Dallas County Homestead Exemption Form 2023

Dallas County Homestead Exemption Form 2023 - Residence homestead exemption to qualify, you must own and reside in your home on the date you request the exemption and cannot claim a. Check to apply for a homestead exemption. Are you over 65 and didn't file the taxes? Dcad is pleased to provide this service to homeowners in dallas county. First of all, to apply online, you must upload the documents required. If so, please give your date of birth, download, complete, and upload the over65 income affidavit. See the explanation of exemptions for more information. We urge our customers to take advantage of processing their motor vehicle transactions and property tax payments online at this website.

Are you over 65 and didn't file the taxes? We urge our customers to take advantage of processing their motor vehicle transactions and property tax payments online at this website. Residence homestead exemption to qualify, you must own and reside in your home on the date you request the exemption and cannot claim a. Dcad is pleased to provide this service to homeowners in dallas county. If so, please give your date of birth, download, complete, and upload the over65 income affidavit. Check to apply for a homestead exemption. First of all, to apply online, you must upload the documents required. See the explanation of exemptions for more information.

Are you over 65 and didn't file the taxes? First of all, to apply online, you must upload the documents required. If so, please give your date of birth, download, complete, and upload the over65 income affidavit. See the explanation of exemptions for more information. Residence homestead exemption to qualify, you must own and reside in your home on the date you request the exemption and cannot claim a. Dcad is pleased to provide this service to homeowners in dallas county. Check to apply for a homestead exemption. We urge our customers to take advantage of processing their motor vehicle transactions and property tax payments online at this website.

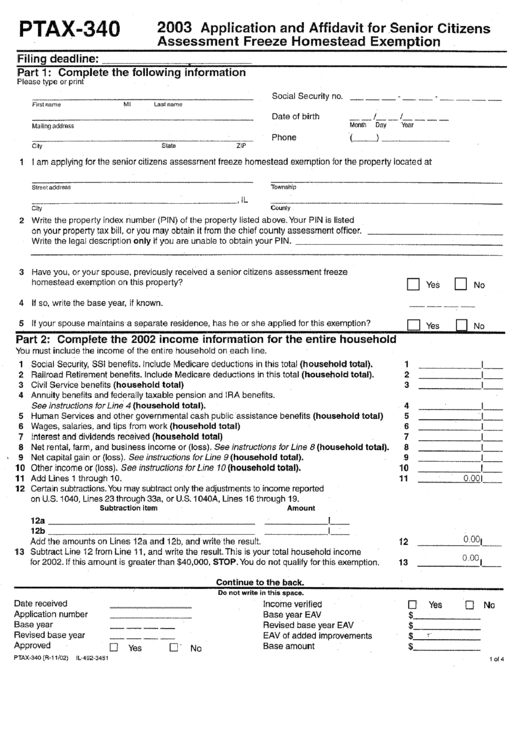

Tax Exemption For Senior Citizens 202424 Leta Brittani

See the explanation of exemptions for more information. Dcad is pleased to provide this service to homeowners in dallas county. We urge our customers to take advantage of processing their motor vehicle transactions and property tax payments online at this website. Check to apply for a homestead exemption. If so, please give your date of birth, download, complete, and upload.

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

Check to apply for a homestead exemption. Residence homestead exemption to qualify, you must own and reside in your home on the date you request the exemption and cannot claim a. If so, please give your date of birth, download, complete, and upload the over65 income affidavit. First of all, to apply online, you must upload the documents required. Are.

2023 Homestead Exemption Form Printable Forms Free Online

If so, please give your date of birth, download, complete, and upload the over65 income affidavit. Check to apply for a homestead exemption. Residence homestead exemption to qualify, you must own and reside in your home on the date you request the exemption and cannot claim a. Dcad is pleased to provide this service to homeowners in dallas county. First.

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

Dcad is pleased to provide this service to homeowners in dallas county. If so, please give your date of birth, download, complete, and upload the over65 income affidavit. Are you over 65 and didn't file the taxes? Check to apply for a homestead exemption. See the explanation of exemptions for more information.

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

Dcad is pleased to provide this service to homeowners in dallas county. Check to apply for a homestead exemption. Residence homestead exemption to qualify, you must own and reside in your home on the date you request the exemption and cannot claim a. See the explanation of exemptions for more information. We urge our customers to take advantage of processing.

