Does Depreciation Go On The Balance Sheet

Does Depreciation Go On The Balance Sheet - Your balance sheet will record depreciation for all of your fixed assets. This reduces the company's net income. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. Accumulated depreciation is listed on the balance sheet. Also, fixed assets are recorded on the balance sheet, and since accumulated depreciation affects a fixed. Depreciation expense is reported on the income statement along with other normal business expenses. Depreciation expense itself does not appear as a separate line item on the balance sheet. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Instead, it affects the value of the asset it is allocated to and subsequently impacts the overall financial position of the company.

Depreciation expense itself does not appear as a separate line item on the balance sheet. Also, fixed assets are recorded on the balance sheet, and since accumulated depreciation affects a fixed. Instead, it affects the value of the asset it is allocated to and subsequently impacts the overall financial position of the company. Accumulated depreciation is listed on the balance sheet. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Your balance sheet will record depreciation for all of your fixed assets. Depreciation expense is reported on the income statement along with other normal business expenses. This reduces the company's net income. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement.

This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. Accumulated depreciation is listed on the balance sheet. Depreciation expense itself does not appear as a separate line item on the balance sheet. Also, fixed assets are recorded on the balance sheet, and since accumulated depreciation affects a fixed. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Depreciation expense is reported on the income statement along with other normal business expenses. Instead, it affects the value of the asset it is allocated to and subsequently impacts the overall financial position of the company. Your balance sheet will record depreciation for all of your fixed assets. This reduces the company's net income.

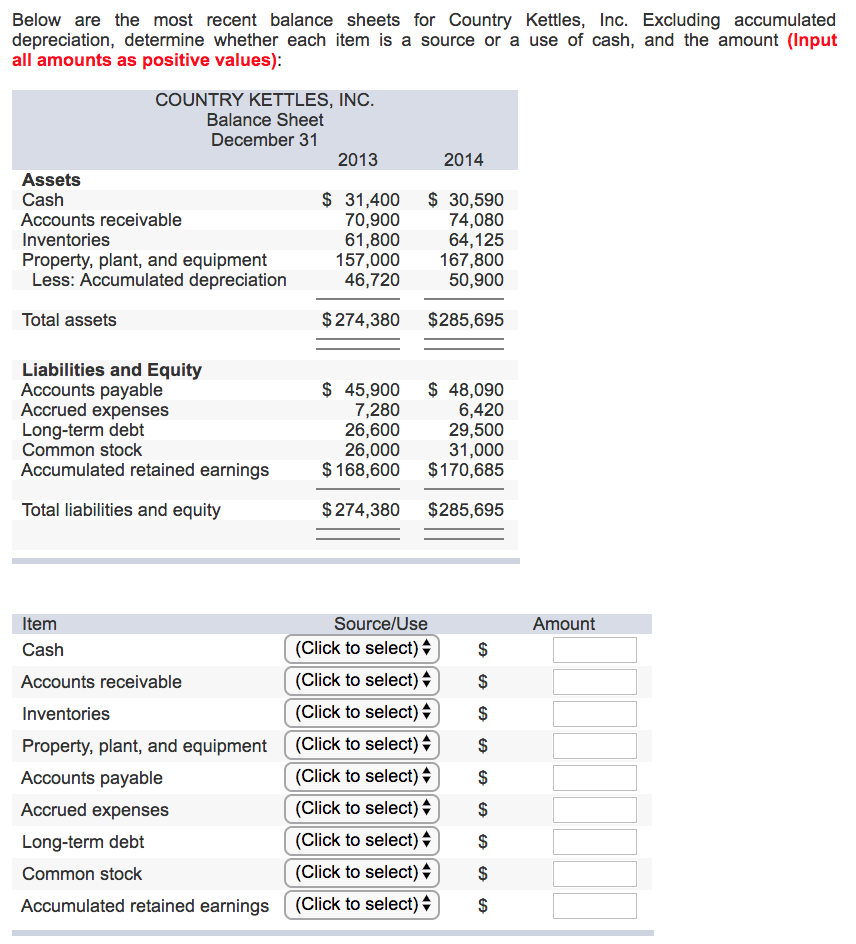

Where Does Equipment Go On A Balance Sheet at John Dominguez blog

Also, fixed assets are recorded on the balance sheet, and since accumulated depreciation affects a fixed. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. Depreciation expense itself does not appear as a separate line item on the balance sheet. Accumulated depreciation is listed on the balance sheet. Depreciation expense is.

