car loan interest is tax deductible, who can deduct car loan interest and how to claim this deduction on your taxes. You cannot deduct a personal car loan or it's interest. You can deduct car loan interest.

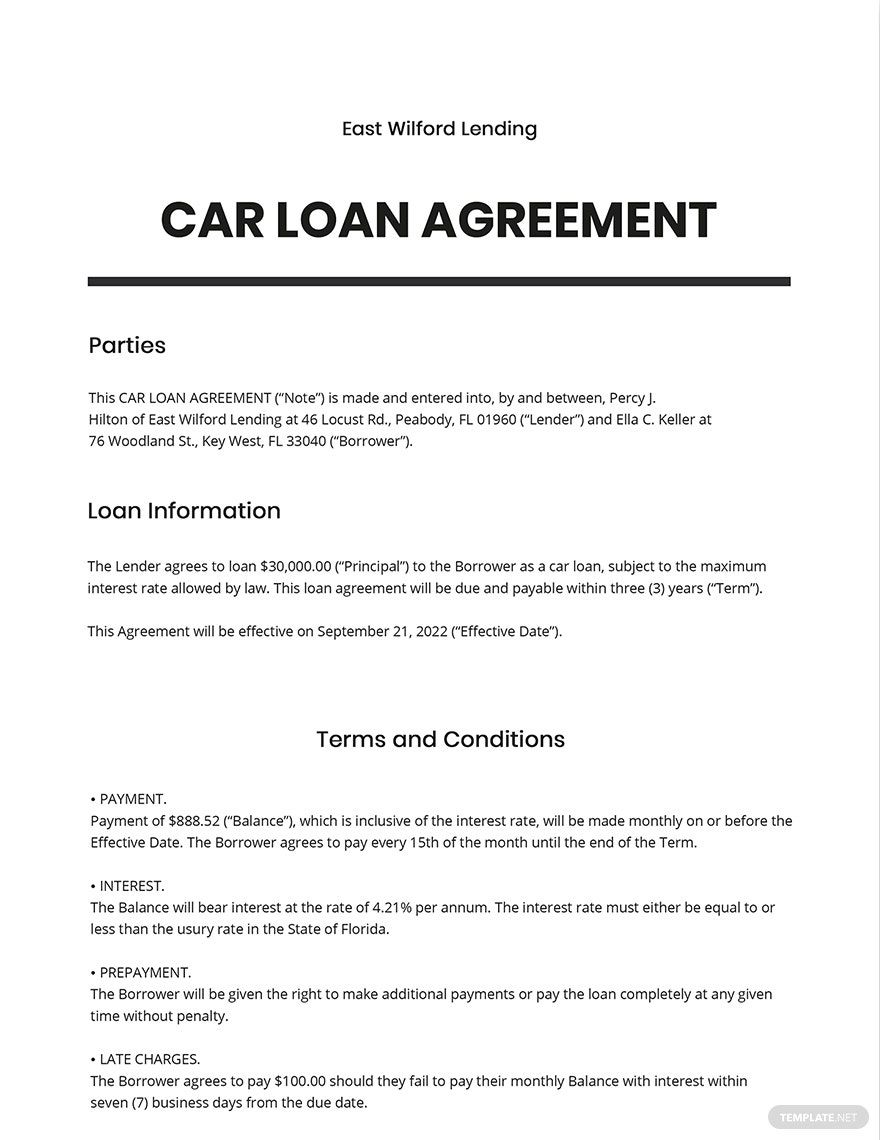

Car Loan Agreement Free Printable Documents

Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers. While typically, deducting car loan interest is not allowed there is one. Learn if car loan interest is tax deductible, who can deduct car loan interest and how to claim this deduction on your taxes. Interest paid on a loan to purchase a car.

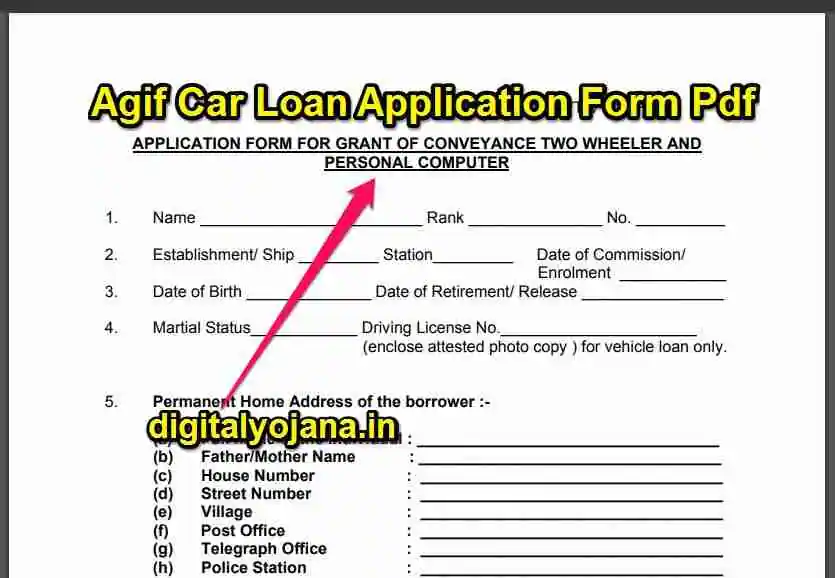

AGIF {All PDF Download} Agif Car Loan Application Form Pdf Army Group

Enter the amount of the deduction — either using the standard. Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers. You cannot deduct a personal car loan or it's interest. Credit card and installment interest incurred for personal expenses. Learn if car loan interest is tax deductible, who can deduct car loan interest.

