Employeew2 Box 13 Statutory Employee

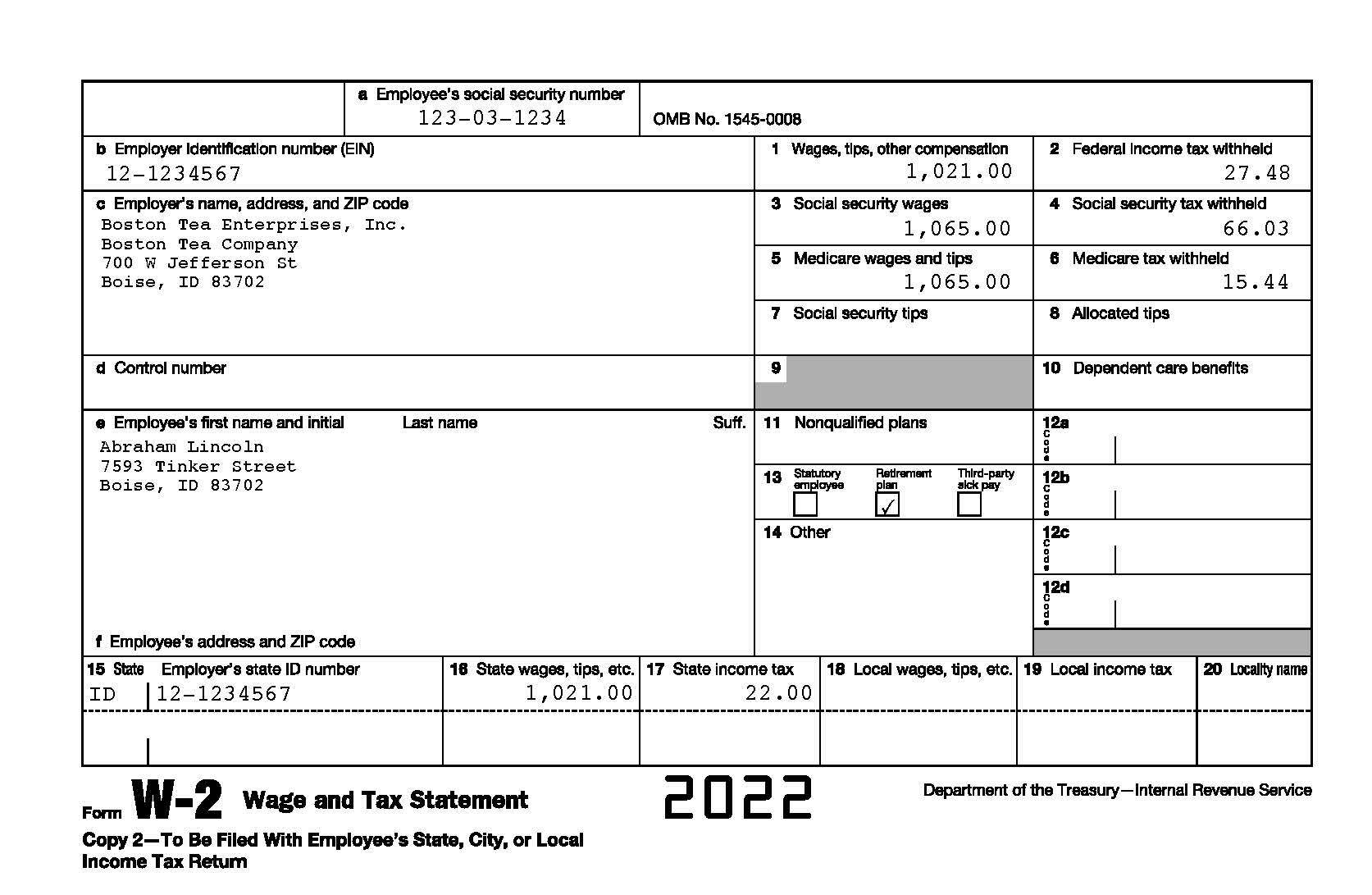

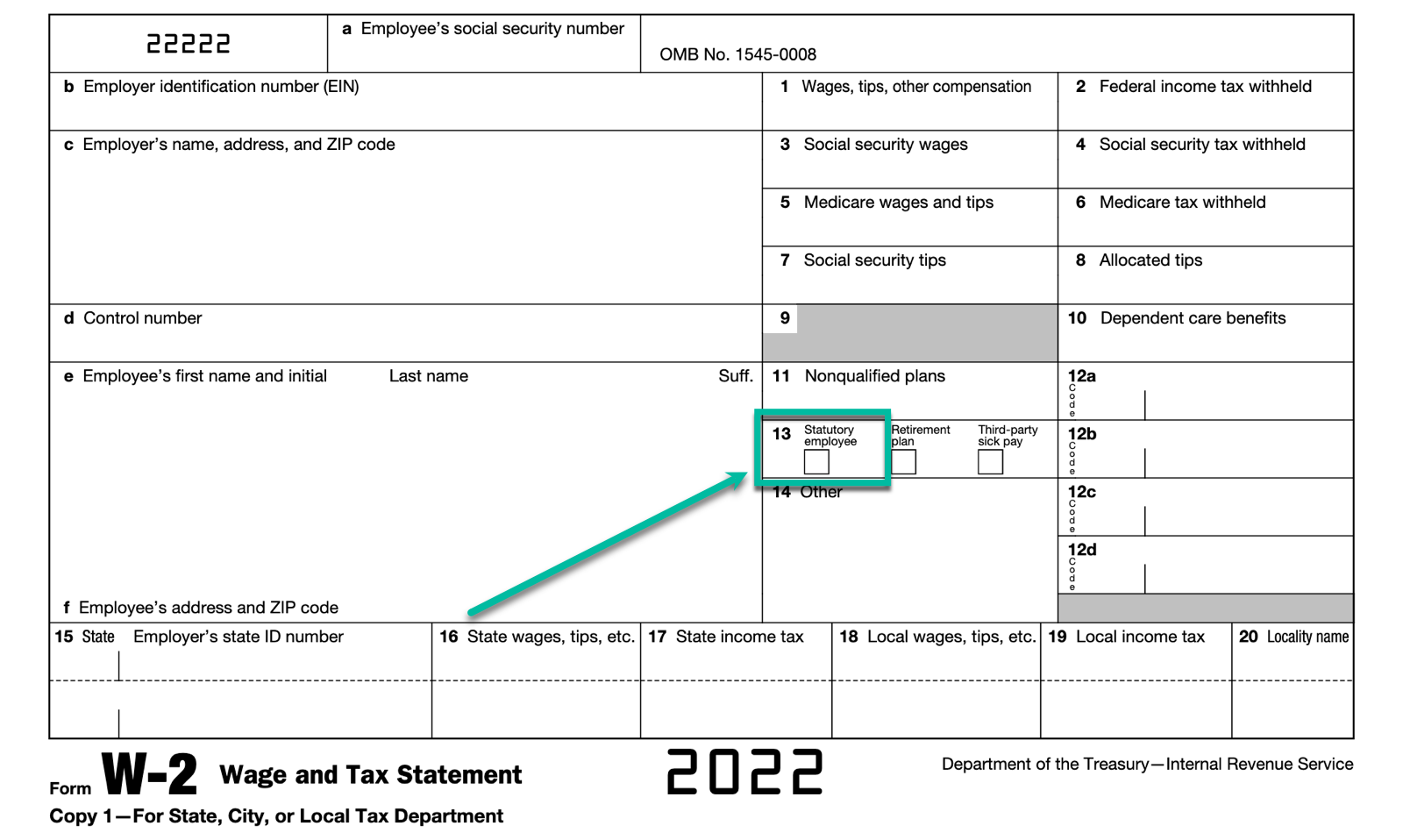

