Form 8621 Filing Requirements

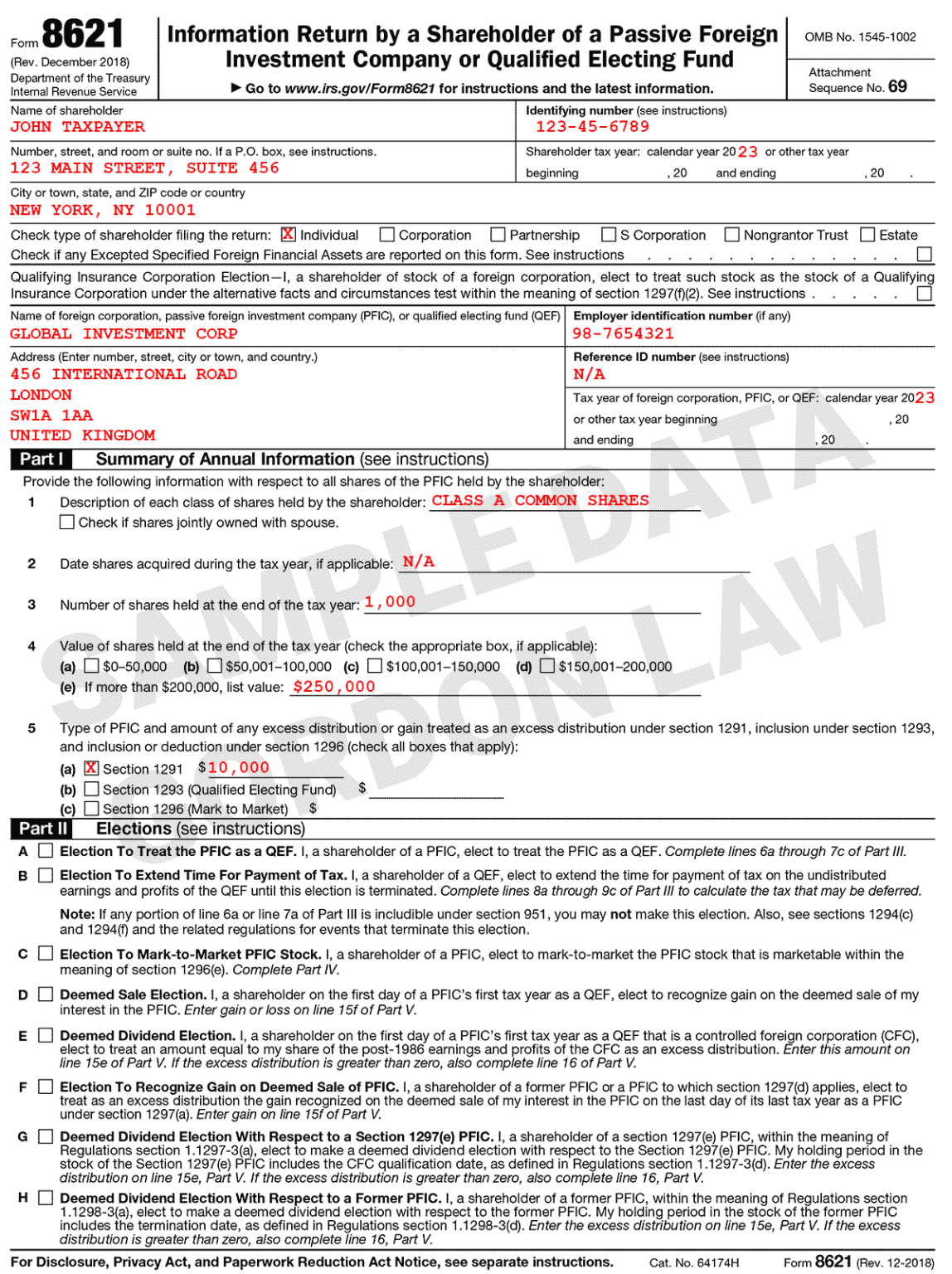

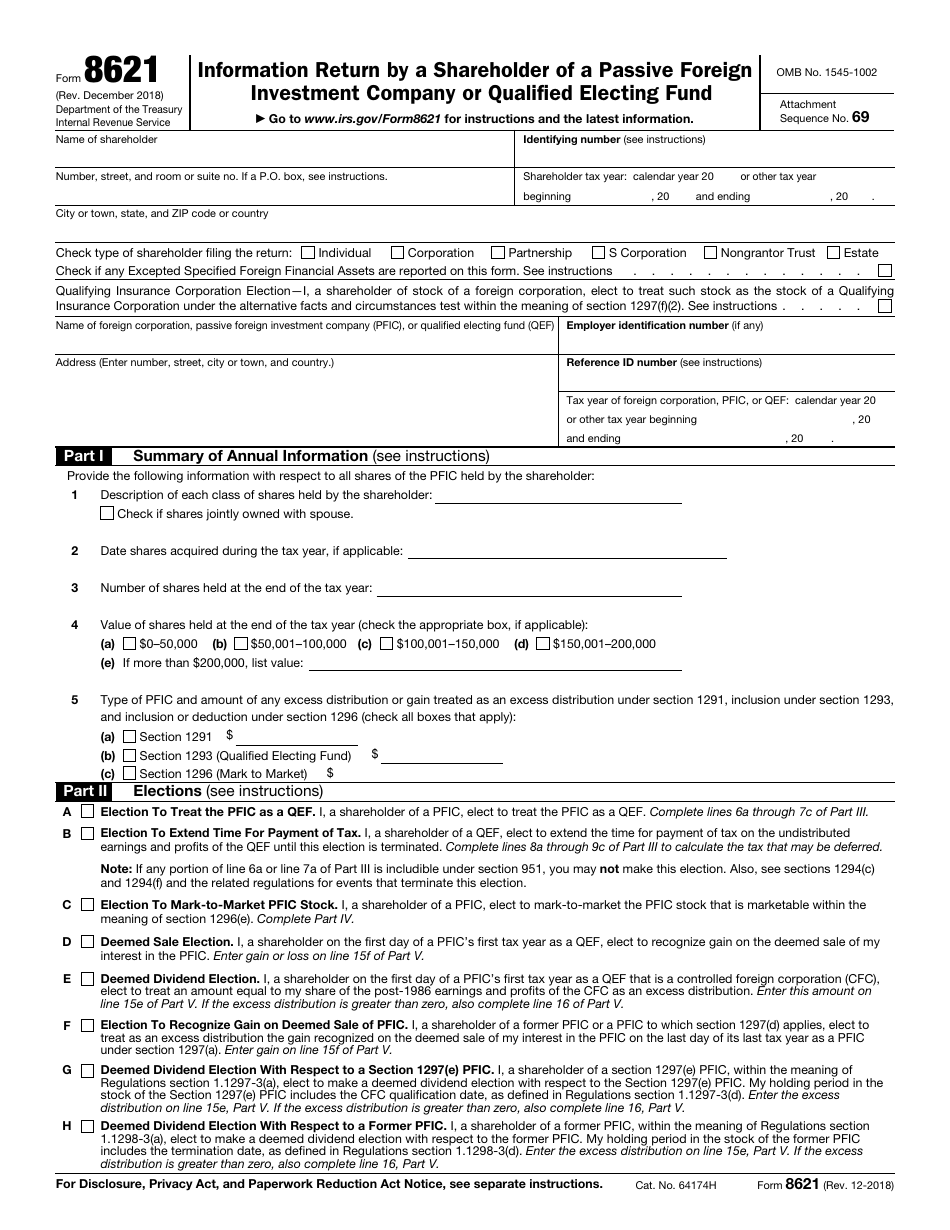

Form 8621 Filing Requirements - This requirement applies to u.s. Here’s a comprehensive guide to. When a us person has foreign accounts, assets, investments, or income — they may have annual irs reporting. Taxpayers who hold investments in pfics, reporting requirements are crucial and involve form 8621. When and where to file. Information about form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, including. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and. Taxpayers who hold shares in a foreign mutual fund must file form 8621.

Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and. Here’s a comprehensive guide to. Taxpayers who hold investments in pfics, reporting requirements are crucial and involve form 8621. Information about form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, including. Taxpayers who hold shares in a foreign mutual fund must file form 8621. When a us person has foreign accounts, assets, investments, or income — they may have annual irs reporting. When and where to file. This requirement applies to u.s.

Taxpayers who hold investments in pfics, reporting requirements are crucial and involve form 8621. When and where to file. When a us person has foreign accounts, assets, investments, or income — they may have annual irs reporting. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and. Information about form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, including. Here’s a comprehensive guide to. Taxpayers who hold shares in a foreign mutual fund must file form 8621. This requirement applies to u.s.

Form 8621 Filing Requirements Who, When, and How to Report Dimov Tax

When a us person has foreign accounts, assets, investments, or income — they may have annual irs reporting. When and where to file. This requirement applies to u.s. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and. Taxpayers who hold investments in pfics, reporting requirements are crucial and involve form 8621.

Guide to IRS Form 8621 PFICs, QEFs, and Filing Requirements Gordon

Taxpayers who hold investments in pfics, reporting requirements are crucial and involve form 8621. When and where to file. Here’s a comprehensive guide to. This requirement applies to u.s. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and.

Form 8621 for American Expatriates and Passive Foreign Investment Companies

When and where to file. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and. Taxpayers who hold shares in a foreign mutual fund must file form 8621. Information about form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, including. Taxpayers who hold investments in.

Understanding Form 8621 Filing Requirements and PFIC Penalties

Taxpayers who hold investments in pfics, reporting requirements are crucial and involve form 8621. When and where to file. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and. Taxpayers who hold shares in a foreign mutual fund must file form 8621. This requirement applies to u.s.

All About Form 8621 SDG Accountant

Information about form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, including. This requirement applies to u.s. When and where to file. Taxpayers who hold investments in pfics, reporting requirements are crucial and involve form 8621. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return).

PFIC (Form 8621) Filing Exception in Regulation vs Instructions

Taxpayers who hold shares in a foreign mutual fund must file form 8621. Here’s a comprehensive guide to. When and where to file. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and. Information about form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, including.

Form 8621 and Passive Foreign Investment Companies for Expats

When and where to file. Taxpayers who hold shares in a foreign mutual fund must file form 8621. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and. Taxpayers who hold investments in pfics, reporting requirements are crucial and involve form 8621. When a us person has foreign accounts, assets, investments, or income.

Form 8621 Fillable Printable Forms Free Online

When and where to file. Here’s a comprehensive guide to. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and. This requirement applies to u.s. Taxpayers who hold investments in pfics, reporting requirements are crucial and involve form 8621.

Form 8621 for American Expatriates and Passive Foreign Investment Companies

When a us person has foreign accounts, assets, investments, or income — they may have annual irs reporting. This requirement applies to u.s. When and where to file. Taxpayers who hold shares in a foreign mutual fund must file form 8621. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and.

Form 8621 Instructions 2024 2025 IRS Forms

Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and. When and where to file. Taxpayers who hold shares in a foreign mutual fund must file form 8621. This requirement applies to u.s. Here’s a comprehensive guide to.

When And Where To File.

This requirement applies to u.s. Taxpayers who hold investments in pfics, reporting requirements are crucial and involve form 8621. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and. When a us person has foreign accounts, assets, investments, or income — they may have annual irs reporting.

Taxpayers Who Hold Shares In A Foreign Mutual Fund Must File Form 8621.

Information about form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, including. Here’s a comprehensive guide to.