Indiana Local Income Tax Rates

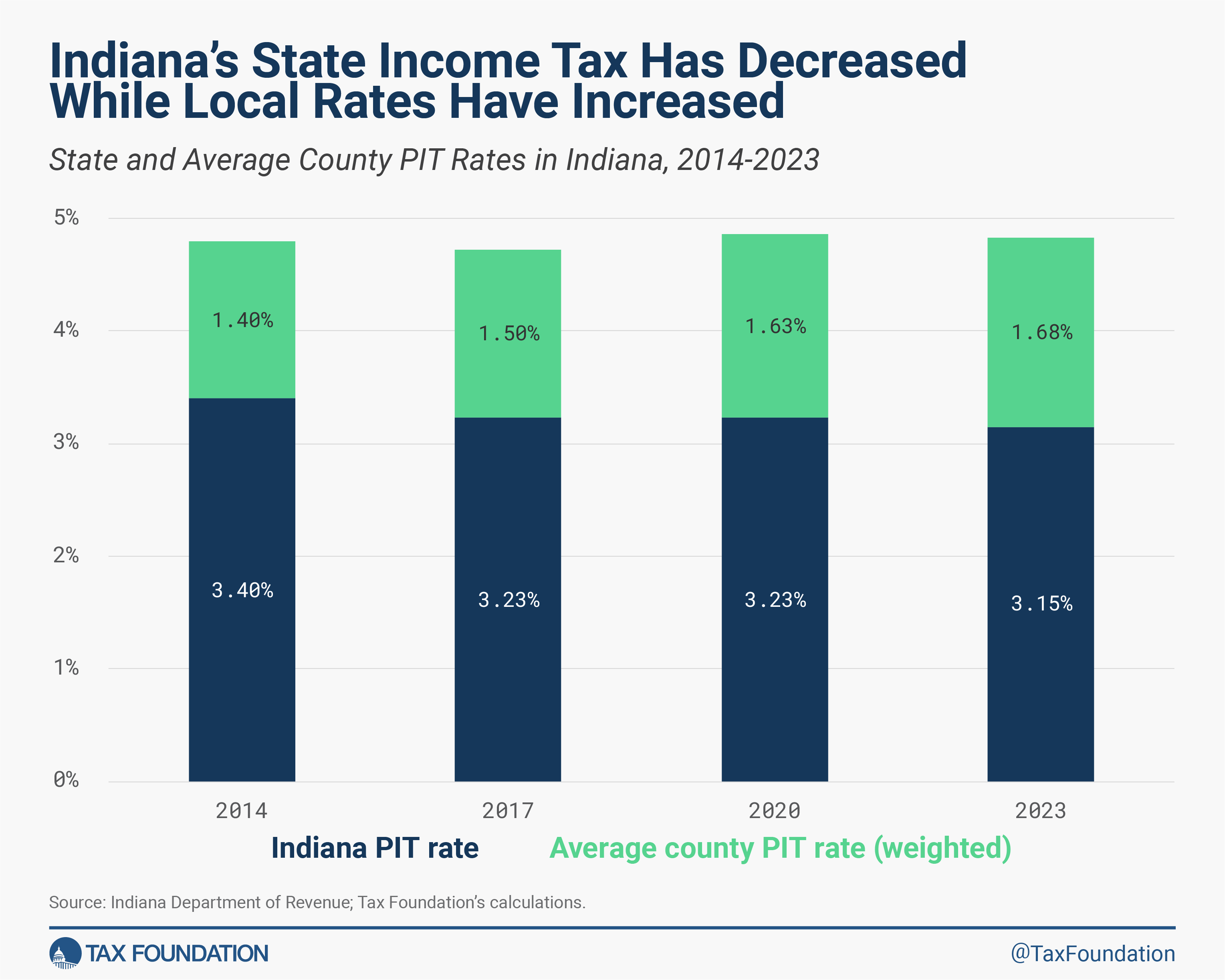

Indiana Local Income Tax Rates - Deduction constant tables table a daily weekly bi. *these rates have changed from last year’s chart. Explore the indiana department of revenue (dor)'s interactive county tax rate map. For 2025, the state adjusted gross income tax rate for individuals is 3.00%. Click on a county, and see which tax rates are in effect. We have information on the local income tax rates in 91 localities in indiana. 1 even as the state income tax rate drops again in. The local income tax rates in six of indiana's 92 counties will increase jan. You can click on any city or county for more details, including the.

