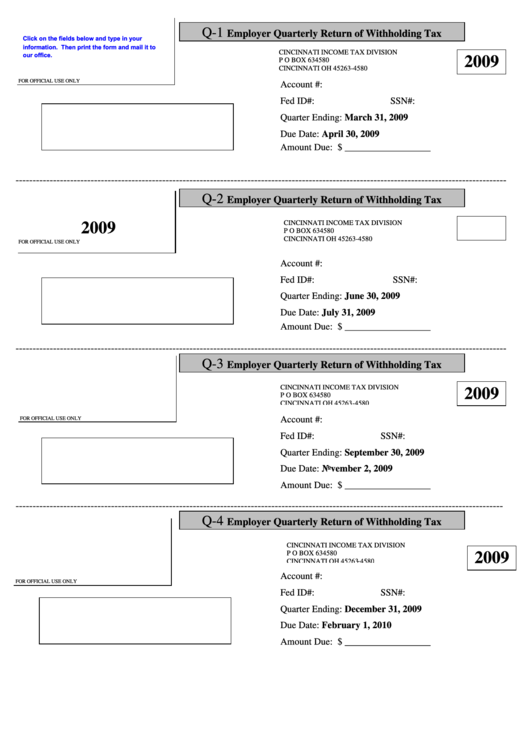

City Of Cincinnati Local Tax

City Of Cincinnati Local Tax - They are intended to supplement cincinnati. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. In addition to the forms below, cincinnati tax forms are available on this website or at our offices located at 805 central avenue, suite. Residents of the city of cincinnati may claim taxes paid to another city up to 2.1% of the qualifying wages reported on each individual w.

Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. They are intended to supplement cincinnati. Residents of the city of cincinnati may claim taxes paid to another city up to 2.1% of the qualifying wages reported on each individual w. In addition to the forms below, cincinnati tax forms are available on this website or at our offices located at 805 central avenue, suite.

In addition to the forms below, cincinnati tax forms are available on this website or at our offices located at 805 central avenue, suite. Residents of the city of cincinnati may claim taxes paid to another city up to 2.1% of the qualifying wages reported on each individual w. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. They are intended to supplement cincinnati.

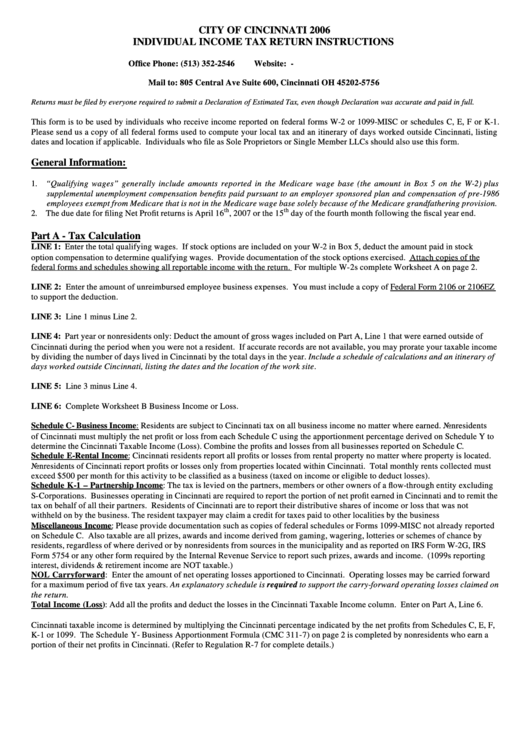

Individual Tax Return Instructions City Of Cincinnati 2006

Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. Residents of the city of cincinnati may claim taxes paid to another city up to 2.1% of the qualifying wages reported on each individual w. In addition to the forms below, cincinnati tax forms.

Cincinnati property taxes going up for first time in 23 years YouTube

Residents of the city of cincinnati may claim taxes paid to another city up to 2.1% of the qualifying wages reported on each individual w. They are intended to supplement cincinnati. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. In addition to.

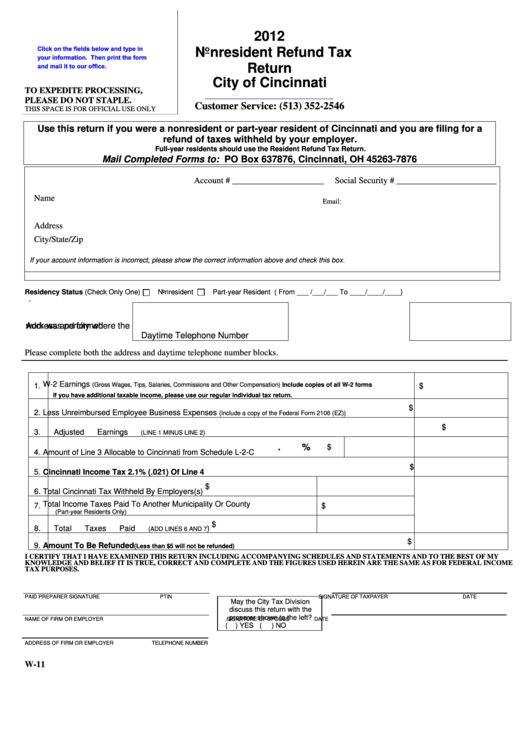

Fillable 2012 Nonresident Refund Tax Return City Of Cincinnati

Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. They are intended to supplement cincinnati. Residents of the city of cincinnati may claim taxes paid to another city up to 2.1% of the qualifying wages reported on each individual w. In addition to.