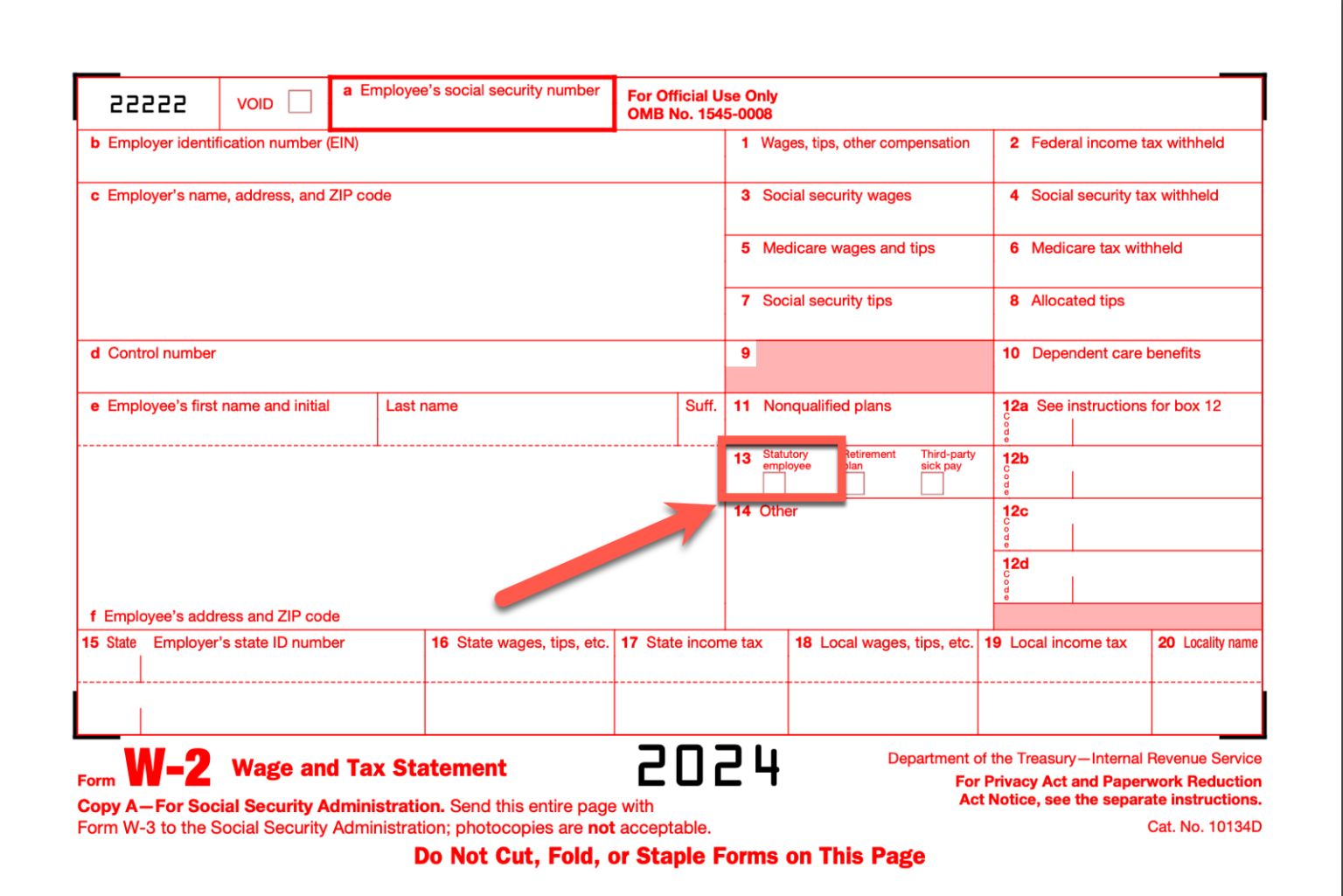

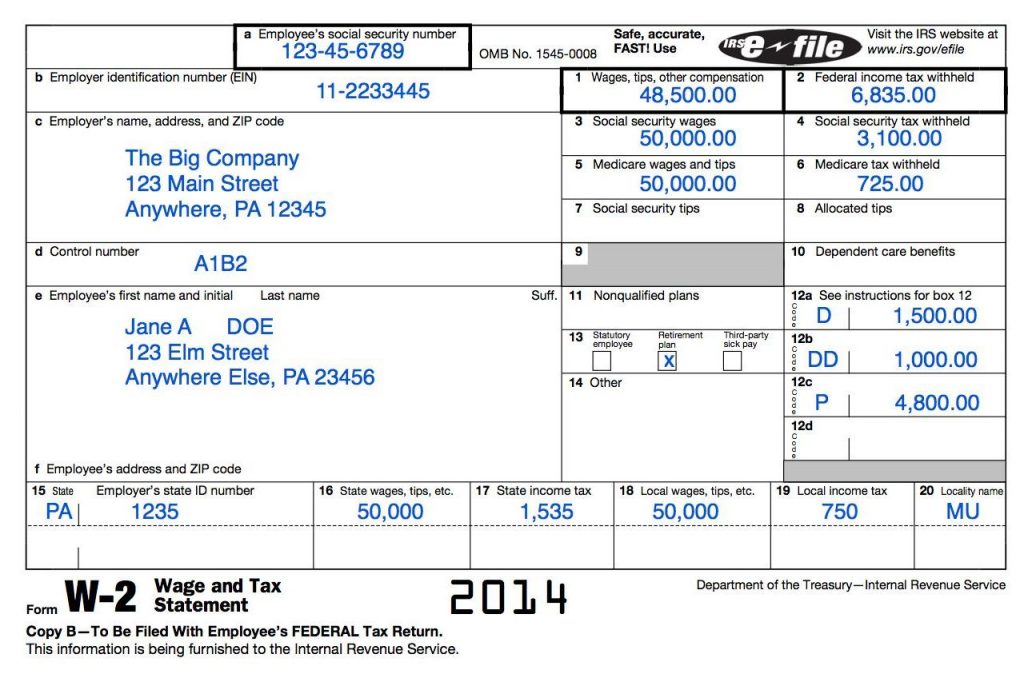

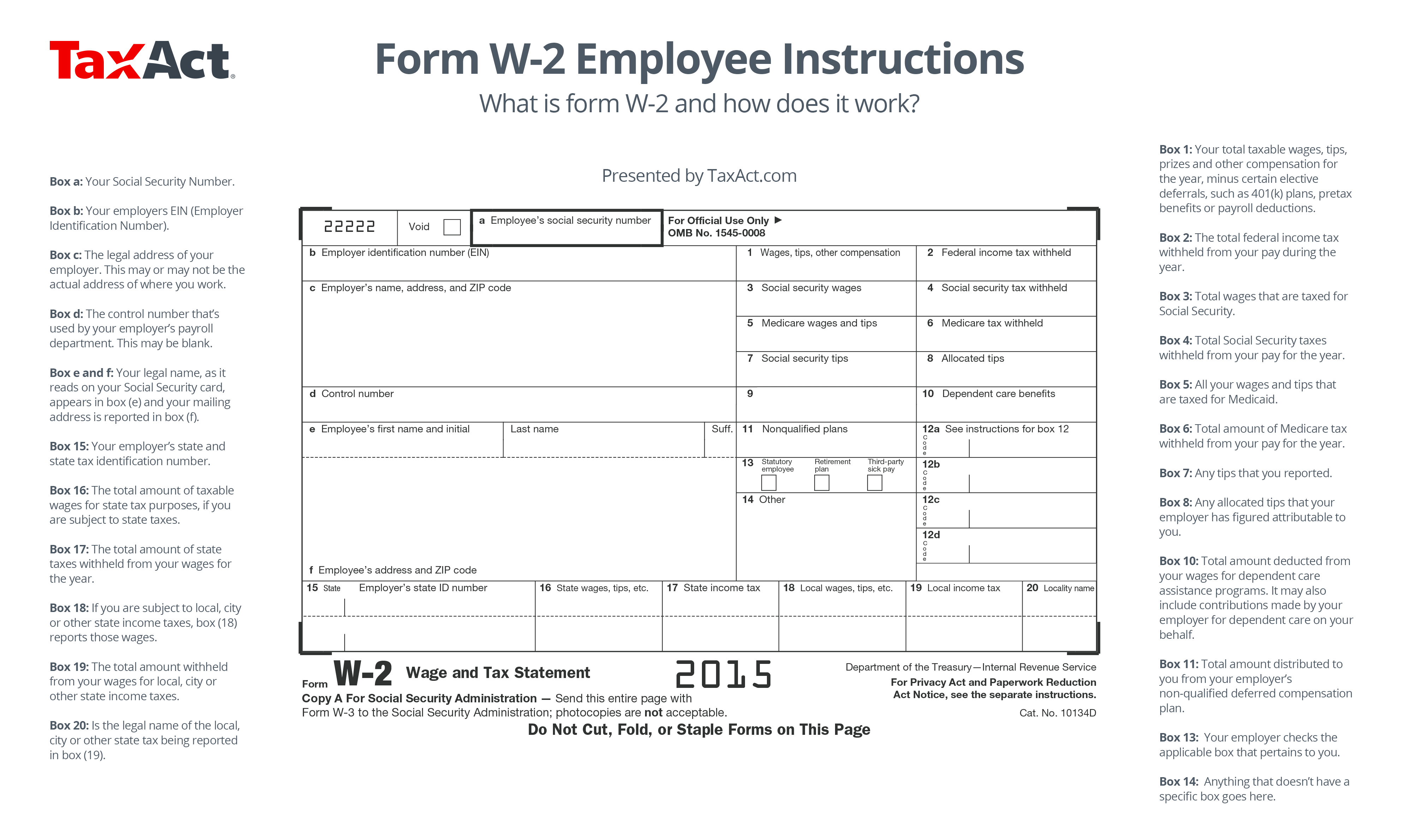

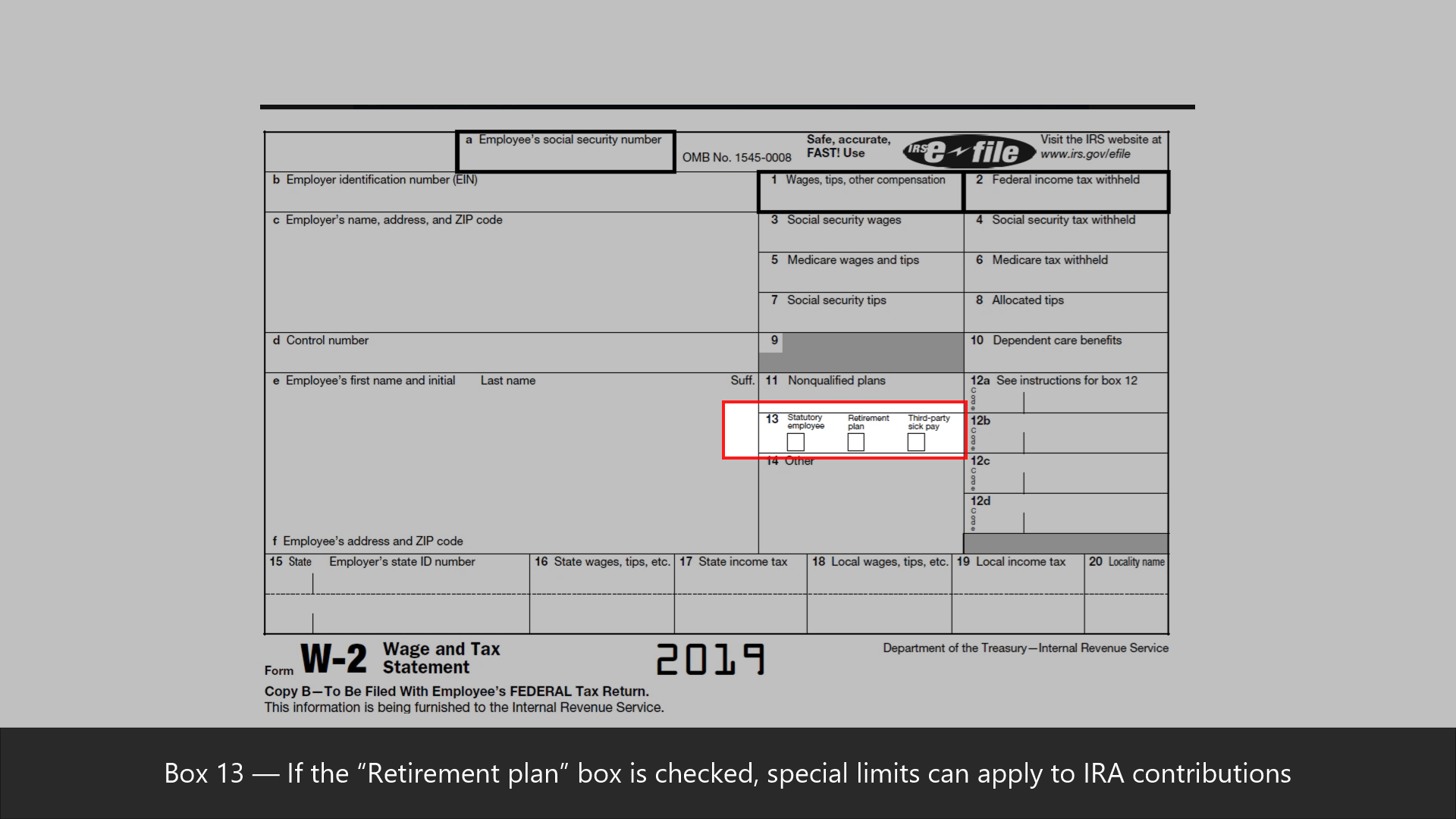

