Employeewashington State Exempt Employee Laws

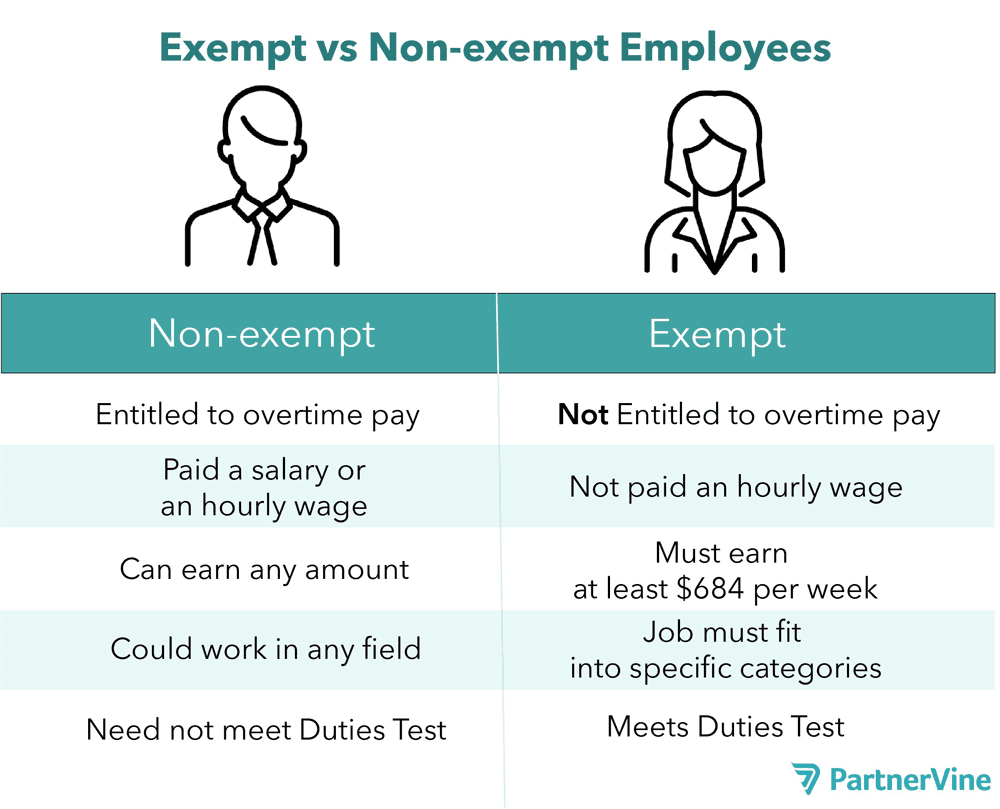

Employeewashington State Exempt Employee Laws - Both washington and federal labor laws require a minimum salary for exempt employees. To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,. The federal standard is $455 per.

The federal standard is $455 per. Both washington and federal labor laws require a minimum salary for exempt employees. To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,.

To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,. The federal standard is $455 per. Both washington and federal labor laws require a minimum salary for exempt employees.

2024 Exempt Employee Salaries Benny Kaitlin

Both washington and federal labor laws require a minimum salary for exempt employees. The federal standard is $455 per. To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,.

What Is an Exempt Employee? AIHR HR Glossary

Both washington and federal labor laws require a minimum salary for exempt employees. To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,. The federal standard is $455 per.

What Is an Exempt Employee? AIHR HR Glossary

Both washington and federal labor laws require a minimum salary for exempt employees. The federal standard is $455 per. To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,.

What is an Exempt Employee in Washington State? HireQuotient

To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,. Both washington and federal labor laws require a minimum salary for exempt employees. The federal standard is $455 per.

What Is an Exempt Employee? Definition, Requirements, Pros & Cons

The federal standard is $455 per. To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,. Both washington and federal labor laws require a minimum salary for exempt employees.

Exempt Employee California 2024 Midge Susette

Both washington and federal labor laws require a minimum salary for exempt employees. The federal standard is $455 per. To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,.

