Does Irs File A Tax Lien With An Installment Agreement

Does Irs File A Tax Lien With An Installment Agreement - It is just a matter of. When you request a payment plan (installment agreement), with certain exceptions, the irs is generally prohibited from levying and the. Irm 5.14.1.4.3, notice of federal tax lien and installment agreements, provides instructions on determining when to file a request. Learn more about the four different types of installment. Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car. The irs allows taxpayers to pay off tax debt through an installment agreement.

Learn more about the four different types of installment. Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car. It is just a matter of. The irs allows taxpayers to pay off tax debt through an installment agreement. Irm 5.14.1.4.3, notice of federal tax lien and installment agreements, provides instructions on determining when to file a request. When you request a payment plan (installment agreement), with certain exceptions, the irs is generally prohibited from levying and the.

Learn more about the four different types of installment. The irs allows taxpayers to pay off tax debt through an installment agreement. Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car. Irm 5.14.1.4.3, notice of federal tax lien and installment agreements, provides instructions on determining when to file a request. When you request a payment plan (installment agreement), with certain exceptions, the irs is generally prohibited from levying and the. It is just a matter of.

7 Types of IRS Installment Agreements Partial Pay Installment Agreement

The irs allows taxpayers to pay off tax debt through an installment agreement. Learn more about the four different types of installment. It is just a matter of. When you request a payment plan (installment agreement), with certain exceptions, the irs is generally prohibited from levying and the. Installment agreements can get tax liens withdrawn, improve your credit score and.

IRS Notice CP523 Intent to Terminate Your Installment Agreement H&R

When you request a payment plan (installment agreement), with certain exceptions, the irs is generally prohibited from levying and the. It is just a matter of. Irm 5.14.1.4.3, notice of federal tax lien and installment agreements, provides instructions on determining when to file a request. Learn more about the four different types of installment. Installment agreements can get tax liens.

How Does the IRS Notify You of a Tax Lien? Rush Tax Resolution

Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car. It is just a matter of. Irm 5.14.1.4.3, notice of federal tax lien and installment agreements, provides instructions on determining when to file a request. Learn more about the four different types of installment. The irs allows taxpayers to pay off.

IRS Installment Agreement Types How Can It Help You

Irm 5.14.1.4.3, notice of federal tax lien and installment agreements, provides instructions on determining when to file a request. Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car. When you request a payment plan (installment agreement), with certain exceptions, the irs is generally prohibited from levying and the. The irs.

Irs Tax Lien Irs Tax Lien Payment Plan

Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car. It is just a matter of. Learn more about the four different types of installment. The irs allows taxpayers to pay off tax debt through an installment agreement. When you request a payment plan (installment agreement), with certain exceptions, the irs.

When Does the IRS File a Tax Lien? — Fortress Tax Relief

Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car. Irm 5.14.1.4.3, notice of federal tax lien and installment agreements, provides instructions on determining when to file a request. The irs allows taxpayers to pay off tax debt through an installment agreement. Learn more about the four different types of installment..

