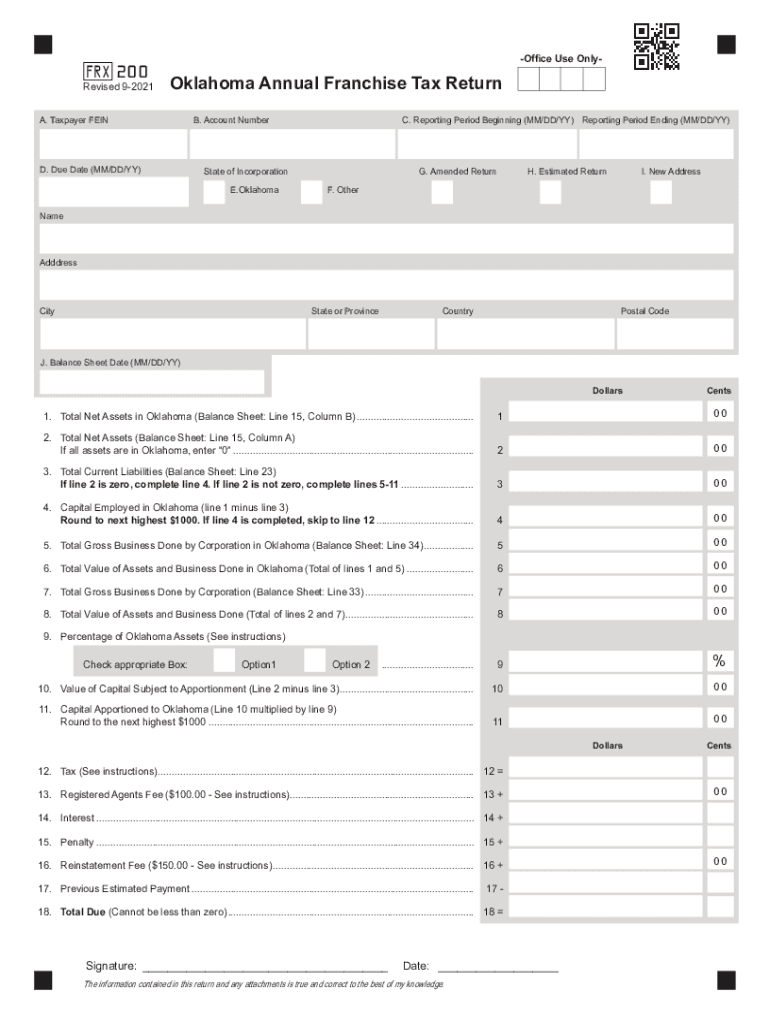

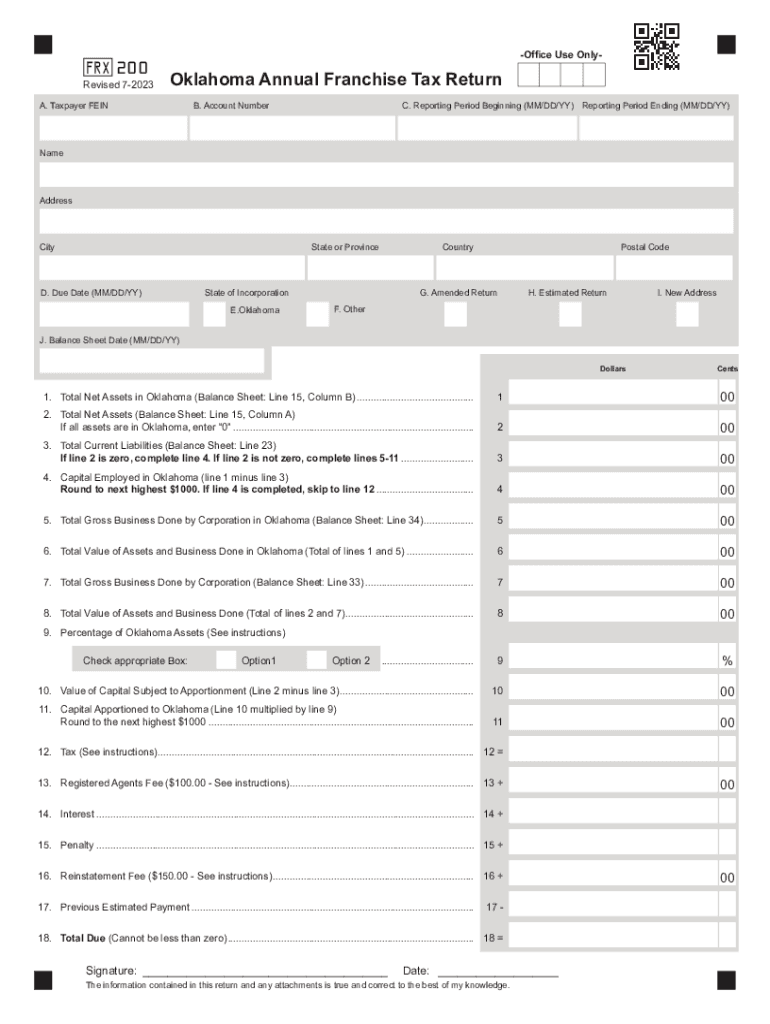

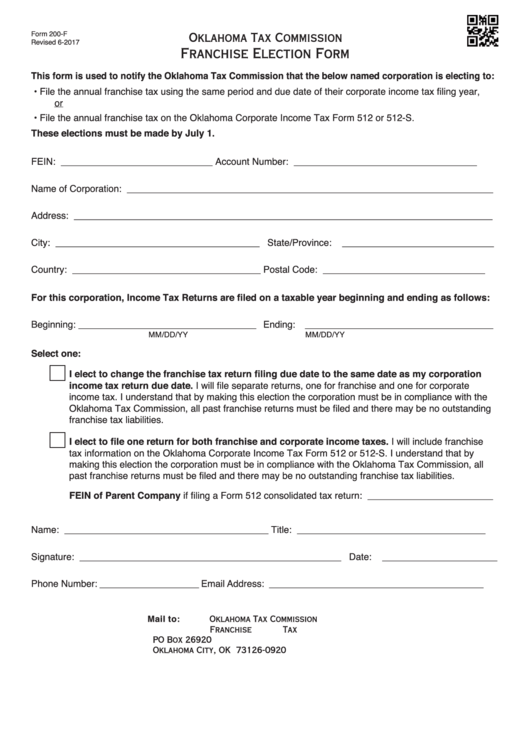

Form 200 F Oklahoma

Form 200 F Oklahoma - • file the annual franchise tax using. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. This page contains schedules b, c, and d for the completion of form 200: Oklahoma annual franchise tax return. This form is used to notify the oklahoma tax commission that the below named corporation is electing to:

Oklahoma annual franchise tax return. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. This form is used to notify the oklahoma tax commission that the below named corporation is electing to: • file the annual franchise tax using. This page contains schedules b, c, and d for the completion of form 200:

This page contains schedules b, c, and d for the completion of form 200: This form is used to notify the oklahoma tax commission that the below named corporation is electing to: Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Oklahoma annual franchise tax return. • file the annual franchise tax using.

