How To Figure Federal Income Tax Rate

How To Figure Federal Income Tax Rate - When you are looking at the federal tax brackets, you are able to determine which tax rate applies to. Calculate your federal, state and local taxes for the current filing year with our free. Here’s how that works for a single person with taxable income of $58,000 per year:.

When you are looking at the federal tax brackets, you are able to determine which tax rate applies to. Here’s how that works for a single person with taxable income of $58,000 per year:. Calculate your federal, state and local taxes for the current filing year with our free.

Here’s how that works for a single person with taxable income of $58,000 per year:. When you are looking at the federal tax brackets, you are able to determine which tax rate applies to. Calculate your federal, state and local taxes for the current filing year with our free.

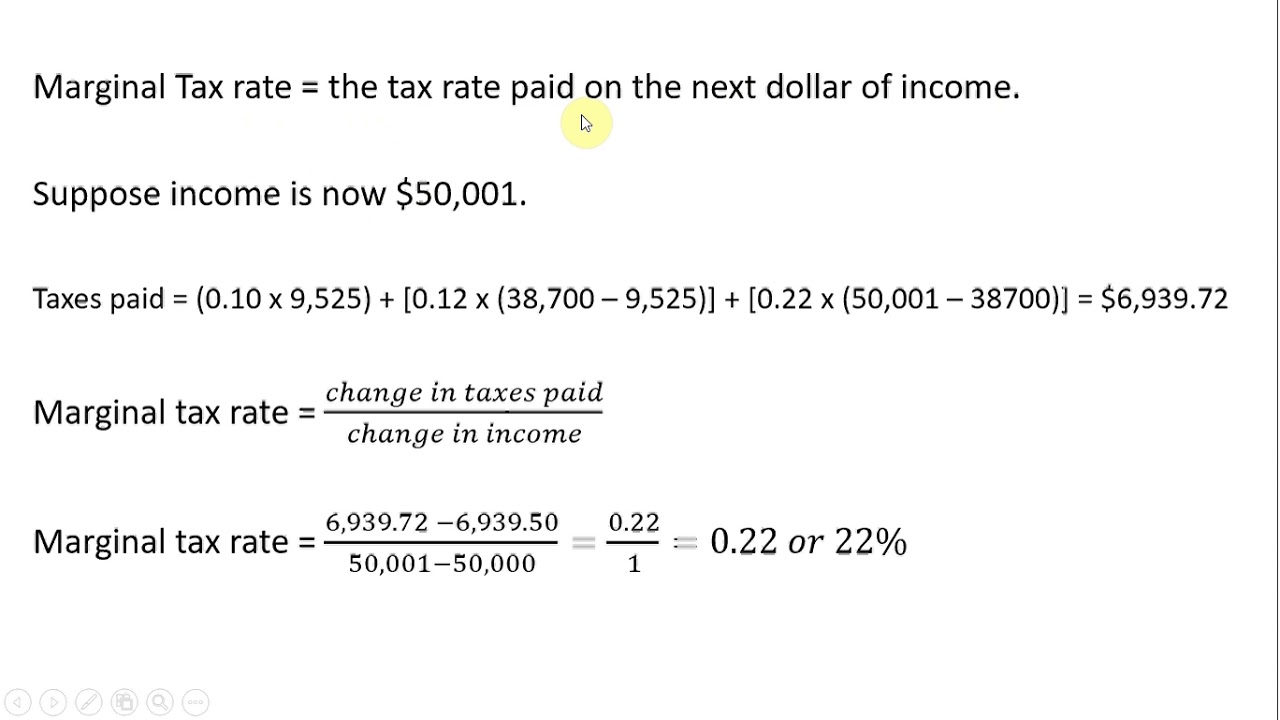

Tax Equation Tessshebaylo

When you are looking at the federal tax brackets, you are able to determine which tax rate applies to. Calculate your federal, state and local taxes for the current filing year with our free. Here’s how that works for a single person with taxable income of $58,000 per year:.