Where is accumulated depreciation on the balance sheet? Financial

Also, fixed assets are recorded on the balance sheet, and since accumulated depreciation affects a fixed. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. This reduces the company's net income. Accumulated depreciation is listed on the balance sheet. Accumulated depreciation represents the total depreciation of a company's fixed assets at.

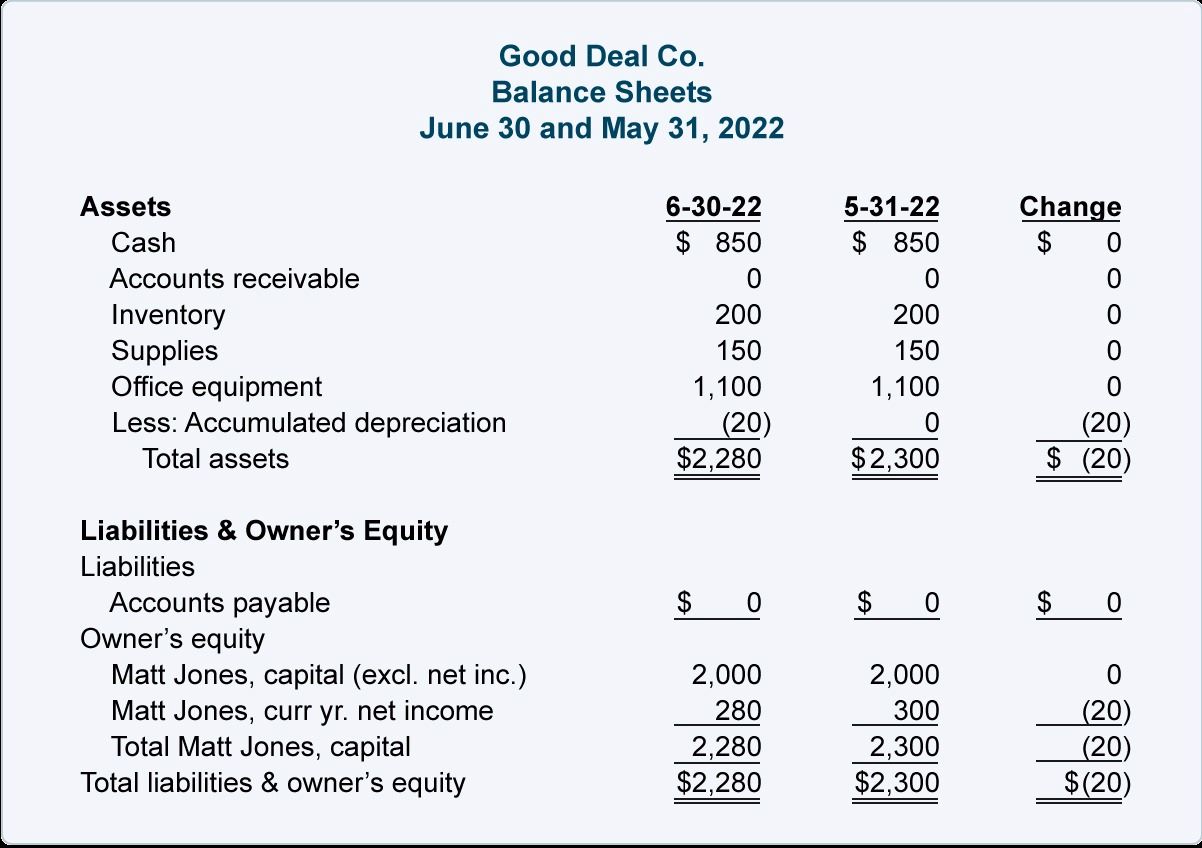

where is accumulated depreciation on balance sheet? Quizlet

This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. Depreciation expense itself does not appear as a separate line item on the balance sheet. Accumulated depreciation is listed on the balance sheet. Depreciation expense is reported on the income statement along with other normal business expenses. Your balance sheet will record.