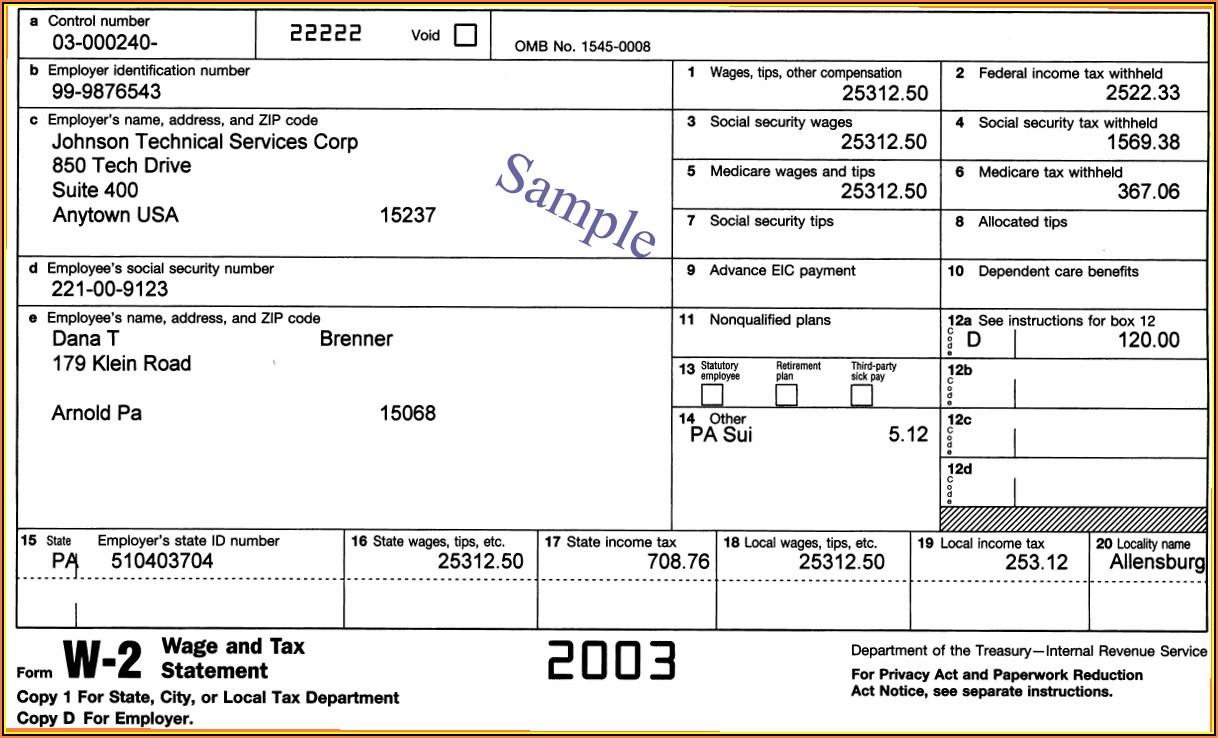

Employeew2 Box 13 Statutory Employee - Statutory employee, retirement plan, and third party sick pay. If this box is checked. A statutory employee is an individual contractor that is treated like an employee. What is a statutory employee? Payments to statutory employees who are subject to social security and medicare taxes but not subject to federal income tax withholding must. It is marked to indicate the employee’s status as a statutory employee, as seen by a check in box 13.

