Form 5498 In Lacerte

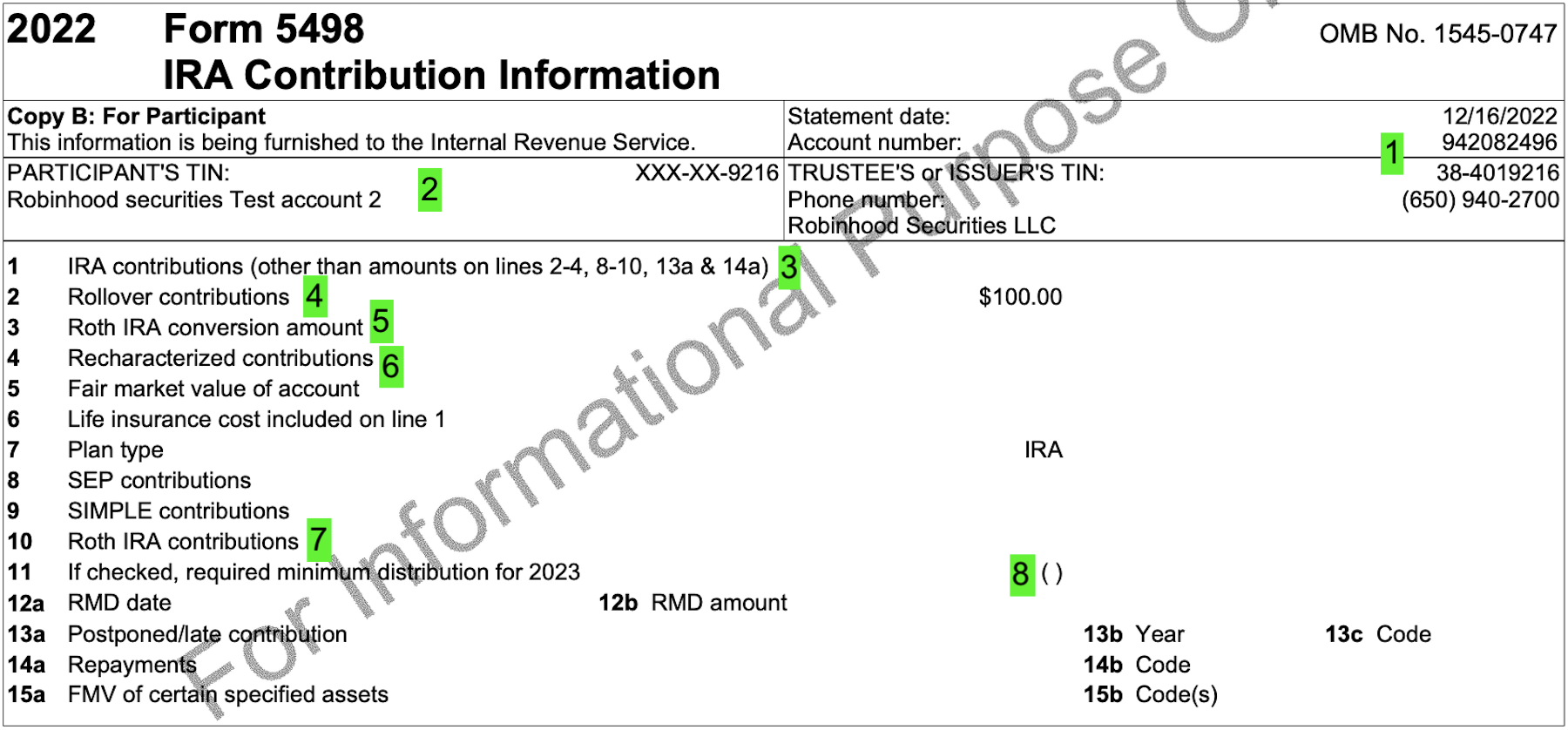

Form 5498 In Lacerte - You don't need to enter your 5498; It is used when you need to. However, i have not received a 1099r form with. Form 5498 lists your ira contributions for the tax year. Just keep it with your tax. Use the left column for taxpayer information. You use the 5498 to confirm that the client (and their broker) did in fact put their stated to you amount into the type of account as. Starting in 2015, ira trustees, custodians and issuers (in the case of individual retirement arrangements) are required to report certain. Go to screen 24, adjustments to income. Form 5498 for my traditional ira shows a value in line 2 (rollover contributions).