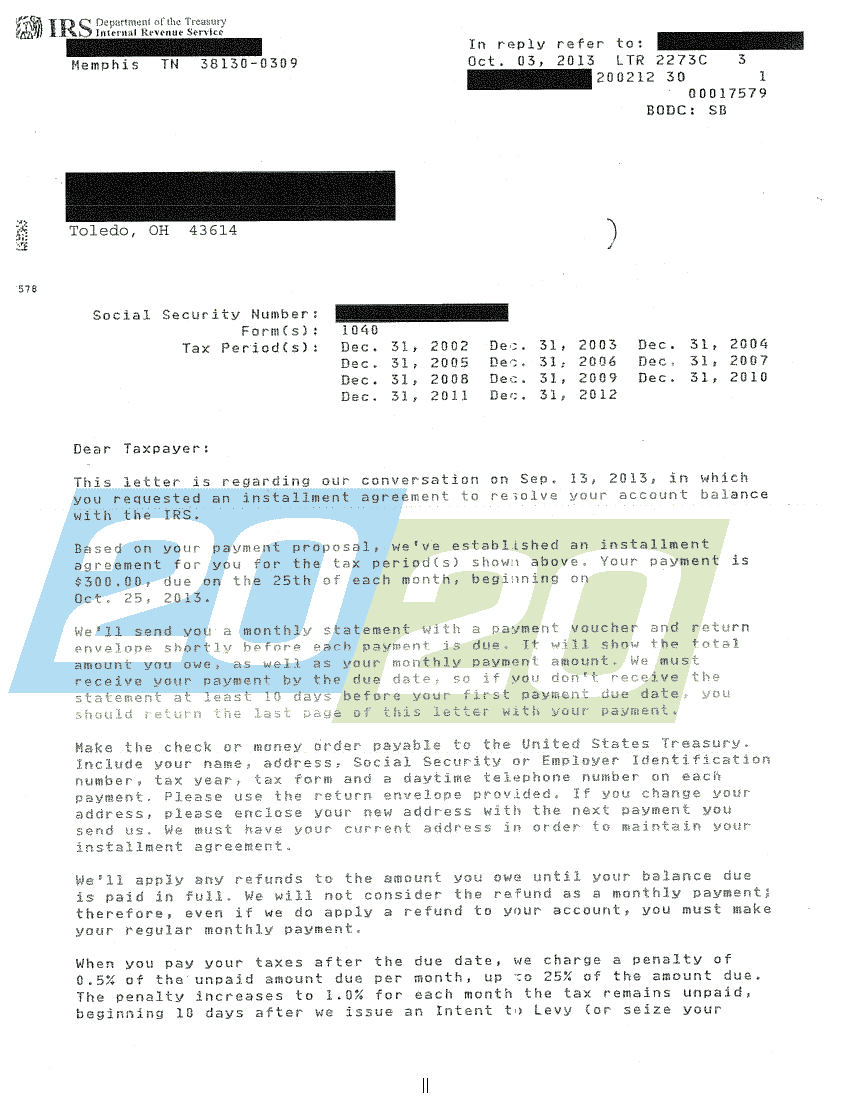

What Do Know If My Installment Agreement Was Rejected; IRS Just Sent Me

Irm 5.14.1.4.3, notice of federal tax lien and installment agreements, provides instructions on determining when to file a request. Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car. It is just a matter of. Learn more about the four different types of installment. The irs allows taxpayers to pay off.

What To Do When Your IRS Account Is in Jeopardy of Lien or Levy

Irm 5.14.1.4.3, notice of federal tax lien and installment agreements, provides instructions on determining when to file a request. Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car. The irs allows taxpayers to pay off tax debt through an installment agreement. It is just a matter of. Learn more about.

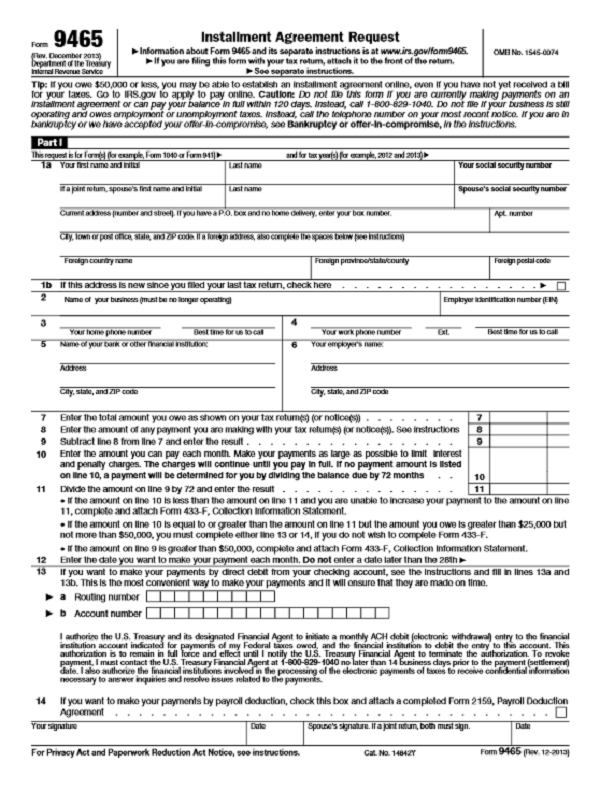

IRS Installment Agreement Form

When you request a payment plan (installment agreement), with certain exceptions, the irs is generally prohibited from levying and the. The irs allows taxpayers to pay off tax debt through an installment agreement. Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car. It is just a matter of. Irm 5.14.1.4.3,.

How to Remove an IRS TAX LIEN from your Credit Report

The irs allows taxpayers to pay off tax debt through an installment agreement. Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car. When you request a payment plan (installment agreement), with certain exceptions, the irs is generally prohibited from levying and the. Learn more about the four different types of.

It Is Just A Matter Of.

When you request a payment plan (installment agreement), with certain exceptions, the irs is generally prohibited from levying and the. Irm 5.14.1.4.3, notice of federal tax lien and installment agreements, provides instructions on determining when to file a request. Installment agreements can get tax liens withdrawn, improve your credit score and help you purchase a house or car. Learn more about the four different types of installment.