How To Record Erc In Quickbooks

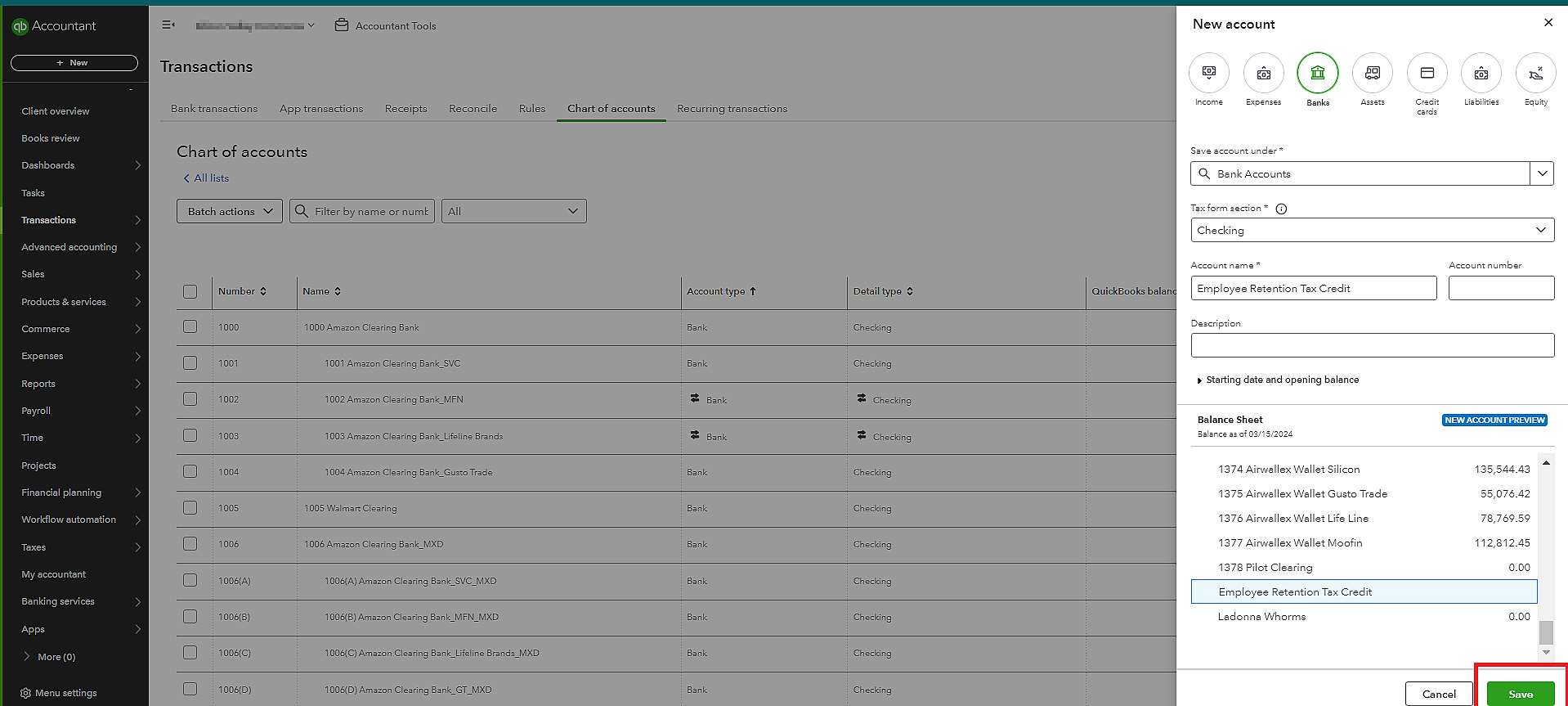

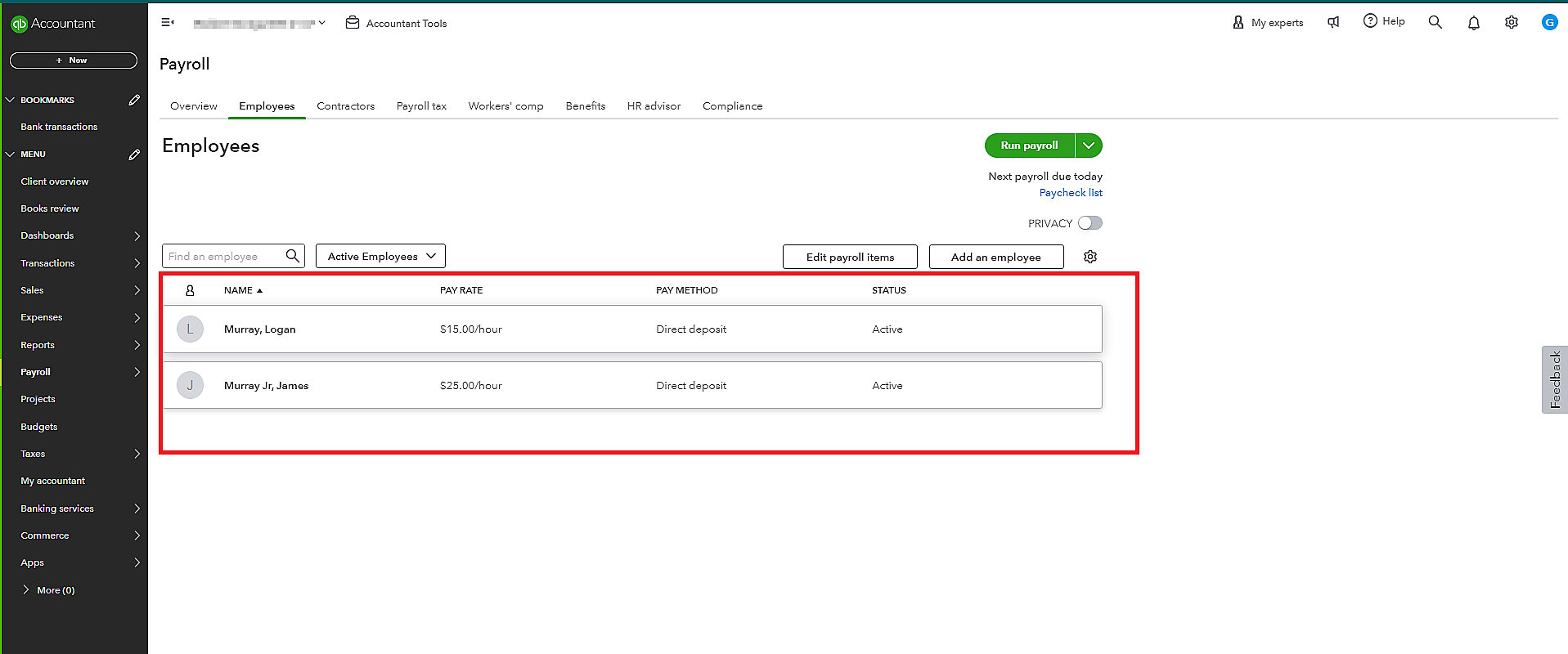

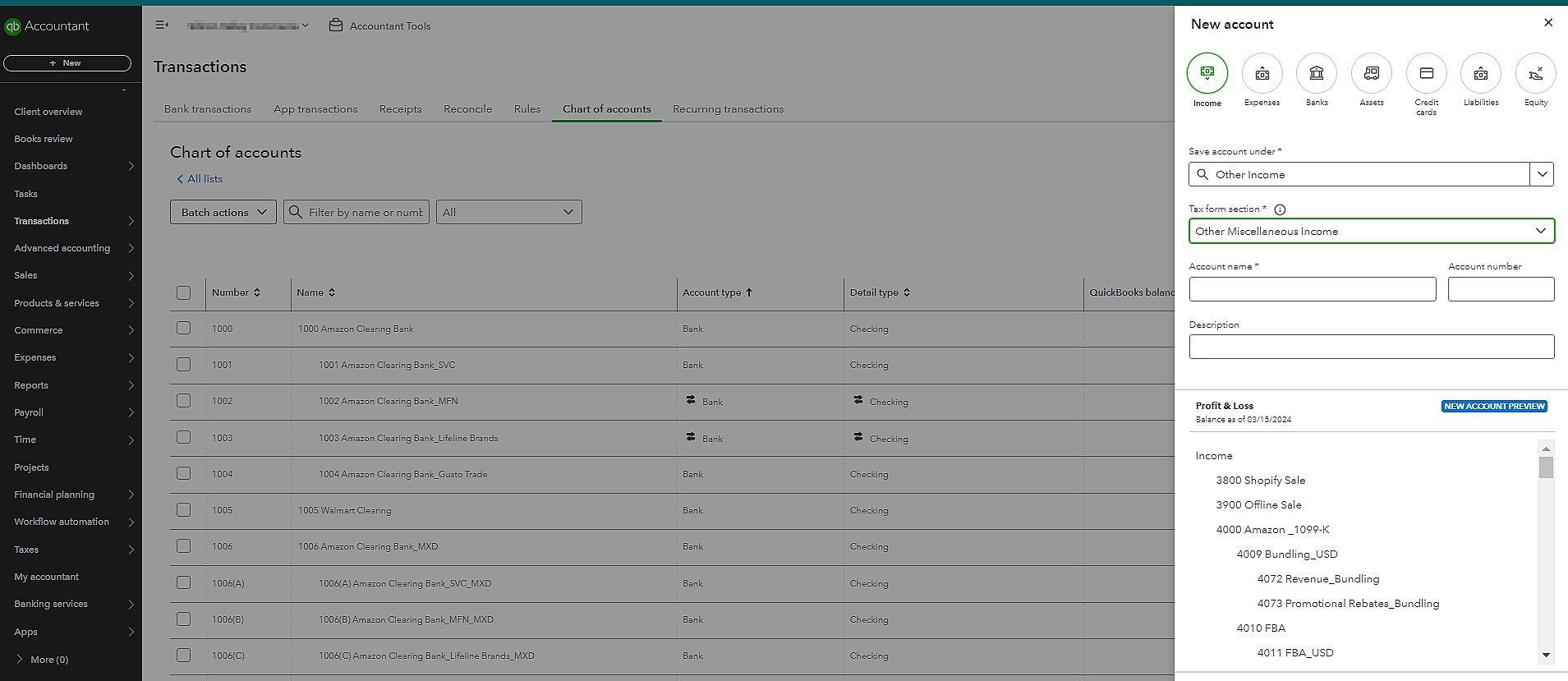

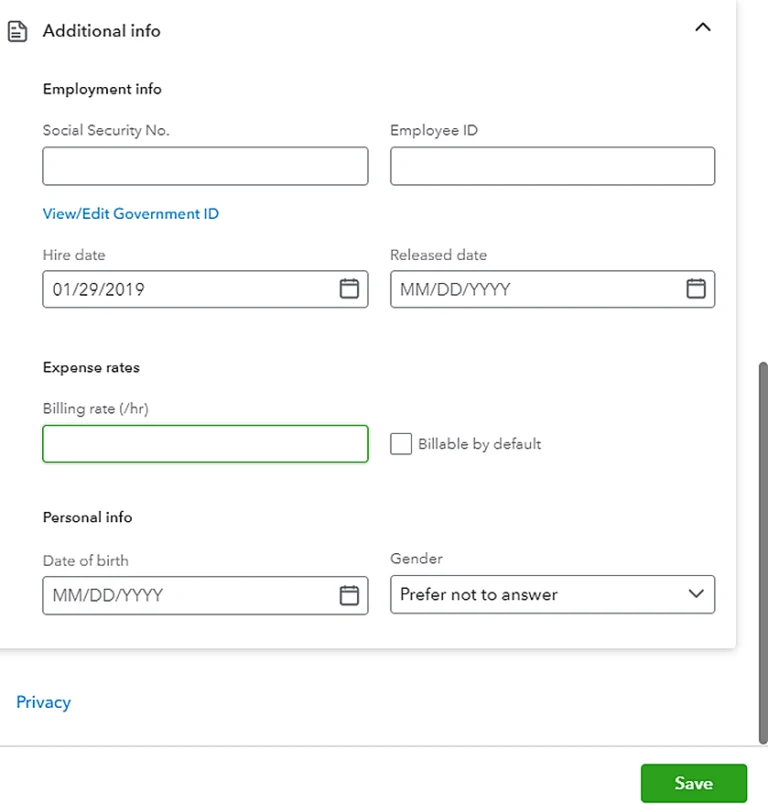

How To Record Erc In Quickbooks - Quickbooks makes it highly convenient to record and monitor employee retention credit. Follow these steps to ensure. Under account type, select other income account. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment):

Follow these steps to ensure. Under account type, select other income account. Quickbooks makes it highly convenient to record and monitor employee retention credit. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment):

To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): Quickbooks makes it highly convenient to record and monitor employee retention credit. Under account type, select other income account. Follow these steps to ensure.

