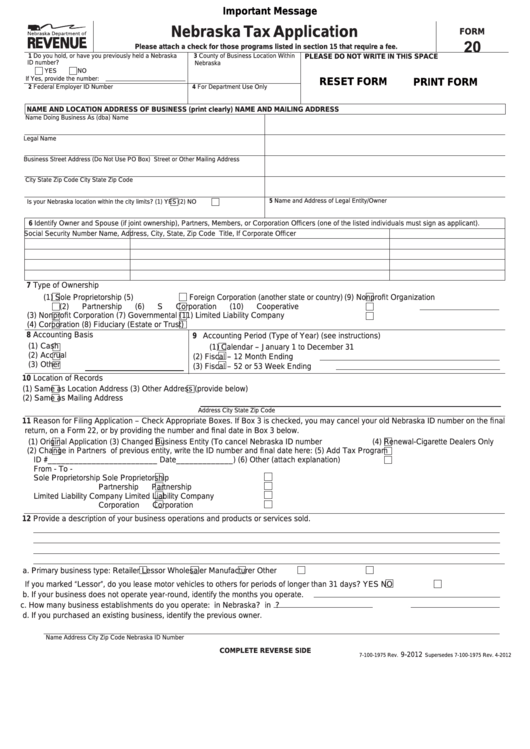

Form 20 Nebraska

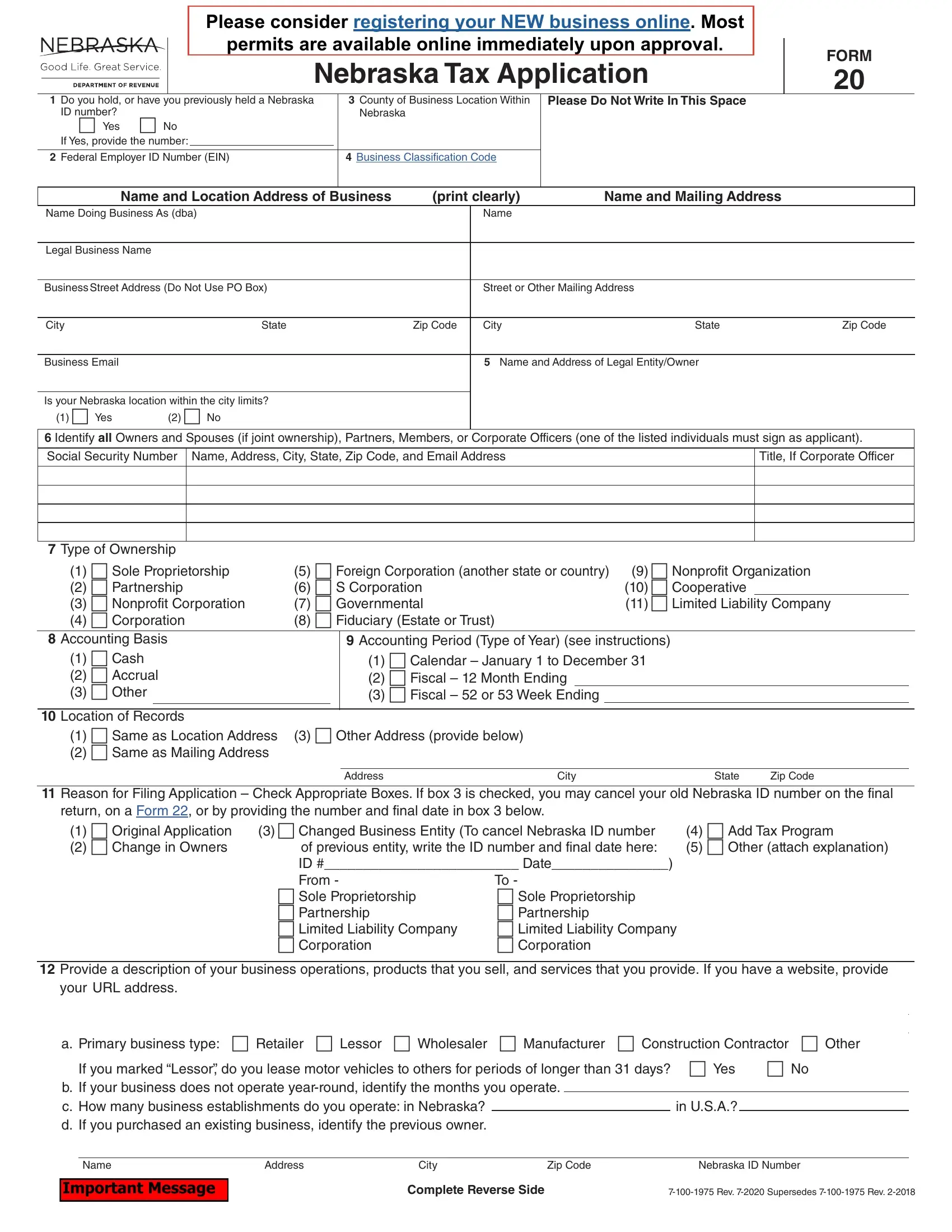

Form 20 Nebraska - Form 20 is filed to apply for permits, licenses, and registrations required to conduct business in nebraska. 6% sales and use tax rate cards : Please log out and do a paper nebraska tax application, form 20 if you are adding a tax program to your current number. 6.5% sales and use tax rate cards :. Also, when owners of an existing. If you are already registered through the streamline sales tax registration system(sstrs), you do not need to apply for. If you need to add sales and use tax collection to your existing nebraska id number you will need to submit a form 20, nebraska tax application to. 5.5% sales and use tax rate cards :

Please log out and do a paper nebraska tax application, form 20 if you are adding a tax program to your current number. 6.5% sales and use tax rate cards :. 5.5% sales and use tax rate cards : If you are already registered through the streamline sales tax registration system(sstrs), you do not need to apply for. Form 20 is filed to apply for permits, licenses, and registrations required to conduct business in nebraska. If you need to add sales and use tax collection to your existing nebraska id number you will need to submit a form 20, nebraska tax application to. 6% sales and use tax rate cards : Also, when owners of an existing.

If you are already registered through the streamline sales tax registration system(sstrs), you do not need to apply for. Form 20 is filed to apply for permits, licenses, and registrations required to conduct business in nebraska. Please log out and do a paper nebraska tax application, form 20 if you are adding a tax program to your current number. 6.5% sales and use tax rate cards :. 5.5% sales and use tax rate cards : Also, when owners of an existing. If you need to add sales and use tax collection to your existing nebraska id number you will need to submit a form 20, nebraska tax application to. 6% sales and use tax rate cards :

2005 NE Form 13 Fill Online, Printable, Fillable, Blank pdfFiller

Also, when owners of an existing. If you are already registered through the streamline sales tax registration system(sstrs), you do not need to apply for. 6.5% sales and use tax rate cards :. If you need to add sales and use tax collection to your existing nebraska id number you will need to submit a form 20, nebraska tax application.

Fillable Form 20 Nebraska Tax Application printable pdf download

Form 20 is filed to apply for permits, licenses, and registrations required to conduct business in nebraska. Also, when owners of an existing. 5.5% sales and use tax rate cards : 6.5% sales and use tax rate cards :. If you need to add sales and use tax collection to your existing nebraska id number you will need to submit.