You use the 5498 to confirm that the client (and their broker) did in fact put their stated to you amount into the type of account as. Form 5498 lists your ira contributions for the tax year. Select traditional ira from the left panel. Just keep it with your tax. Form 5498 for my traditional ira shows a value in line 2 (rollover contributions). Go to screen 24, adjustments to income. Starting in 2015, ira trustees, custodians and issuers (in the case of individual retirement arrangements) are required to report certain. Information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how. You don't need to enter your 5498; However, i have not received a 1099r form with.

It is used when you need to. Use the left column for taxpayer information. You use the 5498 to confirm that the client (and their broker) did in fact put their stated to you amount into the type of account as. Form 5498 lists your ira contributions for the tax year. Just keep it with your tax. Select traditional ira from the left panel. Starting in 2015, ira trustees, custodians and issuers (in the case of individual retirement arrangements) are required to report certain. Information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how. You don't need to enter your 5498; Form 5498 for my traditional ira shows a value in line 2 (rollover contributions).

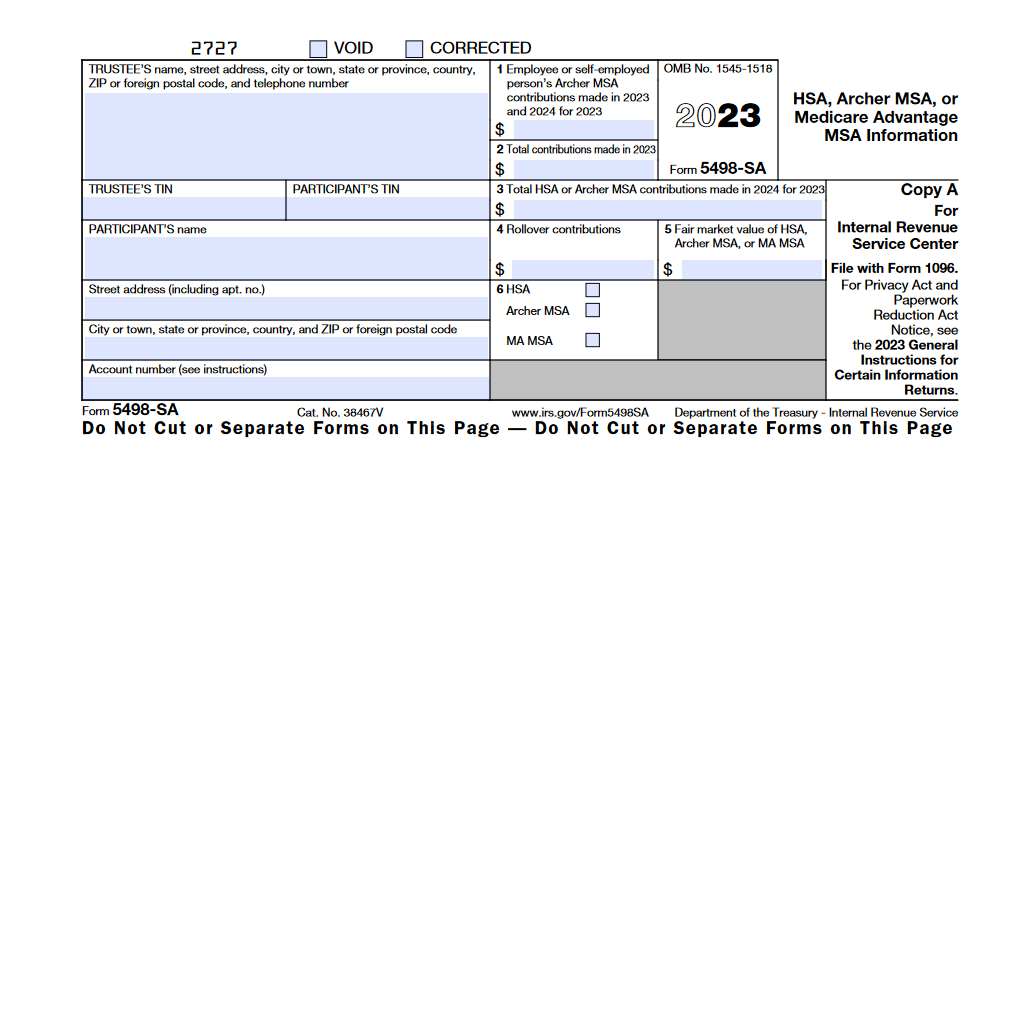

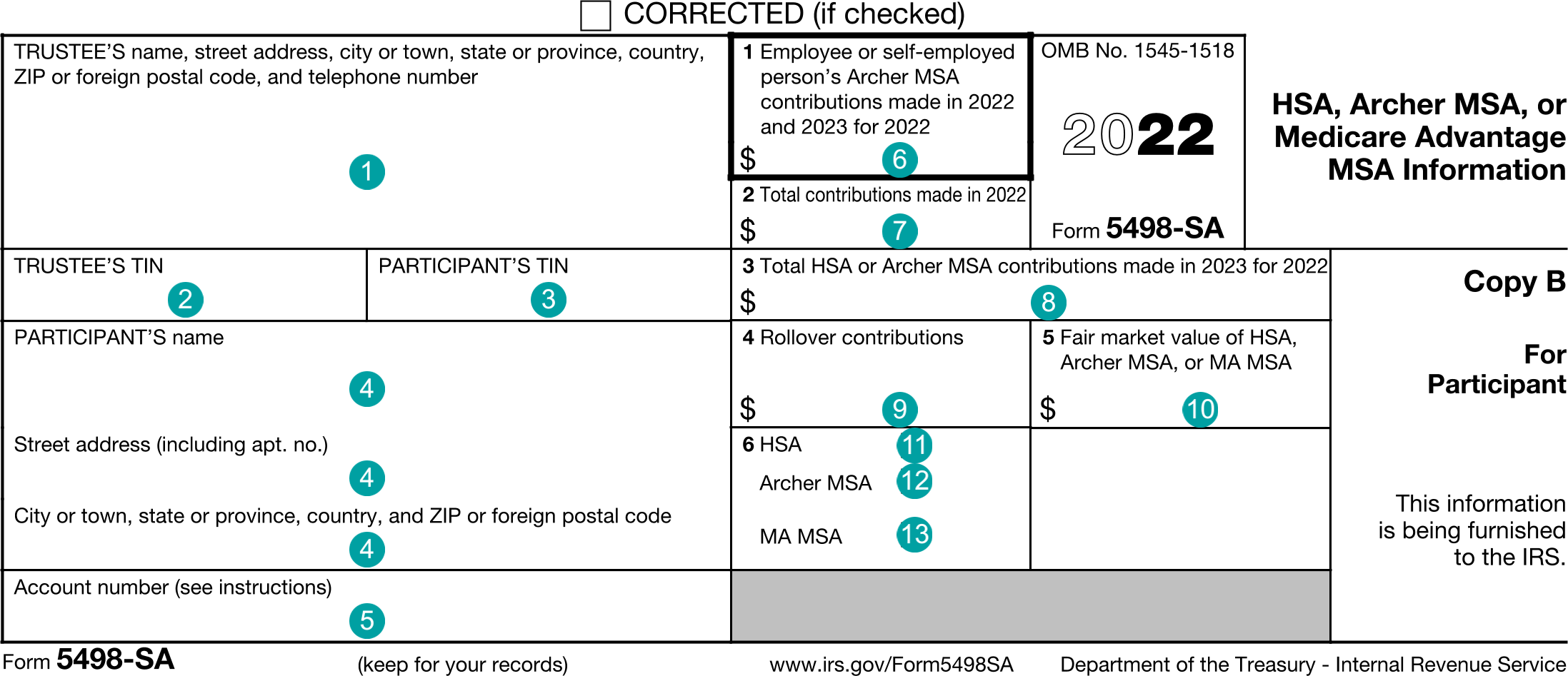

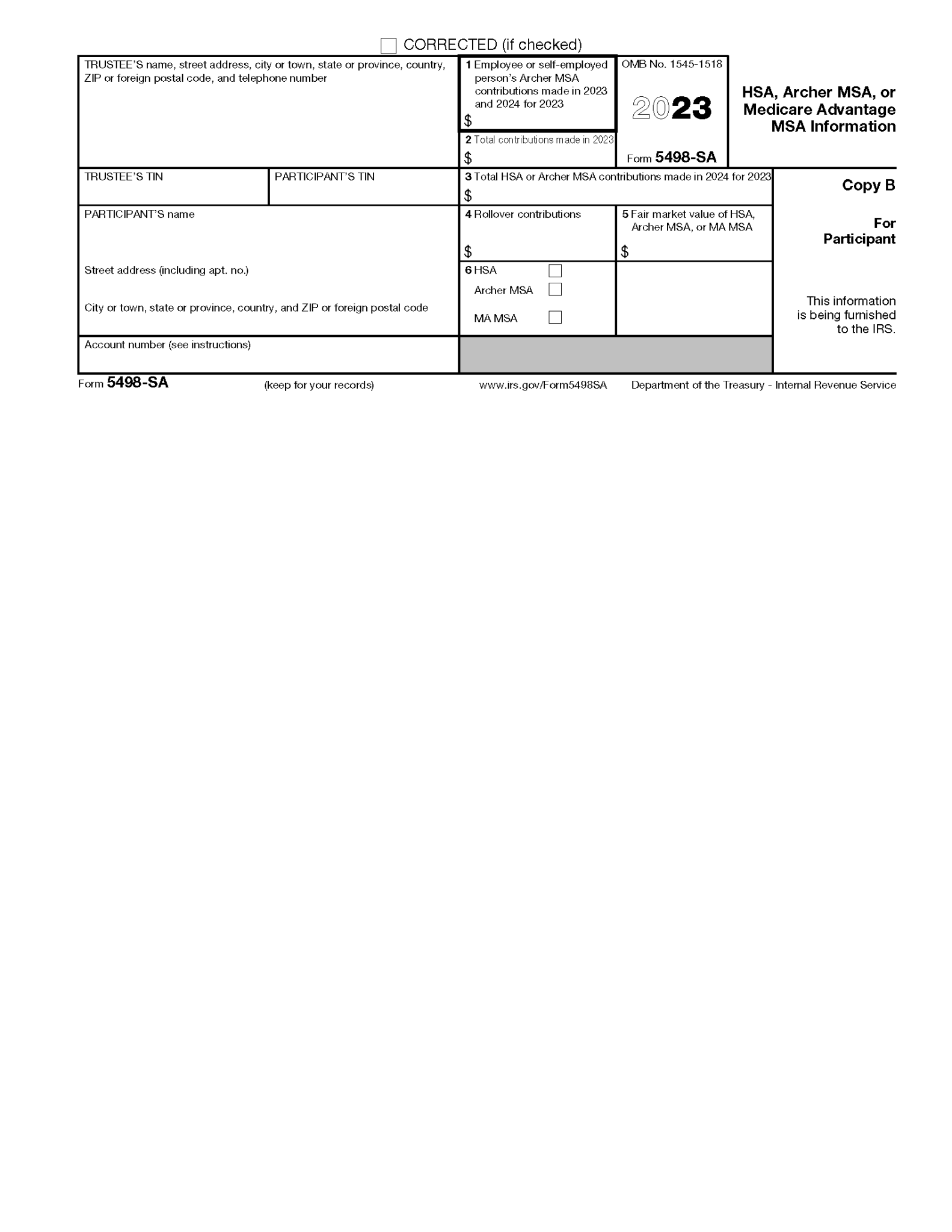

IRS Form 5498SA. HSA, Archer MSA, or Medicare Advantage MSA

It is used when you need to. Use the left column for taxpayer information. Go to screen 24, adjustments to income. Starting in 2015, ira trustees, custodians and issuers (in the case of individual retirement arrangements) are required to report certain. Information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how.

Everything You Need To Know About Tax Form 5498

Use the left column for taxpayer information. However, i have not received a 1099r form with. You don't need to enter your 5498; It is used when you need to. Select traditional ira from the left panel.

IRS Form 5498SA Instructions HSA and MSA Contributions

You don't need to enter your 5498; Go to screen 24, adjustments to income. However, i have not received a 1099r form with. Form 5498 for my traditional ira shows a value in line 2 (rollover contributions). Information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how.

Form 5498 Ira Does It Need To Be Reported Tax

Use the left column for taxpayer information. Information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how. However, i have not received a 1099r form with. Select traditional ira from the left panel. Form 5498 for my traditional ira shows a value in line 2 (rollover contributions).