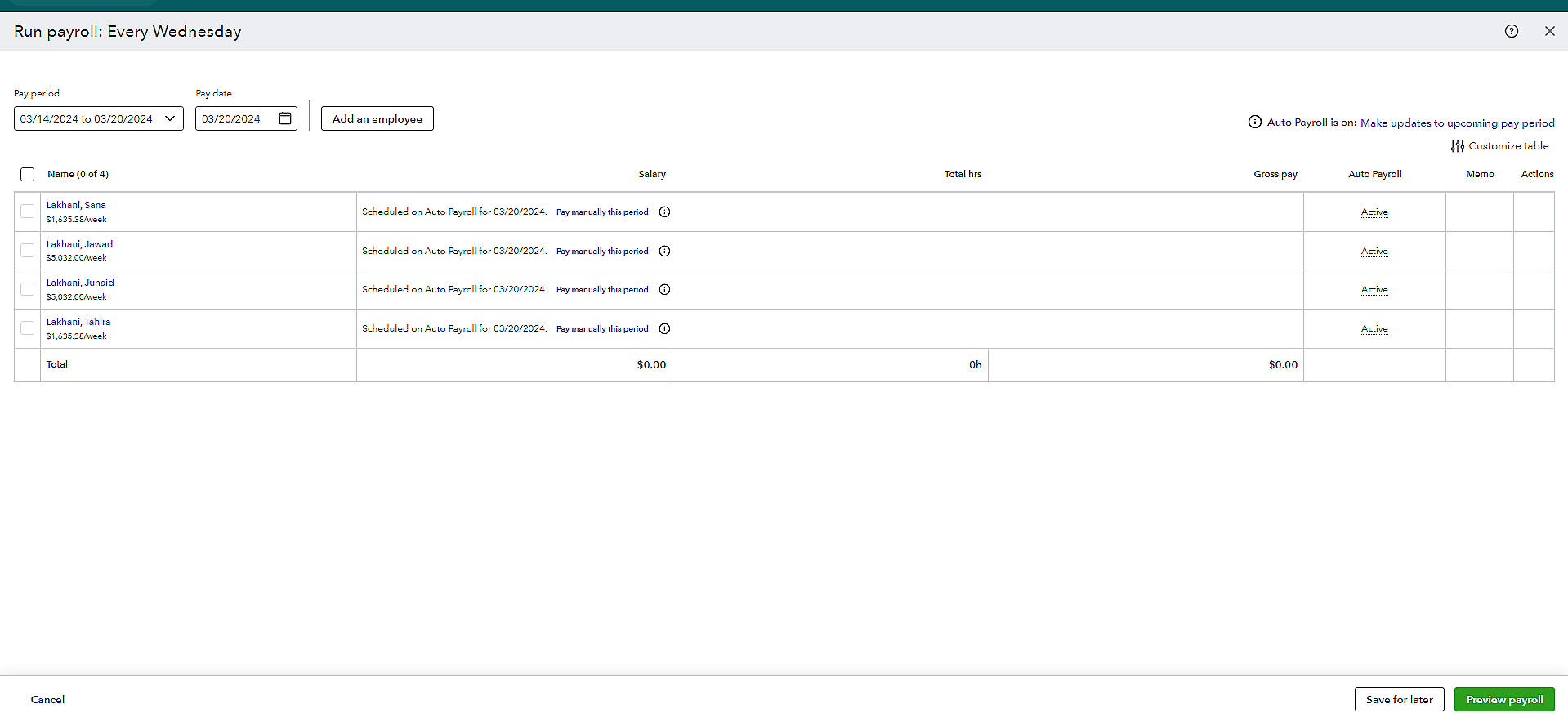

How to Record ERC in QuickBooks?

