Federal Tax Lien Search Florida

Federal Tax Lien Search Florida - Enter a stipulated payment agreement. You can search our database by: Pay the amount in full. The place of inquiry for a federal tax lien in florida depends on the type of property (real or personal) and the type of debtor. Financial records, including but not limited to federal income tax returns, wage and earnings statements, and sworn statements of gross income; To resolve your tax liability, you must do one of the following: You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. A federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. Detail by lien document number; Florida law allows judgment liens to be filed a second time to extend the lien’s validity five more years.

You can search our database by: Pay the amount in full. Enter a stipulated payment agreement. The place of inquiry for a federal tax lien in florida depends on the type of property (real or personal) and the type of debtor. Detail by lien document number; Florida law allows judgment liens to be filed a second time to extend the lien’s validity five more years. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. A federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. To resolve your tax liability, you must do one of the following: The lien protects the government’s.

Enter a stipulated payment agreement. Pay the amount in full. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. To resolve your tax liability, you must do one of the following: The place of inquiry for a federal tax lien in florida depends on the type of property (real or personal) and the type of debtor. A federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. The lien protects the government’s. Florida law allows judgment liens to be filed a second time to extend the lien’s validity five more years. You can search our database by: Financial records, including but not limited to federal income tax returns, wage and earnings statements, and sworn statements of gross income;

Free Federal Tax Lien Search Enter Any Name To Begin

The lien protects the government’s. You can search our database by: A federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. The place of inquiry for a federal tax lien in florida depends on the type of property (real or personal) and the type of debtor. Financial records,.

What Is a Tax Lien? Definition & Impact on Credit TheStreet

Enter a stipulated payment agreement. Financial records, including but not limited to federal income tax returns, wage and earnings statements, and sworn statements of gross income; Florida law allows judgment liens to be filed a second time to extend the lien’s validity five more years. The place of inquiry for a federal tax lien in florida depends on the type.

Search Tax Lien Records

Florida law allows judgment liens to be filed a second time to extend the lien’s validity five more years. Enter a stipulated payment agreement. You can search our database by: A federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. To resolve your tax liability, you must do.

IRS Tax Lien vs. NY Tax Warrant [ 6 FAQs ]

Enter a stipulated payment agreement. A federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. To resolve your tax liability, you must do one of the following: The place of inquiry for a federal tax lien in florida depends on the type of property (real or personal) and.

Federal Tax Lien Federal Tax Lien On Foreclosed Property

Pay the amount in full. Financial records, including but not limited to federal income tax returns, wage and earnings statements, and sworn statements of gross income; Florida law allows judgment liens to be filed a second time to extend the lien’s validity five more years. You can search for a federal tax lien at the recorder's office in the taxpayer's.

Federal Tax Lien Definition

Pay the amount in full. The place of inquiry for a federal tax lien in florida depends on the type of property (real or personal) and the type of debtor. A federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. Enter a stipulated payment agreement. Detail by lien.

