It 20 Form

It 20 Form - General information electronic filing for certain corporations for all taxable years ending after december 31, 2022, a corporation with more. Find the proper forms for individual, corporate, and business taxes. This must be done regardless of the. Check box if you file. 1099, 1040) from the irs. Check box on line 23 for alternate tax rate calculation and enclose a complete copy of this. Check box if the corporation paid any quarterly estimated tax using diferent federal employer identification numbers. Find federal tax forms (e.g. In general, all of the taxpayer’s. Any corporation doing business and having gross income in indiana must file a corporate income tax return.

General information electronic filing for certain corporations for all taxable years ending after december 31, 2022, a corporation with more. Check box if the corporation paid any quarterly estimated tax using diferent federal employer identification numbers. Check box if you file. Find the proper forms for individual, corporate, and business taxes. Check box on line 23 for alternate tax rate calculation and enclose a complete copy of this. This must be done regardless of the. Any corporation doing business and having gross income in indiana must file a corporate income tax return. Find federal tax forms (e.g. 1099, 1040) from the irs. In general, all of the taxpayer’s.

Check box on line 23 for alternate tax rate calculation and enclose a complete copy of this. Any corporation doing business and having gross income in indiana must file a corporate income tax return. Find federal tax forms (e.g. General information electronic filing for certain corporations for all taxable years ending after december 31, 2022, a corporation with more. In general, all of the taxpayer’s. Check box if the corporation paid any quarterly estimated tax using diferent federal employer identification numbers. 1099, 1040) from the irs. Find the proper forms for individual, corporate, and business taxes. Check box if you file. This must be done regardless of the.

I 20 Form Download Fill and Sign Printable Template Online US Legal

Any corporation doing business and having gross income in indiana must file a corporate income tax return. Find federal tax forms (e.g. 1099, 1040) from the irs. Find the proper forms for individual, corporate, and business taxes. This must be done regardless of the.

[150120] Form

In general, all of the taxpayer’s. General information electronic filing for certain corporations for all taxable years ending after december 31, 2022, a corporation with more. This must be done regardless of the. Any corporation doing business and having gross income in indiana must file a corporate income tax return. Find federal tax forms (e.g.

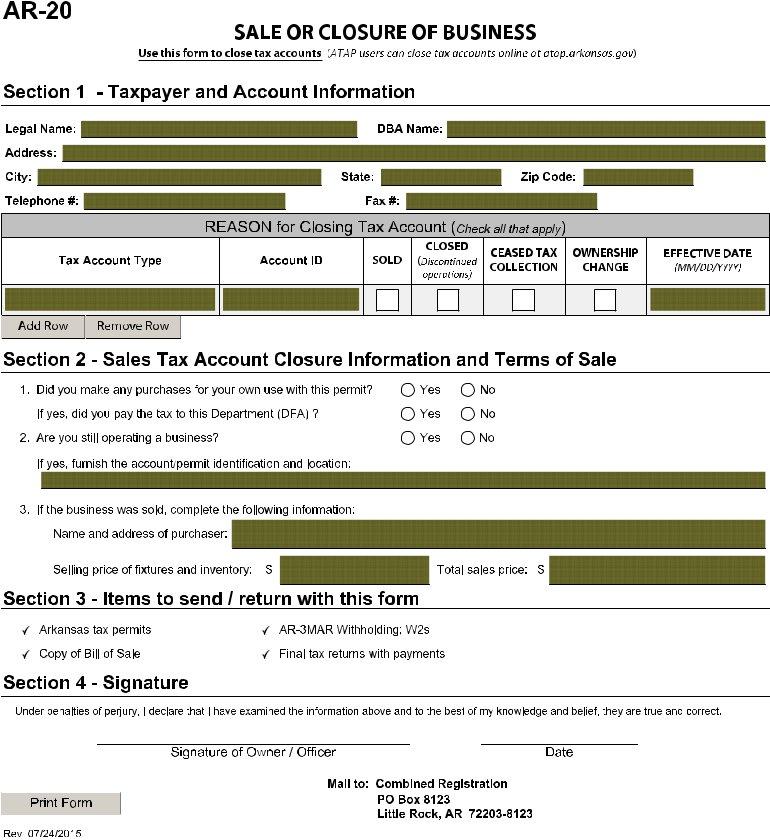

Printable Ar 20 Form Printable Forms Free Online

Check box if the corporation paid any quarterly estimated tax using diferent federal employer identification numbers. Find federal tax forms (e.g. General information electronic filing for certain corporations for all taxable years ending after december 31, 2022, a corporation with more. Check box if you file. 1099, 1040) from the irs.