Follow these steps to ensure. Under account type, select other income account. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): Quickbooks makes it highly convenient to record and monitor employee retention credit.

How to Record ERC in QuickBooks?

Follow these steps to ensure. Under account type, select other income account. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): Quickbooks makes it highly convenient to record and monitor employee retention credit.

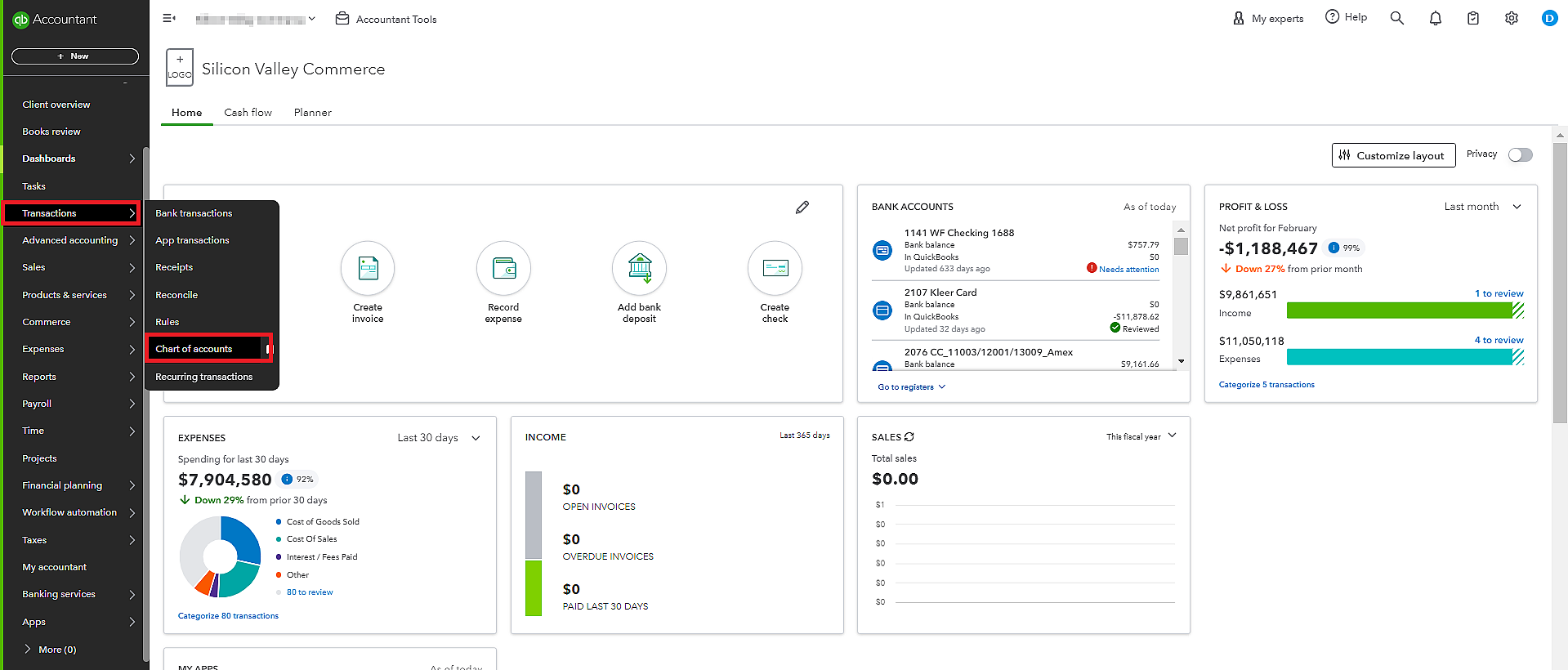

How to Record ERC in QuickBooks?

Follow these steps to ensure. Under account type, select other income account. Quickbooks makes it highly convenient to record and monitor employee retention credit. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment):

How to Record ERC in QuickBooks?

To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): Under account type, select other income account. Quickbooks makes it highly convenient to record and monitor employee retention credit. Follow these steps to ensure.

