How Do Tax Liens Work In Arizona

How Do Tax Liens Work In Arizona - How does someone acquire a tax lien? The online auction is held by real auction on. Arizona revised statutes are central to understanding how these priorities work with tax liens. At the public auction conducted each february. First, to obtain ownership of a property through foreclosing the lien; Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release state tax lien(s). The tax on the property is auctioned in open competitive. The tax lien sale provides for the payment of delinquent property taxes by an bidder. Tax liens take precedence over. Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government.

Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government. The tax lien sale provides for the payment of delinquent property taxes by an bidder. Or second, to obtain a. At the public auction conducted each february. In arizona, if property taxes are not paid, the county treasurer will sell the delinquent lien at public auction. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release state tax lien(s). The online auction is held by real auction on. The tax on the property is auctioned in open competitive. How does someone acquire a tax lien? First, to obtain ownership of a property through foreclosing the lien;

How does someone acquire a tax lien? Tax liens are generally purchased for two reasons: The online auction is held by real auction on. Or second, to obtain a. People buy tax liens for two. Arizona revised statutes are central to understanding how these priorities work with tax liens. At the public auction conducted each february. Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release state tax lien(s). In arizona, if property taxes are not paid, the county treasurer will sell the delinquent lien at public auction.

Tax liens arizona Fill out & sign online DocHub

The tax lien sale provides for the payment of delinquent property taxes by an bidder. In arizona, if property taxes are not paid, the county treasurer will sell the delinquent lien at public auction. At the public auction conducted each february. People buy tax liens for two. Tax liens take precedence over.

Tax Liens An Overview CheckBook IRA LLC

The online auction is held by real auction on. Tax liens are generally purchased for two reasons: The tax on the property is auctioned in open competitive. Or second, to obtain a. Tax liens take precedence over.

Can Bankruptcy Stop Tax Liens in Arizona? Tax Lien Bankruptcy Arizona

First, to obtain ownership of a property through foreclosing the lien; Tax liens are generally purchased for two reasons: How does someone acquire a tax lien? Or second, to obtain a. The tax on the property is auctioned in open competitive.

Do Tax Liens Expire? Levy & Associates

The tax on the property is auctioned in open competitive. Or second, to obtain a. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release state tax lien(s). Arizona revised statutes are central to understanding how these priorities work with tax liens. The tax lien sale provides for.

Arizona Tax Liens Primer Foreclosure Tax Lien

At the public auction conducted each february. In arizona, if property taxes are not paid, the county treasurer will sell the delinquent lien at public auction. The online auction is held by real auction on. First, to obtain ownership of a property through foreclosing the lien; Tax liens are a “hold” against your member’s property, superior to all liens except.

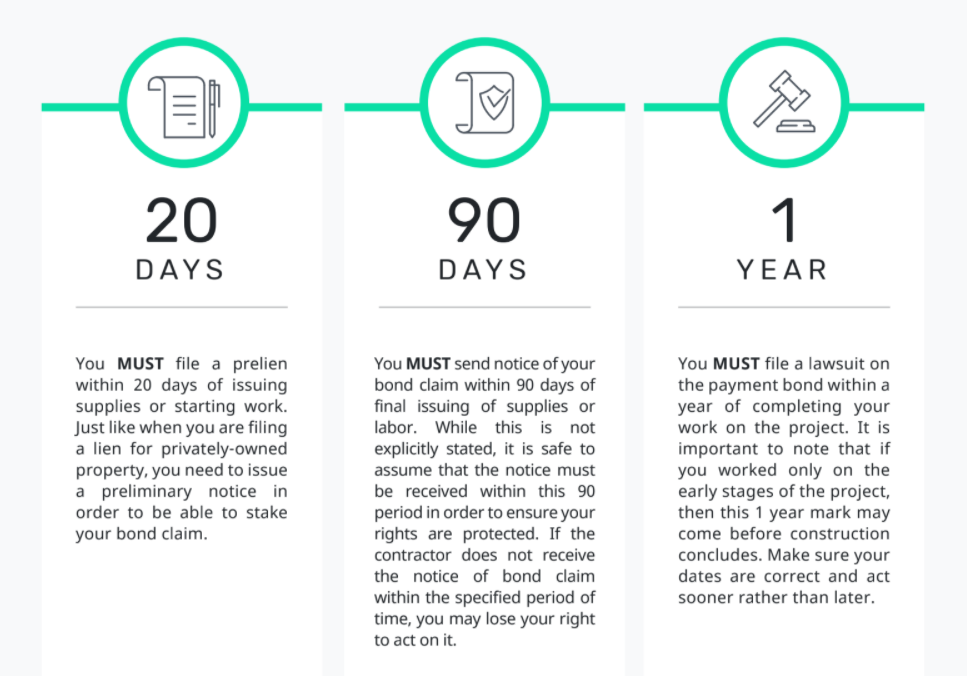

Arizona Mechanic’s Liens Everything You Need to Know Titan Lien

Arizona revised statutes are central to understanding how these priorities work with tax liens. Or second, to obtain a. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release state tax lien(s). First, to obtain ownership of a property through foreclosing the lien; Tax liens are generally purchased.

Understanding Property Tax Liens in Arizona

Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release state tax lien(s). First, to obtain ownership of a property through foreclosing the lien; The tax on the property is auctioned in open competitive. The online auction is held by real auction on. Or second, to obtain a.

Tax Liens Making it Work! CheckBook IRA LLC

Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government. Or second, to obtain a. The tax lien sale provides for the payment of delinquent property taxes by an bidder. Tax liens are generally purchased for two reasons: In arizona, if property taxes are not paid, the county treasurer will sell.

How Do Tax Liens and Levies Work?

First, to obtain ownership of a property through foreclosing the lien; Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government. Arizona revised statutes are central to understanding how these priorities work with tax liens. People buy tax liens for two. How does someone acquire a tax lien?

How Do Tax Liens Work in Canada? Consolidated Credit Canada

The tax on the property is auctioned in open competitive. In arizona, if property taxes are not paid, the county treasurer will sell the delinquent lien at public auction. People buy tax liens for two. First, to obtain ownership of a property through foreclosing the lien; Tax liens are a “hold” against your member’s property, superior to all liens except.

Tax Liens Take Precedence Over.

First, to obtain ownership of a property through foreclosing the lien; At the public auction conducted each february. Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government. How does someone acquire a tax lien?

The Tax Lien Sale Provides For The Payment Of Delinquent Property Taxes By An Bidder.

People buy tax liens for two. Tax liens are generally purchased for two reasons: The online auction is held by real auction on. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release state tax lien(s).

Or Second, To Obtain A.

Arizona revised statutes are central to understanding how these priorities work with tax liens. In arizona, if property taxes are not paid, the county treasurer will sell the delinquent lien at public auction. The tax on the property is auctioned in open competitive.