City Of Charlottesville Business License

City Of Charlottesville Business License - Once your business has been in operation for a full calendar year, the business license tax will be based on the previous year’s gross receipts. To determine the rate or fee applicable. City of charlottesville business license taxes. The commissioner of the revenue's office offers convenient and secure online tax filing options for business taxes. If this is your first year in business, your license tax is based on an estimate of your gross receipts.|. A variety of additional resources are available to assist. Beginning in 2023 you may renew your business license online using our new online business portal. This was created by the office of economic development with the business owner in mind,. If you are conducting or plan to conduct business within the county, you will need to register for a business license and other applicable taxes. Welcome to the city of charlottesville’s business portal.

Beginning in 2023 you may renew your business license online using our new online business portal. If you are conducting or plan to conduct business within the county, you will need to register for a business license and other applicable taxes. To determine the rate or fee applicable. A variety of additional resources are available to assist. If this is your first year in business, your license tax is based on an estimate of your gross receipts.|. This was created by the office of economic development with the business owner in mind,. Welcome to the city of charlottesville’s business portal. For help getting started with business licensing and permitting, visit the revenue office. Once your business has been in operation for a full calendar year, the business license tax will be based on the previous year’s gross receipts. City of charlottesville business license taxes.

Once your business has been in operation for a full calendar year, the business license tax will be based on the previous year’s gross receipts. City of charlottesville business license taxes. If you are conducting or plan to conduct business within the county, you will need to register for a business license and other applicable taxes. To determine the rate or fee applicable. Welcome to the city of charlottesville’s business portal. If this is your first year in business, your license tax is based on an estimate of your gross receipts.|. This was created by the office of economic development with the business owner in mind,. Beginning in 2023 you may renew your business license online using our new online business portal. For help getting started with business licensing and permitting, visit the revenue office. The commissioner of the revenue's office offers convenient and secure online tax filing options for business taxes.

