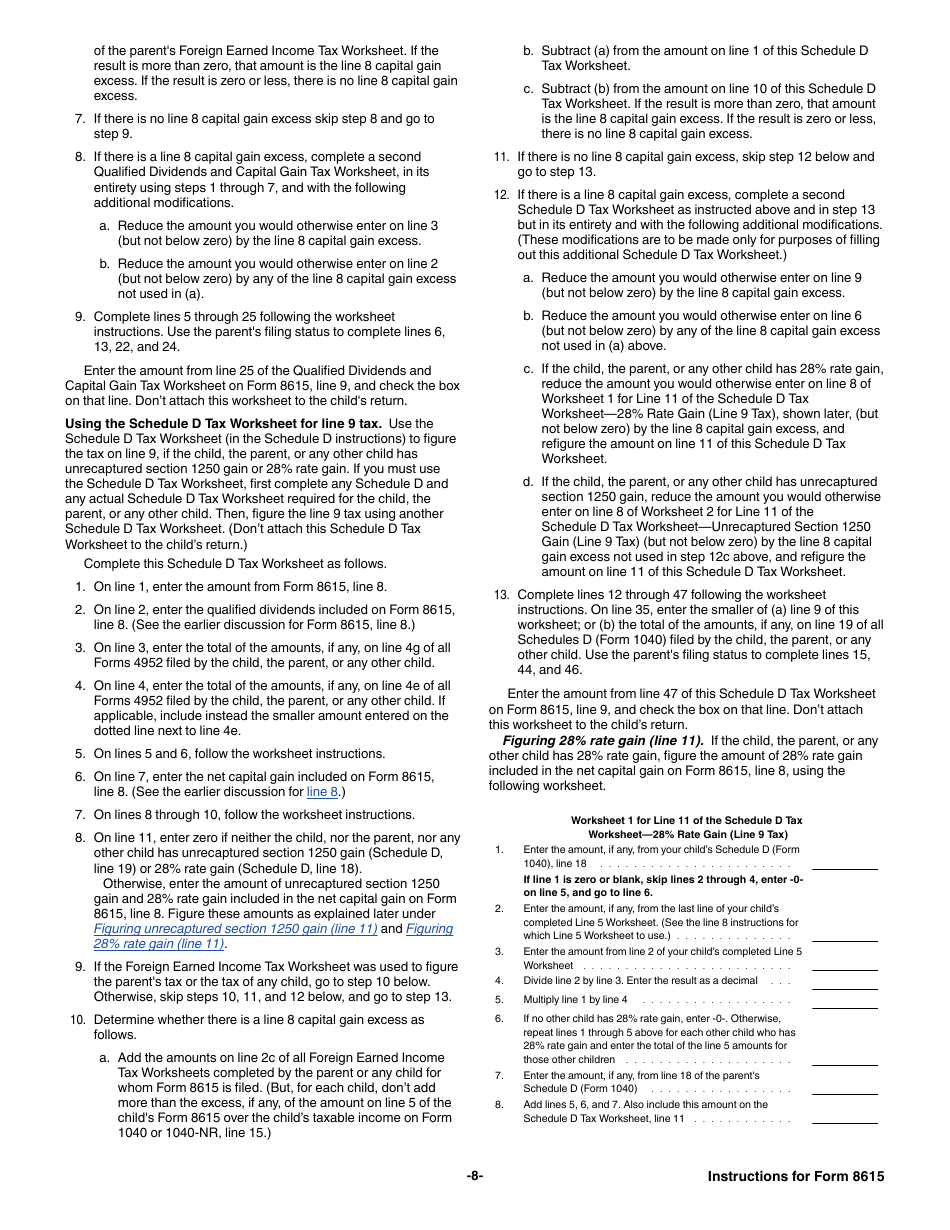

Instructions For Form 8615

Instructions For Form 8615 - When using form 8814, you. The form will help you. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. The child had more than $2,500 of unearned income. Form 8615 must be filed for any child who meets all of the following conditions. Refer to the instructions for form 8615 for more information about what qualifies as earned income. This document offers comprehensive guidance on completing form 8615 for tax year 2023, which is used to calculate taxes for.

