Dc Tax Lien Sale

Dc Tax Lien Sale - Any property that is deemed residential and owner occupied,. A tax lien is attached to a property as soon as it becomes delinquent. (a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on mytax.dc.gov. (a) notwithstanding any other provision of law, whenever any real property in the district of columbia has been, or shall hereafter. Liens for taxes or assessments — confirmation of sale; Please encourage any individual interested in purchasing property at the 2024 annual tax sale to attend the tax sale seminar.

(a) notwithstanding any other provision of law, whenever any real property in the district of columbia has been, or shall hereafter. Liens for taxes or assessments — confirmation of sale; A tax lien is attached to a property as soon as it becomes delinquent. (a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on mytax.dc.gov. Please encourage any individual interested in purchasing property at the 2024 annual tax sale to attend the tax sale seminar. Any property that is deemed residential and owner occupied,.

Please encourage any individual interested in purchasing property at the 2024 annual tax sale to attend the tax sale seminar. (a) notwithstanding any other provision of law, whenever any real property in the district of columbia has been, or shall hereafter. Liens for taxes or assessments — confirmation of sale; A tax lien is attached to a property as soon as it becomes delinquent. (a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on mytax.dc.gov. Any property that is deemed residential and owner occupied,.

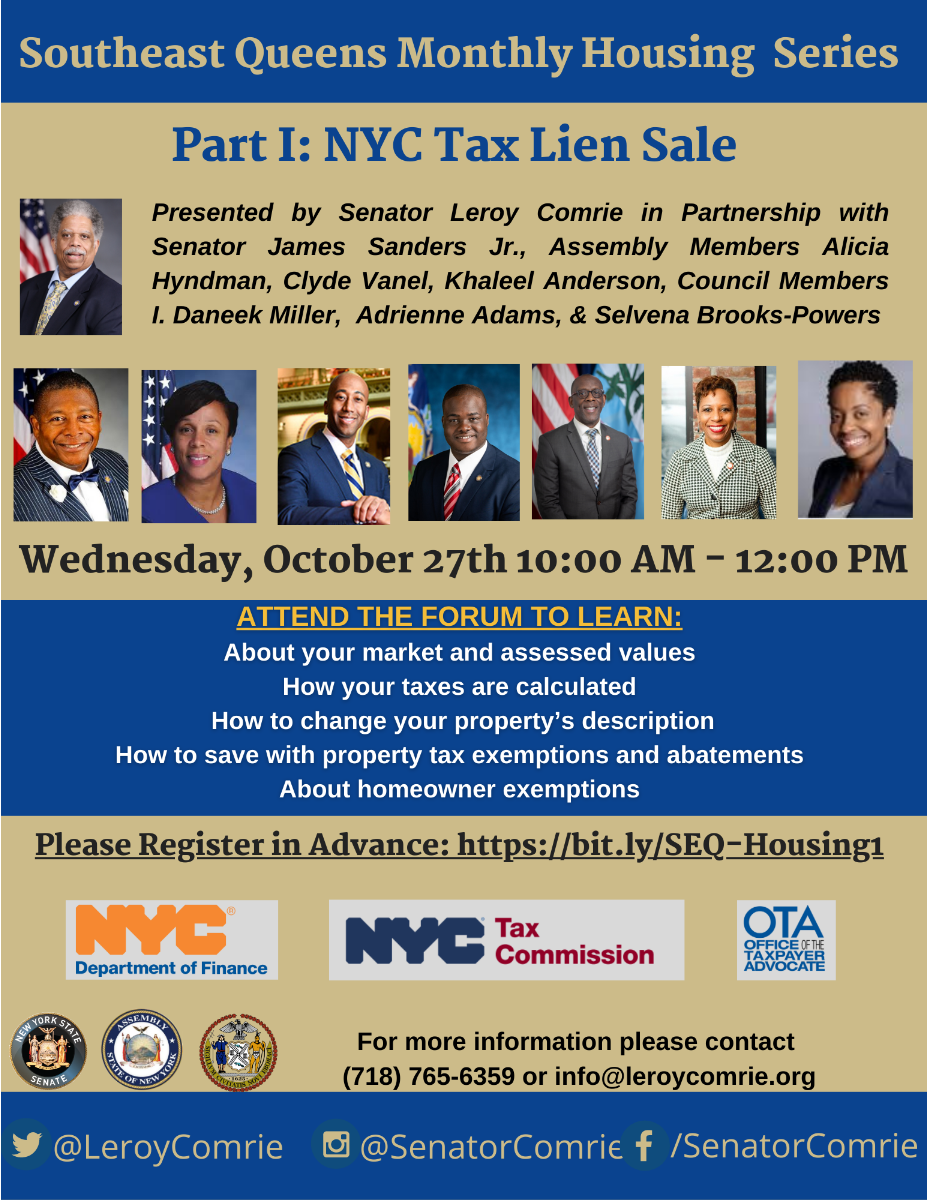

NYC Tax Lien Sale Information Session Jamaica311

Please encourage any individual interested in purchasing property at the 2024 annual tax sale to attend the tax sale seminar. Any property that is deemed residential and owner occupied,. A tax lien is attached to a property as soon as it becomes delinquent. (a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on.