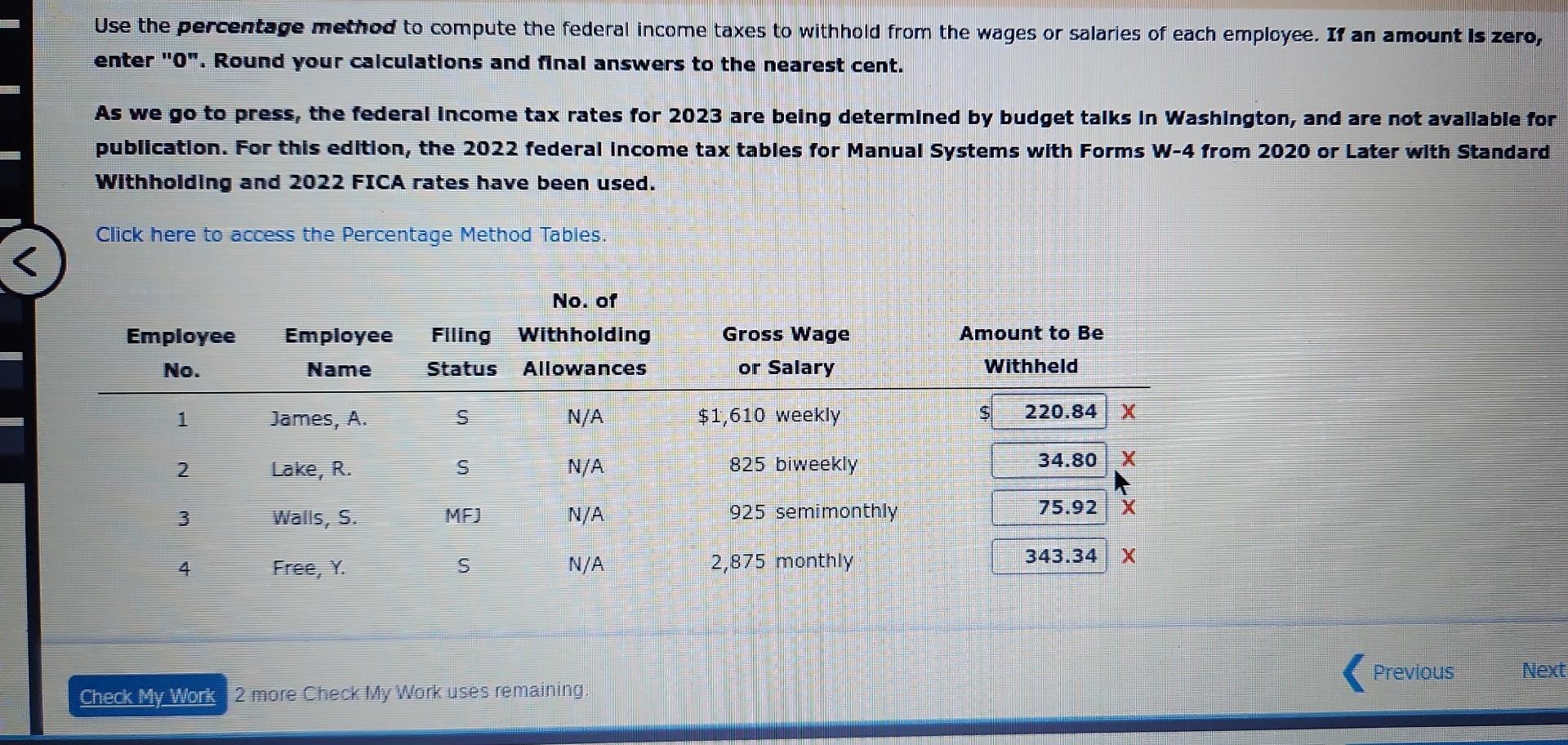

Solved The federal tax rate schedule for a person filing a

Calculate your federal, state and local taxes for the current filing year with our free. Here’s how that works for a single person with taxable income of $58,000 per year:. When you are looking at the federal tax brackets, you are able to determine which tax rate applies to.