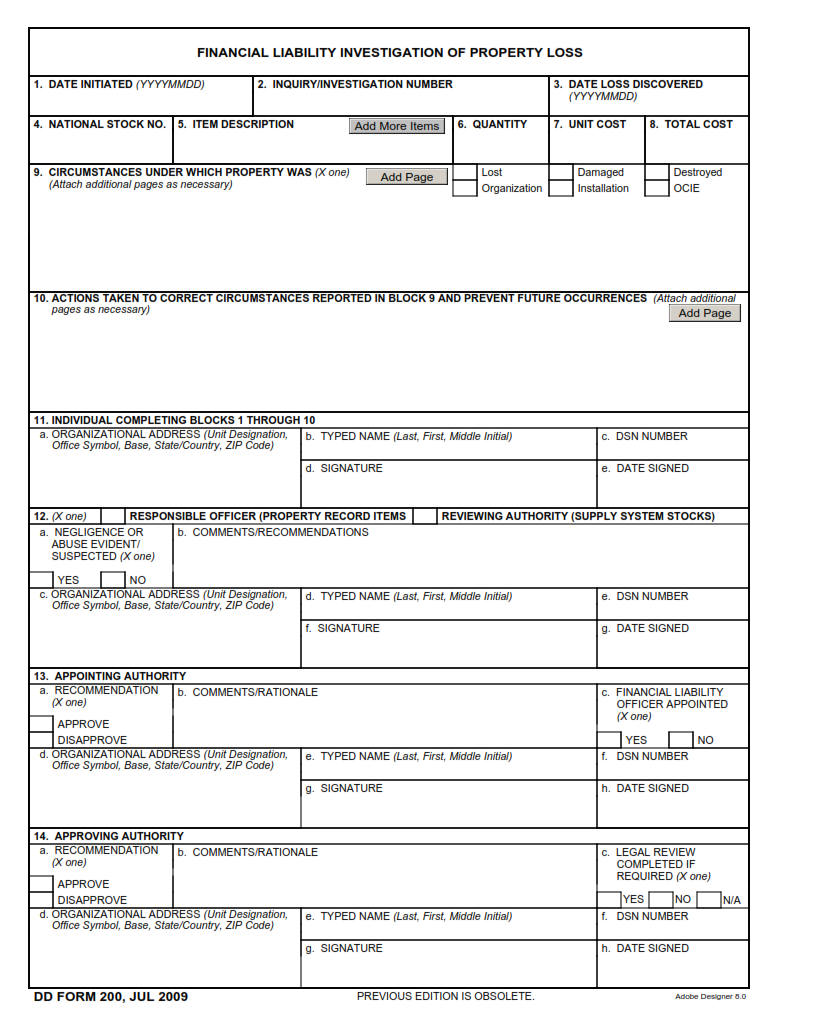

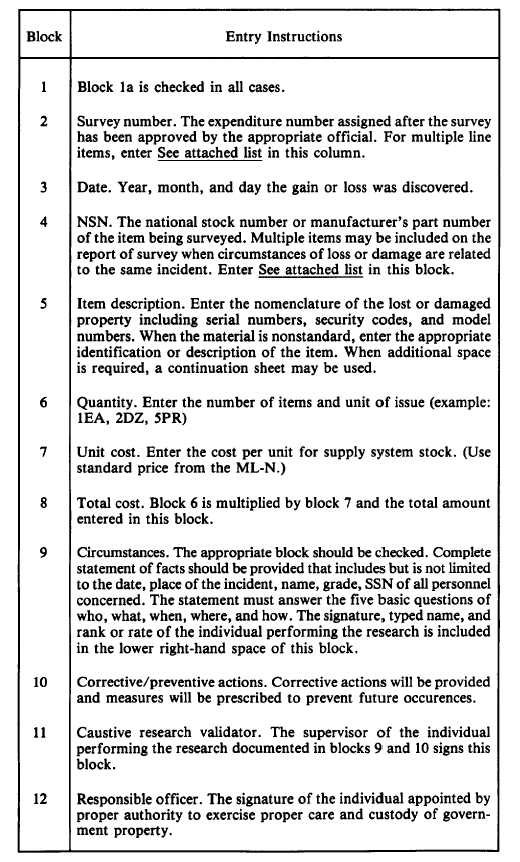

DD Form 200 Financial Liability Investigation of Property Loss

Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. This form is used to notify the oklahoma tax commission that the below named corporation is electing to: • file the annual franchise tax using. Oklahoma annual franchise tax return. This page contains schedules b, c, and d for the.

