Form 1099 R Code J

Form 1099 R Code J - Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. If any other code, such as 8 or p, applies, use code j. Recharacterized ira contribution made for 2017. Taxable amount is blank and it is. One of those questions will ask about. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. Use code r for a. Code j indicates that there was an early distribution from a roth ira. The amount may or may not be taxable depending on the.

The amount may or may not be taxable depending on the. Taxable amount is blank and it is. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. Code j indicates that there was an early distribution from a roth ira. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. Recharacterized ira contribution made for 2017. If any other code, such as 8 or p, applies, use code j. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. One of those questions will ask about. Use code r for a.

Use code r for a. Recharacterized ira contribution made for 2017. Code j indicates that there was an early distribution from a roth ira. The amount may or may not be taxable depending on the. If any other code, such as 8 or p, applies, use code j. One of those questions will ask about. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. Taxable amount is blank and it is.

1099 r form Fill out & sign online DocHub

If any other code, such as 8 or p, applies, use code j. Taxable amount is blank and it is. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. Recharacterized ira contribution made for 2017. If a rollover contribution is made to a traditional or roth ira that is.

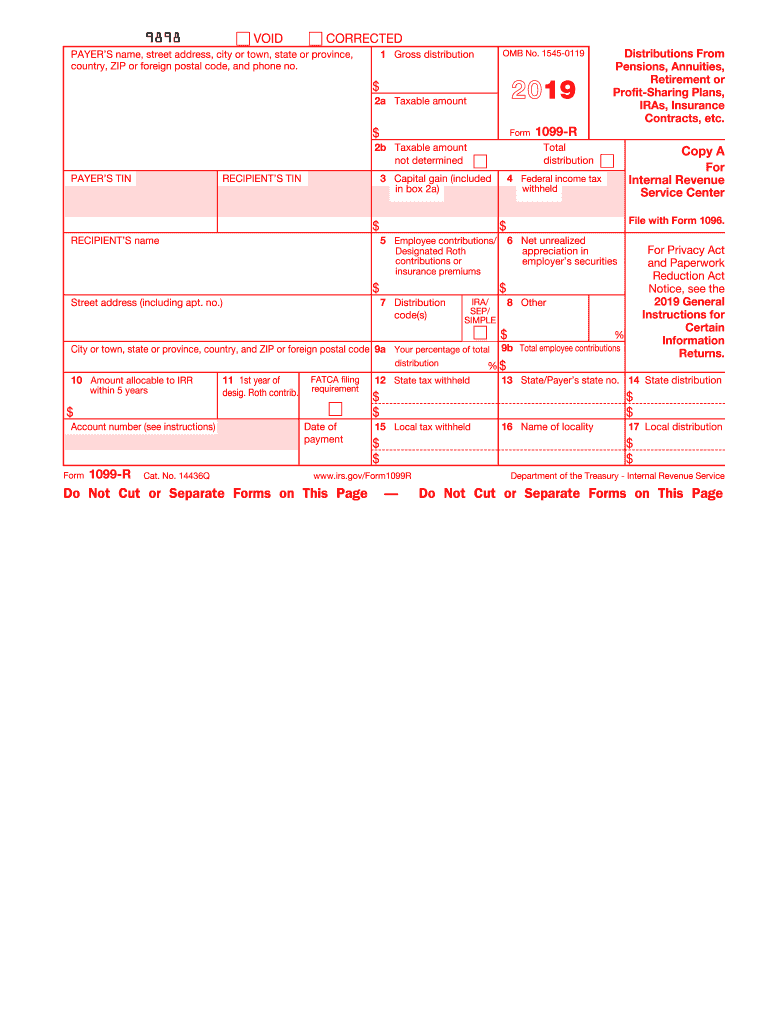

2019 1099 Form Complete with ease airSlate SignNow

Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. If any other code, such as 8 or p, applies, use code j. The amount may or may not be taxable depending on the. If a rollover contribution is made to a traditional or roth ira.

Printable 1099 R Form Printable Forms Free Online

One of those questions will ask about. If any other code, such as 8 or p, applies, use code j. Recharacterized ira contribution made for 2017. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. Client has a form 1099r with a code j in.

1099 Reporting Threshold 2024 Twila Ingeberg

Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. Use code r for a. The amount may or may not be taxable depending on the. One of those questions will ask about. Taxable amount is blank and it is.

