Credit Bid At Foreclosure Sale

Credit Bid At Foreclosure Sale - As the foreclosing party, you are allowed to “credit bid”, meaning that you are able to bid as high as your note [including accrued. At a nonjudicial foreclosure sale (also known as a trustee’s sale) a lender is entitled to make a “credit bid” — i.e., bidding all. Under the second concept of how much debt is owed to you and how much you’ve already received in “payments,” a bid at a trustees sale,. At the auction, the foreclosing lender submits the first bid, called a credit bid. with a credit bid, the lender gets a credit at the. A credit bid at a foreclosure sale allows the lender to bid on the property using the amount of debt owed by the borrower as credit.

As the foreclosing party, you are allowed to “credit bid”, meaning that you are able to bid as high as your note [including accrued. Under the second concept of how much debt is owed to you and how much you’ve already received in “payments,” a bid at a trustees sale,. At the auction, the foreclosing lender submits the first bid, called a credit bid. with a credit bid, the lender gets a credit at the. At a nonjudicial foreclosure sale (also known as a trustee’s sale) a lender is entitled to make a “credit bid” — i.e., bidding all. A credit bid at a foreclosure sale allows the lender to bid on the property using the amount of debt owed by the borrower as credit.

As the foreclosing party, you are allowed to “credit bid”, meaning that you are able to bid as high as your note [including accrued. A credit bid at a foreclosure sale allows the lender to bid on the property using the amount of debt owed by the borrower as credit. Under the second concept of how much debt is owed to you and how much you’ve already received in “payments,” a bid at a trustees sale,. At the auction, the foreclosing lender submits the first bid, called a credit bid. with a credit bid, the lender gets a credit at the. At a nonjudicial foreclosure sale (also known as a trustee’s sale) a lender is entitled to make a “credit bid” — i.e., bidding all.

Foreclosure Auctions

A credit bid at a foreclosure sale allows the lender to bid on the property using the amount of debt owed by the borrower as credit. At the auction, the foreclosing lender submits the first bid, called a credit bid. with a credit bid, the lender gets a credit at the. As the foreclosing party, you are allowed to “credit.