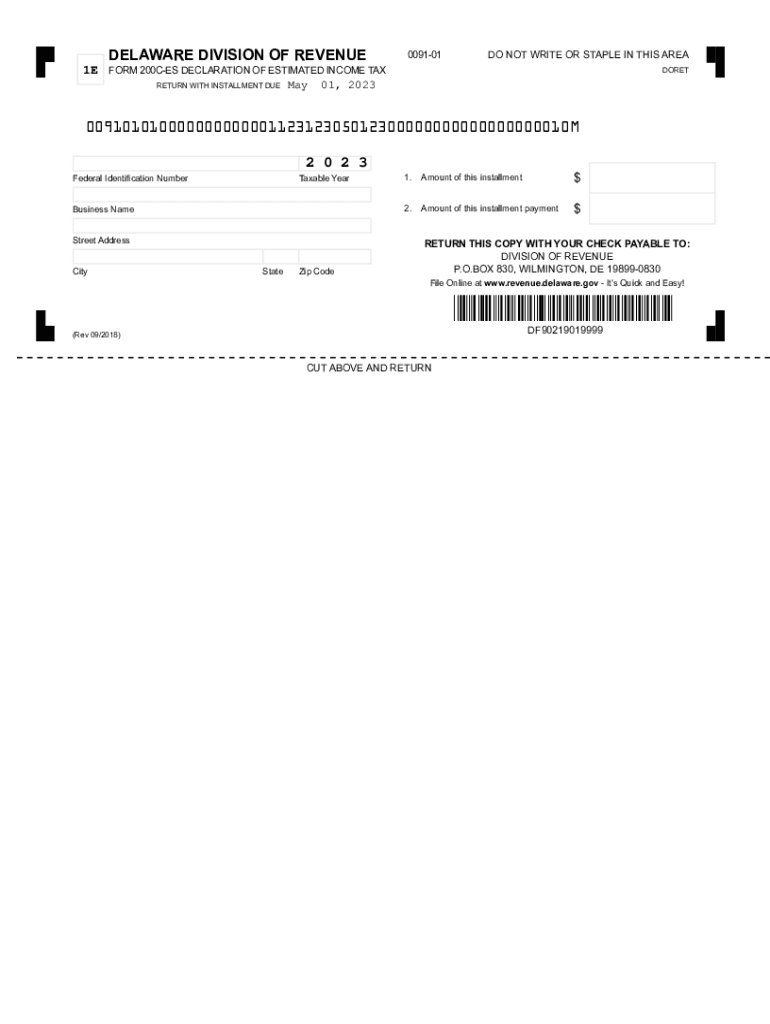

Delaware Form 200ES Declaration of Estimated Tax for Fill out & sign

This page contains schedules b, c, and d for the completion of form 200: Oklahoma annual franchise tax return. This form is used to notify the oklahoma tax commission that the below named corporation is electing to: Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. • file the.

Fillable Online Form 200F Franchise Election Form Fax Email Print

• file the annual franchise tax using. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Oklahoma annual franchise tax return. This form is used to notify the oklahoma tax commission that the below named corporation is electing to: This page contains schedules b, c, and d for the.

Ce 200 Printable Form

Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. This page contains schedules b, c, and d for the completion of form 200: This form is used to notify the oklahoma tax commission that the below named corporation is electing to: Oklahoma annual franchise tax return. • file the.

Form 200 f oklahoma Fill out & sign online DocHub

Oklahoma annual franchise tax return. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. This form is used to notify the oklahoma tax commission that the below named corporation is electing to: • file the annual franchise tax using. This page contains schedules b, c, and d for the.