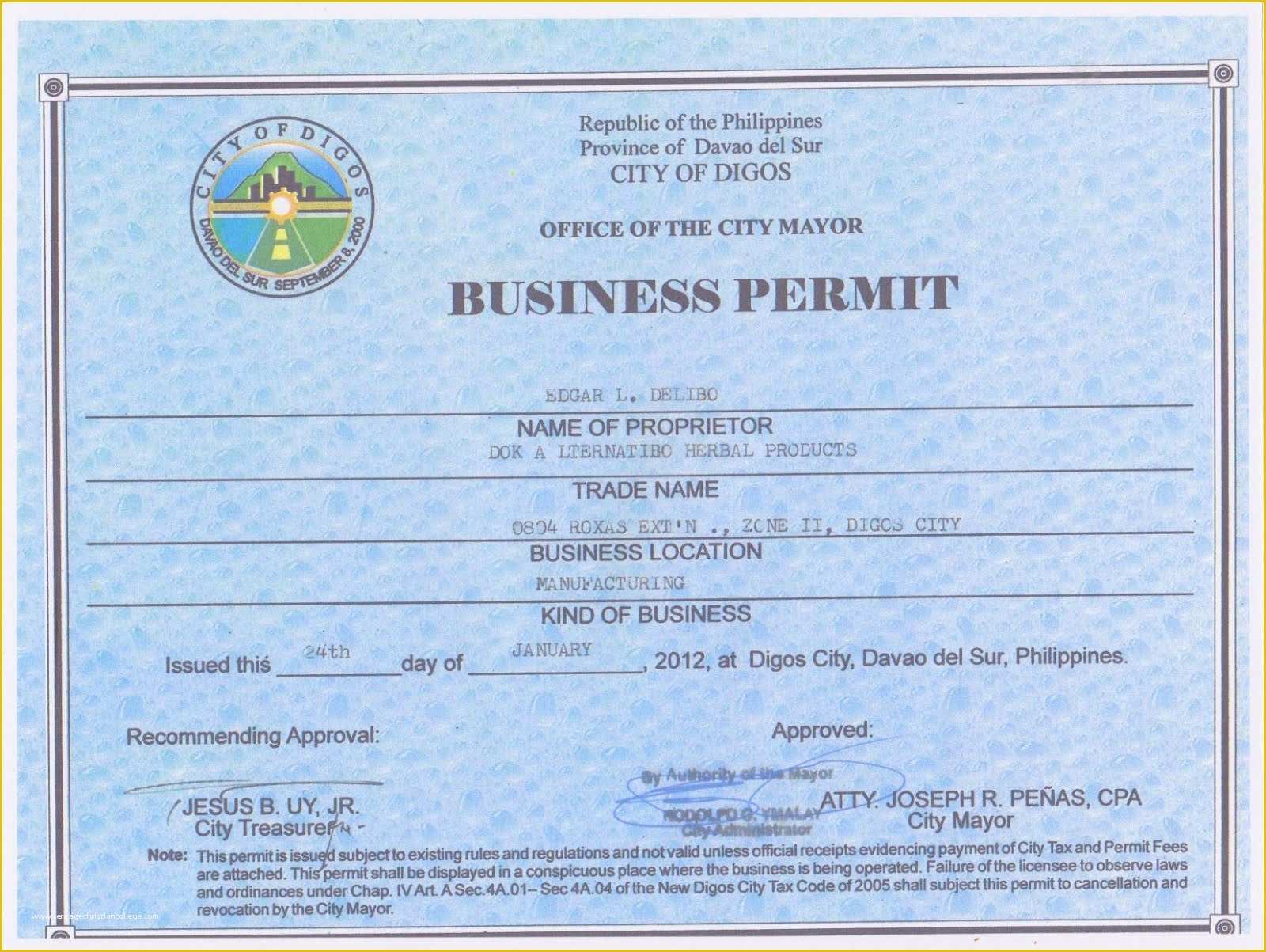

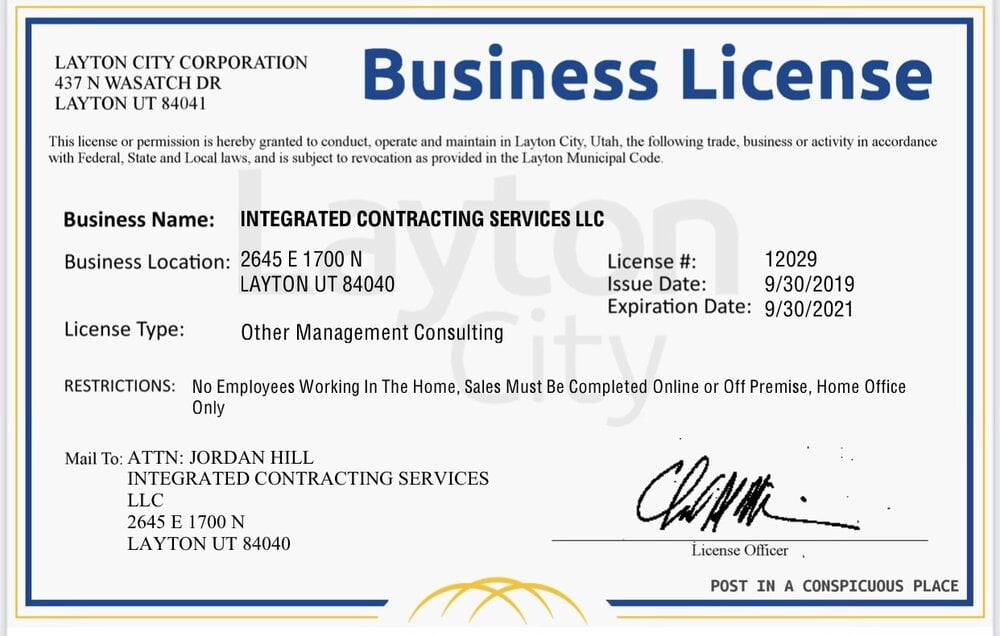

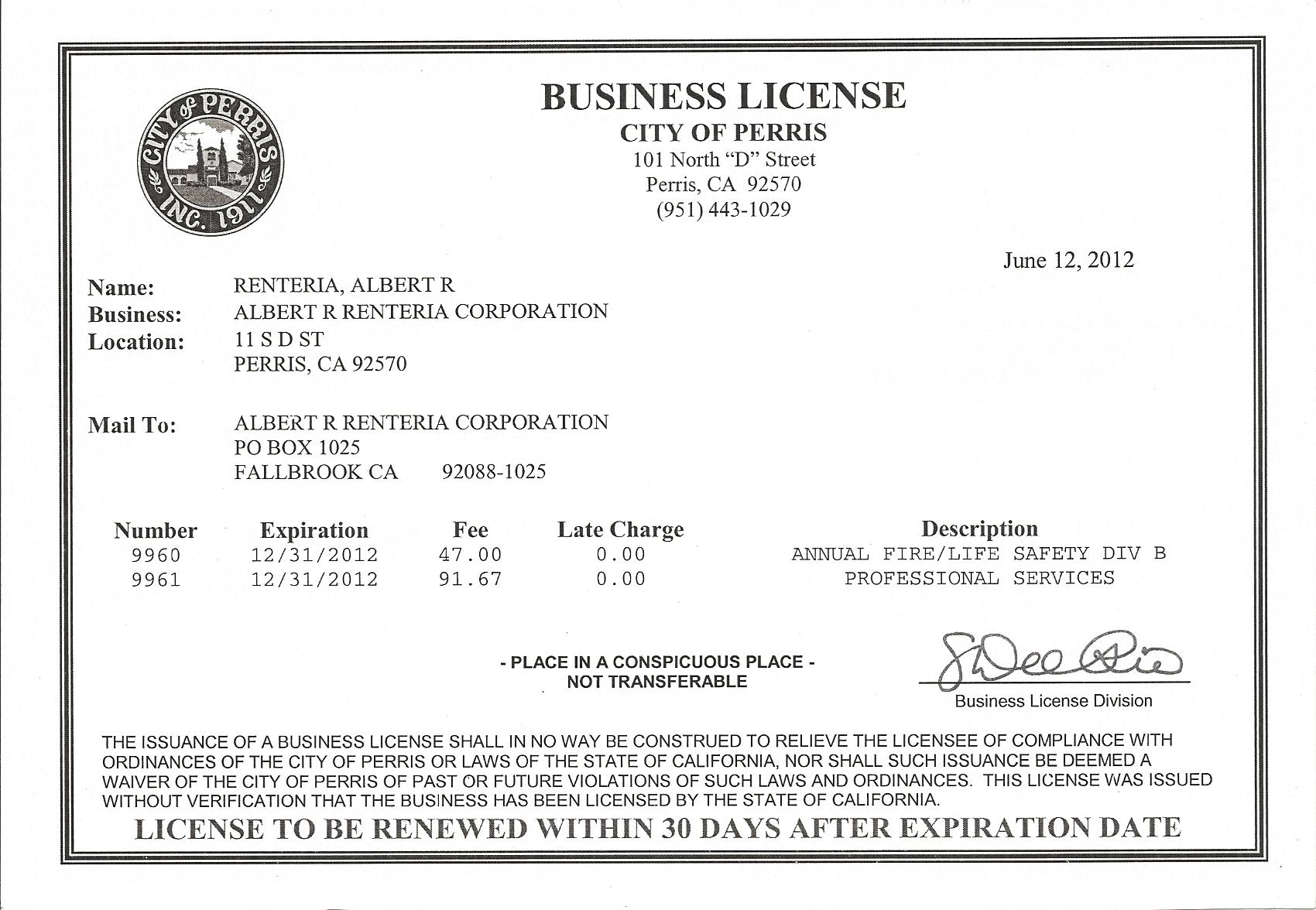

49 Free Business License Template Heritagechristiancollege

A variety of additional resources are available to assist. For help getting started with business licensing and permitting, visit the revenue office. If this is your first year in business, your license tax is based on an estimate of your gross receipts.|. If you are conducting or plan to conduct business within the county, you will need to register for.

Online Business Tax Portal Charlottesville, VA

City of charlottesville business license taxes. If you are conducting or plan to conduct business within the county, you will need to register for a business license and other applicable taxes. If this is your first year in business, your license tax is based on an estimate of your gross receipts.|. The commissioner of the revenue's office offers convenient and.

Do freelancers need a business license? r/Charlottesville

Once your business has been in operation for a full calendar year, the business license tax will be based on the previous year’s gross receipts. If this is your first year in business, your license tax is based on an estimate of your gross receipts.|. The commissioner of the revenue's office offers convenient and secure online tax filing options for.

How to get a small business license? Puvanesvarar Consulting

The commissioner of the revenue's office offers convenient and secure online tax filing options for business taxes. Beginning in 2023 you may renew your business license online using our new online business portal. This was created by the office of economic development with the business owner in mind,. City of charlottesville business license taxes. A variety of additional resources are.

Business License Template

Once your business has been in operation for a full calendar year, the business license tax will be based on the previous year’s gross receipts. Beginning in 2023 you may renew your business license online using our new online business portal. City of charlottesville business license taxes. The commissioner of the revenue's office offers convenient and secure online tax filing.

Online Business Tax Portal Charlottesville, VA

Once your business has been in operation for a full calendar year, the business license tax will be based on the previous year’s gross receipts. Beginning in 2023 you may renew your business license online using our new online business portal. For help getting started with business licensing and permitting, visit the revenue office. Welcome to the city of charlottesville’s.