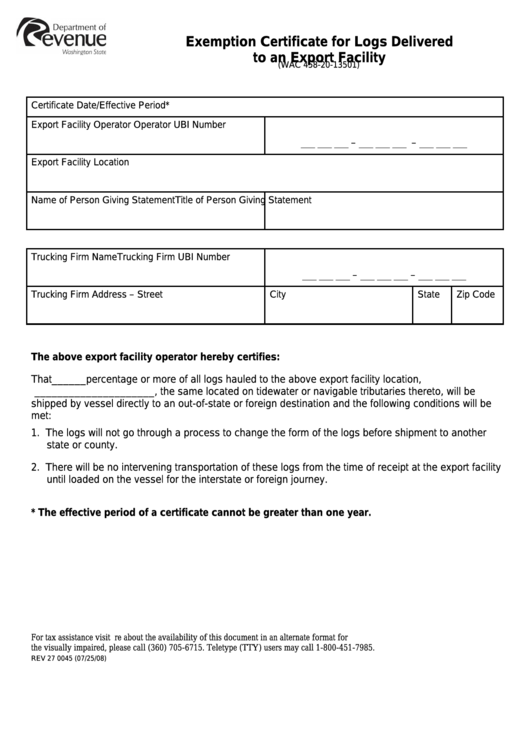

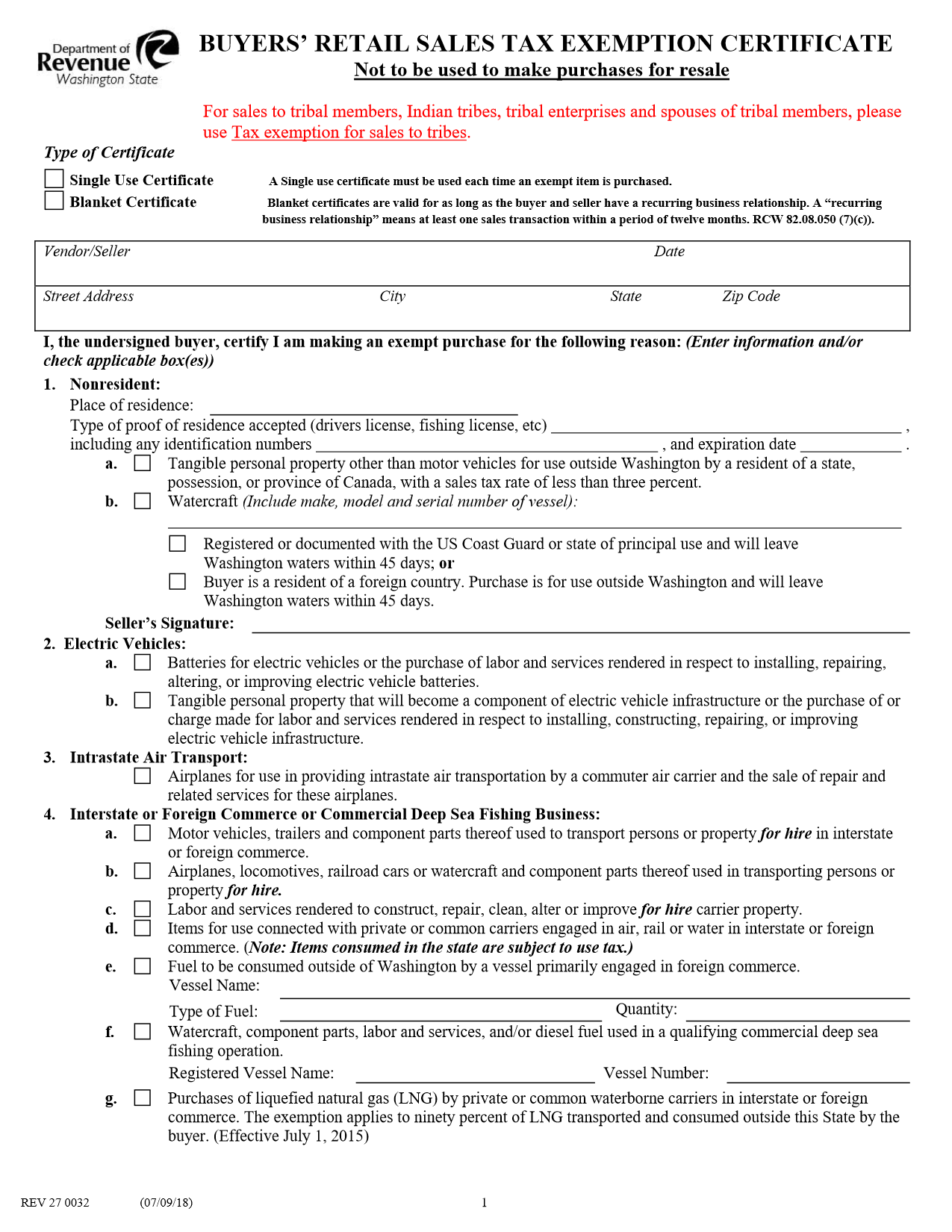

Washington State Certificate Of Exemption Form

To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,. Both washington and federal labor laws require a minimum salary for exempt employees. The federal standard is $455 per.

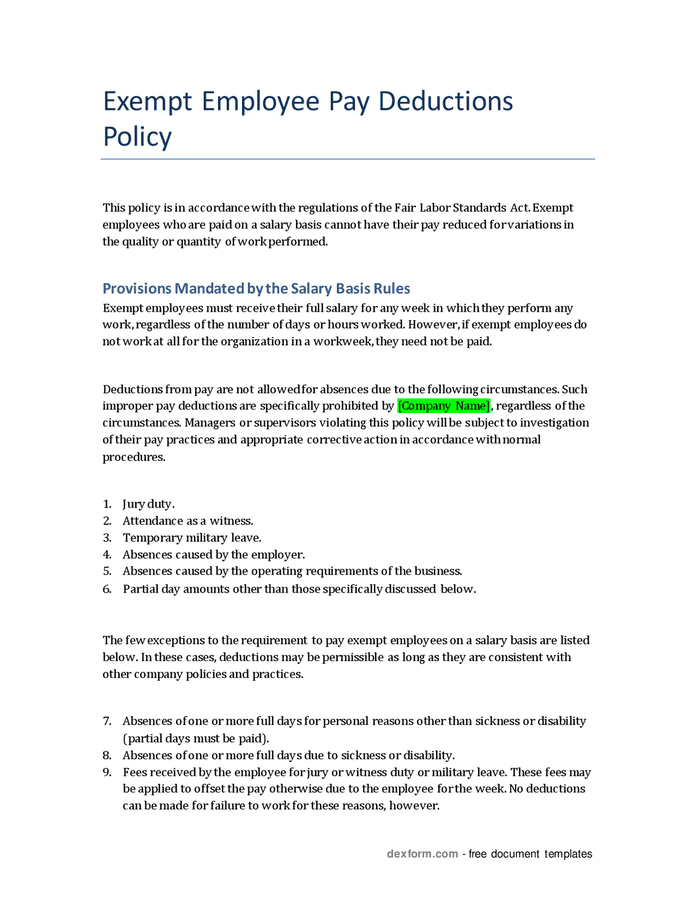

Exempt employee pay deductions policy in Word and Pdf formats

To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,. Both washington and federal labor laws require a minimum salary for exempt employees. The federal standard is $455 per.

Washington State Federal Tax Exempt Form

Both washington and federal labor laws require a minimum salary for exempt employees. To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,. The federal standard is $455 per.

Exempt Employee Salary Threshold 2024 Vinni Romonda

The federal standard is $455 per. To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,. Both washington and federal labor laws require a minimum salary for exempt employees.

Both Washington And Federal Labor Laws Require A Minimum Salary For Exempt Employees.

The federal standard is $455 per. To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,.