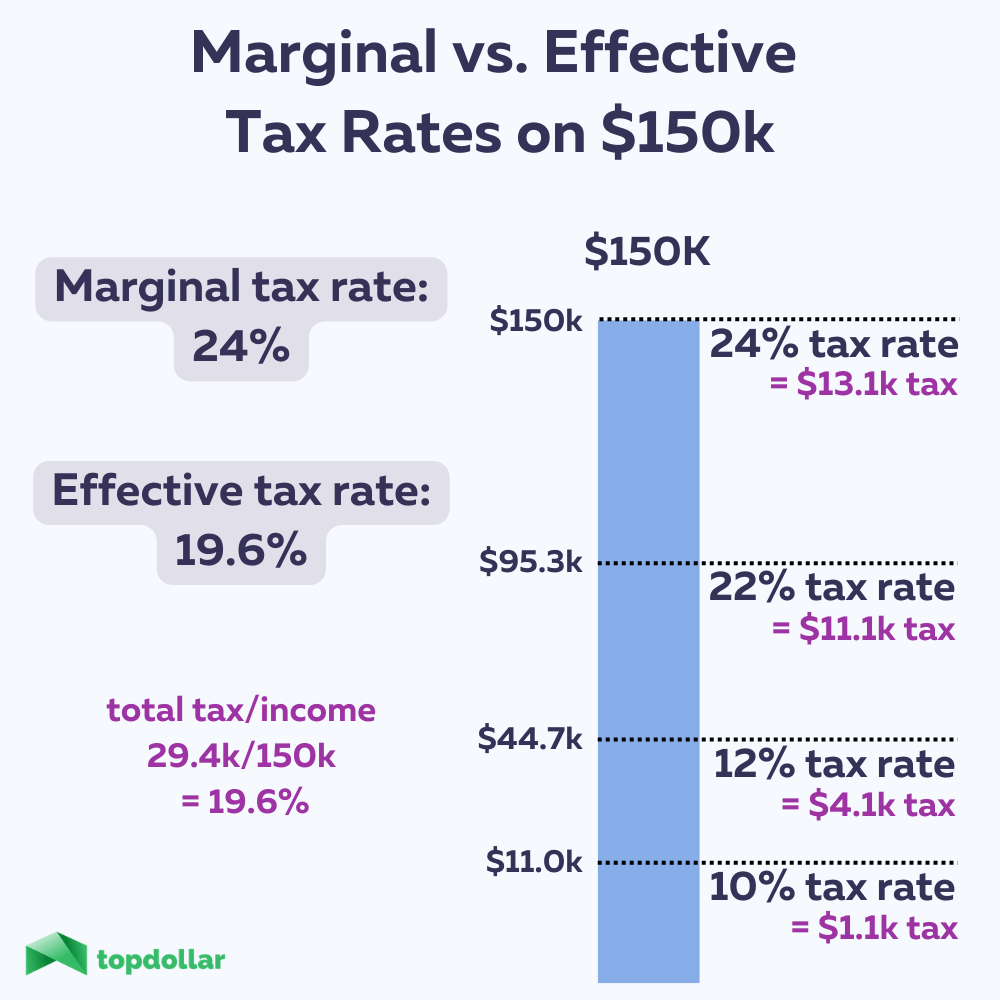

Top Federal Tax Rate 2024 Marna Sharity

When you are looking at the federal tax brackets, you are able to determine which tax rate applies to. Here’s how that works for a single person with taxable income of $58,000 per year:. Calculate your federal, state and local taxes for the current filing year with our free.

How to Calculate Federal Tax A StepbyStep Guide The

Calculate your federal, state and local taxes for the current filing year with our free. Here’s how that works for a single person with taxable income of $58,000 per year:. When you are looking at the federal tax brackets, you are able to determine which tax rate applies to.

Como Se Calcula El Federal Tax Withheld Templates Printable Free

Here’s how that works for a single person with taxable income of $58,000 per year:. When you are looking at the federal tax brackets, you are able to determine which tax rate applies to. Calculate your federal, state and local taxes for the current filing year with our free.