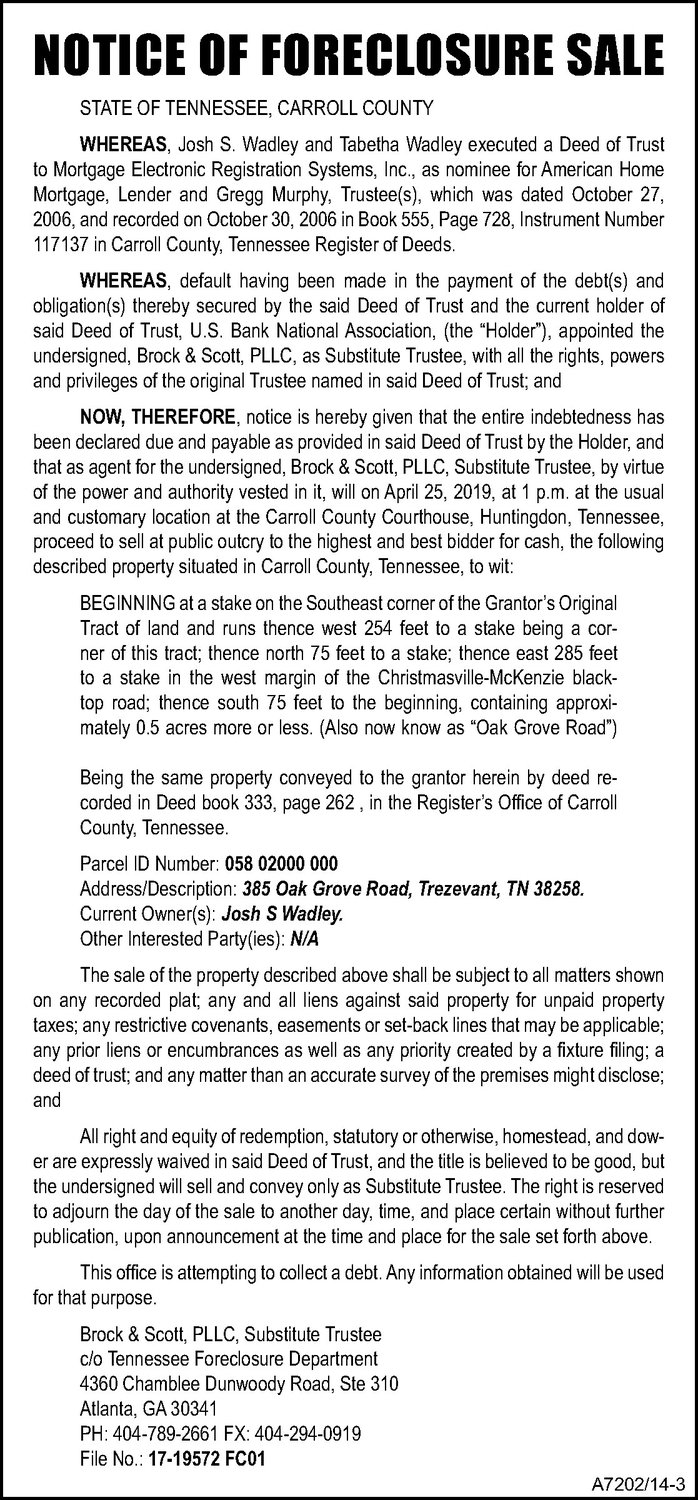

Notice of Foreclosure Sale WADLEY The Mckenzie Banner

Under the second concept of how much debt is owed to you and how much you’ve already received in “payments,” a bid at a trustees sale,. A credit bid at a foreclosure sale allows the lender to bid on the property using the amount of debt owed by the borrower as credit. As the foreclosing party, you are allowed to.