When using form 8814, you. Form 8615 must be filed for any child who meets all of the following conditions. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. The child had more than $2,500 of unearned income. The form will help you. This document offers comprehensive guidance on completing form 8615 for tax year 2023, which is used to calculate taxes for. Refer to the instructions for form 8615 for more information about what qualifies as earned income.

This document offers comprehensive guidance on completing form 8615 for tax year 2023, which is used to calculate taxes for. Form 8615 must be filed for any child who meets all of the following conditions. Refer to the instructions for form 8615 for more information about what qualifies as earned income. When using form 8814, you. The child had more than $2,500 of unearned income. The form will help you. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return.

Download Instructions for IRS Form 8615 Tax for Certain Children Who

This document offers comprehensive guidance on completing form 8615 for tax year 2023, which is used to calculate taxes for. When using form 8814, you. The child had more than $2,500 of unearned income. Form 8615 must be filed for any child who meets all of the following conditions. Refer to the instructions for form 8615 for more information about.

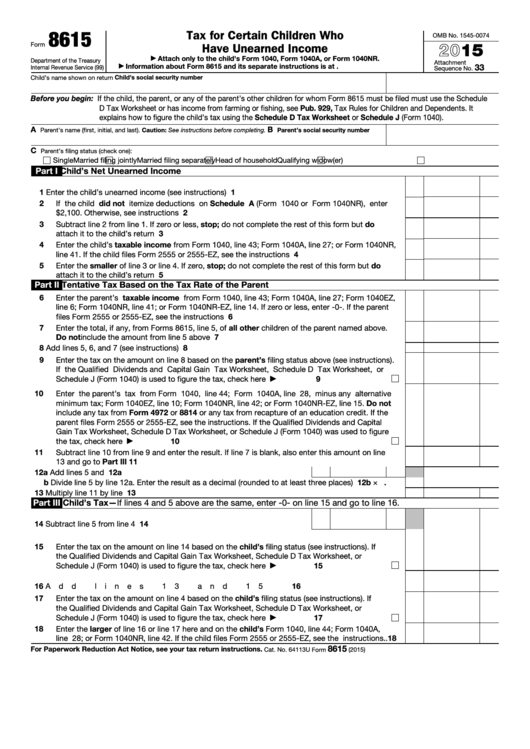

Fillable Form 8615 Tax For Certain Children Who Have Unearned

This document offers comprehensive guidance on completing form 8615 for tax year 2023, which is used to calculate taxes for. Form 8615 must be filed for any child who meets all of the following conditions. Refer to the instructions for form 8615 for more information about what qualifies as earned income. If the child doesn't qualify for a form 8814.

IRS Form 8615 Instructions

The child had more than $2,500 of unearned income. The form will help you. Refer to the instructions for form 8615 for more information about what qualifies as earned income. When using form 8814, you. This document offers comprehensive guidance on completing form 8615 for tax year 2023, which is used to calculate taxes for.