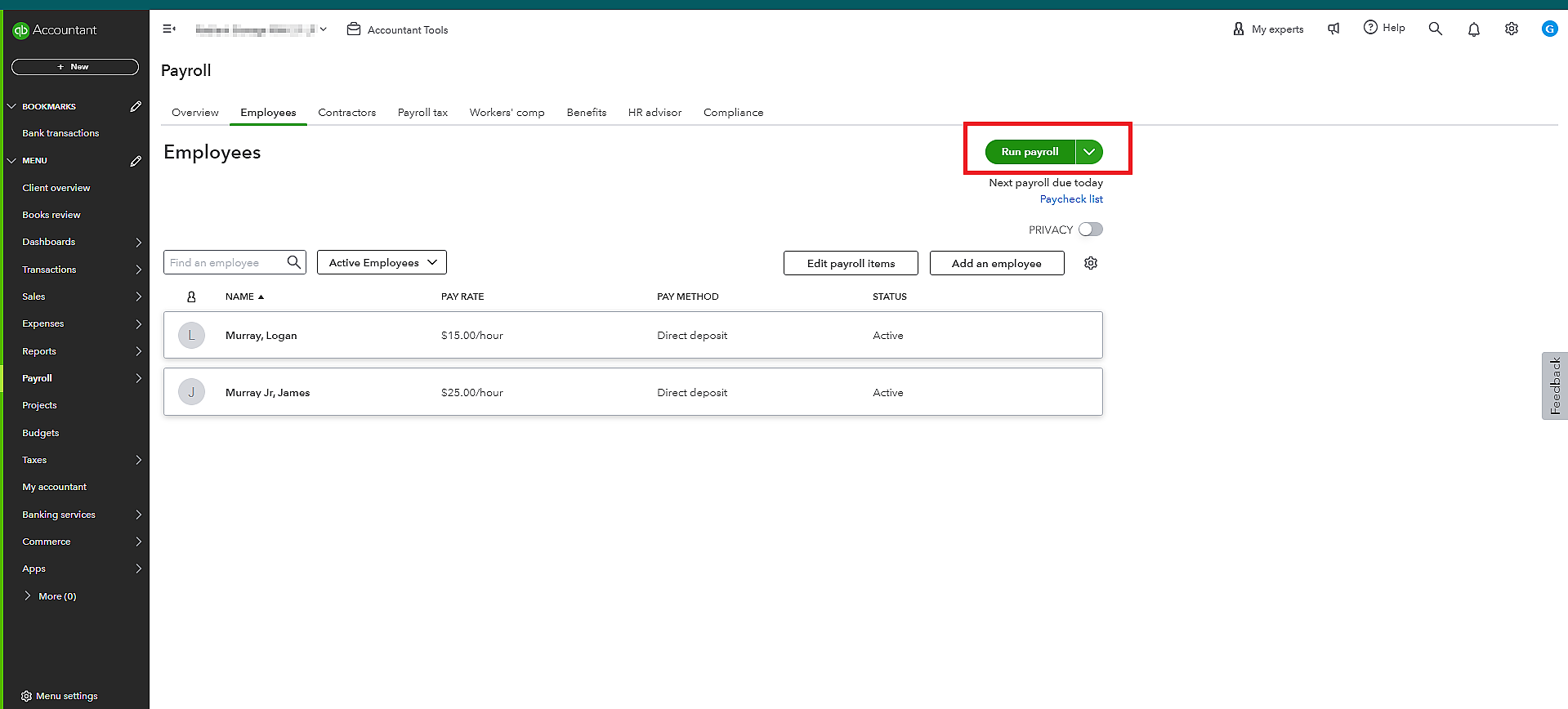

How to Record ERC in QuickBooks?

Follow these steps to ensure. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): Quickbooks makes it highly convenient to record and monitor employee retention credit. Under account type, select other income account.

How to Record ERC in QuickBooks?

Follow these steps to ensure. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): Under account type, select other income account. Quickbooks makes it highly convenient to record and monitor employee retention credit.