Deduction constant tables table a daily weekly bi. 1 even as the state income tax rate drops again in. You can click on any city or county for more details, including the. The local income tax rates in six of indiana's 92 counties will increase jan. For 2025, the state adjusted gross income tax rate for individuals is 3.00%. We have information on the local income tax rates in 91 localities in indiana. *these rates have changed from last year’s chart. Click on a county, and see which tax rates are in effect. Explore the indiana department of revenue (dor)'s interactive county tax rate map.

Explore the indiana department of revenue (dor)'s interactive county tax rate map. Deduction constant tables table a daily weekly bi. We have information on the local income tax rates in 91 localities in indiana. 1 even as the state income tax rate drops again in. You can click on any city or county for more details, including the. For 2025, the state adjusted gross income tax rate for individuals is 3.00%. Click on a county, and see which tax rates are in effect. The local income tax rates in six of indiana's 92 counties will increase jan. *these rates have changed from last year’s chart.

Indiana County Tax Rates 2023 24 PELAJARAN

We have information on the local income tax rates in 91 localities in indiana. 1 even as the state income tax rate drops again in. Deduction constant tables table a daily weekly bi. For 2025, the state adjusted gross income tax rate for individuals is 3.00%. The local income tax rates in six of indiana's 92 counties will increase jan.

Midwest State and Sales Tax Rates Iowans for Tax Relief

Click on a county, and see which tax rates are in effect. *these rates have changed from last year’s chart. 1 even as the state income tax rate drops again in. Explore the indiana department of revenue (dor)'s interactive county tax rate map. For 2025, the state adjusted gross income tax rate for individuals is 3.00%.

Indiana County Tax Rates 2024 Dale Mignon

Explore the indiana department of revenue (dor)'s interactive county tax rate map. We have information on the local income tax rates in 91 localities in indiana. You can click on any city or county for more details, including the. For 2025, the state adjusted gross income tax rate for individuals is 3.00%. Deduction constant tables table a daily weekly bi.

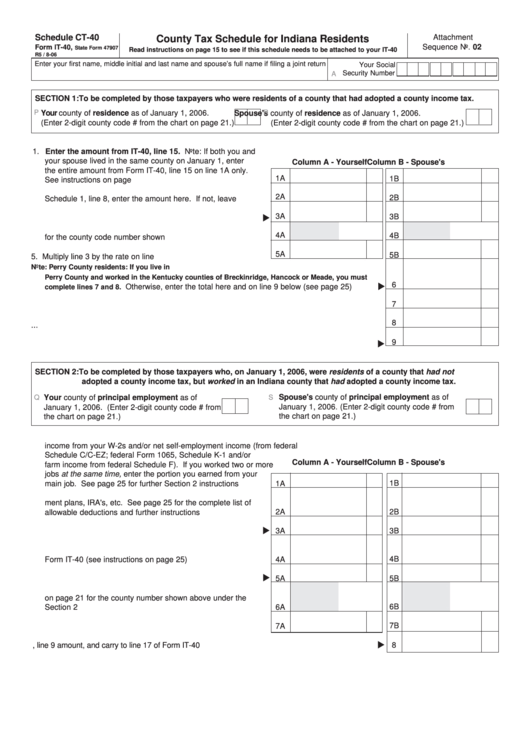

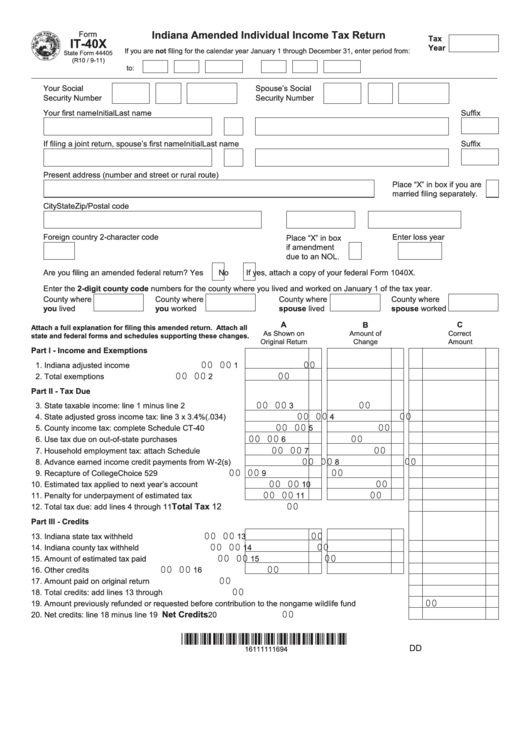

Indiana County Tax Form

You can click on any city or county for more details, including the. The local income tax rates in six of indiana's 92 counties will increase jan. *these rates have changed from last year’s chart. Click on a county, and see which tax rates are in effect. For 2025, the state adjusted gross income tax rate for individuals is 3.00%.