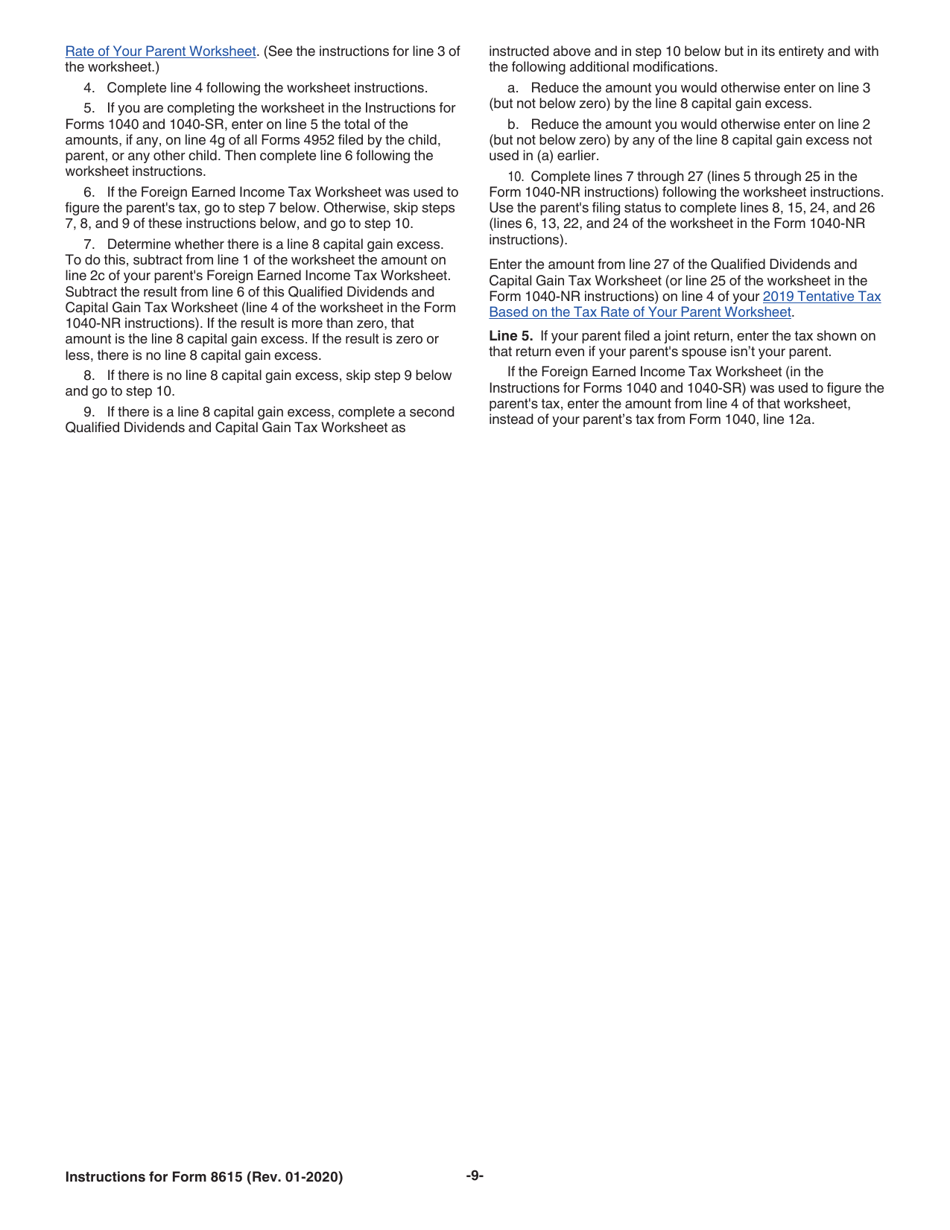

Download Instructions for IRS Form 8615 Tax for Certain Children Who

If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. The form will help you. When using form 8814, you. Form 8615 must be filed for any child who meets all of the following conditions. Refer to the instructions for form 8615 for more information about what qualifies as earned income.

Don’t Miss Out On These Facts About the Form 8615 TurboTax

If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. The form will help you. Refer to the instructions for form 8615 for more information about what qualifies as earned income. Form 8615 must be filed for any child who meets all of the following conditions. The child had more than $2,500.