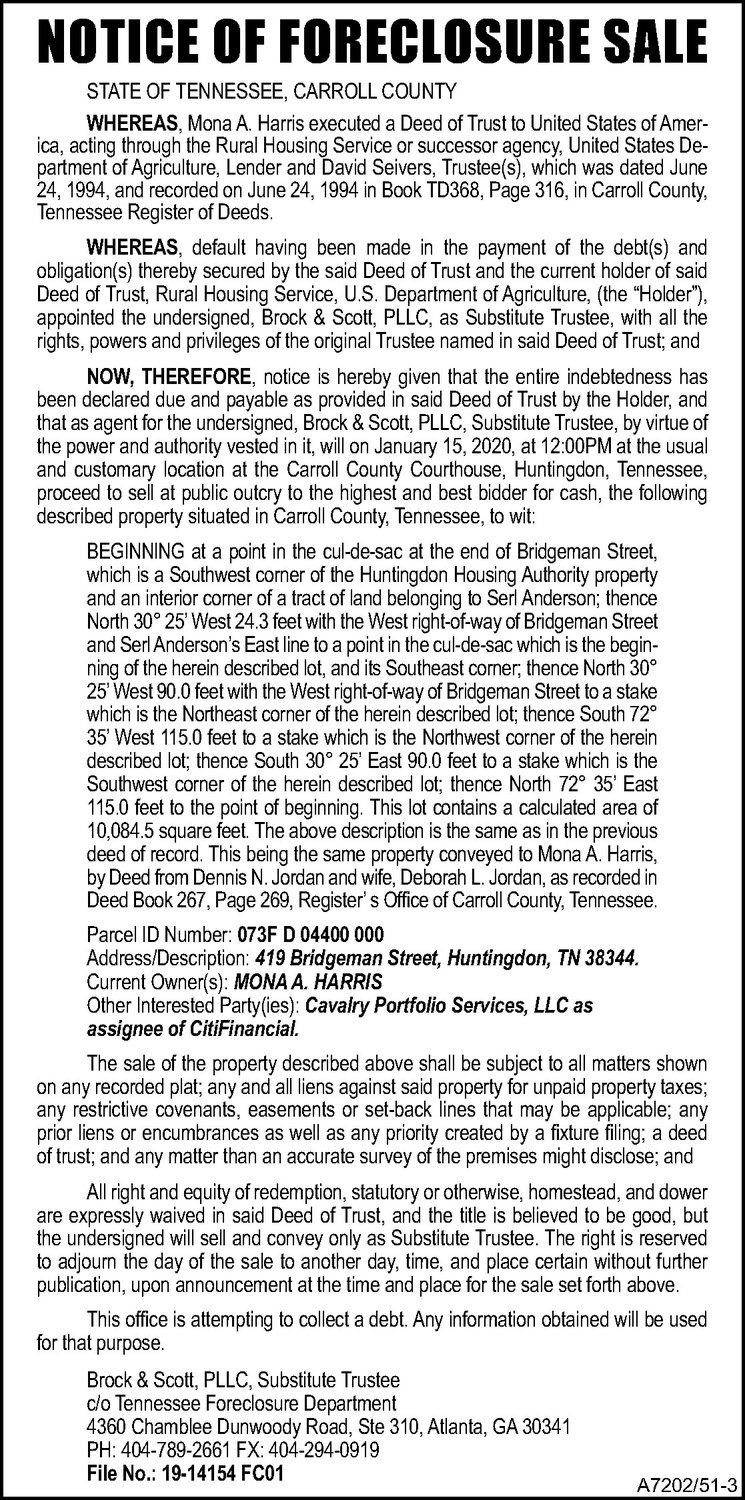

Notice of Foreclosure Sale HARRIS The Mckenzie Banner

As the foreclosing party, you are allowed to “credit bid”, meaning that you are able to bid as high as your note [including accrued. At a nonjudicial foreclosure sale (also known as a trustee’s sale) a lender is entitled to make a “credit bid” — i.e., bidding all. Under the second concept of how much debt is owed to you.

Who Can Bid at a Foreclosure Auction?

At a nonjudicial foreclosure sale (also known as a trustee’s sale) a lender is entitled to make a “credit bid” — i.e., bidding all. As the foreclosing party, you are allowed to “credit bid”, meaning that you are able to bid as high as your note [including accrued. Under the second concept of how much debt is owed to you.

Credit Bid PDF Summary Judgment Loans

At a nonjudicial foreclosure sale (also known as a trustee’s sale) a lender is entitled to make a “credit bid” — i.e., bidding all. As the foreclosing party, you are allowed to “credit bid”, meaning that you are able to bid as high as your note [including accrued. A credit bid at a foreclosure sale allows the lender to bid.

Best Practices for Credit Bidding at Foreclosure American Association

Under the second concept of how much debt is owed to you and how much you’ve already received in “payments,” a bid at a trustees sale,. At the auction, the foreclosing lender submits the first bid, called a credit bid. with a credit bid, the lender gets a credit at the. At a nonjudicial foreclosure sale (also known as a.