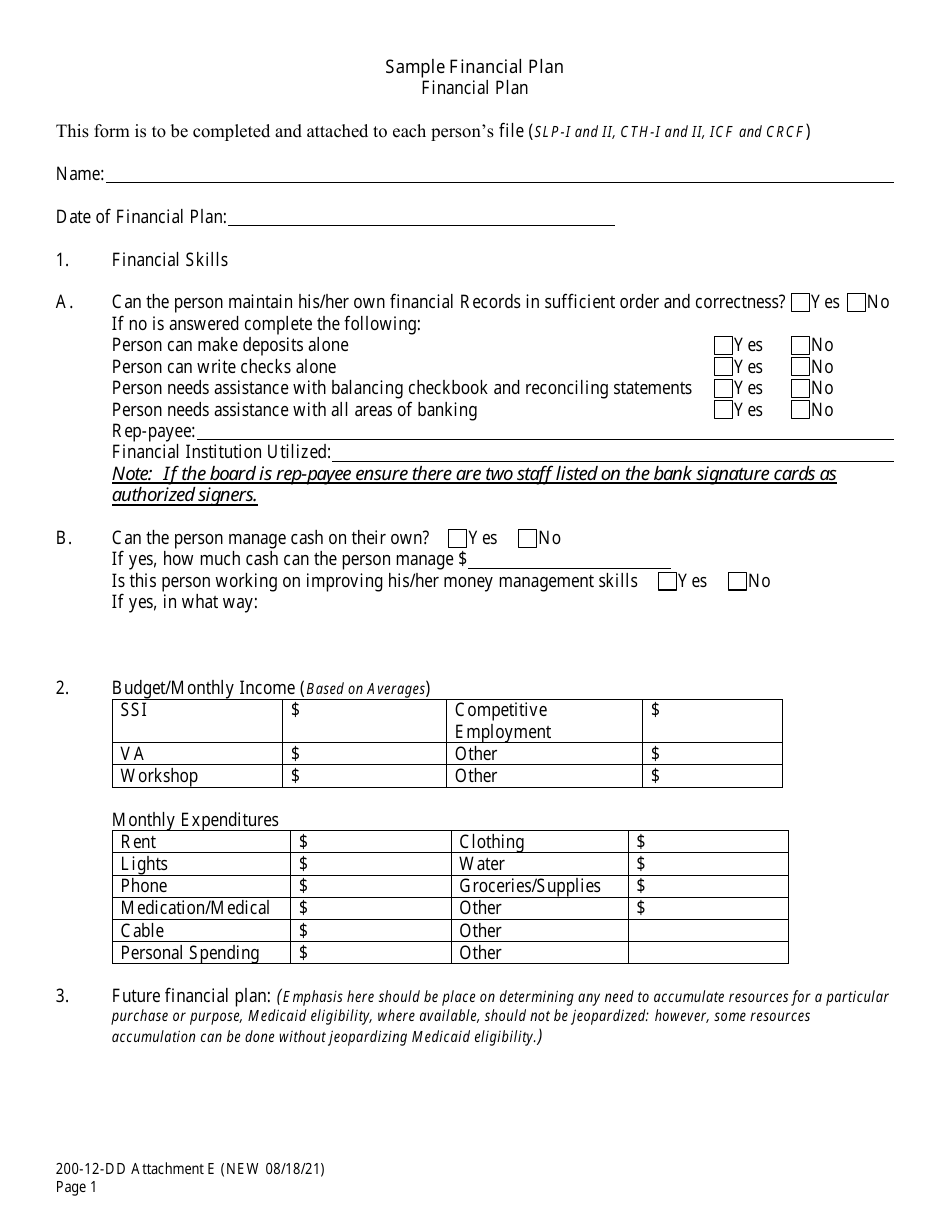

Form 20012DD Attachment E Fill Out, Sign Online and Download

This form is used to notify the oklahoma tax commission that the below named corporation is electing to: Oklahoma annual franchise tax return. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. This page contains schedules b, c, and d for the completion of form 200: • file the.

+GF+ AGIECHARMILLES FORM 200 2017 Die Sinking EDM machine REMIswiss

• file the annual franchise tax using. This page contains schedules b, c, and d for the completion of form 200: Oklahoma annual franchise tax return. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. This form is used to notify the oklahoma tax commission that the below named.

Instructions for Preparation of DD Form 200 12655_69

• file the annual franchise tax using. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Oklahoma annual franchise tax return. This page contains schedules b, c, and d for the completion of form 200: This form is used to notify the oklahoma tax commission that the below named.

