Form For Vat Return

Form For Vat Return - Forms for claiming a vat refund if your business is registered in a country outside the uk A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to.

Forms for claiming a vat refund if your business is registered in a country outside the uk A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to.

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

Product Update 417 VAT return correction form for year 2018 available

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

VAT return template EasyBooks Small Business Bookkeeping App Try

Forms for claiming a vat refund if your business is registered in a country outside the uk A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to.

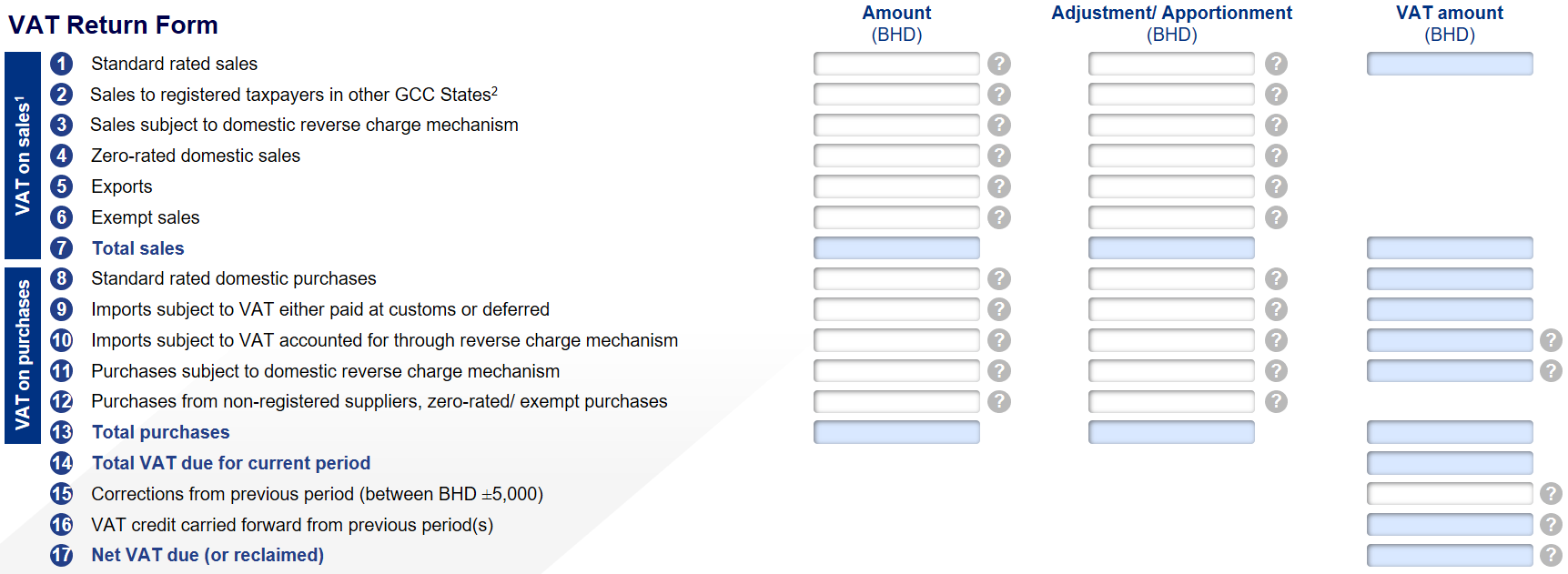

VAT Return Format in Bahrain Tally Solutions

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

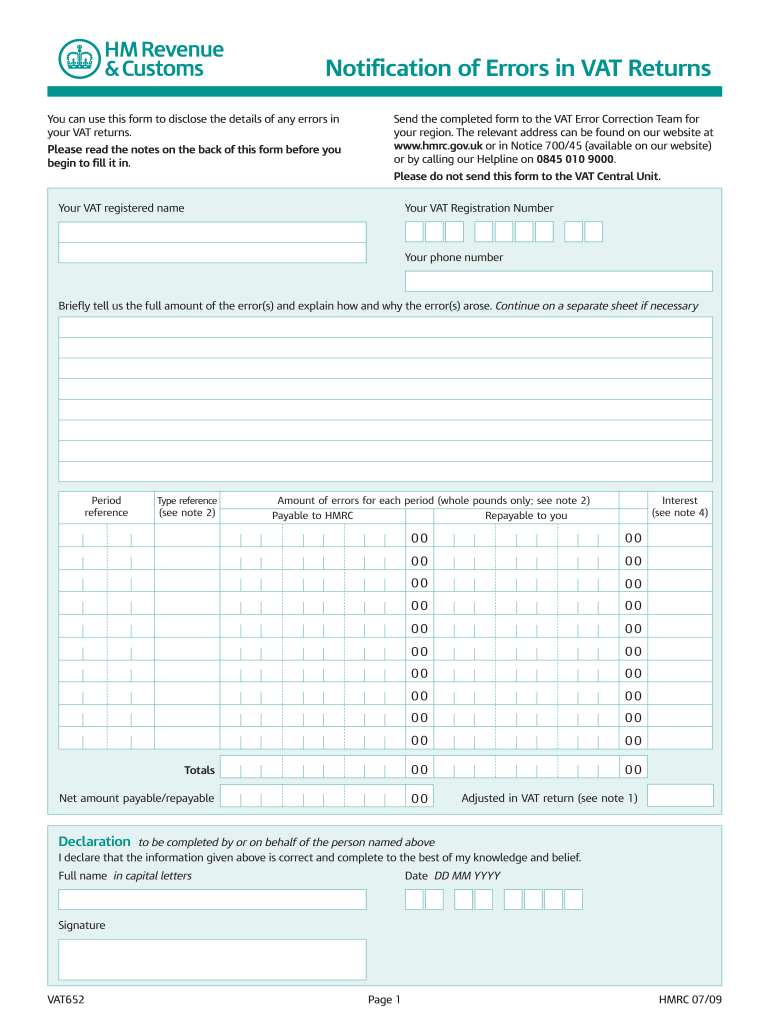