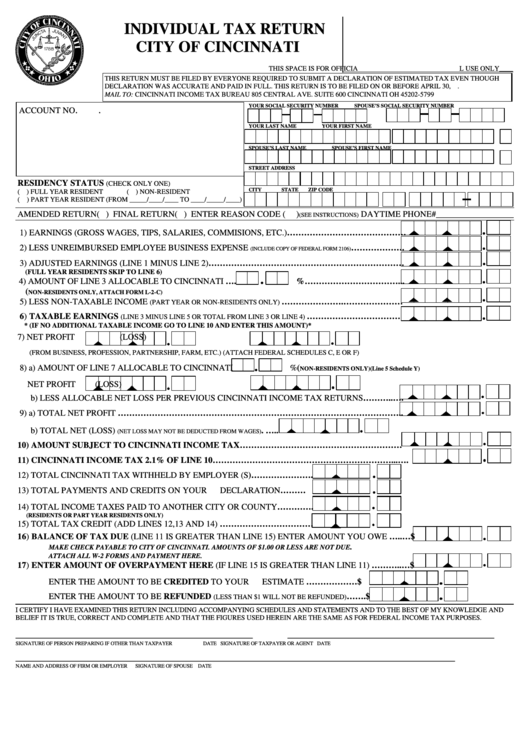

Individual Tax Return City Of Cincinnati, Ohio printable pdf download

Residents of the city of cincinnati may claim taxes paid to another city up to 2.1% of the qualifying wages reported on each individual w. In addition to the forms below, cincinnati tax forms are available on this website or at our offices located at 805 central avenue, suite. They are intended to supplement cincinnati. Residents of cincinnati pay a.

State and Local Tax XB4 Tax, Assurance and Advisory Services

Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. In addition to the forms below, cincinnati tax forms are available on this website or at our offices located at 805 central avenue, suite. Residents of the city of cincinnati may claim taxes paid.

How Cincinnati's residential tax abatement program works WVXU

Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. They are intended to supplement cincinnati. Residents of the city of cincinnati may claim taxes paid to another city up to 2.1% of the qualifying wages reported on each individual w. In addition to.

Find the Best Tax Preparation Services in Cincinnati, OH

Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. Residents of the city of cincinnati may claim taxes paid to another city up to 2.1% of the qualifying wages reported on each individual w. In addition to the forms below, cincinnati tax forms.

Cincinnati tax forms Fill out & sign online DocHub

Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. Residents of the city of cincinnati may claim taxes paid to another city up to 2.1% of the qualifying wages reported on each individual w. They are intended to supplement cincinnati. In addition to.

Top 61 City Of Cincinnati, Oh Tax Forms And Templates free to download

Residents of the city of cincinnati may claim taxes paid to another city up to 2.1% of the qualifying wages reported on each individual w. They are intended to supplement cincinnati. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. In addition to.