Fillable Form 200F Franchise Election Oklahoma Tax Commission

This page contains schedules b, c, and d for the completion of form 200: Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. • file the annual franchise tax using. Oklahoma annual franchise tax return. This form is used to notify the oklahoma tax commission that the below named.

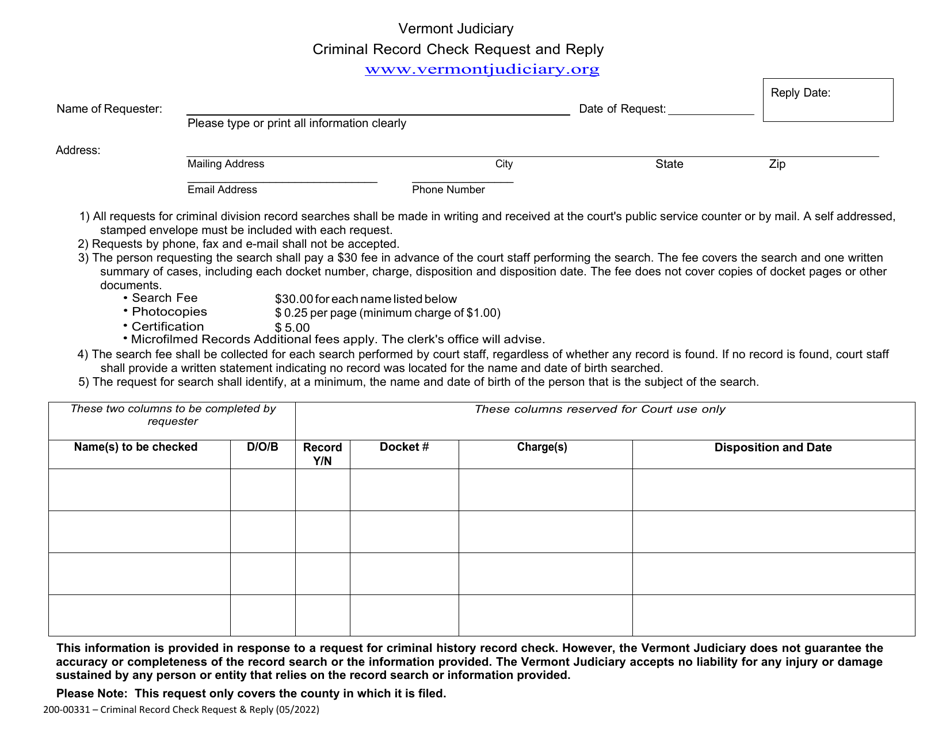

Form 20000331 Download Fillable PDF or Fill Online Criminal Record

This form is used to notify the oklahoma tax commission that the below named corporation is electing to: Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. • file the annual franchise tax using. This page contains schedules b, c, and d for the completion of form 200: Oklahoma.

Oklahoma Annual Franchise Tax Return.

This form is used to notify the oklahoma tax commission that the below named corporation is electing to: This page contains schedules b, c, and d for the completion of form 200: Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. • file the annual franchise tax using.