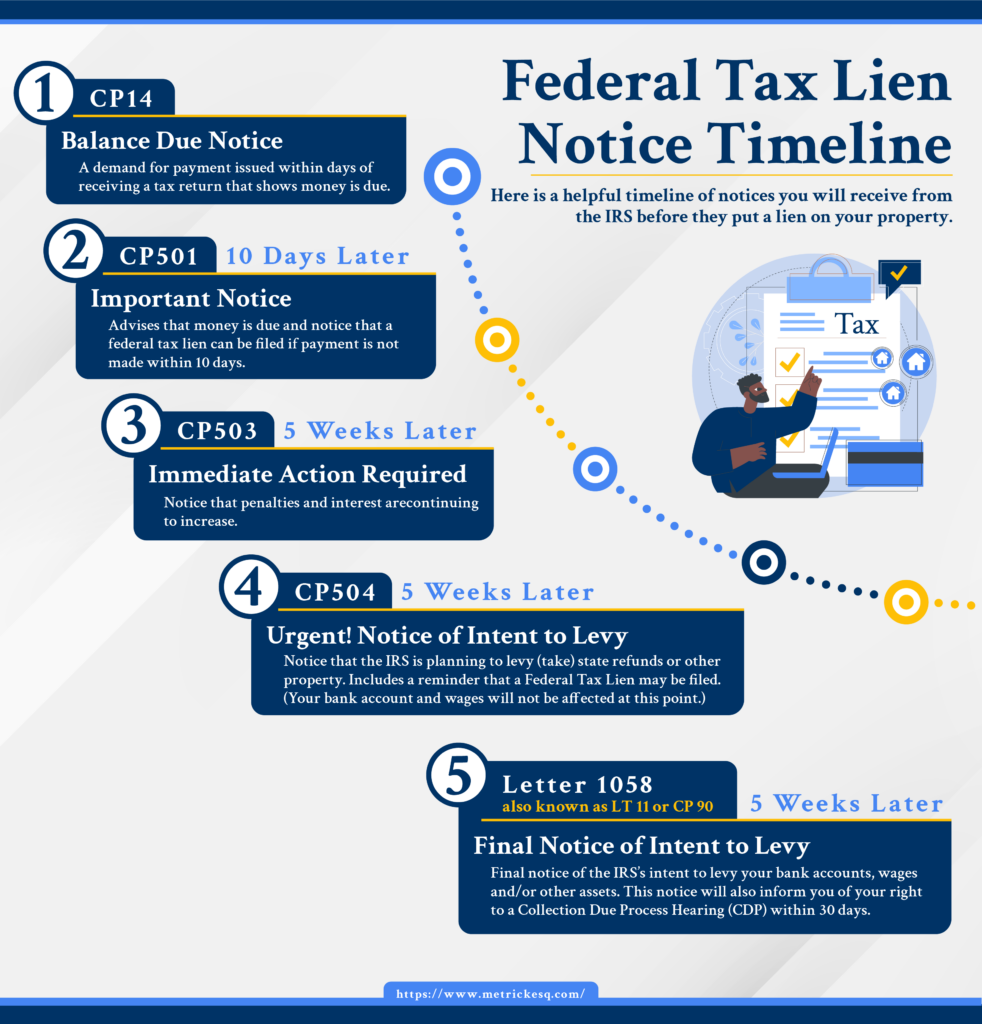

Federal Tax Lien Notice Timeline Ira J. Metrick, Esq.

Enter a stipulated payment agreement. Florida law allows judgment liens to be filed a second time to extend the lien’s validity five more years. The place of inquiry for a federal tax lien in florida depends on the type of property (real or personal) and the type of debtor. To resolve your tax liability, you must do one of the.

Federal Tax Lien February 2017

The place of inquiry for a federal tax lien in florida depends on the type of property (real or personal) and the type of debtor. Enter a stipulated payment agreement. The lien protects the government’s. Florida law allows judgment liens to be filed a second time to extend the lien’s validity five more years. You can search our database by:

How to Remove a Federal Tax Lien Heartland Tax Solutions

Florida law allows judgment liens to be filed a second time to extend the lien’s validity five more years. Detail by lien document number; To resolve your tax liability, you must do one of the following: You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a.

Federal tax lien on foreclosed property laderdriver

The lien protects the government’s. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. Financial records, including but not limited to federal income tax returns, wage and earnings statements, and sworn statements of gross income; Florida law allows judgment liens to be filed a.

A Federal Tax Lien Is The Government’s Legal Claim Against Your Property When You Neglect Or Fail To Pay A Tax Debt.

Enter a stipulated payment agreement. The lien protects the government’s. Pay the amount in full. The place of inquiry for a federal tax lien in florida depends on the type of property (real or personal) and the type of debtor.

Florida Law Allows Judgment Liens To Be Filed A Second Time To Extend The Lien’s Validity Five More Years.

Detail by lien document number; To resolve your tax liability, you must do one of the following: You can search our database by: Financial records, including but not limited to federal income tax returns, wage and earnings statements, and sworn statements of gross income;

![IRS Tax Lien vs. NY Tax Warrant [ 6 FAQs ]](https://taxproblemlawcenter.com/wp-content/uploads/2020/11/Travel_269-1024x1024.jpg)

/tax-lien-497446038-d3fe1b94273f4700ad75e4fa45f0fda9.jpg)