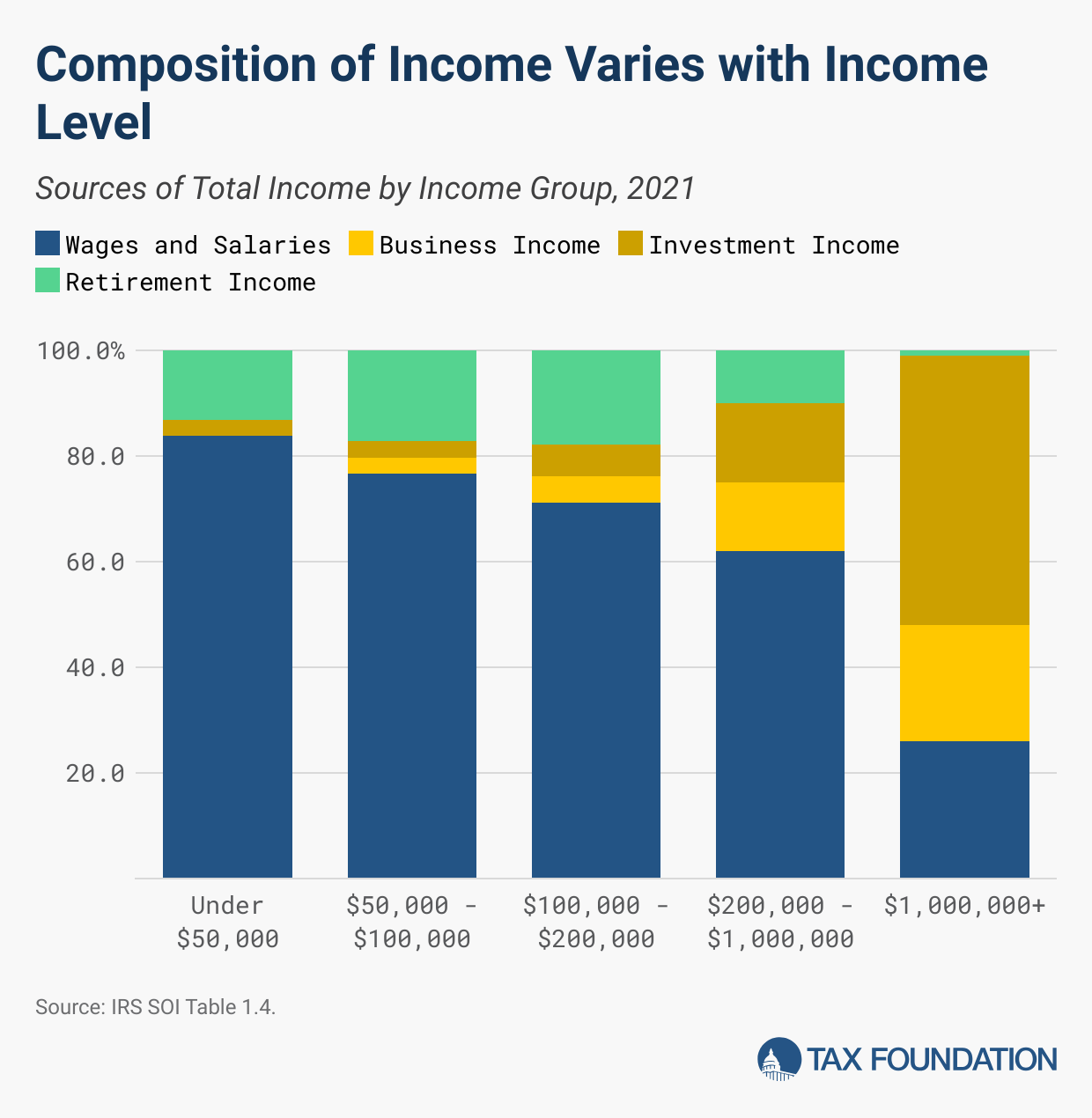

Sources of Personal Tax Returns Data Tax Foundation

Calculate your federal, state and local taxes for the current filing year with our free. When you are looking at the federal tax brackets, you are able to determine which tax rate applies to. Here’s how that works for a single person with taxable income of $58,000 per year:.