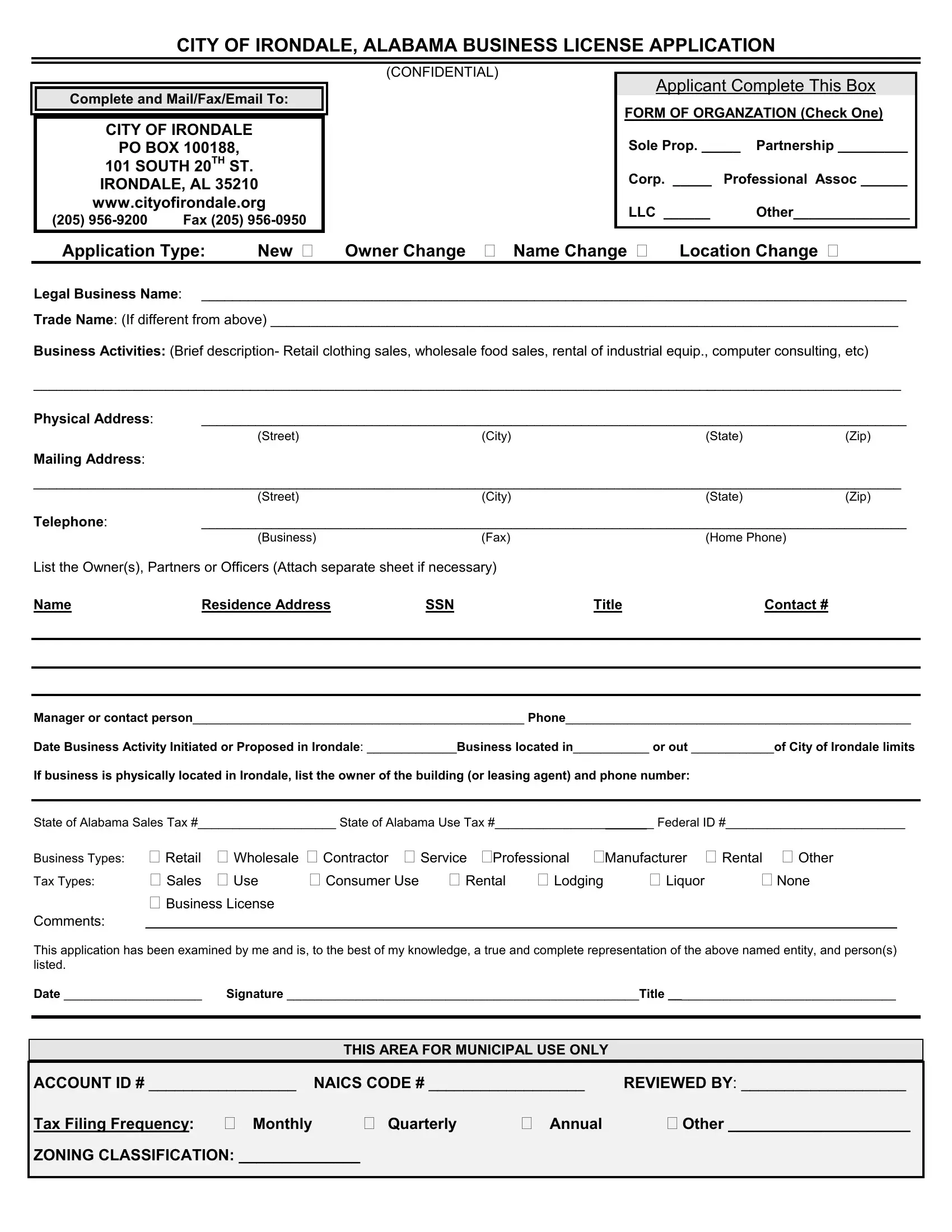

Alabama Business License Application PDF Form FormsPal

Beginning in 2023 you may renew your business license online using our new online business portal. If you are conducting or plan to conduct business within the county, you will need to register for a business license and other applicable taxes. Welcome to the city of charlottesville’s business portal. If this is your first year in business, your license tax.

How to Get a City Business License YouTube

Once your business has been in operation for a full calendar year, the business license tax will be based on the previous year’s gross receipts. If you are conducting or plan to conduct business within the county, you will need to register for a business license and other applicable taxes. A variety of additional resources are available to assist. If.

Business License Samples Expense Spreadshee business license samples.

Once your business has been in operation for a full calendar year, the business license tax will be based on the previous year’s gross receipts. To determine the rate or fee applicable. If you are conducting or plan to conduct business within the county, you will need to register for a business license and other applicable taxes. This was created.

Business License License Lookup

A variety of additional resources are available to assist. City of charlottesville business license taxes. Once your business has been in operation for a full calendar year, the business license tax will be based on the previous year’s gross receipts. For help getting started with business licensing and permitting, visit the revenue office. Welcome to the city of charlottesville’s business.

Welcome To The City Of Charlottesville’s Business Portal.

Once your business has been in operation for a full calendar year, the business license tax will be based on the previous year’s gross receipts. A variety of additional resources are available to assist. This was created by the office of economic development with the business owner in mind,. The commissioner of the revenue's office offers convenient and secure online tax filing options for business taxes.

If This Is Your First Year In Business, Your License Tax Is Based On An Estimate Of Your Gross Receipts.|.

City of charlottesville business license taxes. Beginning in 2023 you may renew your business license online using our new online business portal. For help getting started with business licensing and permitting, visit the revenue office. If you are conducting or plan to conduct business within the county, you will need to register for a business license and other applicable taxes.