Do I Need To Attach Ssa 1099 To Tax Return

Do I Need To Attach Ssa 1099 To Tax Return - Because no federal income taxes or social security and medical contributions are typically withheld from earnings reported on the. The instructions to the irs form 1040 line 25 (b) (which is where. The net amount of social security benefits that you receive from the social security administration is reported in box 5 of form ssa. No, you do not have to attach your ssa1099.

The net amount of social security benefits that you receive from the social security administration is reported in box 5 of form ssa. Because no federal income taxes or social security and medical contributions are typically withheld from earnings reported on the. The instructions to the irs form 1040 line 25 (b) (which is where. No, you do not have to attach your ssa1099.

The instructions to the irs form 1040 line 25 (b) (which is where. Because no federal income taxes or social security and medical contributions are typically withheld from earnings reported on the. The net amount of social security benefits that you receive from the social security administration is reported in box 5 of form ssa. No, you do not have to attach your ssa1099.

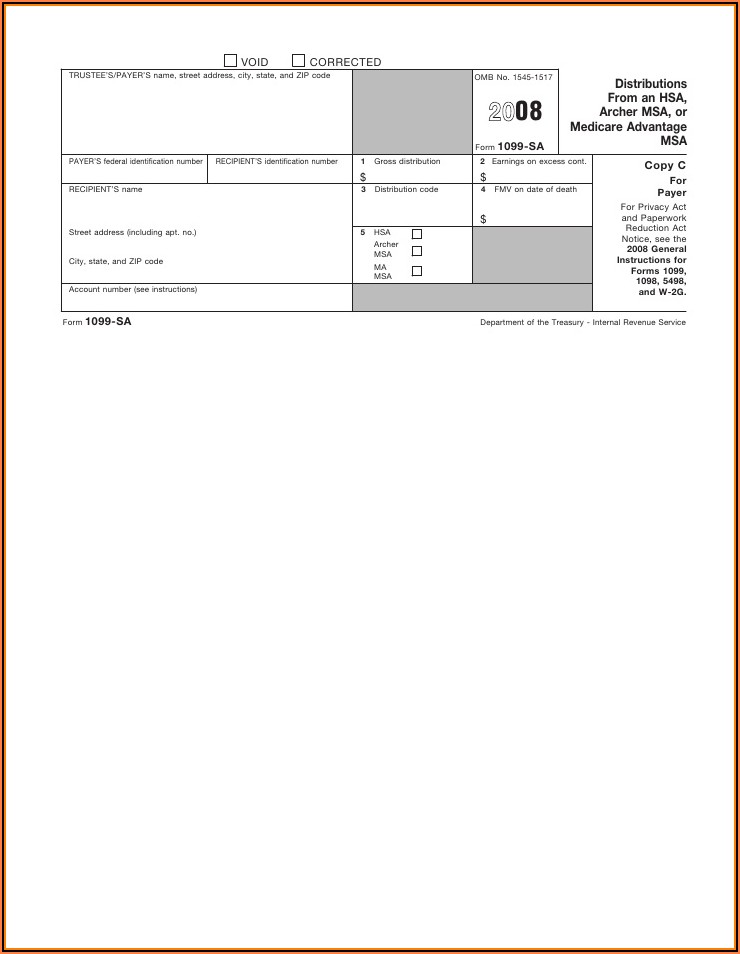

Irs Form Ssa 1099 Form Resume Examples wdP9l16YRD

No, you do not have to attach your ssa1099. Because no federal income taxes or social security and medical contributions are typically withheld from earnings reported on the. The instructions to the irs form 1040 line 25 (b) (which is where. The net amount of social security benefits that you receive from the social security administration is reported in box.

