How Do Tax Liens Work In Florida

How Do Tax Liens Work In Florida - How property tax lien sales work in florida in an effort to recover unpaid property taxes, florida organizes annual tax lien sales. A tax lien certificate, or tax certificate is not a purchase of property; In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june. First off, you should know that tax liens and tax deeds are both sold in the state of florida. The tax lien is sold to an investor prior to. This process is governed by. Rather, it is a lien imposed on the property by payment of the delinquent taxes.

A tax lien certificate, or tax certificate is not a purchase of property; The tax lien is sold to an investor prior to. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june. This process is governed by. Rather, it is a lien imposed on the property by payment of the delinquent taxes. How property tax lien sales work in florida in an effort to recover unpaid property taxes, florida organizes annual tax lien sales. First off, you should know that tax liens and tax deeds are both sold in the state of florida.

This process is governed by. A tax lien certificate, or tax certificate is not a purchase of property; First off, you should know that tax liens and tax deeds are both sold in the state of florida. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june. The tax lien is sold to an investor prior to. Rather, it is a lien imposed on the property by payment of the delinquent taxes. How property tax lien sales work in florida in an effort to recover unpaid property taxes, florida organizes annual tax lien sales.

Tax Lien Investing How Do Tax Liens Work in Florida hardmoneylenders.io

A tax lien certificate, or tax certificate is not a purchase of property; How property tax lien sales work in florida in an effort to recover unpaid property taxes, florida organizes annual tax lien sales. This process is governed by. First off, you should know that tax liens and tax deeds are both sold in the state of florida. In.

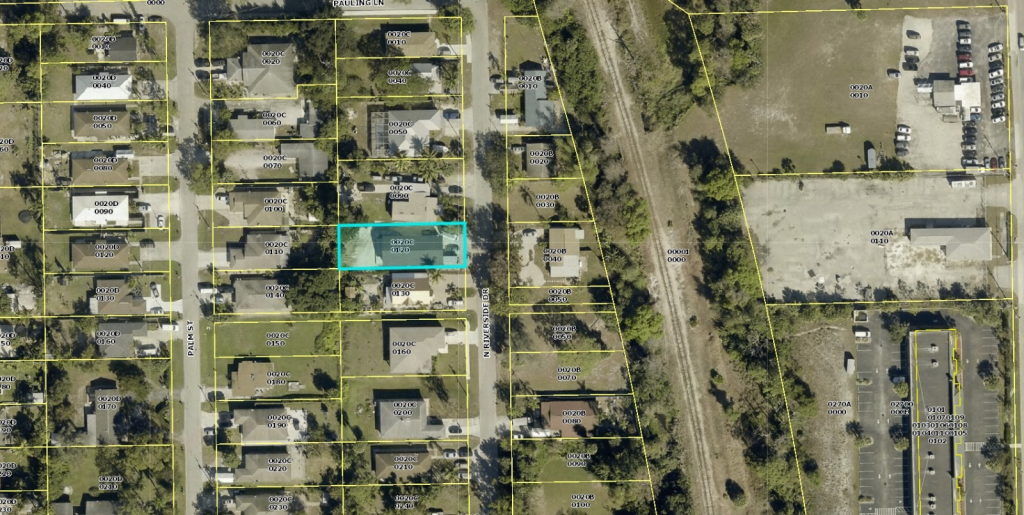

Tax Liens Emanuel Use Case Florida

This process is governed by. Rather, it is a lien imposed on the property by payment of the delinquent taxes. The tax lien is sold to an investor prior to. First off, you should know that tax liens and tax deeds are both sold in the state of florida. How property tax lien sales work in florida in an effort.

Tax Lien Investing How Do Tax Liens Work in Florida hardmoneylenders.io

In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june. A tax lien certificate, or tax certificate is not a purchase of property; First off, you should know that tax liens and tax deeds are both sold in the state of florida. How property tax lien sales work in.

Do Tax Liens Expire? Levy & Associates

This process is governed by. How property tax lien sales work in florida in an effort to recover unpaid property taxes, florida organizes annual tax lien sales. The tax lien is sold to an investor prior to. Rather, it is a lien imposed on the property by payment of the delinquent taxes. In florida, acquiring a tax lien begins with.

Tax Lien Investing How Do Tax Liens Work in Florida Hard Money Lenders

How property tax lien sales work in florida in an effort to recover unpaid property taxes, florida organizes annual tax lien sales. The tax lien is sold to an investor prior to. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june. A tax lien certificate, or tax certificate.

Tax Lien Investing How Do Tax Liens Work in Florida Hard Money Lenders

Rather, it is a lien imposed on the property by payment of the delinquent taxes. The tax lien is sold to an investor prior to. How property tax lien sales work in florida in an effort to recover unpaid property taxes, florida organizes annual tax lien sales. In florida, acquiring a tax lien begins with the annual tax certificate sale,.

Tax Lien Investing How Do Tax Liens Work in Florida hardmoneylenders.io

This process is governed by. The tax lien is sold to an investor prior to. Rather, it is a lien imposed on the property by payment of the delinquent taxes. First off, you should know that tax liens and tax deeds are both sold in the state of florida. How property tax lien sales work in florida in an effort.

Tax Lien Investing How Do Tax Liens Work in Florida hardmoneylenders.io

How property tax lien sales work in florida in an effort to recover unpaid property taxes, florida organizes annual tax lien sales. The tax lien is sold to an investor prior to. First off, you should know that tax liens and tax deeds are both sold in the state of florida. A tax lien certificate, or tax certificate is not.

Tax Liens Emanuel Use Case Florida

How property tax lien sales work in florida in an effort to recover unpaid property taxes, florida organizes annual tax lien sales. This process is governed by. A tax lien certificate, or tax certificate is not a purchase of property; Rather, it is a lien imposed on the property by payment of the delinquent taxes. The tax lien is sold.

Tax Lien Investing How Do Tax Liens Work in Florida hardmoneylenders.io

Rather, it is a lien imposed on the property by payment of the delinquent taxes. How property tax lien sales work in florida in an effort to recover unpaid property taxes, florida organizes annual tax lien sales. This process is governed by. The tax lien is sold to an investor prior to. First off, you should know that tax liens.

A Tax Lien Certificate, Or Tax Certificate Is Not A Purchase Of Property;

Rather, it is a lien imposed on the property by payment of the delinquent taxes. The tax lien is sold to an investor prior to. This process is governed by. How property tax lien sales work in florida in an effort to recover unpaid property taxes, florida organizes annual tax lien sales.

First Off, You Should Know That Tax Liens And Tax Deeds Are Both Sold In The State Of Florida.

In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june.