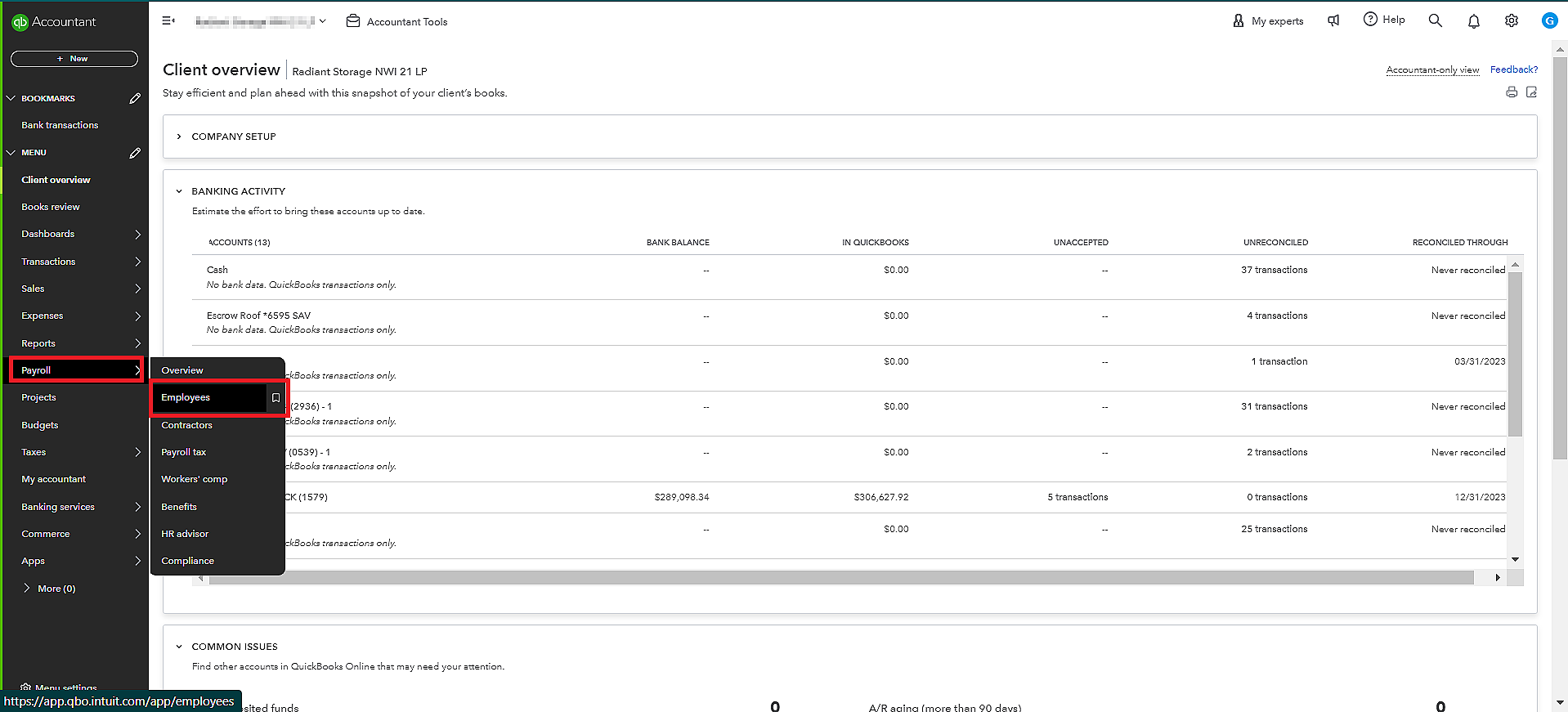

How to Record ERC in QuickBooks?

Under account type, select other income account. Quickbooks makes it highly convenient to record and monitor employee retention credit. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): Follow these steps to ensure.

How to Record ERC in QuickBooks?

Under account type, select other income account. Quickbooks makes it highly convenient to record and monitor employee retention credit. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): Follow these steps to ensure.

How to Record ERC in QuickBooks?

Quickbooks makes it highly convenient to record and monitor employee retention credit. Follow these steps to ensure. Under account type, select other income account. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment):

How to Record ERC in QuickBooks?

Under account type, select other income account. Quickbooks makes it highly convenient to record and monitor employee retention credit. Follow these steps to ensure. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment):

To Record A Deposit For The Refund Of Liabilities (Which Are, As You Say, Sitting On Your Balance Sheet As An Overpayment):

Quickbooks makes it highly convenient to record and monitor employee retention credit. Follow these steps to ensure. Under account type, select other income account.