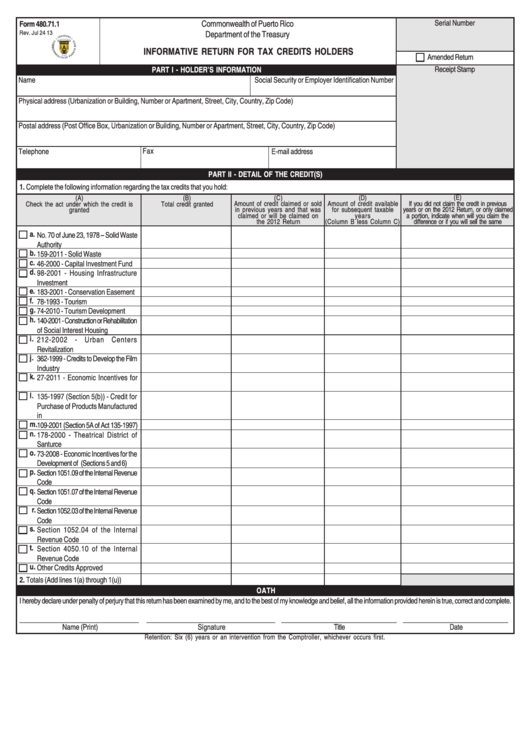

Formpuerto Rico Form 480 6 A

Formpuerto Rico Form 480 6 A - Form 480.7f “annual return of payments received for advertising, insurance premiums, telecommunication, internet access. It covers investment income that has been subject to puerto rico. You can include this pr. Yes, you will need to report this puerto rican bank interest as income on your income tax returns. 16 rows 1 beginning in calendar 2019, payments for services rendered during the year that were previously reported on forms 480.6a, 480.6b. In order for puerto rico forms 480.6a, 480.6b, and 480.7a to be filed, an account has to be registered on suri. Pursuant to the puerto rico internal revenue code of 2011, as amended (code), an income tax return must be filed by any resident individual that: Form 480 is a document that summarizes payments that have not been subject to withholding, payments generated to a supplier.

Form 480.7f “annual return of payments received for advertising, insurance premiums, telecommunication, internet access. Pursuant to the puerto rico internal revenue code of 2011, as amended (code), an income tax return must be filed by any resident individual that: Form 480 is a document that summarizes payments that have not been subject to withholding, payments generated to a supplier. You can include this pr. 16 rows 1 beginning in calendar 2019, payments for services rendered during the year that were previously reported on forms 480.6a, 480.6b. Yes, you will need to report this puerto rican bank interest as income on your income tax returns. It covers investment income that has been subject to puerto rico. In order for puerto rico forms 480.6a, 480.6b, and 480.7a to be filed, an account has to be registered on suri.

Form 480.7f “annual return of payments received for advertising, insurance premiums, telecommunication, internet access. 16 rows 1 beginning in calendar 2019, payments for services rendered during the year that were previously reported on forms 480.6a, 480.6b. Pursuant to the puerto rico internal revenue code of 2011, as amended (code), an income tax return must be filed by any resident individual that: Yes, you will need to report this puerto rican bank interest as income on your income tax returns. Form 480 is a document that summarizes payments that have not been subject to withholding, payments generated to a supplier. It covers investment income that has been subject to puerto rico. You can include this pr. In order for puerto rico forms 480.6a, 480.6b, and 480.7a to be filed, an account has to be registered on suri.

2012 Form PR 480.20 Fill Online, Printable, Fillable, Blank pdfFiller

Form 480.7f “annual return of payments received for advertising, insurance premiums, telecommunication, internet access. You can include this pr. 16 rows 1 beginning in calendar 2019, payments for services rendered during the year that were previously reported on forms 480.6a, 480.6b. Pursuant to the puerto rico internal revenue code of 2011, as amended (code), an income tax return must be.

Printable 480 9 Form Printable Forms Free Online

It covers investment income that has been subject to puerto rico. Form 480.7f “annual return of payments received for advertising, insurance premiums, telecommunication, internet access. Yes, you will need to report this puerto rican bank interest as income on your income tax returns. You can include this pr. Pursuant to the puerto rico internal revenue code of 2011, as amended.

Form 480 9 Printable Printable Forms Free Online

16 rows 1 beginning in calendar 2019, payments for services rendered during the year that were previously reported on forms 480.6a, 480.6b. You can include this pr. It covers investment income that has been subject to puerto rico. Form 480 is a document that summarizes payments that have not been subject to withholding, payments generated to a supplier. Form 480.7f.

Form 480 6c Fill out & sign online DocHub

Pursuant to the puerto rico internal revenue code of 2011, as amended (code), an income tax return must be filed by any resident individual that: In order for puerto rico forms 480.6a, 480.6b, and 480.7a to be filed, an account has to be registered on suri. Yes, you will need to report this puerto rican bank interest as income on.

Formulario 480 Fill Online, Printable, Fillable, Blank pdfFiller

Pursuant to the puerto rico internal revenue code of 2011, as amended (code), an income tax return must be filed by any resident individual that: Form 480 is a document that summarizes payments that have not been subject to withholding, payments generated to a supplier. You can include this pr. In order for puerto rico forms 480.6a, 480.6b, and 480.7a.