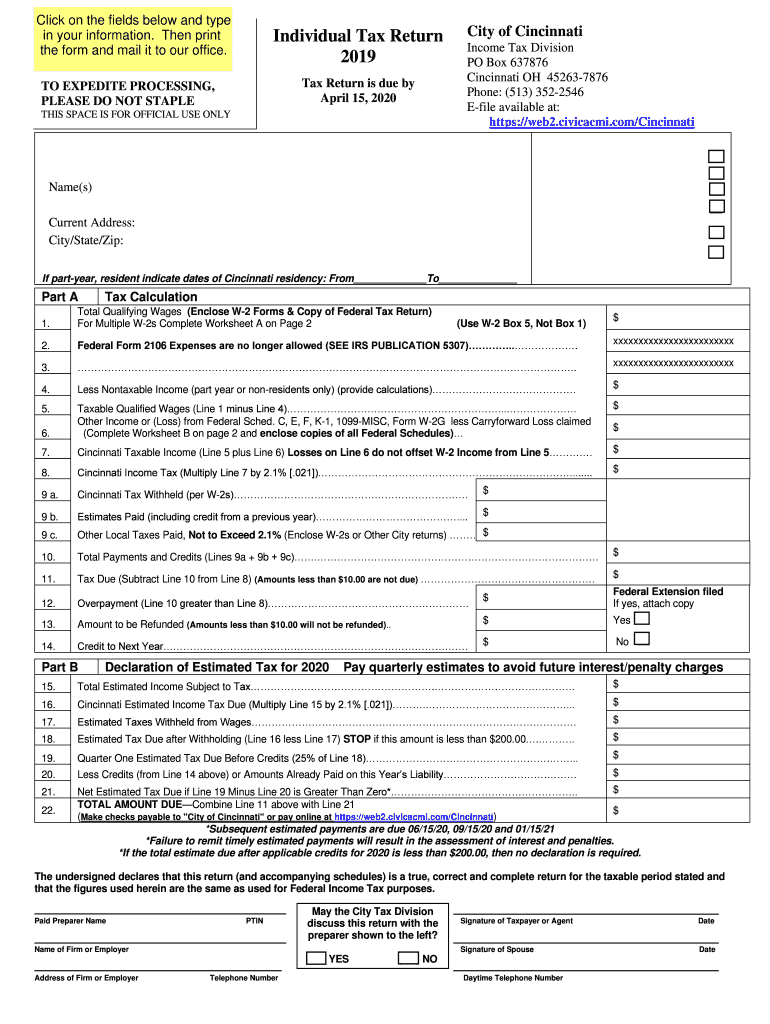

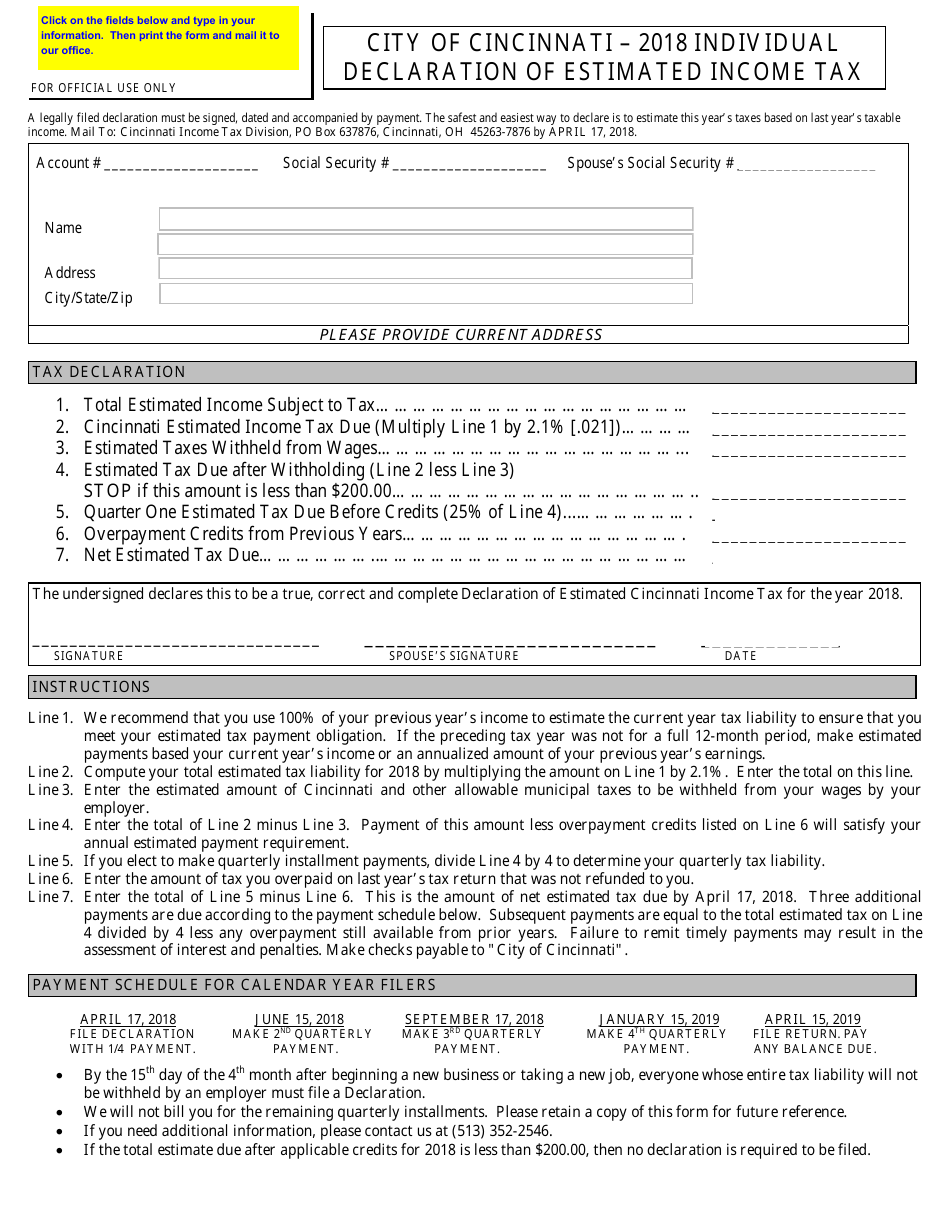

2018 City of Cincinnati, Ohio Individual Declaration of Estimated

Residents of the city of cincinnati may claim taxes paid to another city up to 2.1% of the qualifying wages reported on each individual w. They are intended to supplement cincinnati. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. In addition to.

Residents Of Cincinnati Pay A Flat City Income Tax Of 2.10% On Earned Income, In Addition To The Ohio Income Tax And The Federal Income Tax.

They are intended to supplement cincinnati. Residents of the city of cincinnati may claim taxes paid to another city up to 2.1% of the qualifying wages reported on each individual w. In addition to the forms below, cincinnati tax forms are available on this website or at our offices located at 805 central avenue, suite.