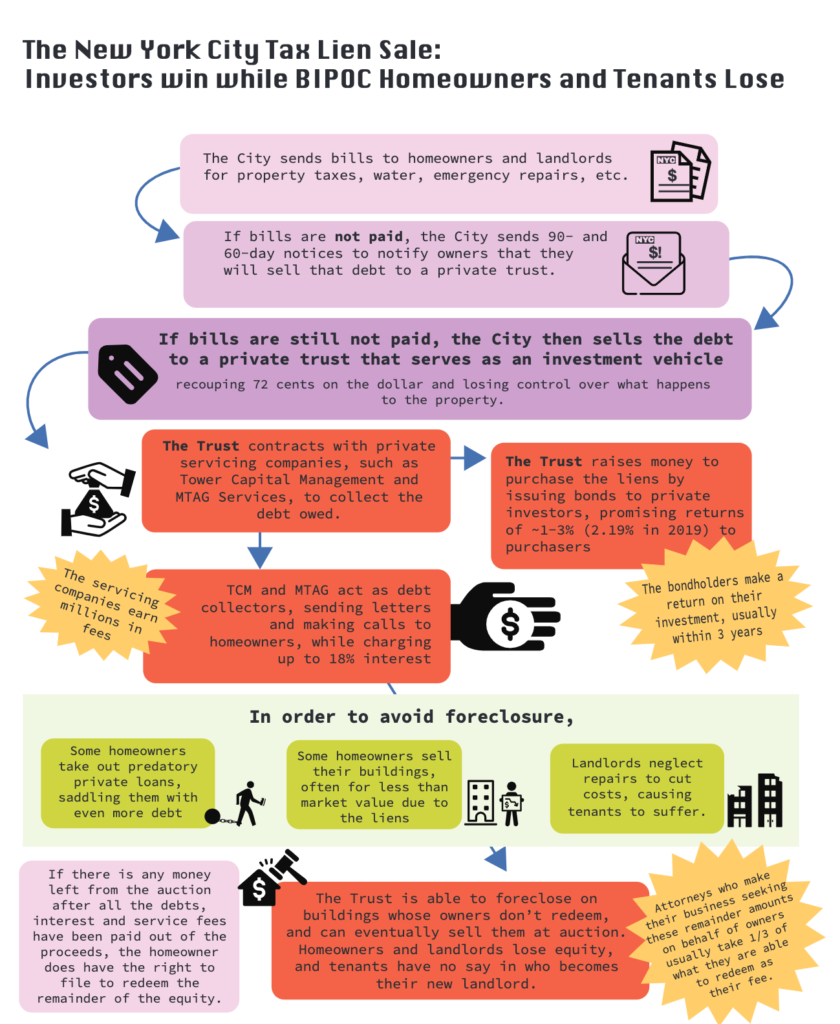

Informational Brochure About the Tax Lien Sale EastNewYorkCLT

Any property that is deemed residential and owner occupied,. Liens for taxes or assessments — confirmation of sale; A tax lien is attached to a property as soon as it becomes delinquent. (a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on mytax.dc.gov. (a) notwithstanding any other provision of law, whenever any real.

Tax Review PDF Taxes Tax Lien

Liens for taxes or assessments — confirmation of sale; A tax lien is attached to a property as soon as it becomes delinquent. (a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on mytax.dc.gov. Please encourage any individual interested in purchasing property at the 2024 annual tax sale to attend the tax sale.

TAX2 TSN (REMEDIES) PDF Taxes Tax Lien

Liens for taxes or assessments — confirmation of sale; Please encourage any individual interested in purchasing property at the 2024 annual tax sale to attend the tax sale seminar. A tax lien is attached to a property as soon as it becomes delinquent. (a) notwithstanding any other provision of law, whenever any real property in the district of columbia has.

Abolish The Tax Lien Sale EastNewYorkCLT

(a) notwithstanding any other provision of law, whenever any real property in the district of columbia has been, or shall hereafter. Please encourage any individual interested in purchasing property at the 2024 annual tax sale to attend the tax sale seminar. A tax lien is attached to a property as soon as it becomes delinquent. (a) the tax sale purchaser.