Indiana County Tax Form

We have information on the local income tax rates in 91 localities in indiana. 1 even as the state income tax rate drops again in. Explore the indiana department of revenue (dor)'s interactive county tax rate map. The local income tax rates in six of indiana's 92 counties will increase jan. Click on a county, and see which tax rates.

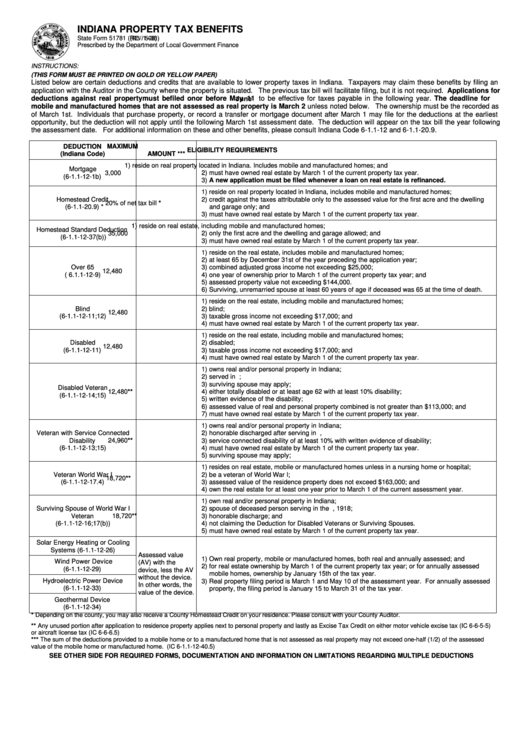

Indiana Property Tax Benefits Form Printable Pdf Download

1 even as the state income tax rate drops again in. *these rates have changed from last year’s chart. The local income tax rates in six of indiana's 92 counties will increase jan. Click on a county, and see which tax rates are in effect. For 2025, the state adjusted gross income tax rate for individuals is 3.00%.

Indiana Local Taxes Compatible with State Tax Reform?

Click on a county, and see which tax rates are in effect. *these rates have changed from last year’s chart. Deduction constant tables table a daily weekly bi. 1 even as the state income tax rate drops again in. The local income tax rates in six of indiana's 92 counties will increase jan.

Kenya Tax Tables Tax Rates and Thresholds in Kenya

Deduction constant tables table a daily weekly bi. For 2025, the state adjusted gross income tax rate for individuals is 3.00%. The local income tax rates in six of indiana's 92 counties will increase jan. We have information on the local income tax rates in 91 localities in indiana. 1 even as the state income tax rate drops again in.

Marion County Indiana Local Tax Form

The local income tax rates in six of indiana's 92 counties will increase jan. We have information on the local income tax rates in 91 localities in indiana. You can click on any city or county for more details, including the. Click on a county, and see which tax rates are in effect. 1 even as the state income tax.

Indiana County Tax Rates 2024 Dale Mignon

You can click on any city or county for more details, including the. *these rates have changed from last year’s chart. Click on a county, and see which tax rates are in effect. Explore the indiana department of revenue (dor)'s interactive county tax rate map. The local income tax rates in six of indiana's 92 counties will increase jan.

Explore The Indiana Department Of Revenue (Dor)'S Interactive County Tax Rate Map.

For 2025, the state adjusted gross income tax rate for individuals is 3.00%. You can click on any city or county for more details, including the. 1 even as the state income tax rate drops again in. Deduction constant tables table a daily weekly bi.

We Have Information On The Local Income Tax Rates In 91 Localities In Indiana.

The local income tax rates in six of indiana's 92 counties will increase jan. *these rates have changed from last year’s chart. Click on a county, and see which tax rates are in effect.