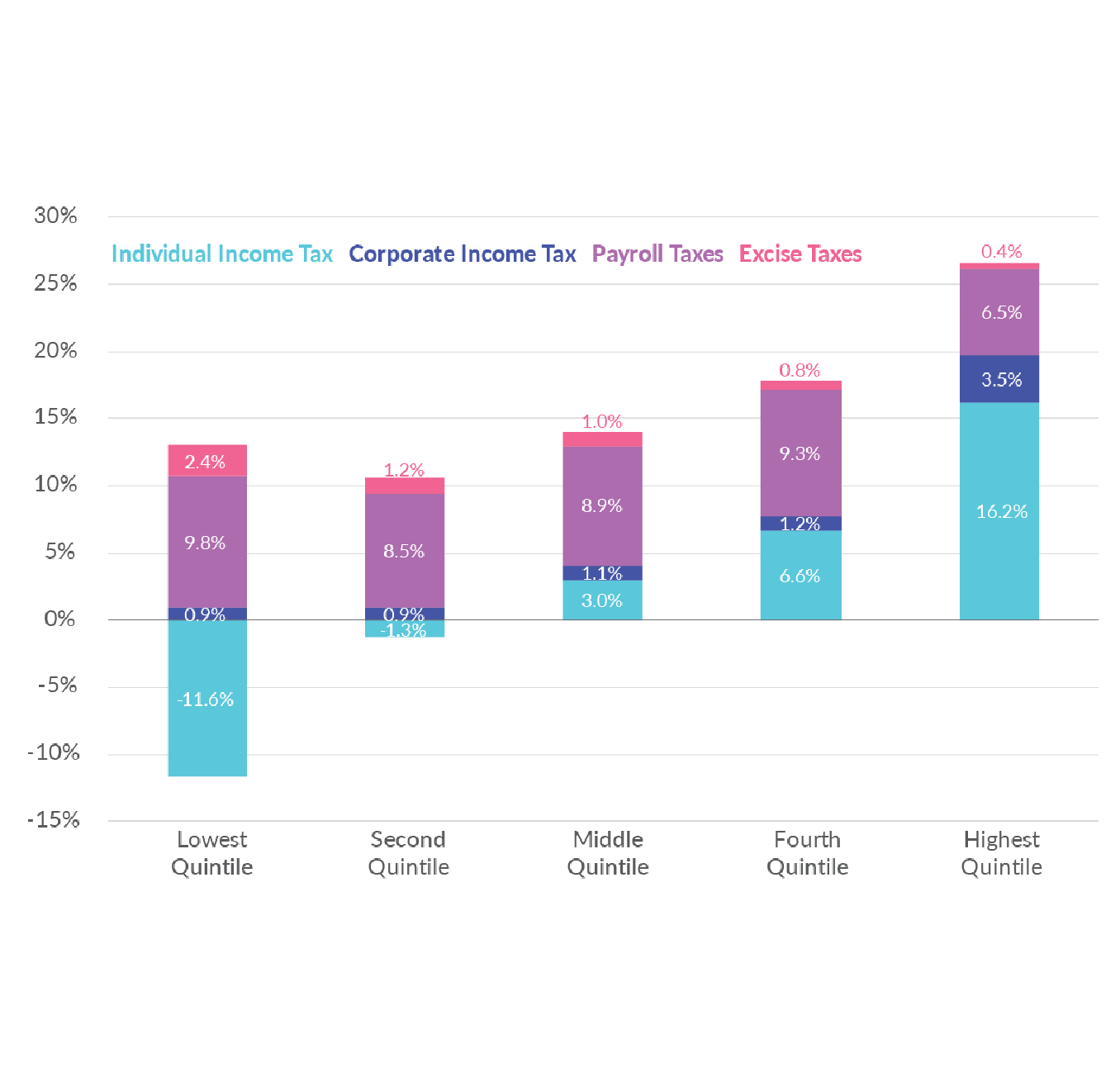

Who Pays Federal Taxes? Latest Federal Tax Data

When you are looking at the federal tax brackets, you are able to determine which tax rate applies to. Calculate your federal, state and local taxes for the current filing year with our free. Here’s how that works for a single person with taxable income of $58,000 per year:.

Creekside Chat CHART Average Federal Tax Rate by Group

Calculate your federal, state and local taxes for the current filing year with our free. Here’s how that works for a single person with taxable income of $58,000 per year:. When you are looking at the federal tax brackets, you are able to determine which tax rate applies to.

Federal Tax Rates by Group and Tax Source

Here’s how that works for a single person with taxable income of $58,000 per year:. When you are looking at the federal tax brackets, you are able to determine which tax rate applies to. Calculate your federal, state and local taxes for the current filing year with our free.

How to Calculate Federal Tax

When you are looking at the federal tax brackets, you are able to determine which tax rate applies to. Calculate your federal, state and local taxes for the current filing year with our free. Here’s how that works for a single person with taxable income of $58,000 per year:.

Here’s How That Works For A Single Person With Taxable Income Of $58,000 Per Year:.

When you are looking at the federal tax brackets, you are able to determine which tax rate applies to. Calculate your federal, state and local taxes for the current filing year with our free.