Where Does Depreciation Expense Go On A Balance Sheet LiveWell

This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. Also, fixed assets are recorded on the balance sheet, and since accumulated depreciation affects a fixed. Accumulated depreciation is listed on the balance sheet. This reduces the company's net income. Depreciation expense itself does not appear as a separate line item on.

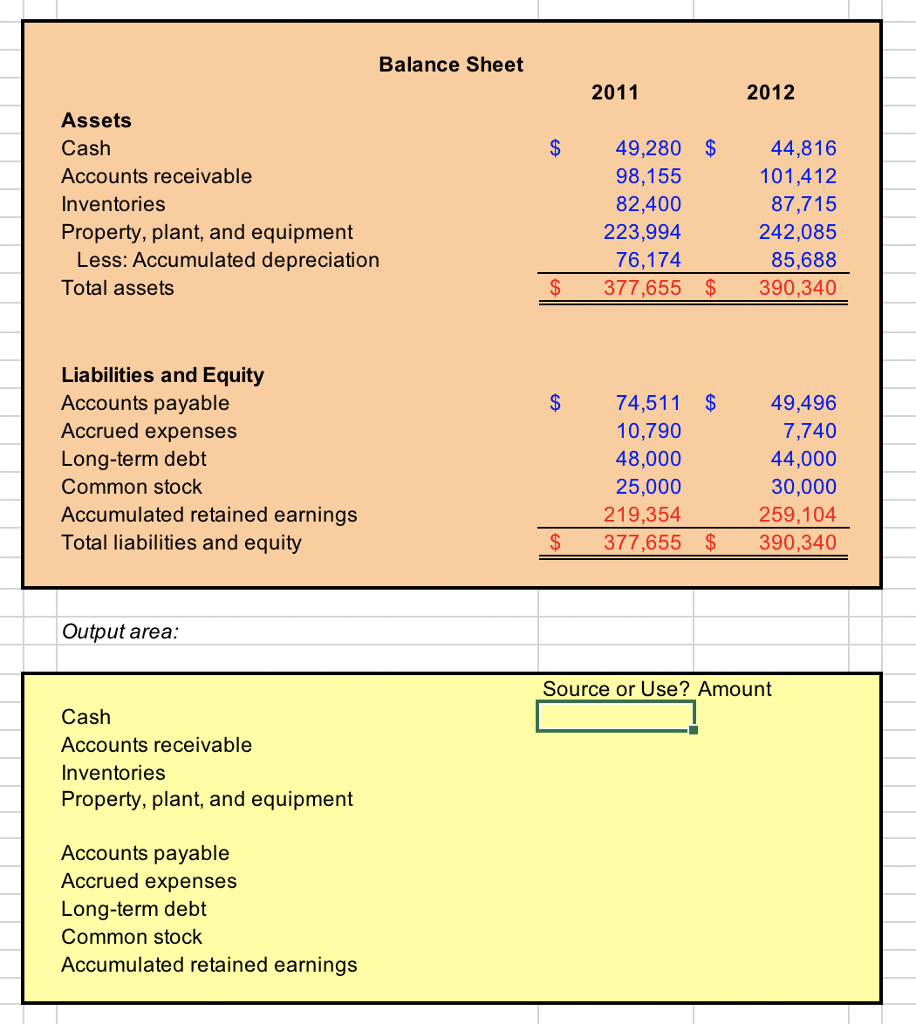

Accumulated depreciation assets lasopainbox

This reduces the company's net income. Depreciation expense is reported on the income statement along with other normal business expenses. Depreciation expense itself does not appear as a separate line item on the balance sheet. Instead, it affects the value of the asset it is allocated to and subsequently impacts the overall financial position of the company. Also, fixed assets.

Where Does Accumulated Amortization Go On The Balance Sheet LiveWell

Accumulated depreciation is listed on the balance sheet. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. Depreciation expense is reported on the income statement along with other normal business expenses. Depreciation expense itself does not appear as a separate line item on the balance sheet. Also, fixed assets are recorded.