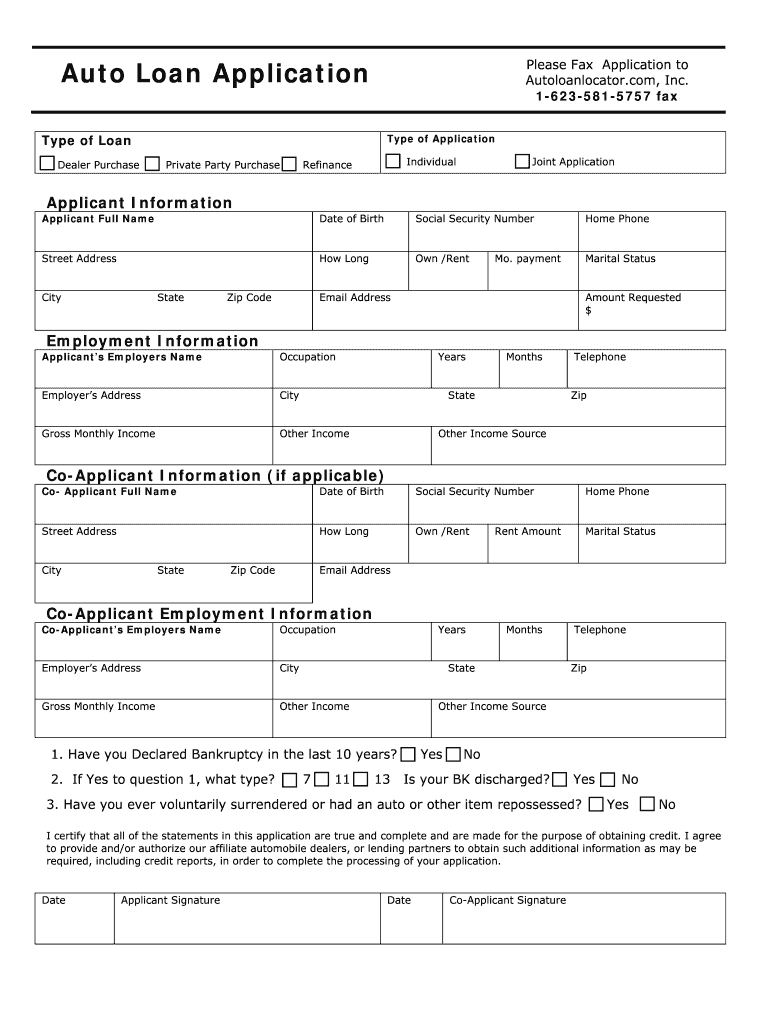

Printable Auto Credit Application PDF Edit & Share airSlate SignNow

Credit card and installment interest incurred for personal expenses. Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers. While typically, deducting car loan interest is not allowed there is one. Learn if car loan interest is tax deductible, who can deduct car loan interest and how to claim this deduction on your taxes..

Car Loan Agreement Form Template Google Docs, Word

Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers. While typically, deducting car loan interest is not allowed there is one. Learn if car loan interest is tax deductible, who can deduct car loan interest and how to claim this deduction on your taxes. You can deduct car loan interest on irs form.

Maximum Age for Car Loan Malaysia RuthfvDudley

You can deduct car loan interest on irs form 1040 schedule c. Credit card and installment interest incurred for personal expenses. Learn if car loan interest is tax deductible, who can deduct car loan interest and how to claim this deduction on your taxes. Enter the amount of the deduction — either using the standard. Deducting auto loan interest on.

Car Loan Interest Rates 2024 Check EMI, Eligibility, Down Payment

You can deduct car loan interest on irs form 1040 schedule c. Enter the amount of the deduction — either using the standard. Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers. Credit card and installment interest incurred for personal expenses. Learn if car loan interest is tax deductible, who can deduct car.

Printable Auto Credit Application Pdf Fill Online, Printable

Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers. You can deduct car loan interest on irs form 1040 schedule c. You cannot deduct a personal car loan or it's interest. Credit card and installment interest incurred for personal expenses. Learn if car loan interest is tax deductible, who can deduct car loan.

Pin on Places to Visit

Interest paid on a loan to purchase a car for personal use. Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers. Enter the amount of the deduction — either using the standard. You can deduct car loan interest on irs form 1040 schedule c. Learn if car loan interest is tax deductible, who.

Car Loan Comparison Rate, Examples and Lenders in Australia

Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers. Credit card and installment interest incurred for personal expenses. You can deduct car loan interest on irs form 1040 schedule c. You cannot deduct a personal car loan or it's interest. Learn if car loan interest is tax deductible, who can deduct car loan.

You Can Deduct Car Loan Interest On Irs Form 1040 Schedule C.

While typically, deducting car loan interest is not allowed there is one. Interest paid on a loan to purchase a car for personal use. You cannot deduct a personal car loan or it's interest. Credit card and installment interest incurred for personal expenses.

Deducting Auto Loan Interest On Your Federal Income Tax Return Is Not Allowed For Typical Borrowers.

Learn if car loan interest is tax deductible, who can deduct car loan interest and how to claim this deduction on your taxes. Enter the amount of the deduction — either using the standard.