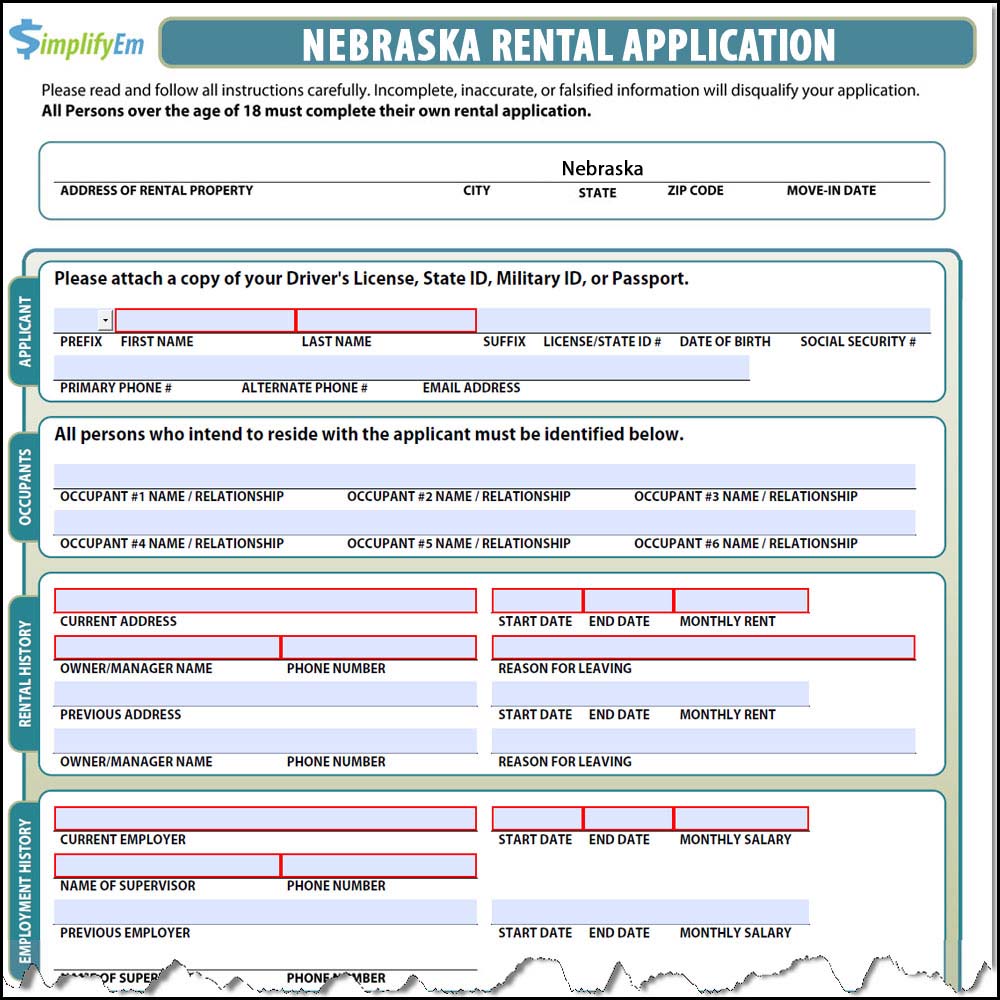

Nebraska Rental Application

Please log out and do a paper nebraska tax application, form 20 if you are adding a tax program to your current number. If you are already registered through the streamline sales tax registration system(sstrs), you do not need to apply for. If you need to add sales and use tax collection to your existing nebraska id number you will.

More Midwest states are moving to block foreign ownership of farmland

Form 20 is filed to apply for permits, licenses, and registrations required to conduct business in nebraska. If you need to add sales and use tax collection to your existing nebraska id number you will need to submit a form 20, nebraska tax application to. Please log out and do a paper nebraska tax application, form 20 if you are.