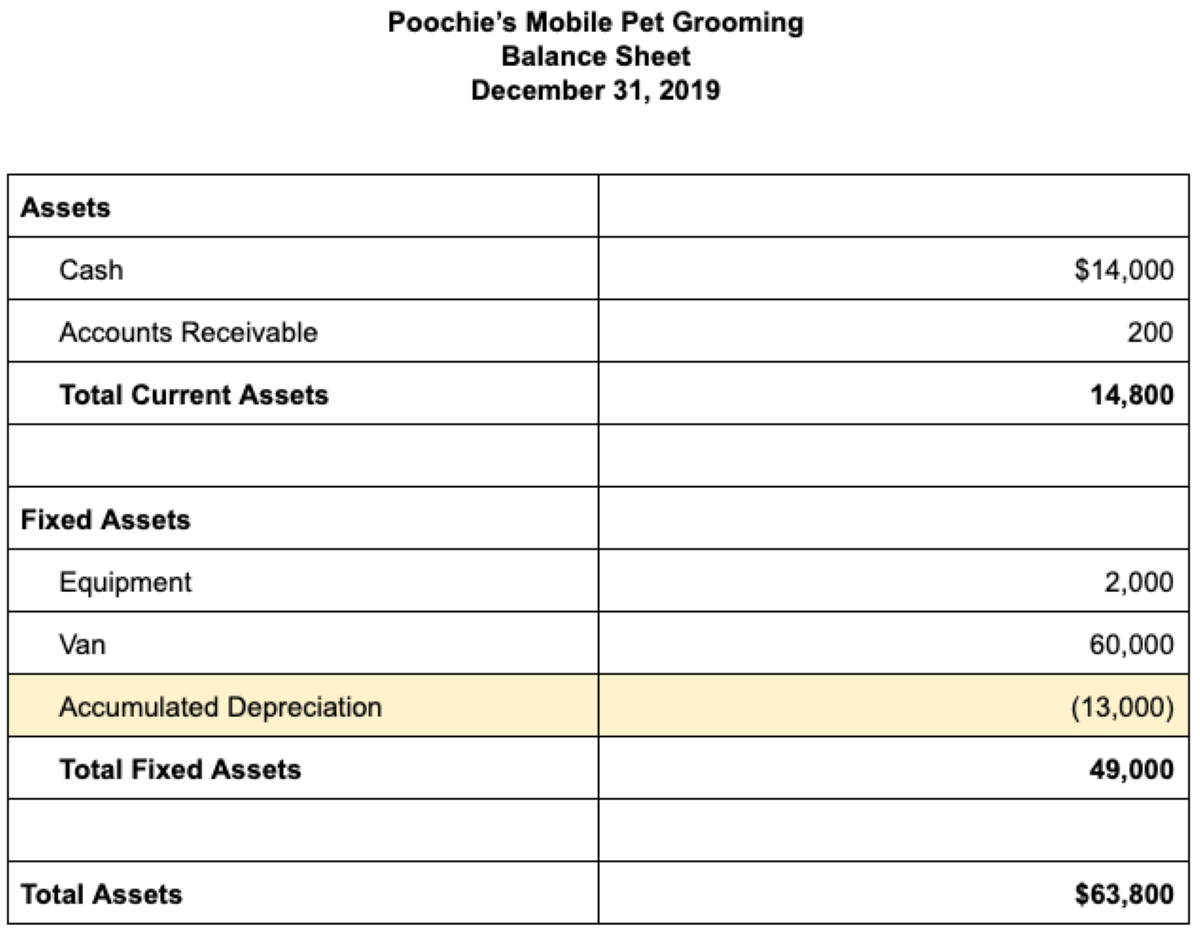

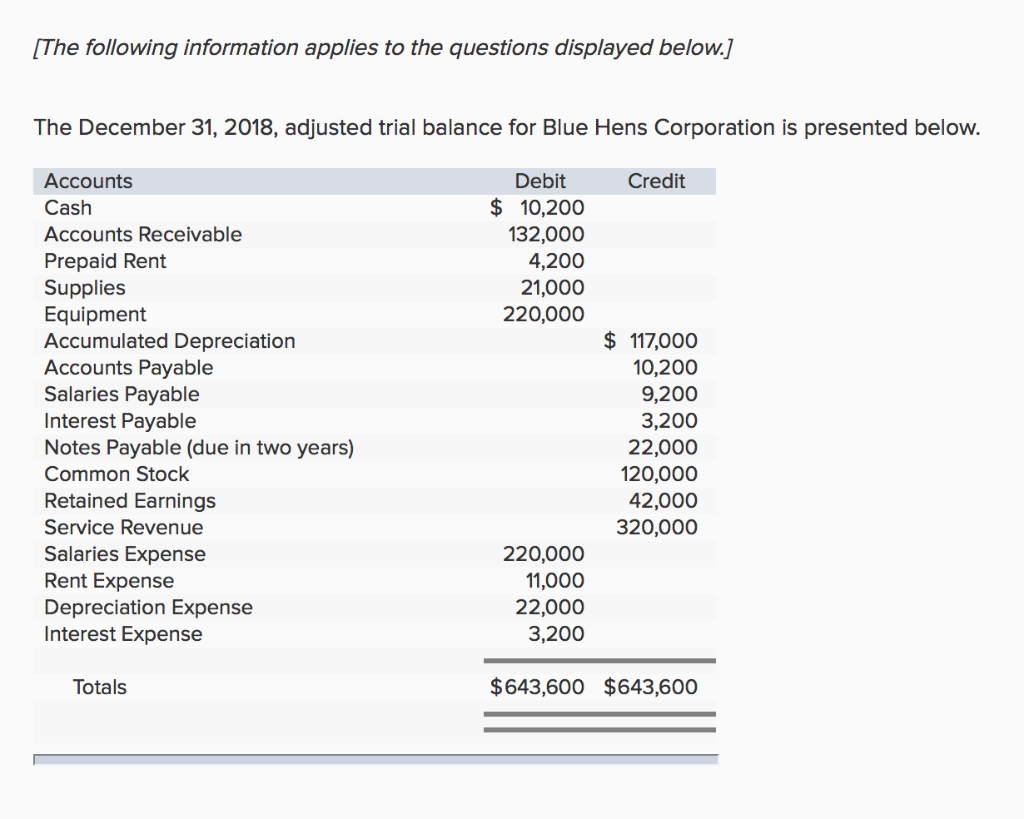

Solved 3. Prepare a classified balance sheet as of December

Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Your balance sheet will record depreciation for all of your fixed assets. Accumulated depreciation is listed on the balance sheet. Instead, it affects the value of the asset it is allocated to and subsequently impacts the overall financial position of the company. Depreciation.

How do you account for depreciation on a balance sheet? Leia aqui Is

Instead, it affects the value of the asset it is allocated to and subsequently impacts the overall financial position of the company. Accumulated depreciation is listed on the balance sheet. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. Depreciation expense itself does not appear as a separate line item on.

Why is depreciation an asset? Leia aqui Why is depreciation expense an

Depreciation expense itself does not appear as a separate line item on the balance sheet. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. Accumulated depreciation is listed on the balance sheet. Your balance sheet will record depreciation for all of your fixed assets. Instead, it affects the value of the.

Why is depreciation an asset? Leia aqui Why is depreciation expense an

This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Also, fixed assets are recorded on the balance sheet, and since accumulated depreciation affects a fixed. Depreciation expense is reported on the income statement along.

This Reduces The Company's Net Income.

Depreciation expense itself does not appear as a separate line item on the balance sheet. Accumulated depreciation is listed on the balance sheet. Instead, it affects the value of the asset it is allocated to and subsequently impacts the overall financial position of the company. Also, fixed assets are recorded on the balance sheet, and since accumulated depreciation affects a fixed.

This Means You’ll See More Overall Depreciation On Your Balance Sheet Than You Will On An Income Statement.

Depreciation expense is reported on the income statement along with other normal business expenses. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Your balance sheet will record depreciation for all of your fixed assets.