Income Tax Return Form For Nri

Income Tax Return Form For Nri - Any individual whose income exceeds rs 2,50,000 is required to file an income tax return in india. Explore the income tax return for nri and its filing process in 8 easy steps like filing form 26as, etc. Learn how to file income tax.

Explore the income tax return for nri and its filing process in 8 easy steps like filing form 26as, etc. Learn how to file income tax. Any individual whose income exceeds rs 2,50,000 is required to file an income tax return in india.

Explore the income tax return for nri and its filing process in 8 easy steps like filing form 26as, etc. Learn how to file income tax. Any individual whose income exceeds rs 2,50,000 is required to file an income tax return in india.

NRIs How to File Your Tax Return on Rental from Indian

Explore the income tax return for nri and its filing process in 8 easy steps like filing form 26as, etc. Learn how to file income tax. Any individual whose income exceeds rs 2,50,000 is required to file an income tax return in india.

How to File ITR 2 Form For NRI Tax Return on New Portal AY 2022

Any individual whose income exceeds rs 2,50,000 is required to file an income tax return in india. Explore the income tax return for nri and its filing process in 8 easy steps like filing form 26as, etc. Learn how to file income tax.

Tax Return for NRIs Guidelines and Updates for 2023

Learn how to file income tax. Explore the income tax return for nri and its filing process in 8 easy steps like filing form 26as, etc. Any individual whose income exceeds rs 2,50,000 is required to file an income tax return in india.

Tax Return Verifiled

Learn how to file income tax. Any individual whose income exceeds rs 2,50,000 is required to file an income tax return in india. Explore the income tax return for nri and its filing process in 8 easy steps like filing form 26as, etc.

Nri Tax Return Filing Services in New Delhi ID 27258707762

Any individual whose income exceeds rs 2,50,000 is required to file an income tax return in india. Explore the income tax return for nri and its filing process in 8 easy steps like filing form 26as, etc. Learn how to file income tax.

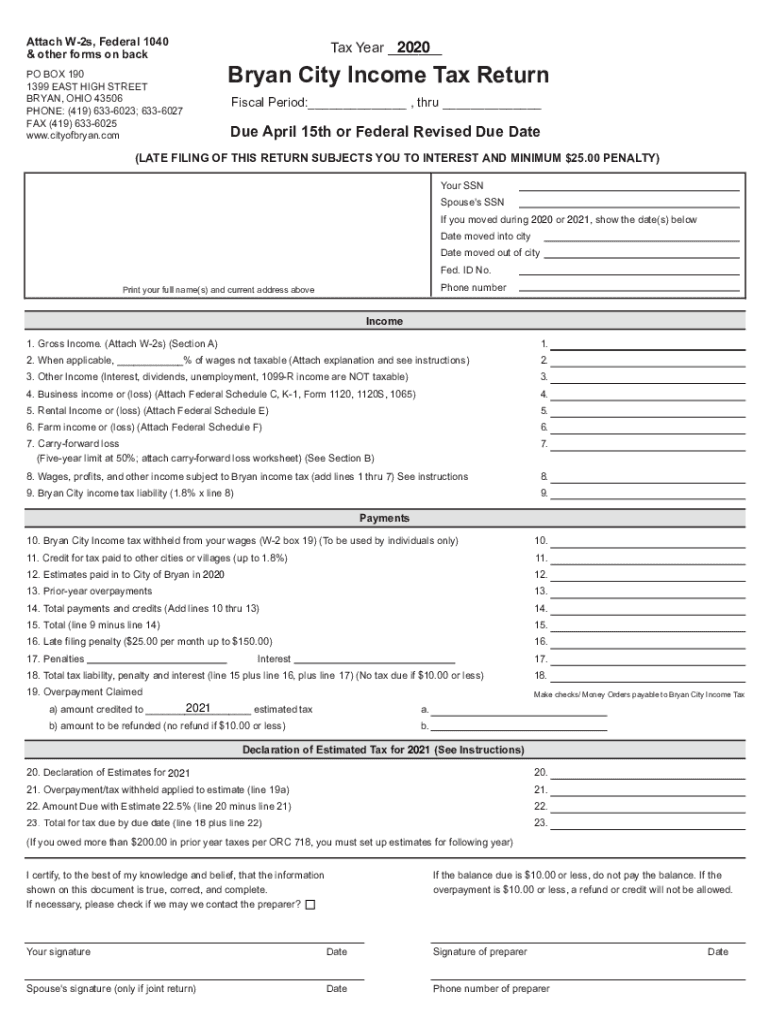

2018 Tax Return Complete with ease airSlate SignNow

Learn how to file income tax. Any individual whose income exceeds rs 2,50,000 is required to file an income tax return in india. Explore the income tax return for nri and its filing process in 8 easy steps like filing form 26as, etc.

Comprehensive FAQs on NRI Tax Returns in India

Any individual whose income exceeds rs 2,50,000 is required to file an income tax return in india. Learn how to file income tax. Explore the income tax return for nri and its filing process in 8 easy steps like filing form 26as, etc.

Tax Return Common ITR Form aims to end confusion over selecting

Learn how to file income tax. Any individual whose income exceeds rs 2,50,000 is required to file an income tax return in india. Explore the income tax return for nri and its filing process in 8 easy steps like filing form 26as, etc.

How to file tax return for NRI in a few simple steps?

Learn how to file income tax. Any individual whose income exceeds rs 2,50,000 is required to file an income tax return in india. Explore the income tax return for nri and its filing process in 8 easy steps like filing form 26as, etc.

Any Individual Whose Income Exceeds Rs 2,50,000 Is Required To File An Income Tax Return In India.

Learn how to file income tax. Explore the income tax return for nri and its filing process in 8 easy steps like filing form 26as, etc.