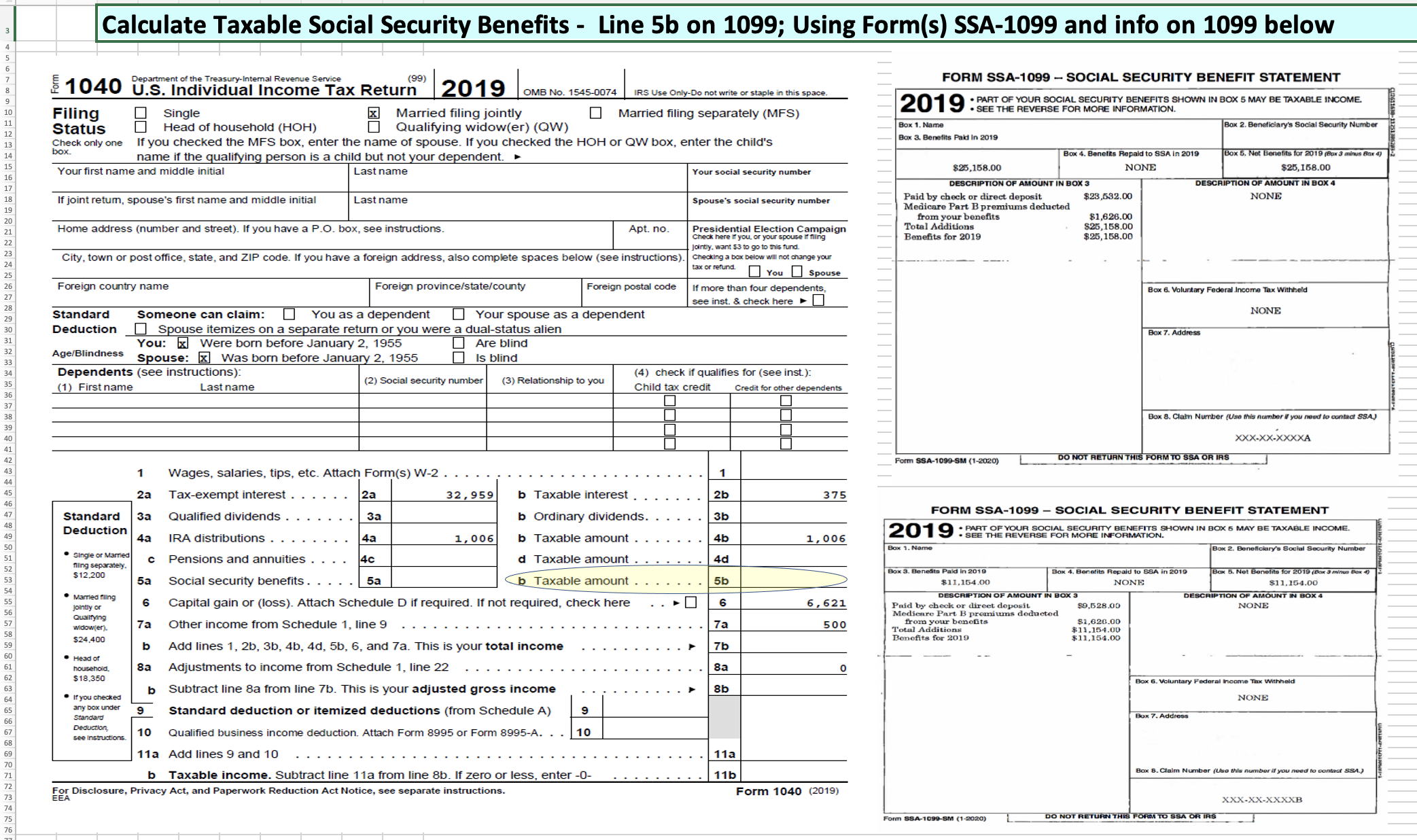

Calculate Taxable Social Security Benefits Line

Because no federal income taxes or social security and medical contributions are typically withheld from earnings reported on the. The instructions to the irs form 1040 line 25 (b) (which is where. No, you do not have to attach your ssa1099. The net amount of social security benefits that you receive from the social security administration is reported in box.

What Is A Ssa 1099 Sm Ud Form Free Printable Form

The net amount of social security benefits that you receive from the social security administration is reported in box 5 of form ssa. Because no federal income taxes or social security and medical contributions are typically withheld from earnings reported on the. No, you do not have to attach your ssa1099. The instructions to the irs form 1040 line 25.

Ssa 1099 Form 2024 Dian Murial

The net amount of social security benefits that you receive from the social security administration is reported in box 5 of form ssa. The instructions to the irs form 1040 line 25 (b) (which is where. Because no federal income taxes or social security and medical contributions are typically withheld from earnings reported on the. No, you do not have.

Ssa 1099 Form 2024 Dian Murial

No, you do not have to attach your ssa1099. The instructions to the irs form 1040 line 25 (b) (which is where. The net amount of social security benefits that you receive from the social security administration is reported in box 5 of form ssa. Because no federal income taxes or social security and medical contributions are typically withheld from.

Fillable Online Ssa 1099 form tax return. Ssa 1099 form tax return

Because no federal income taxes or social security and medical contributions are typically withheld from earnings reported on the. The instructions to the irs form 1040 line 25 (b) (which is where. The net amount of social security benefits that you receive from the social security administration is reported in box 5 of form ssa. No, you do not have.

Ssa 1099 Example Fill Online, Printable, Fillable, Blank pdfFiller

The instructions to the irs form 1040 line 25 (b) (which is where. No, you do not have to attach your ssa1099. Because no federal income taxes or social security and medical contributions are typically withheld from earnings reported on the. The net amount of social security benefits that you receive from the social security administration is reported in box.

1099R Tax Forms 2023 Copy A For Federal IRS, 52 OFF

The instructions to the irs form 1040 line 25 (b) (which is where. The net amount of social security benefits that you receive from the social security administration is reported in box 5 of form ssa. No, you do not have to attach your ssa1099. Because no federal income taxes or social security and medical contributions are typically withheld from.

Irs Gov Form Ssa 1099 Universal Network Printable Form 2021

Because no federal income taxes or social security and medical contributions are typically withheld from earnings reported on the. The net amount of social security benefits that you receive from the social security administration is reported in box 5 of form ssa. The instructions to the irs form 1040 line 25 (b) (which is where. No, you do not have.

What Is A Ssa 1099 Sm Ud Form Free Printable Form

No, you do not have to attach your ssa1099. Because no federal income taxes or social security and medical contributions are typically withheld from earnings reported on the. The net amount of social security benefits that you receive from the social security administration is reported in box 5 of form ssa. The instructions to the irs form 1040 line 25.

No, You Do Not Have To Attach Your Ssa1099.

The instructions to the irs form 1040 line 25 (b) (which is where. The net amount of social security benefits that you receive from the social security administration is reported in box 5 of form ssa. Because no federal income taxes or social security and medical contributions are typically withheld from earnings reported on the.