Vat652 Form Pdf Fill Online, Printable, Fillable, Blank pdfFiller

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

What is a VAT return? FreeAgent

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

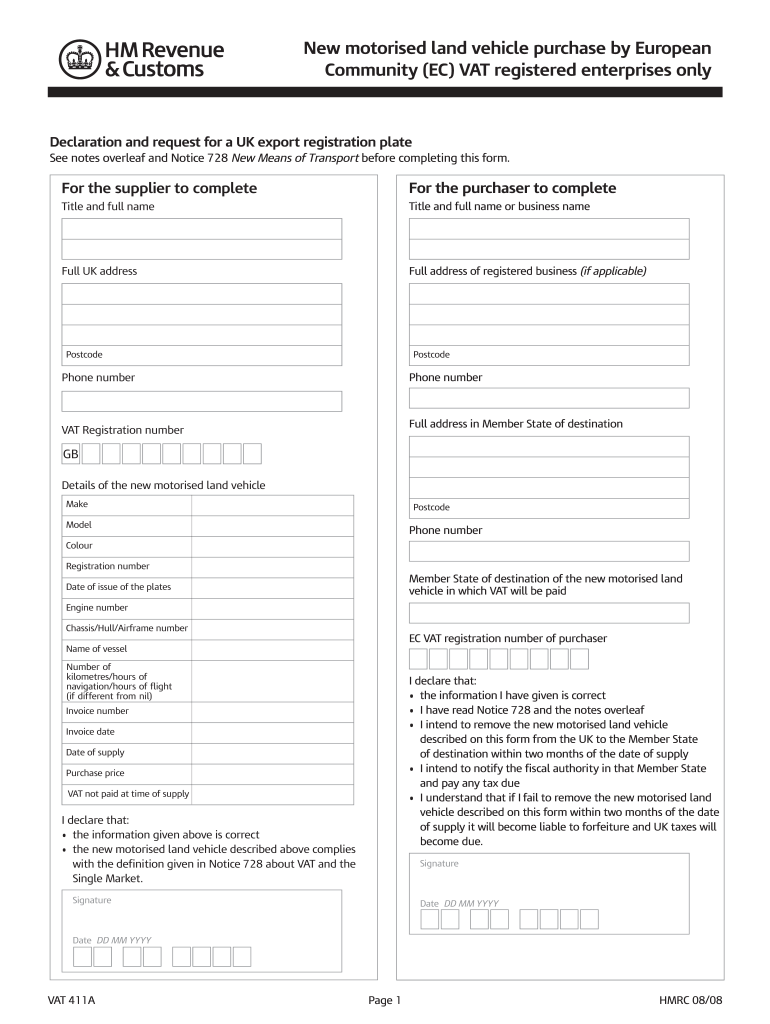

Vat 411a Form Complete with ease airSlate SignNow

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

Checking, editing and locking a VAT return FreeAgent Support

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

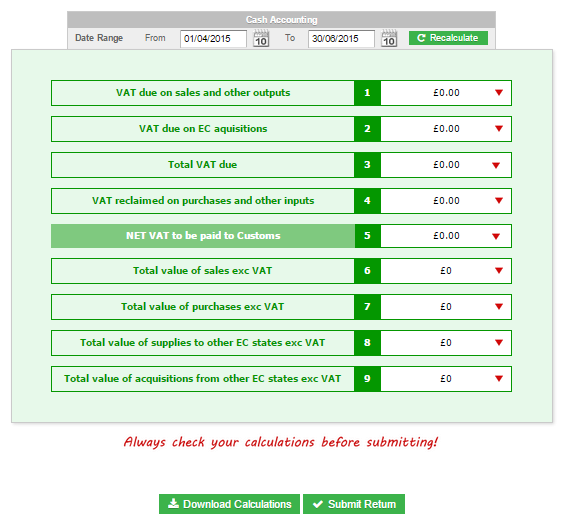

VAT Returns Guide VAT QuickFile

Forms for claiming a vat refund if your business is registered in a country outside the uk A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to.

VAT Return Form VAT 3 (Kenya)

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

Forms For Claiming A Vat Refund If Your Business Is Registered In A Country Outside The Uk

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to.