Formhow Do I Get Form 9325

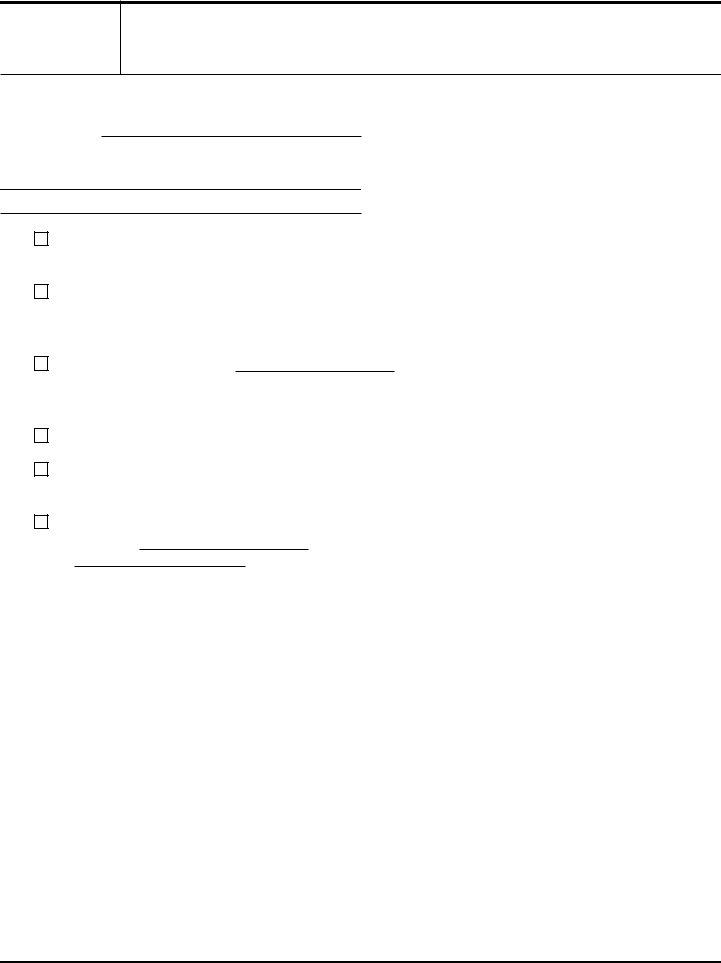

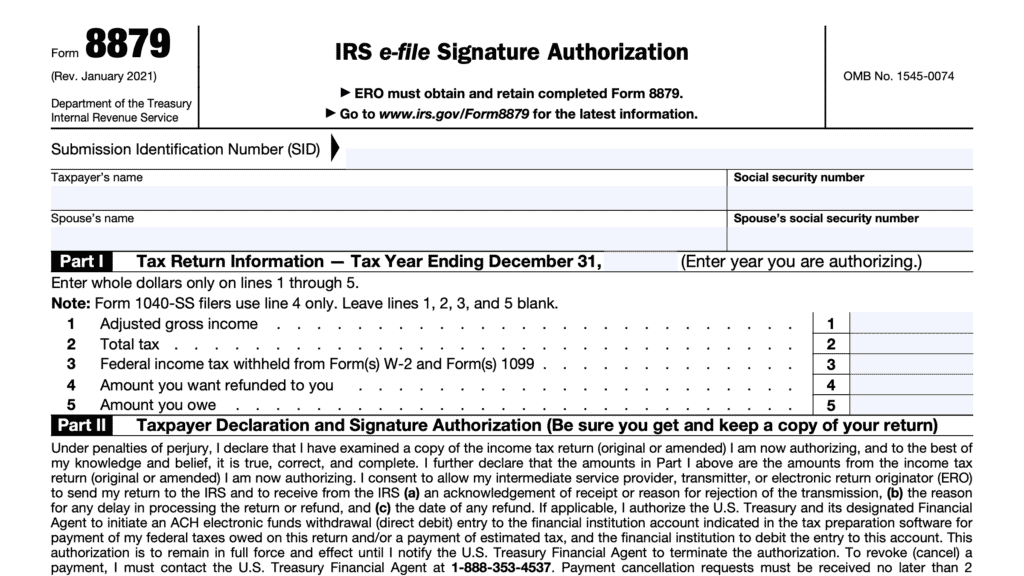

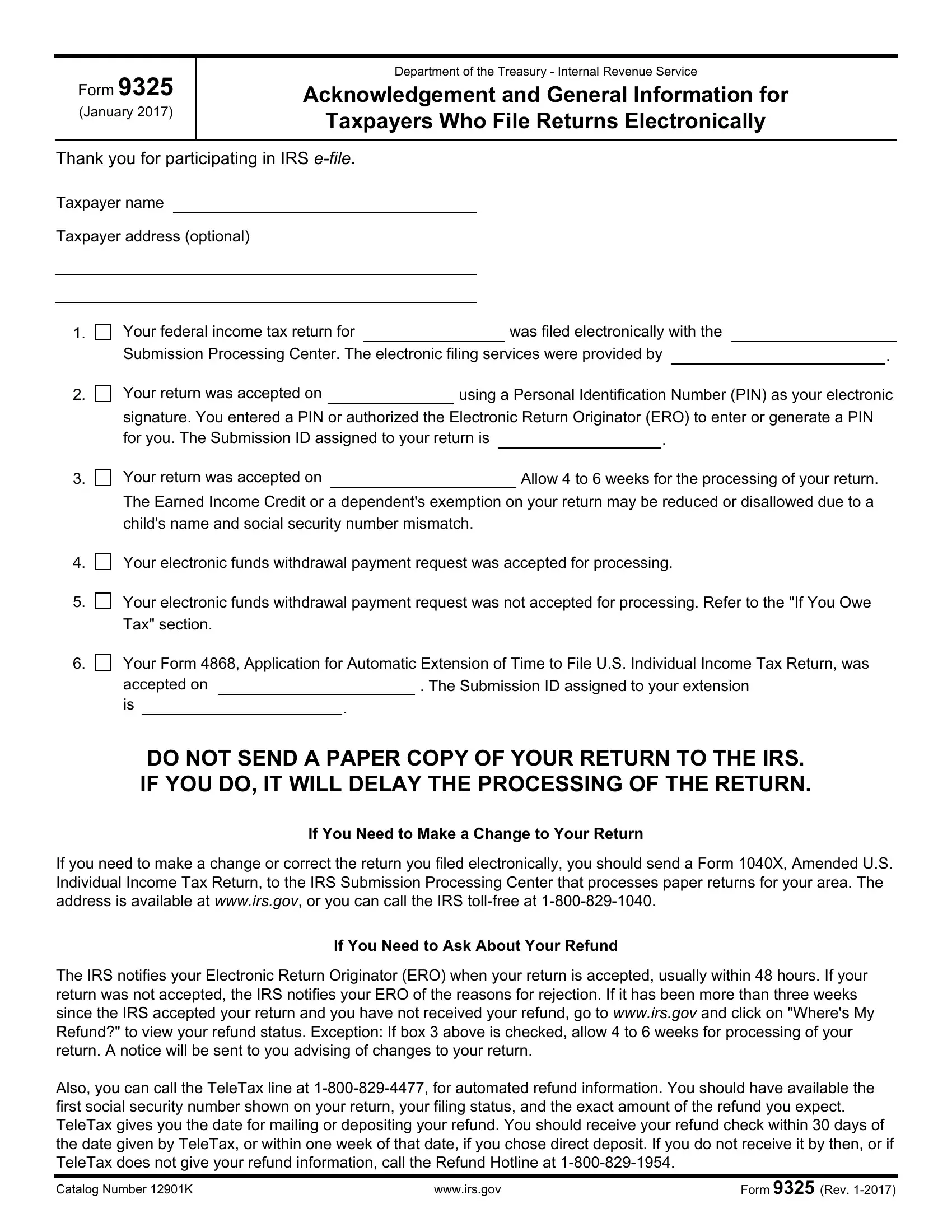

Formhow Do I Get Form 9325 - A form 9325, acknowledgement and general information for taxpayers who file returns electronically, is not needed when. Click on a column heading to sort the list by the. There are two ways to print form 9325 for a specific client: If you used turbotax your tax return was self. The form you are asking about is only used by paid professional tax preparers. Form 9325 is generated by your tax return preparer as a receipt, based upon irs notification that they received regarding your. View more information about using irs forms, instructions, publications and other item files. Irs form 9325 is a confirmation form from the irs that the original individual tax return or extension has been received through the electronic filing. Form 9325 and ef notice are.

View more information about using irs forms, instructions, publications and other item files. Click on a column heading to sort the list by the. Irs form 9325 is a confirmation form from the irs that the original individual tax return or extension has been received through the electronic filing. A form 9325, acknowledgement and general information for taxpayers who file returns electronically, is not needed when. There are two ways to print form 9325 for a specific client: The form you are asking about is only used by paid professional tax preparers. Form 9325 is generated by your tax return preparer as a receipt, based upon irs notification that they received regarding your. If you used turbotax your tax return was self. Form 9325 and ef notice are.