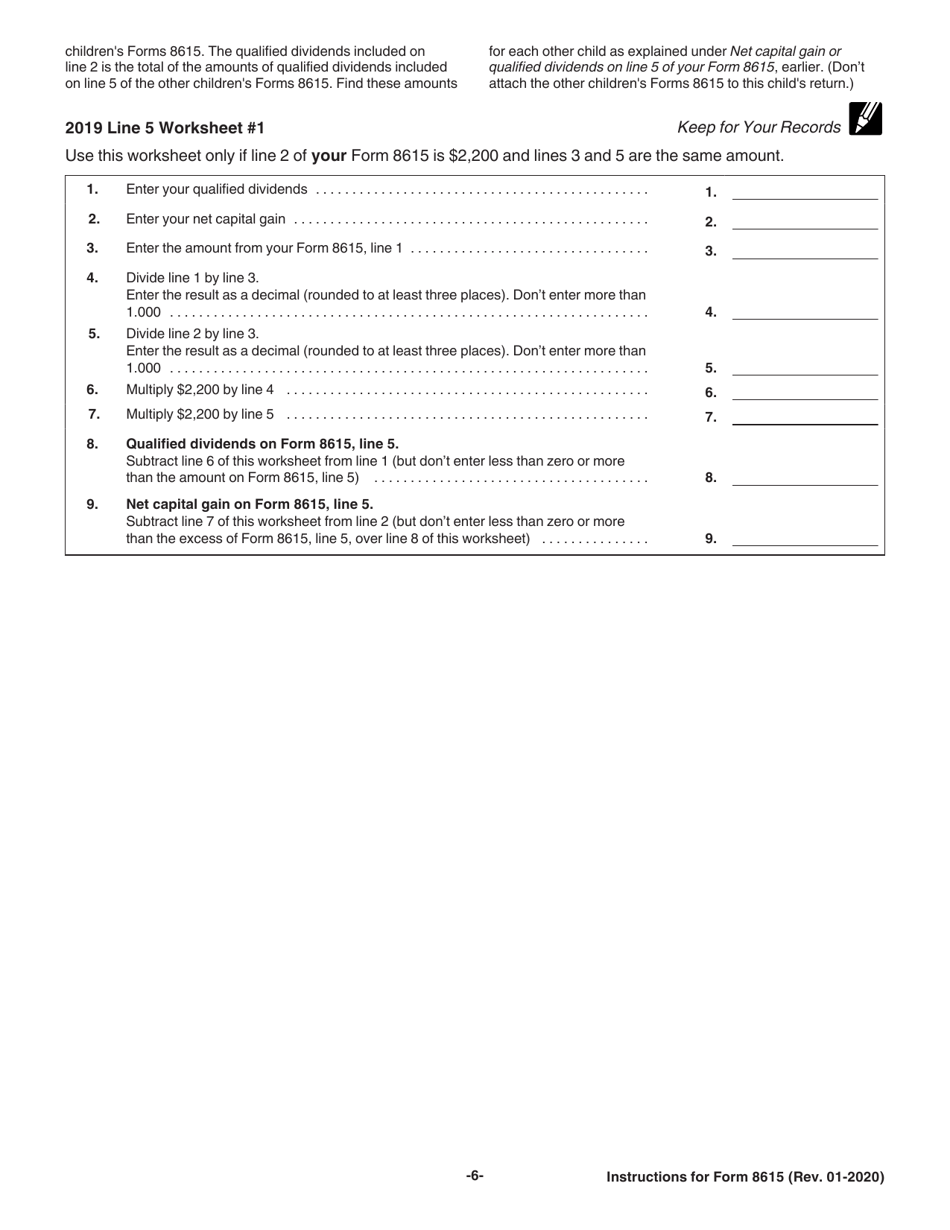

Download Instructions for IRS Form 8615 Tax for Certain Children Who

The form will help you. This document offers comprehensive guidance on completing form 8615 for tax year 2023, which is used to calculate taxes for. Form 8615 must be filed for any child who meets all of the following conditions. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. When using.

Download Instructions for IRS Form 8615 Tax for Certain Children Who

The form will help you. Form 8615 must be filed for any child who meets all of the following conditions. When using form 8814, you. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. This document offers comprehensive guidance on completing form 8615 for tax year 2023, which is used to.

Fillable Online Instructions for Form 8615 (2020)Internal Revenue

If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. The form will help you. Form 8615 must be filed for any child who meets all of the following conditions. When using form 8814, you. The child had more than $2,500 of unearned income.

Download Instructions for IRS Form 8615 Tax for Certain Children Who

The form will help you. Form 8615 must be filed for any child who meets all of the following conditions. This document offers comprehensive guidance on completing form 8615 for tax year 2023, which is used to calculate taxes for. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Refer to.

Fillable Online www.irs.govpubirsprior2020 Instructions for Form 8615

Refer to the instructions for form 8615 for more information about what qualifies as earned income. The form will help you. When using form 8814, you. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. The child had more than $2,500 of unearned income.