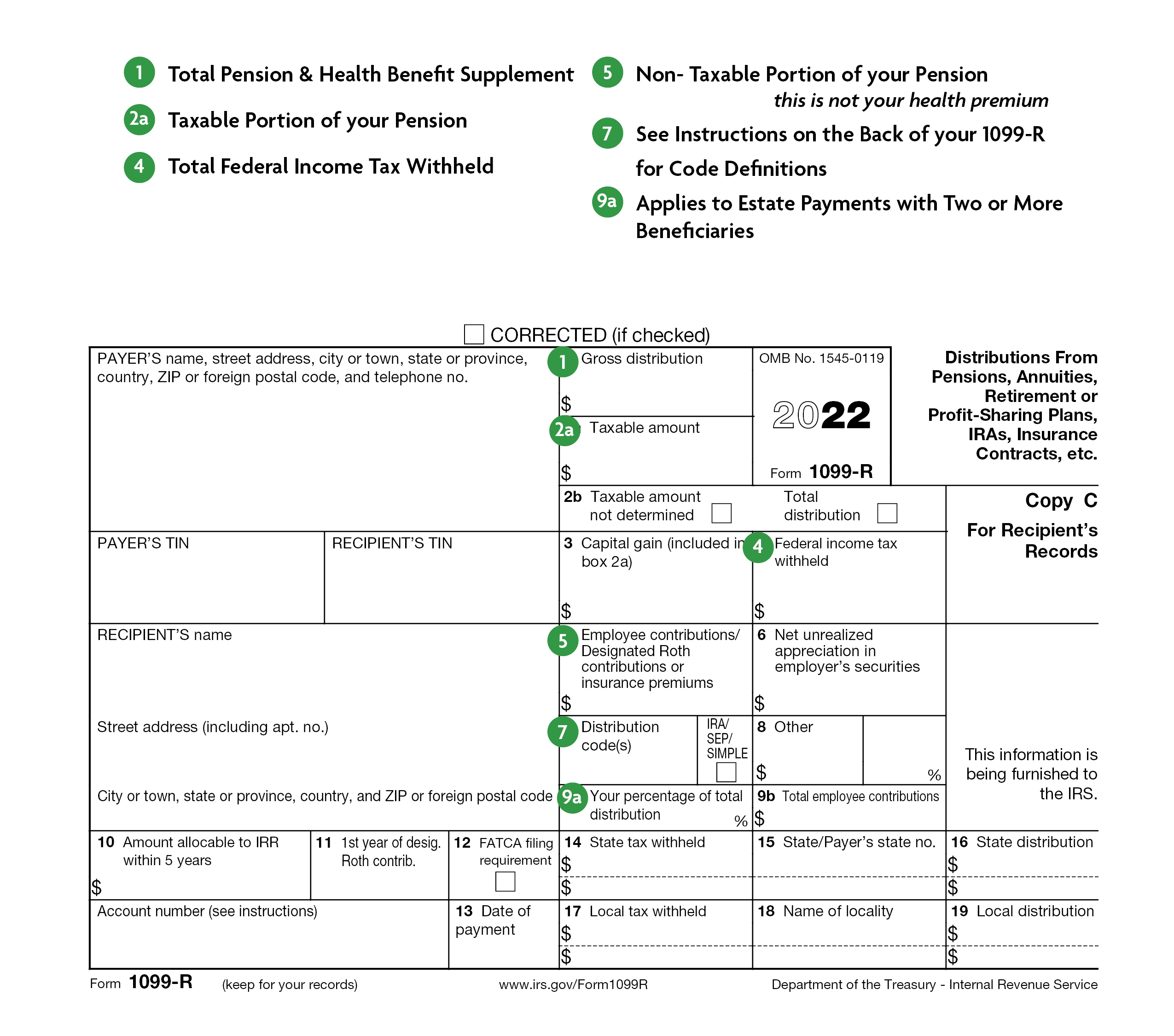

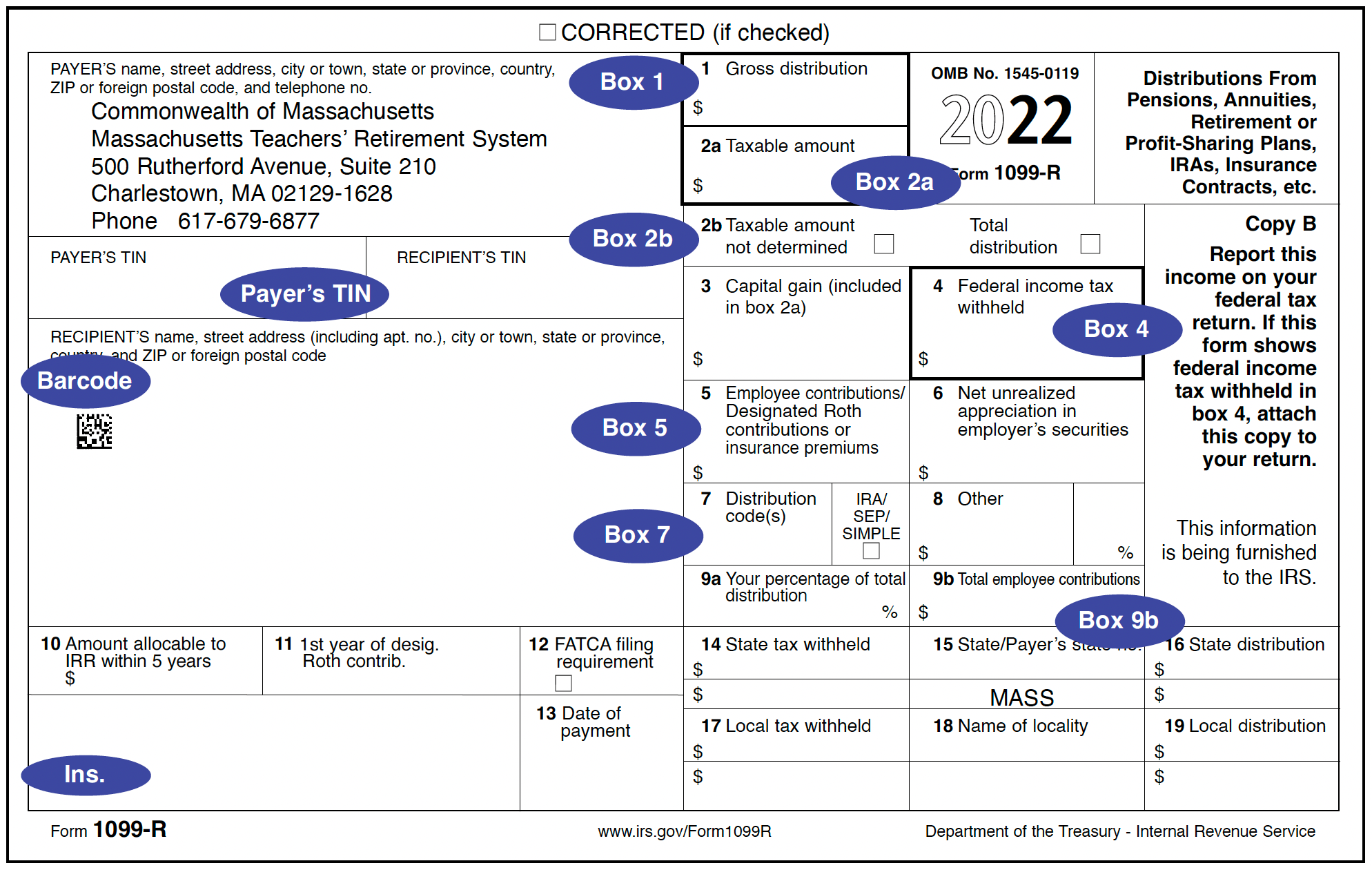

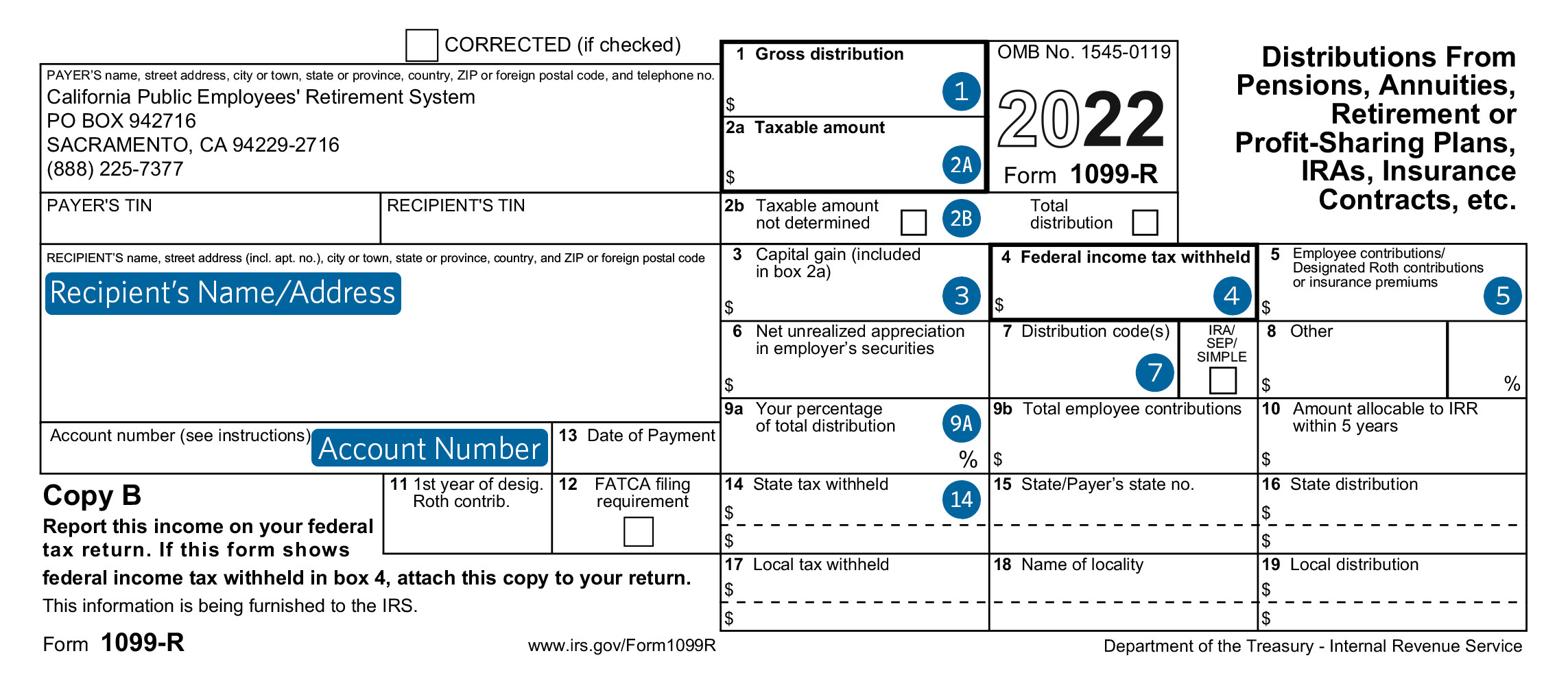

1099 Pension

Use code r for a. If any other code, such as 8 or p, applies, use code j. Code j indicates that there was an early distribution from a roth ira. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. Client has a form 1099r.