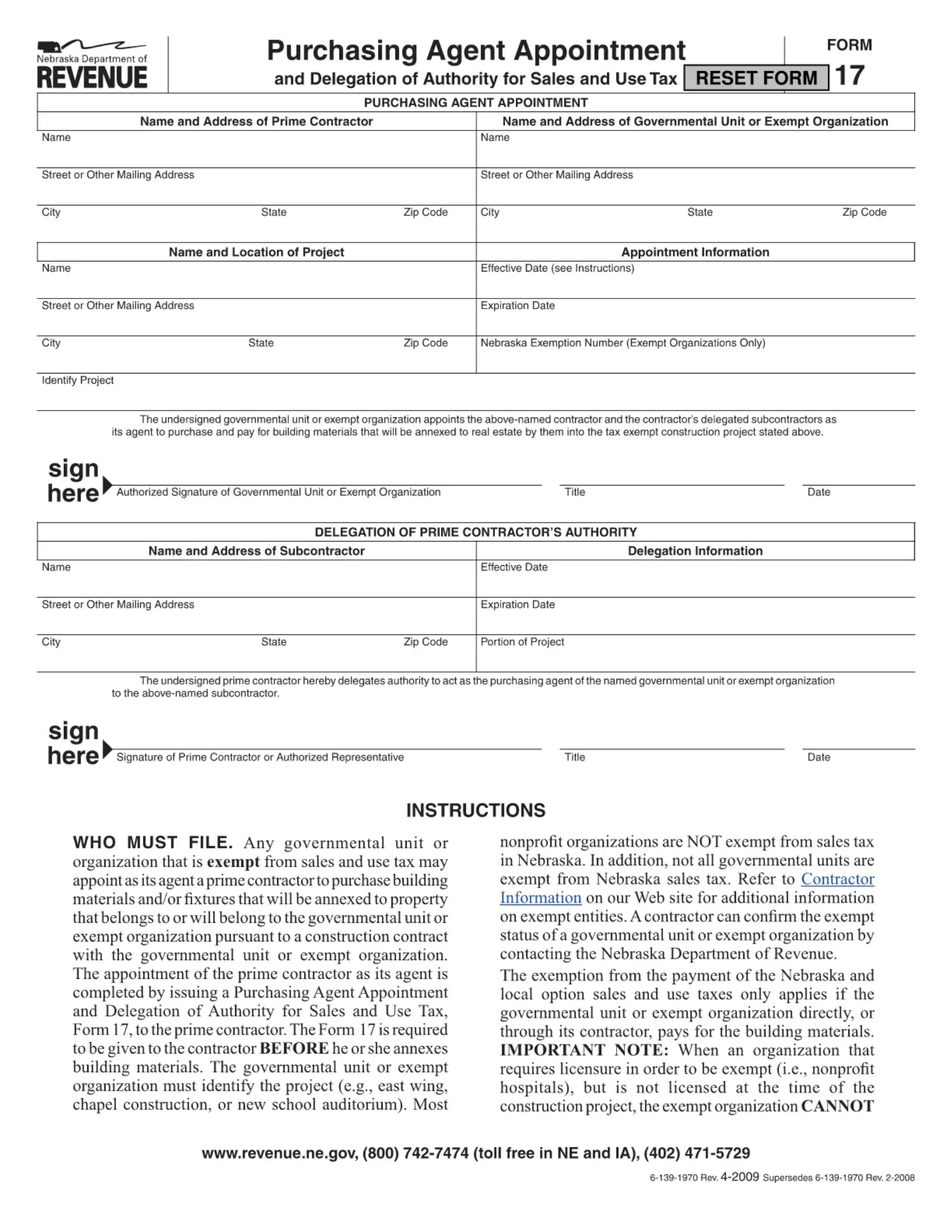

Nebraska Form 17 ≡ Fill Out Printable PDF Forms Online

Also, when owners of an existing. Please log out and do a paper nebraska tax application, form 20 if you are adding a tax program to your current number. Form 20 is filed to apply for permits, licenses, and registrations required to conduct business in nebraska. 5.5% sales and use tax rate cards : If you need to add sales.

Nebraska Form 20 ≡ Fill Out Printable PDF Forms Online

6.5% sales and use tax rate cards :. 5.5% sales and use tax rate cards : Also, when owners of an existing. 6% sales and use tax rate cards : Form 20 is filed to apply for permits, licenses, and registrations required to conduct business in nebraska.

Form 20 okey FORM 20 [See Rule 47] APPLICATION FOR REGISTRATION OF

If you are already registered through the streamline sales tax registration system(sstrs), you do not need to apply for. If you need to add sales and use tax collection to your existing nebraska id number you will need to submit a form 20, nebraska tax application to. 6.5% sales and use tax rate cards :. Also, when owners of an.