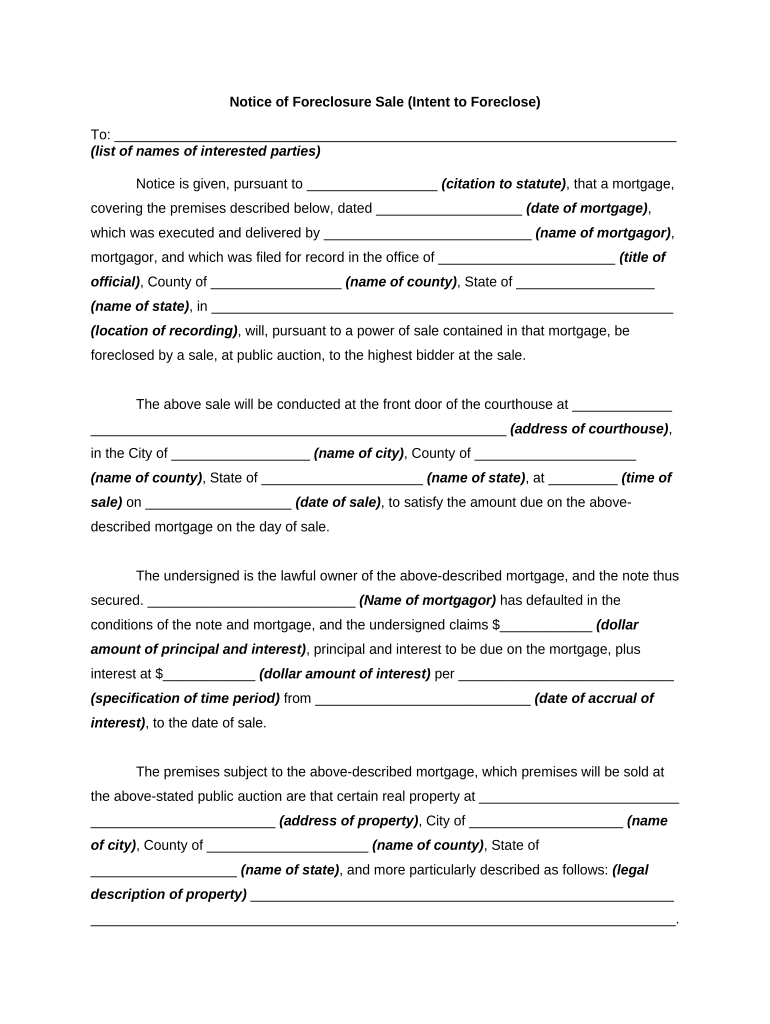

foreclosure sale Doc Template pdfFiller

Under the second concept of how much debt is owed to you and how much you’ve already received in “payments,” a bid at a trustees sale,. At the auction, the foreclosing lender submits the first bid, called a credit bid. with a credit bid, the lender gets a credit at the. A credit bid at a foreclosure sale allows the.

Foreclosure sale Fill out & sign online DocHub

At the auction, the foreclosing lender submits the first bid, called a credit bid. with a credit bid, the lender gets a credit at the. A credit bid at a foreclosure sale allows the lender to bid on the property using the amount of debt owed by the borrower as credit. At a nonjudicial foreclosure sale (also known as a.