Form 9325 is generated by your tax return preparer as a receipt, based upon irs notification that they received regarding your. If you used turbotax your tax return was self. View more information about using irs forms, instructions, publications and other item files. There are two ways to print form 9325 for a specific client: Click on a column heading to sort the list by the. Form 9325 and ef notice are. The form you are asking about is only used by paid professional tax preparers. A form 9325, acknowledgement and general information for taxpayers who file returns electronically, is not needed when. Irs form 9325 is a confirmation form from the irs that the original individual tax return or extension has been received through the electronic filing.

Form 9325 ≡ Fill Out Printable PDF Forms Online

A form 9325, acknowledgement and general information for taxpayers who file returns electronically, is not needed when. Irs form 9325 is a confirmation form from the irs that the original individual tax return or extension has been received through the electronic filing. There are two ways to print form 9325 for a specific client: View more information about using irs.

Form 9325 Fill out & sign online DocHub

If you used turbotax your tax return was self. Irs form 9325 is a confirmation form from the irs that the original individual tax return or extension has been received through the electronic filing. Form 9325 and ef notice are. There are two ways to print form 9325 for a specific client: The form you are asking about is only.

Form 9325 ≡ Fill Out Printable PDF Forms Online

Click on a column heading to sort the list by the. If you used turbotax your tax return was self. View more information about using irs forms, instructions, publications and other item files. Irs form 9325 is a confirmation form from the irs that the original individual tax return or extension has been received through the electronic filing. Form 9325.

Irs Form 9325 Printable

There are two ways to print form 9325 for a specific client: View more information about using irs forms, instructions, publications and other item files. Click on a column heading to sort the list by the. A form 9325, acknowledgement and general information for taxpayers who file returns electronically, is not needed when. The form you are asking about is.

Form 9325 Papers Acknowledgement General Information Stock Illustration

The form you are asking about is only used by paid professional tax preparers. Irs form 9325 is a confirmation form from the irs that the original individual tax return or extension has been received through the electronic filing. Form 9325 is generated by your tax return preparer as a receipt, based upon irs notification that they received regarding your..

Form 9325 can also be printed from the online EF database.

The form you are asking about is only used by paid professional tax preparers. There are two ways to print form 9325 for a specific client: If you used turbotax your tax return was self. Irs form 9325 is a confirmation form from the irs that the original individual tax return or extension has been received through the electronic filing..

Form 9325 ≡ Fill Out Printable PDF Forms Online

Irs form 9325 is a confirmation form from the irs that the original individual tax return or extension has been received through the electronic filing. View more information about using irs forms, instructions, publications and other item files. A form 9325, acknowledgement and general information for taxpayers who file returns electronically, is not needed when. Form 9325 and ef notice.

Form 9325 2014 Fill out & sign online DocHub

Irs form 9325 is a confirmation form from the irs that the original individual tax return or extension has been received through the electronic filing. If you used turbotax your tax return was self. There are two ways to print form 9325 for a specific client: View more information about using irs forms, instructions, publications and other item files. The.

Fillable Online How Do Fossils FormHow Fossils Form Fax Email Print

A form 9325, acknowledgement and general information for taxpayers who file returns electronically, is not needed when. Irs form 9325 is a confirmation form from the irs that the original individual tax return or extension has been received through the electronic filing. Click on a column heading to sort the list by the. There are two ways to print form.

Fill Free fillable F9325 Accessible Form 9325 (Rev. 12017) PDF form

If you used turbotax your tax return was self. A form 9325, acknowledgement and general information for taxpayers who file returns electronically, is not needed when. View more information about using irs forms, instructions, publications and other item files. Irs form 9325 is a confirmation form from the irs that the original individual tax return or extension has been received.

A Form 9325, Acknowledgement And General Information For Taxpayers Who File Returns Electronically, Is Not Needed When.

Form 9325 and ef notice are. View more information about using irs forms, instructions, publications and other item files. There are two ways to print form 9325 for a specific client: The form you are asking about is only used by paid professional tax preparers.

Irs Form 9325 Is A Confirmation Form From The Irs That The Original Individual Tax Return Or Extension Has Been Received Through The Electronic Filing.

If you used turbotax your tax return was self. Form 9325 is generated by your tax return preparer as a receipt, based upon irs notification that they received regarding your. Click on a column heading to sort the list by the.