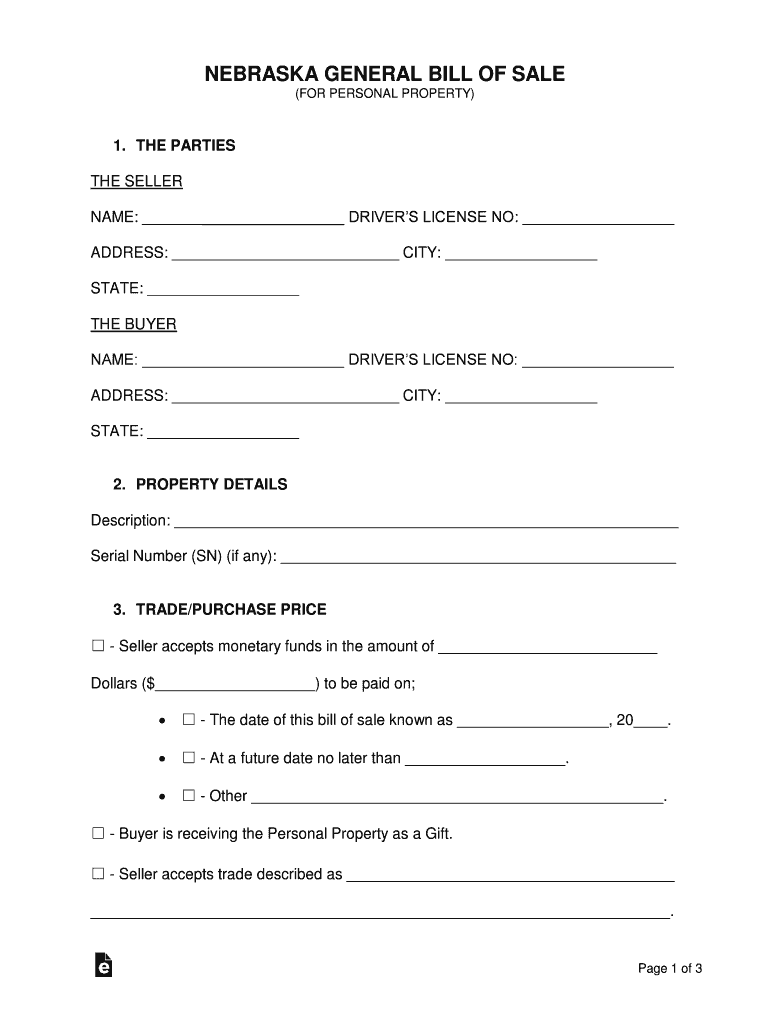

Nebraska General Bill of Sale Form PDFWord Fill Out and Sign

5.5% sales and use tax rate cards : If you need to add sales and use tax collection to your existing nebraska id number you will need to submit a form 20, nebraska tax application to. Form 20 is filed to apply for permits, licenses, and registrations required to conduct business in nebraska. Also, when owners of an existing. If.

Healthcare Career Educational Resources Nebraska Panhandler Area

Please log out and do a paper nebraska tax application, form 20 if you are adding a tax program to your current number. 6% sales and use tax rate cards : If you are already registered through the streamline sales tax registration system(sstrs), you do not need to apply for. 6.5% sales and use tax rate cards :. If you.

Events / Calendar NEGOP

Also, when owners of an existing. Form 20 is filed to apply for permits, licenses, and registrations required to conduct business in nebraska. If you need to add sales and use tax collection to your existing nebraska id number you will need to submit a form 20, nebraska tax application to. If you are already registered through the streamline sales.

5.5% Sales And Use Tax Rate Cards :

If you need to add sales and use tax collection to your existing nebraska id number you will need to submit a form 20, nebraska tax application to. Form 20 is filed to apply for permits, licenses, and registrations required to conduct business in nebraska. 6.5% sales and use tax rate cards :. Please log out and do a paper nebraska tax application, form 20 if you are adding a tax program to your current number.

Also, When Owners Of An Existing.

If you are already registered through the streamline sales tax registration system(sstrs), you do not need to apply for. 6% sales and use tax rate cards :

![Form 20 okey FORM 20 [See Rule 47] APPLICATION FOR REGISTRATION OF](https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/f0015378549bf51cbd4ca1d12166e334/thumb_1200_1553.png)