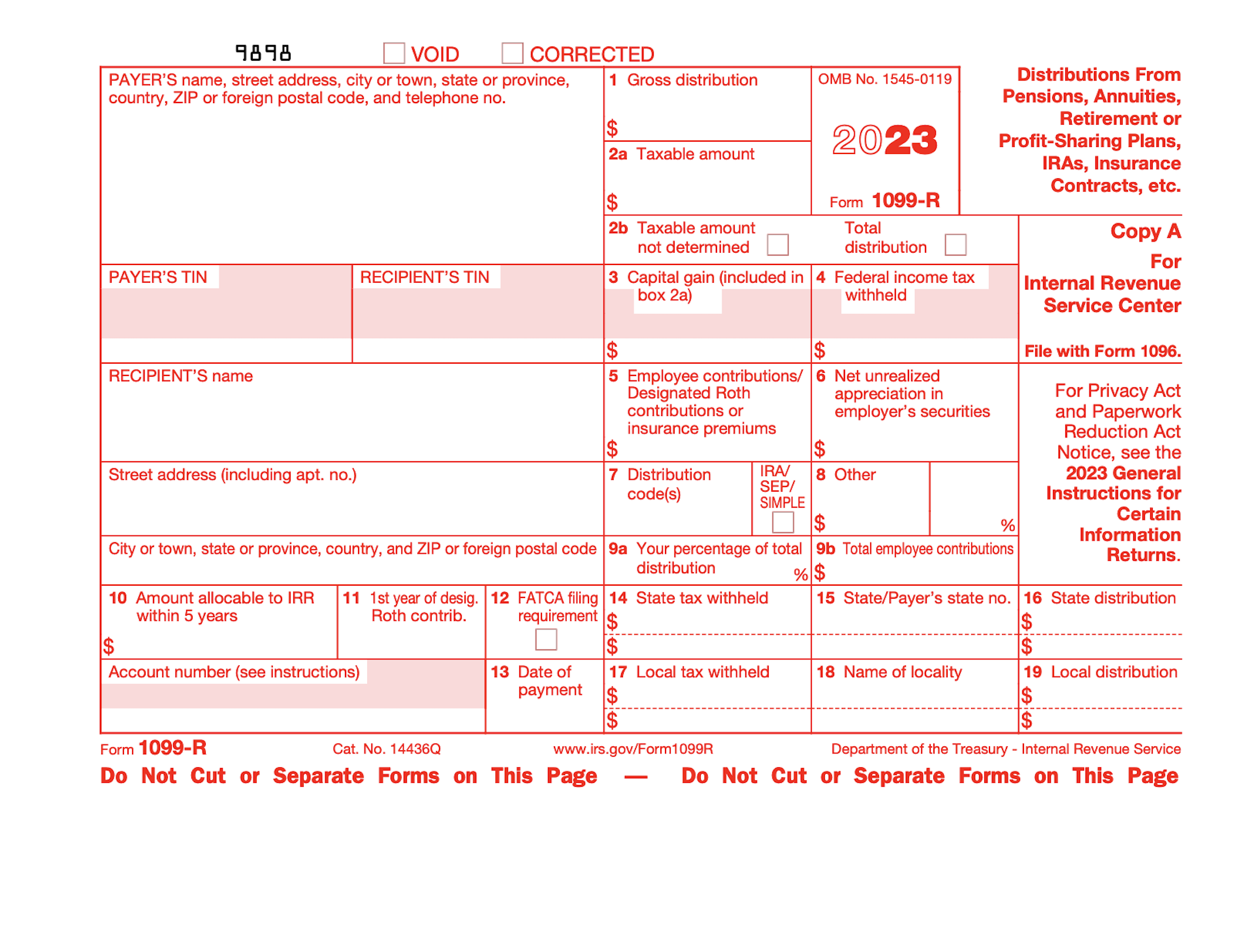

How to read your 1099R and 5498 Robinhood

Information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how. Starting in 2015, ira trustees, custodians and issuers (in the case of individual retirement arrangements) are required to report certain. It is used when you need to. Use the left column for taxpayer information. However, i have not received a 1099r.

IRS Form 5498SA ≡ Fill Out Printable PDF Forms Online, 44 OFF

Starting in 2015, ira trustees, custodians and issuers (in the case of individual retirement arrangements) are required to report certain. It is used when you need to. Go to screen 24, adjustments to income. Select traditional ira from the left panel. Use the left column for taxpayer information.

Free IRS Form 5498SA PDF eForms

Select traditional ira from the left panel. Form 5498 for my traditional ira shows a value in line 2 (rollover contributions). Form 5498 lists your ira contributions for the tax year. You use the 5498 to confirm that the client (and their broker) did in fact put their stated to you amount into the type of account as. Just keep.

2024 Form 5498 Ruby Rosaleen

Starting in 2015, ira trustees, custodians and issuers (in the case of individual retirement arrangements) are required to report certain. Form 5498 for my traditional ira shows a value in line 2 (rollover contributions). Use the left column for taxpayer information. You don't need to enter your 5498; Form 5498 lists your ira contributions for the tax year.

IRS Form 5498 Instructions

Form 5498 lists your ira contributions for the tax year. It is used when you need to. Information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how. Starting in 2015, ira trustees, custodians and issuers (in the case of individual retirement arrangements) are required to report certain. Select traditional ira from.

HSA Demystifying Tax Form 5498SA Bigger Insights

Form 5498 for my traditional ira shows a value in line 2 (rollover contributions). Form 5498 lists your ira contributions for the tax year. Just keep it with your tax. Starting in 2015, ira trustees, custodians and issuers (in the case of individual retirement arrangements) are required to report certain. Use the left column for taxpayer information.

You Don't Need To Enter Your 5498;

You use the 5498 to confirm that the client (and their broker) did in fact put their stated to you amount into the type of account as. Select traditional ira from the left panel. Go to screen 24, adjustments to income. Form 5498 lists your ira contributions for the tax year.

It Is Used When You Need To.

Starting in 2015, ira trustees, custodians and issuers (in the case of individual retirement arrangements) are required to report certain. Information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how. Just keep it with your tax. Use the left column for taxpayer information.

However, I Have Not Received A 1099R Form With.

Form 5498 for my traditional ira shows a value in line 2 (rollover contributions).