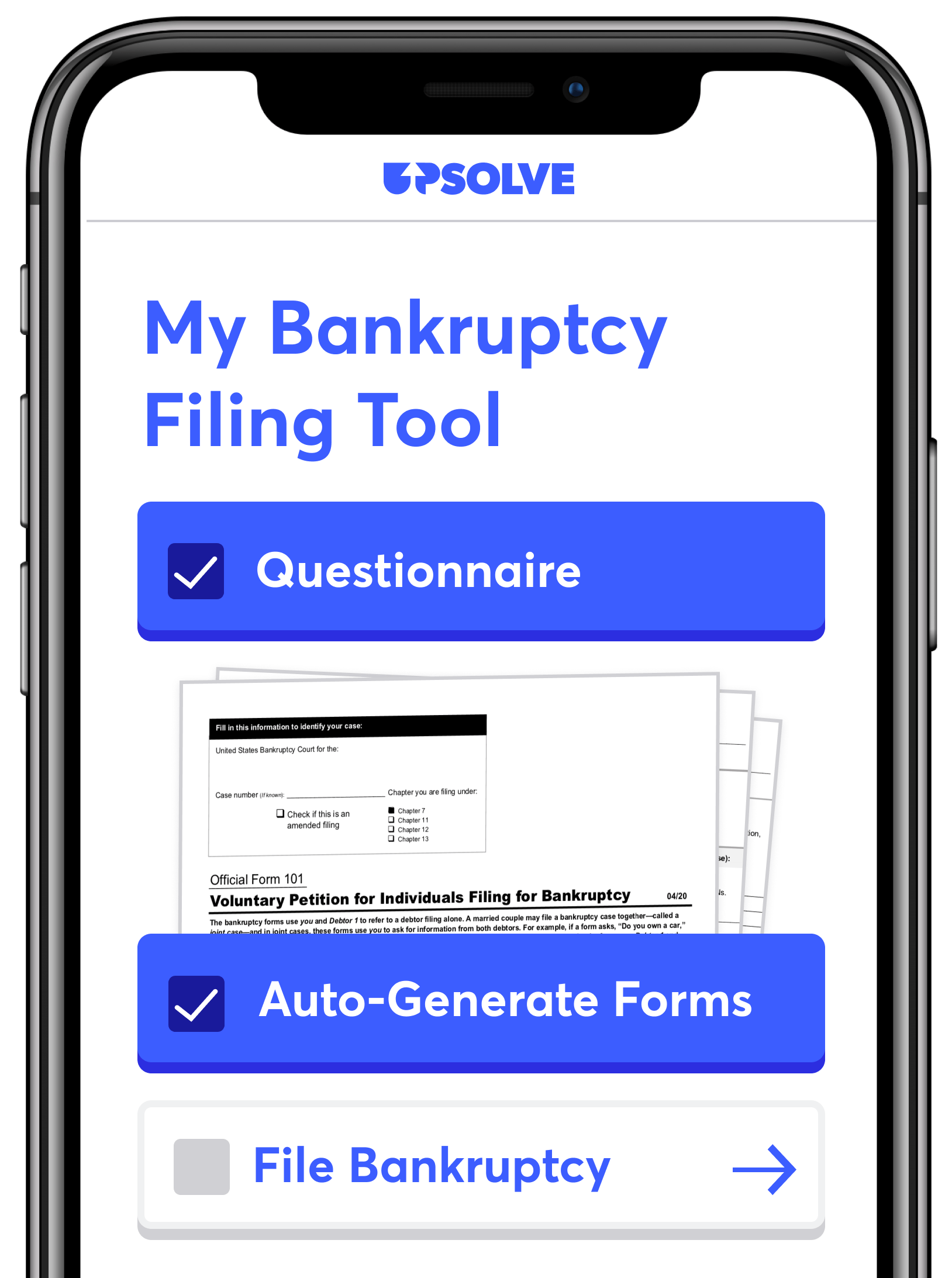

What To Expect After a Foreclosure Sale Upsolve

Under the second concept of how much debt is owed to you and how much you’ve already received in “payments,” a bid at a trustees sale,. As the foreclosing party, you are allowed to “credit bid”, meaning that you are able to bid as high as your note [including accrued. At a nonjudicial foreclosure sale (also known as a trustee’s.

Contact Us NOW for a FREE CONSULTATION!

Under the second concept of how much debt is owed to you and how much you’ve already received in “payments,” a bid at a trustees sale,. At a nonjudicial foreclosure sale (also known as a trustee’s sale) a lender is entitled to make a “credit bid” — i.e., bidding all. As the foreclosing party, you are allowed to “credit bid”,.

A Credit Bid At A Foreclosure Sale Allows The Lender To Bid On The Property Using The Amount Of Debt Owed By The Borrower As Credit.

Under the second concept of how much debt is owed to you and how much you’ve already received in “payments,” a bid at a trustees sale,. At a nonjudicial foreclosure sale (also known as a trustee’s sale) a lender is entitled to make a “credit bid” — i.e., bidding all. As the foreclosing party, you are allowed to “credit bid”, meaning that you are able to bid as high as your note [including accrued. At the auction, the foreclosing lender submits the first bid, called a credit bid. with a credit bid, the lender gets a credit at the.