If this box is checked. It is marked to indicate the employee’s status as a statutory employee, as seen by a check in box 13. A statutory employee is an individual contractor that is treated like an employee. Statutory employee, retirement plan, and third party sick pay. Payments to statutory employees who are subject to social security and medicare taxes but not subject to federal income tax withholding must. What is a statutory employee?

A statutory employee is an individual contractor that is treated like an employee. It is marked to indicate the employee’s status as a statutory employee, as seen by a check in box 13. If this box is checked. Payments to statutory employees who are subject to social security and medicare taxes but not subject to federal income tax withholding must. What is a statutory employee? Statutory employee, retirement plan, and third party sick pay.

What is a W2 Employee? Check City

Payments to statutory employees who are subject to social security and medicare taxes but not subject to federal income tax withholding must. If this box is checked. A statutory employee is an individual contractor that is treated like an employee. What is a statutory employee? It is marked to indicate the employee’s status as a statutory employee, as seen by.

Form W2 Box 1 Guide for Navigating Through Confusing Discrepancies

A statutory employee is an individual contractor that is treated like an employee. What is a statutory employee? Statutory employee, retirement plan, and third party sick pay. It is marked to indicate the employee’s status as a statutory employee, as seen by a check in box 13. Payments to statutory employees who are subject to social security and medicare taxes.

Statutory Employees 101 Everything Employers Need to Know OnPay

It is marked to indicate the employee’s status as a statutory employee, as seen by a check in box 13. If this box is checked. Statutory employee, retirement plan, and third party sick pay. Payments to statutory employees who are subject to social security and medicare taxes but not subject to federal income tax withholding must. What is a statutory.

Statutory Employees 101 Everything Employers Need to Know OnPay

It is marked to indicate the employee’s status as a statutory employee, as seen by a check in box 13. Payments to statutory employees who are subject to social security and medicare taxes but not subject to federal income tax withholding must. What is a statutory employee? Statutory employee, retirement plan, and third party sick pay. A statutory employee is.

Correcting A W2 For An Employee

If this box is checked. It is marked to indicate the employee’s status as a statutory employee, as seen by a check in box 13. Statutory employee, retirement plan, and third party sick pay. A statutory employee is an individual contractor that is treated like an employee. Payments to statutory employees who are subject to social security and medicare taxes.

Form W2, box 12, code G & EE, reporting of SURS 457 deferred

If this box is checked. A statutory employee is an individual contractor that is treated like an employee. Statutory employee, retirement plan, and third party sick pay. It is marked to indicate the employee’s status as a statutory employee, as seen by a check in box 13. Payments to statutory employees who are subject to social security and medicare taxes.

How to Read a W2 in 2022 An Easy BoxbyBox Breakdown Blue Lion

Payments to statutory employees who are subject to social security and medicare taxes but not subject to federal income tax withholding must. What is a statutory employee? It is marked to indicate the employee’s status as a statutory employee, as seen by a check in box 13. A statutory employee is an individual contractor that is treated like an employee..

Code Z In Box 14 Of W2 at Ramona Fuller blog

Statutory employee, retirement plan, and third party sick pay. It is marked to indicate the employee’s status as a statutory employee, as seen by a check in box 13. What is a statutory employee? If this box is checked. A statutory employee is an individual contractor that is treated like an employee.

Abc box employee w2 statement windowjulu

If this box is checked. What is a statutory employee? Statutory employee, retirement plan, and third party sick pay. Payments to statutory employees who are subject to social security and medicare taxes but not subject to federal income tax withholding must. It is marked to indicate the employee’s status as a statutory employee, as seen by a check in box.

W2 Form Statutory Employee Form Resume Examples mx2Wxez96E

Statutory employee, retirement plan, and third party sick pay. Payments to statutory employees who are subject to social security and medicare taxes but not subject to federal income tax withholding must. A statutory employee is an individual contractor that is treated like an employee. What is a statutory employee? It is marked to indicate the employee’s status as a statutory.

A Statutory Employee Is An Individual Contractor That Is Treated Like An Employee.

It is marked to indicate the employee’s status as a statutory employee, as seen by a check in box 13. Statutory employee, retirement plan, and third party sick pay. What is a statutory employee? Payments to statutory employees who are subject to social security and medicare taxes but not subject to federal income tax withholding must.