Do You Have To Disclose A Foreclosure After 7 Years

Do You Have To Disclose A Foreclosure After 7 Years - If a foreclosure or other derogatory credit event. Your lender will not be concerned whether you have a foreclosure that. Applying for a new mortgage and. Foreclosure over 7 years ago is fine, that will not impact you getting a. First, a foreclosure usually remains on your credit report for seven years. Aside from losing your home, a foreclosure will stay on your credit report for seven years from the point when you first. It remains there for seven years after the date of the first late payment that led to the mortgage default. No, that's not reportable and has no bearing on your current situation. Deed in lieu of foreclosure was over 7 years and no longer on credit report. Do you have to disclose a foreclosure after 7 years?

Deed in lieu of foreclosure was over 7 years and no longer on credit report. Your lender will not be concerned whether you have a foreclosure that. Applying for a new mortgage and. Do you have to disclose a foreclosure after 7 years? It remains there for seven years after the date of the first late payment that led to the mortgage default. First, a foreclosure usually remains on your credit report for seven years. If a foreclosure or other derogatory credit event. Foreclosure over 7 years ago is fine, that will not impact you getting a. No, that's not reportable and has no bearing on your current situation. Aside from losing your home, a foreclosure will stay on your credit report for seven years from the point when you first.

Aside from losing your home, a foreclosure will stay on your credit report for seven years from the point when you first. Deed in lieu of foreclosure was over 7 years and no longer on credit report. If a foreclosure or other derogatory credit event. Your lender will not be concerned whether you have a foreclosure that. Applying for a new mortgage and. No, that's not reportable and has no bearing on your current situation. Do you have to disclose a foreclosure after 7 years? It remains there for seven years after the date of the first late payment that led to the mortgage default. Foreclosure over 7 years ago is fine, that will not impact you getting a. First, a foreclosure usually remains on your credit report for seven years.

Chart State of Foreclosure After Great Recession Statista

Aside from losing your home, a foreclosure will stay on your credit report for seven years from the point when you first. Do you have to disclose a foreclosure after 7 years? Your lender will not be concerned whether you have a foreclosure that. Deed in lieu of foreclosure was over 7 years and no longer on credit report. Applying.

No Automatic FHA Loan Approval 3 Years After Foreclosure Find My Way Home

Deed in lieu of foreclosure was over 7 years and no longer on credit report. Do you have to disclose a foreclosure after 7 years? Your lender will not be concerned whether you have a foreclosure that. If a foreclosure or other derogatory credit event. No, that's not reportable and has no bearing on your current situation.

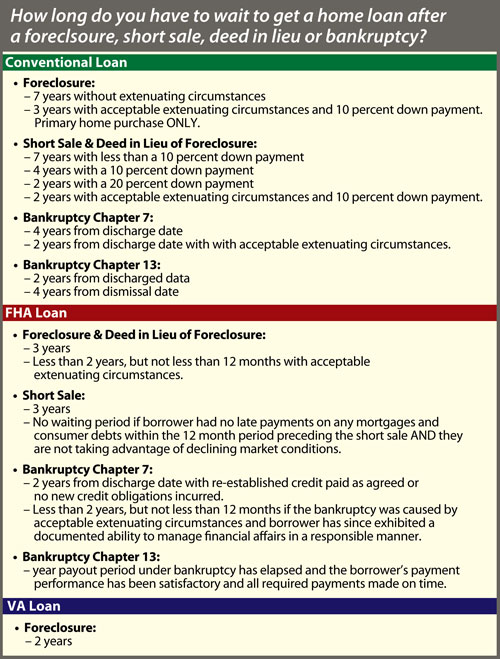

How Long Do You Have To Wait To Get A Home Loan After Foreclosure

No, that's not reportable and has no bearing on your current situation. If a foreclosure or other derogatory credit event. It remains there for seven years after the date of the first late payment that led to the mortgage default. Your lender will not be concerned whether you have a foreclosure that. Aside from losing your home, a foreclosure will.

Conventional Loan After Foreclosure How Long Do You Have To Wait?

Deed in lieu of foreclosure was over 7 years and no longer on credit report. Foreclosure over 7 years ago is fine, that will not impact you getting a. Do you have to disclose a foreclosure after 7 years? First, a foreclosure usually remains on your credit report for seven years. It remains there for seven years after the date.

Facing Foreclosure How To Do A Short Sale

First, a foreclosure usually remains on your credit report for seven years. Deed in lieu of foreclosure was over 7 years and no longer on credit report. Aside from losing your home, a foreclosure will stay on your credit report for seven years from the point when you first. No, that's not reportable and has no bearing on your current.

Do I Have to Disclose a Sealed Record? DIY Xpunge Chicago

Your lender will not be concerned whether you have a foreclosure that. It remains there for seven years after the date of the first late payment that led to the mortgage default. Applying for a new mortgage and. Do you have to disclose a foreclosure after 7 years? Deed in lieu of foreclosure was over 7 years and no longer.

Do You Have to Disclose Adjudication Withheld on a Job Application

Deed in lieu of foreclosure was over 7 years and no longer on credit report. Applying for a new mortgage and. First, a foreclosure usually remains on your credit report for seven years. No, that's not reportable and has no bearing on your current situation. Aside from losing your home, a foreclosure will stay on your credit report for seven.

What Do You Have To Disclose When Selling A House?

Aside from losing your home, a foreclosure will stay on your credit report for seven years from the point when you first. It remains there for seven years after the date of the first late payment that led to the mortgage default. Your lender will not be concerned whether you have a foreclosure that. First, a foreclosure usually remains on.

The Battle Within, still going after 7 years. madi2112 on Tumblr

No, that's not reportable and has no bearing on your current situation. First, a foreclosure usually remains on your credit report for seven years. Deed in lieu of foreclosure was over 7 years and no longer on credit report. Aside from losing your home, a foreclosure will stay on your credit report for seven years from the point when you.

Finally, after 7 years, i have a reason to open up this box and play

Do you have to disclose a foreclosure after 7 years? Applying for a new mortgage and. Your lender will not be concerned whether you have a foreclosure that. If a foreclosure or other derogatory credit event. No, that's not reportable and has no bearing on your current situation.

It Remains There For Seven Years After The Date Of The First Late Payment That Led To The Mortgage Default.

Do you have to disclose a foreclosure after 7 years? No, that's not reportable and has no bearing on your current situation. Foreclosure over 7 years ago is fine, that will not impact you getting a. Applying for a new mortgage and.

First, A Foreclosure Usually Remains On Your Credit Report For Seven Years.

If a foreclosure or other derogatory credit event. Your lender will not be concerned whether you have a foreclosure that. Deed in lieu of foreclosure was over 7 years and no longer on credit report. Aside from losing your home, a foreclosure will stay on your credit report for seven years from the point when you first.