Tax Lien Training Special Expired — Financial Freedom University

A tax lien is attached to a property as soon as it becomes delinquent. Liens for taxes or assessments — confirmation of sale; (a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on mytax.dc.gov. Any property that is deemed residential and owner occupied,. Please encourage any individual interested in purchasing property at the.

Analysis of Bulk Tax Lien Sale Center for Community Progress

Liens for taxes or assessments — confirmation of sale; (a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on mytax.dc.gov. (a) notwithstanding any other provision of law, whenever any real property in the district of columbia has been, or shall hereafter. A tax lien is attached to a property as soon as it.

Tax Lien Focus Group Real Estate And Profit Acceleration Enjoy Your

(a) notwithstanding any other provision of law, whenever any real property in the district of columbia has been, or shall hereafter. A tax lien is attached to a property as soon as it becomes delinquent. Liens for taxes or assessments — confirmation of sale; (a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes.

NYC Tax Lien Sale Reform Conference EastNewYorkCLT

Please encourage any individual interested in purchasing property at the 2024 annual tax sale to attend the tax sale seminar. (a) notwithstanding any other provision of law, whenever any real property in the district of columbia has been, or shall hereafter. A tax lien is attached to a property as soon as it becomes delinquent. Any property that is deemed.

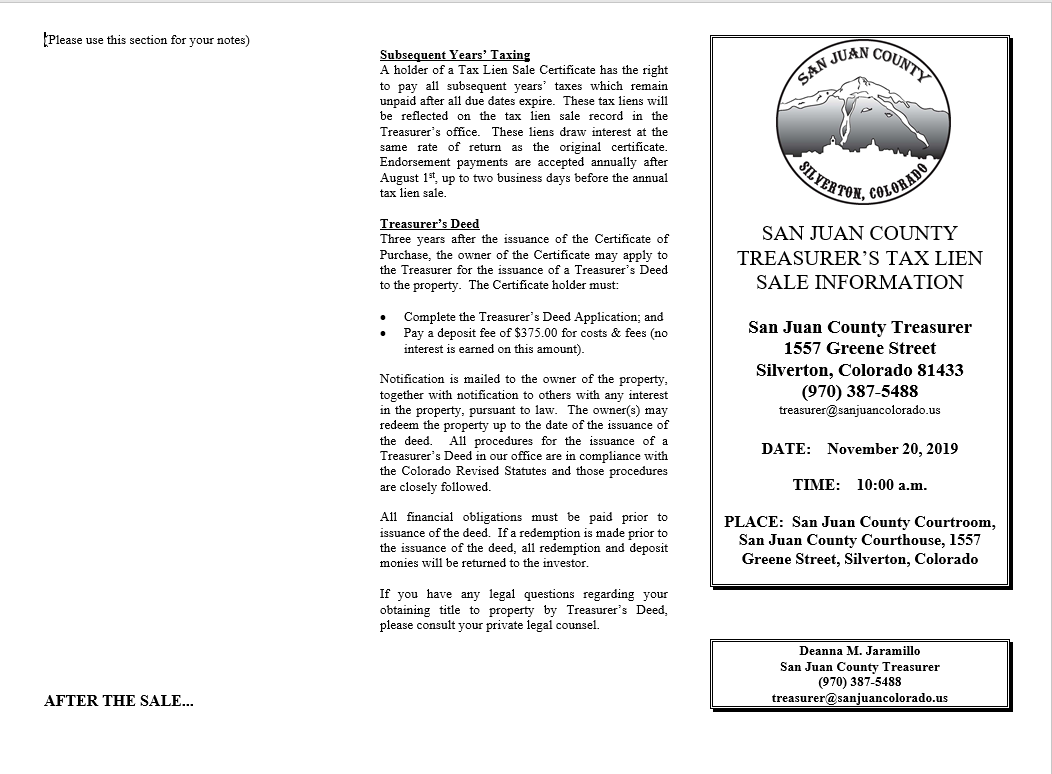

Tax Lien Sale San Juan County

Please encourage any individual interested in purchasing property at the 2024 annual tax sale to attend the tax sale seminar. Any property that is deemed residential and owner occupied,. Liens for taxes or assessments — confirmation of sale; (a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on mytax.dc.gov. (a) notwithstanding any other.

Please Encourage Any Individual Interested In Purchasing Property At The 2024 Annual Tax Sale To Attend The Tax Sale Seminar.

(a) notwithstanding any other provision of law, whenever any real property in the district of columbia has been, or shall hereafter. Any property that is deemed residential and owner occupied,. Liens for taxes or assessments — confirmation of sale; (a) the tax sale purchaser shall electronically submit a request to pay subsequent real property taxes on mytax.dc.gov.