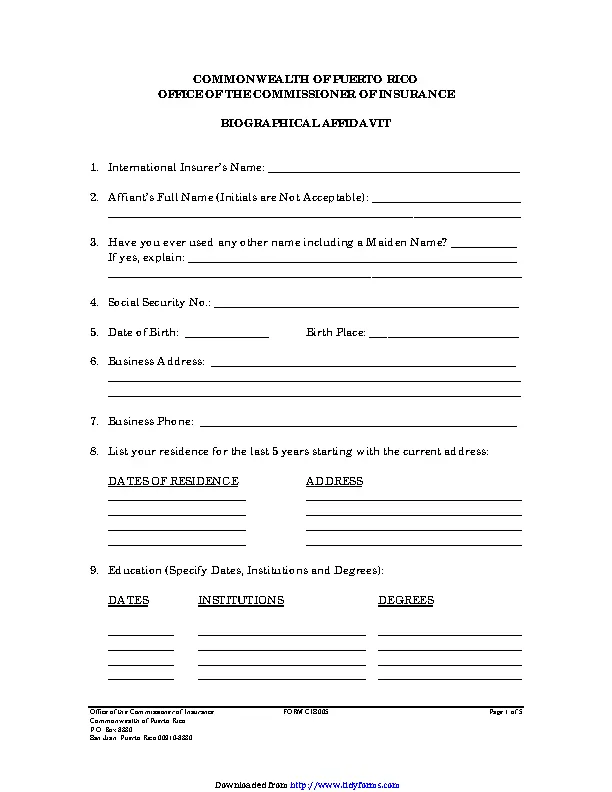

Puerto Rico Biographical Affidavit Form PDFSimpli

Form 480 is a document that summarizes payments that have not been subject to withholding, payments generated to a supplier. It covers investment income that has been subject to puerto rico. Yes, you will need to report this puerto rican bank interest as income on your income tax returns. You can include this pr. Pursuant to the puerto rico internal.

Form 480 6c Fill out & sign online DocHub

Form 480 is a document that summarizes payments that have not been subject to withholding, payments generated to a supplier. Pursuant to the puerto rico internal revenue code of 2011, as amended (code), an income tax return must be filed by any resident individual that: You can include this pr. It covers investment income that has been subject to puerto.

Formulario 480.6 ec Actualizado septiembre 2023

Yes, you will need to report this puerto rican bank interest as income on your income tax returns. It covers investment income that has been subject to puerto rico. Pursuant to the puerto rico internal revenue code of 2011, as amended (code), an income tax return must be filed by any resident individual that: Form 480.7f “annual return of payments.

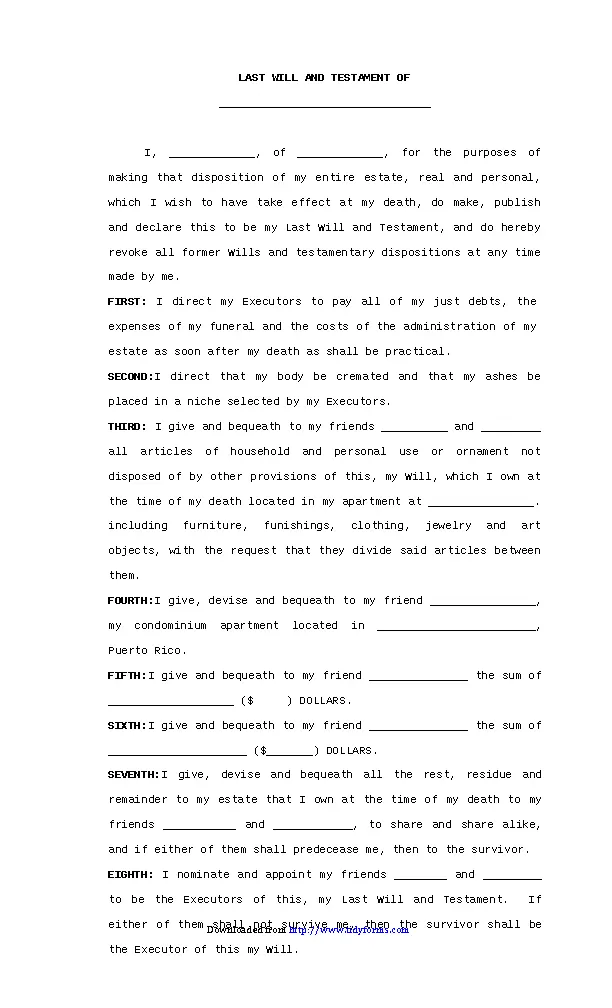

Puerto Rico Last Will And Testament Form PDFSimpli

You can include this pr. It covers investment income that has been subject to puerto rico. 16 rows 1 beginning in calendar 2019, payments for services rendered during the year that were previously reported on forms 480.6a, 480.6b. In order for puerto rico forms 480.6a, 480.6b, and 480.7a to be filed, an account has to be registered on suri. Pursuant.

Top 601 Puerto Rico Department Of Treasury Forms And Templates free to

Yes, you will need to report this puerto rican bank interest as income on your income tax returns. Form 480 is a document that summarizes payments that have not been subject to withholding, payments generated to a supplier. You can include this pr. 16 rows 1 beginning in calendar 2019, payments for services rendered during the year that were previously.

It Covers Investment Income That Has Been Subject To Puerto Rico.

Form 480.7f “annual return of payments received for advertising, insurance premiums, telecommunication, internet access. You can include this pr. 16 rows 1 beginning in calendar 2019, payments for services rendered during the year that were previously reported on forms 480.6a, 480.6b. Pursuant to the puerto rico internal revenue code of 2011, as amended (code), an income tax return must be filed by any resident individual that:

Form 480 Is A Document That Summarizes Payments That Have Not Been Subject To Withholding, Payments Generated To A Supplier.

In order for puerto rico forms 480.6a, 480.6b, and 480.7a to be filed, an account has to be registered on suri. Yes, you will need to report this puerto rican bank interest as income on your income tax returns.