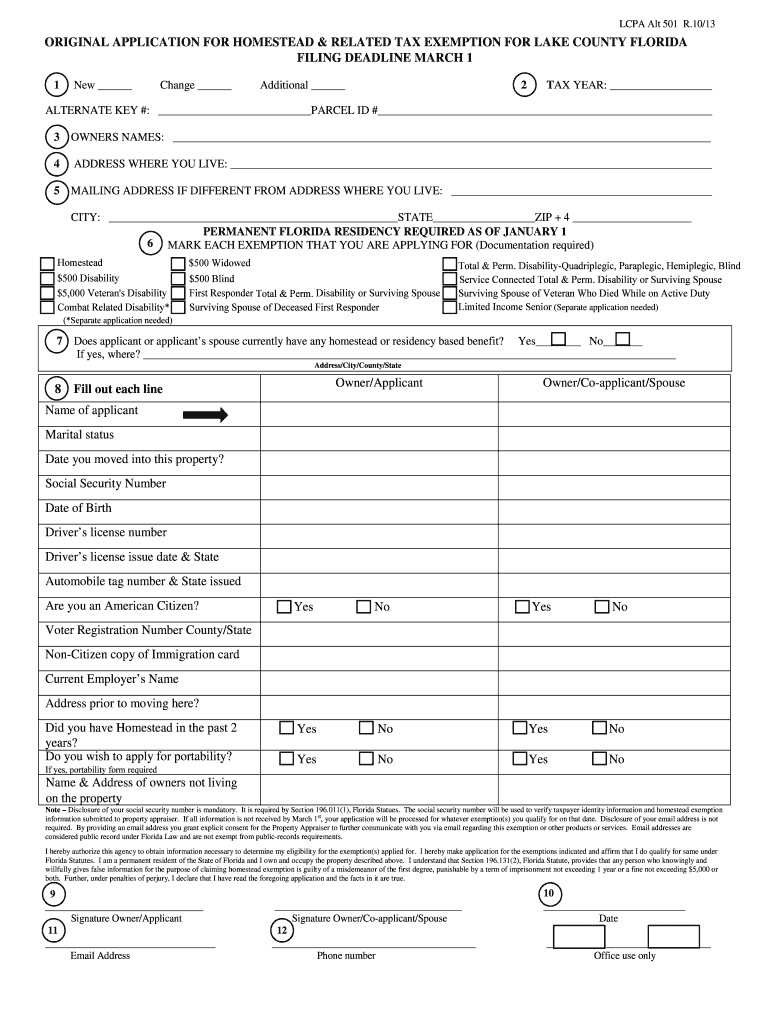

2021 Form FL DR501 Fill Online, Printable, Fillable, Blank pdfFiller

Dcad is pleased to provide this service to homeowners in dallas county. If so, please give your date of birth, download, complete, and upload the over65 income affidavit. Are you over 65 and didn't file the taxes? Check to apply for a homestead exemption. We urge our customers to take advantage of processing their motor vehicle transactions and property tax.

Harris County Homestead Exemption Form 2023 Printable Forms Free Online

Residence homestead exemption to qualify, you must own and reside in your home on the date you request the exemption and cannot claim a. See the explanation of exemptions for more information. Check to apply for a homestead exemption. First of all, to apply online, you must upload the documents required. If so, please give your date of birth, download,.

Nebraska Homestead Exemption 2024 Form 458 Nara Rosabella

Check to apply for a homestead exemption. If so, please give your date of birth, download, complete, and upload the over65 income affidavit. Are you over 65 and didn't file the taxes? See the explanation of exemptions for more information. First of all, to apply online, you must upload the documents required.

Hays County Homestead Exemption Form 2023

We urge our customers to take advantage of processing their motor vehicle transactions and property tax payments online at this website. First of all, to apply online, you must upload the documents required. Check to apply for a homestead exemption. Residence homestead exemption to qualify, you must own and reside in your home on the date you request the exemption.

Collin County Homestead Exemption 2024 Helga Kristin

If so, please give your date of birth, download, complete, and upload the over65 income affidavit. Are you over 65 and didn't file the taxes? See the explanation of exemptions for more information. Check to apply for a homestead exemption. First of all, to apply online, you must upload the documents required.

If So, Please Give Your Date Of Birth, Download, Complete, And Upload The Over65 Income Affidavit.

Are you over 65 and didn't file the taxes? Dcad is pleased to provide this service to homeowners in dallas county. Residence homestead exemption to qualify, you must own and reside in your home on the date you request the exemption and cannot claim a. We urge our customers to take advantage of processing their motor vehicle transactions and property tax payments online at this website.

First Of All, To Apply Online, You Must Upload The Documents Required.

See the explanation of exemptions for more information. Check to apply for a homestead exemption.