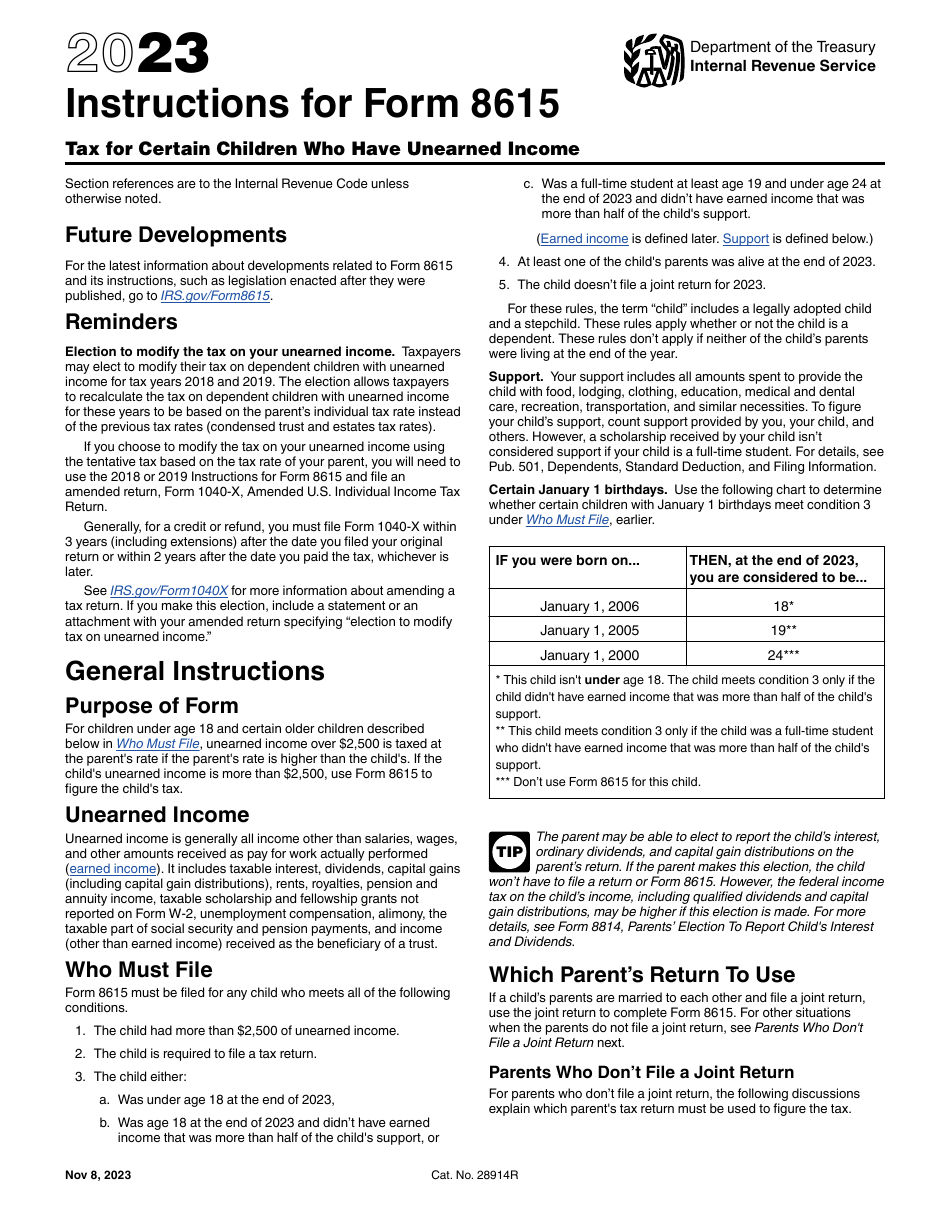

This Document Offers Comprehensive Guidance On Completing Form 8615 For Tax Year 2023, Which Is Used To Calculate Taxes For.

When using form 8814, you. Form 8615 must be filed for any child who meets all of the following conditions. The form will help you. Refer to the instructions for form 8615 for more information about what qualifies as earned income.

The Child Had More Than $2,500 Of Unearned Income.

If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return.