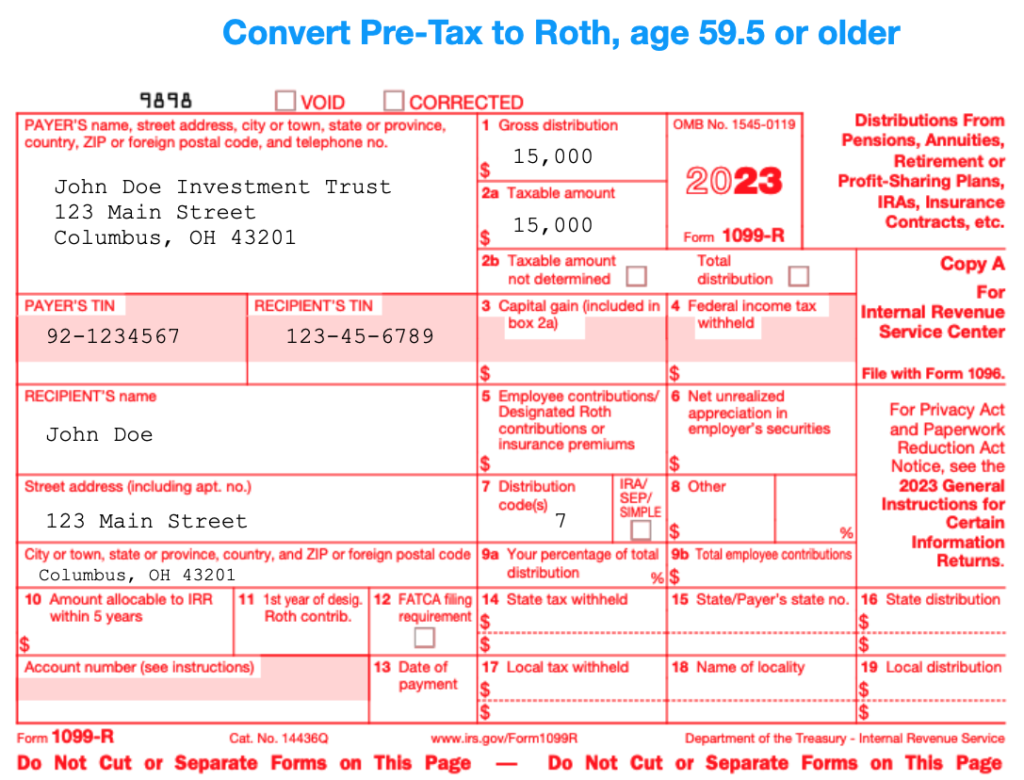

2023 Form 1099 R Printable Forms Free Online

Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. If any other code, such as 8 or p, applies, use code j. One of those questions will ask about. Client has a form 1099r with a code j in box 7 which states early distribution.

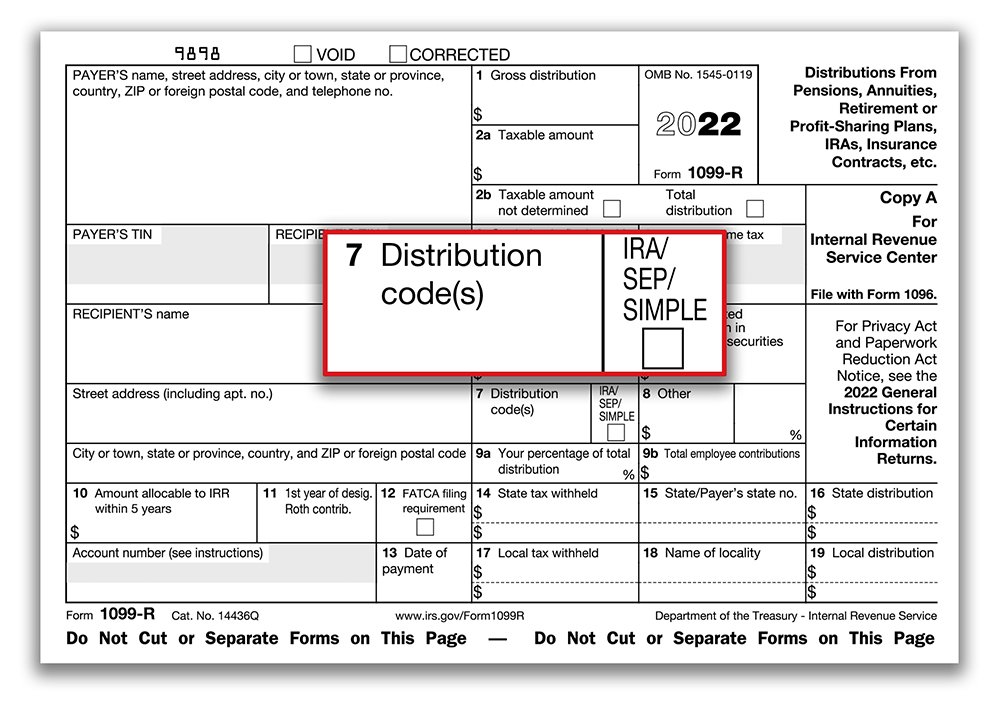

Selecting the Correct IRS Form 1099R Box 7 Distribution Codes — Ascensus

The amount may or may not be taxable depending on the. Use code r for a. Code j indicates that there was an early distribution from a roth ira. Recharacterized ira contribution made for 2017. If any other code, such as 8 or p, applies, use code j.

Neat What Is Non Standard 1099r A Chronological Report About Tigers

Recharacterized ira contribution made for 2017. The amount may or may not be taxable depending on the. Code j indicates that there was an early distribution from a roth ira. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. If any other.

1099 Pension

One of those questions will ask about. The amount may or may not be taxable depending on the. Taxable amount is blank and it is. If any other code, such as 8 or p, applies, use code j. Recharacterized ira contribution made for 2017.

Does a 1099R hurt your taxes?

Use code r for a. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. The amount may or may not be taxable depending on the..

If Any Other Code, Such As 8 Or P, Applies, Use Code J.

Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. One of those questions will ask about. Use code r for a. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in.

Recharacterized Ira Contribution Made For 2017.

Taxable amount is blank and it is. The amount may or may not be taxable depending on the. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. Code j indicates that there was an early distribution from a roth ira.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png)

:max_bytes(150000):strip_icc()/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)