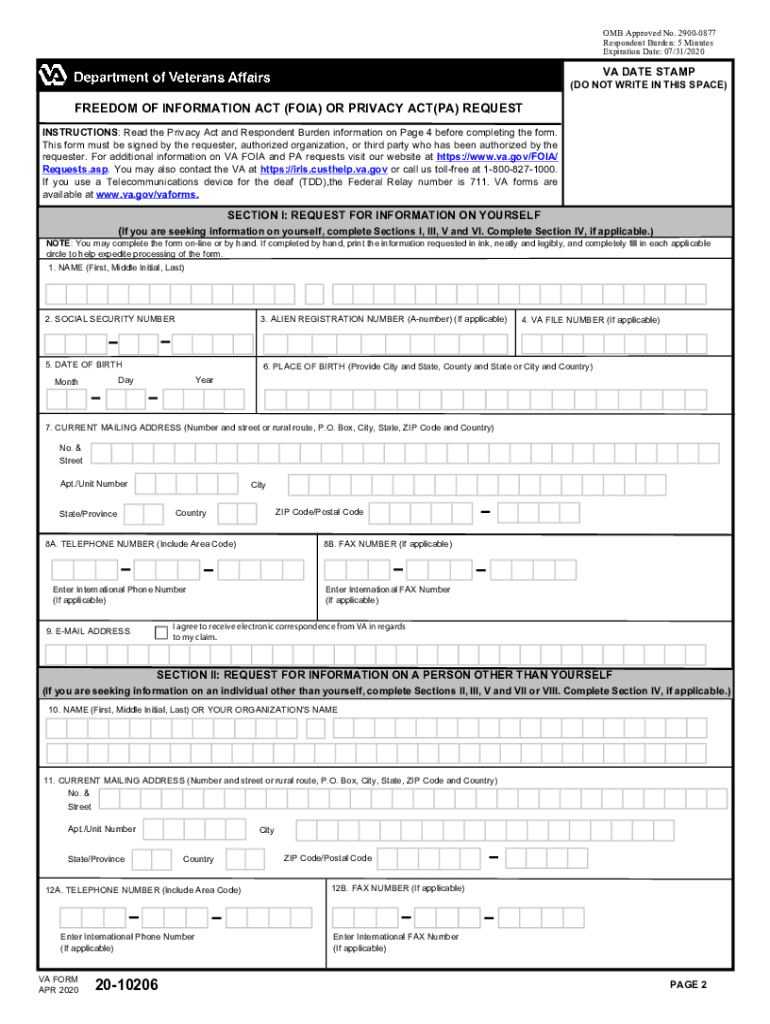

2020 VA Form 2010206 Fill Online, Printable, Fillable, Blank pdfFiller

Find the proper forms for individual, corporate, and business taxes. 1099, 1040) from the irs. Any corporation doing business and having gross income in indiana must file a corporate income tax return. Check box if the corporation paid any quarterly estimated tax using diferent federal employer identification numbers. General information electronic filing for certain corporations for all taxable years ending.

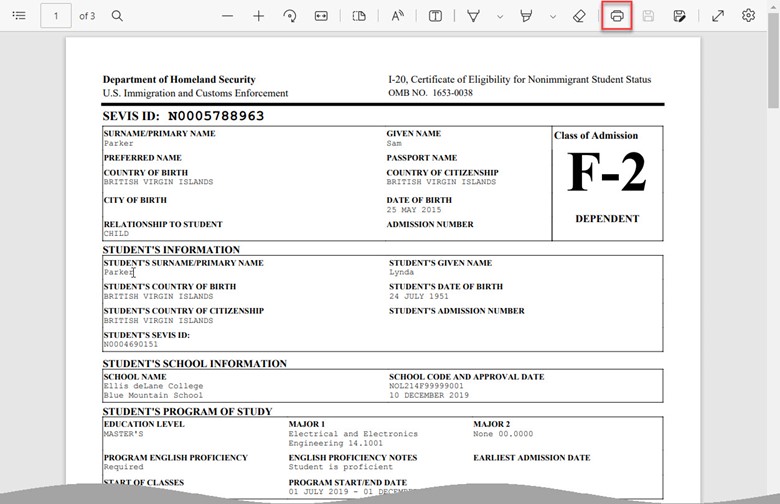

Print Dependent's Form I20 Study in the States

In general, all of the taxpayer’s. Find the proper forms for individual, corporate, and business taxes. Find federal tax forms (e.g. Any corporation doing business and having gross income in indiana must file a corporate income tax return. Check box if you file.

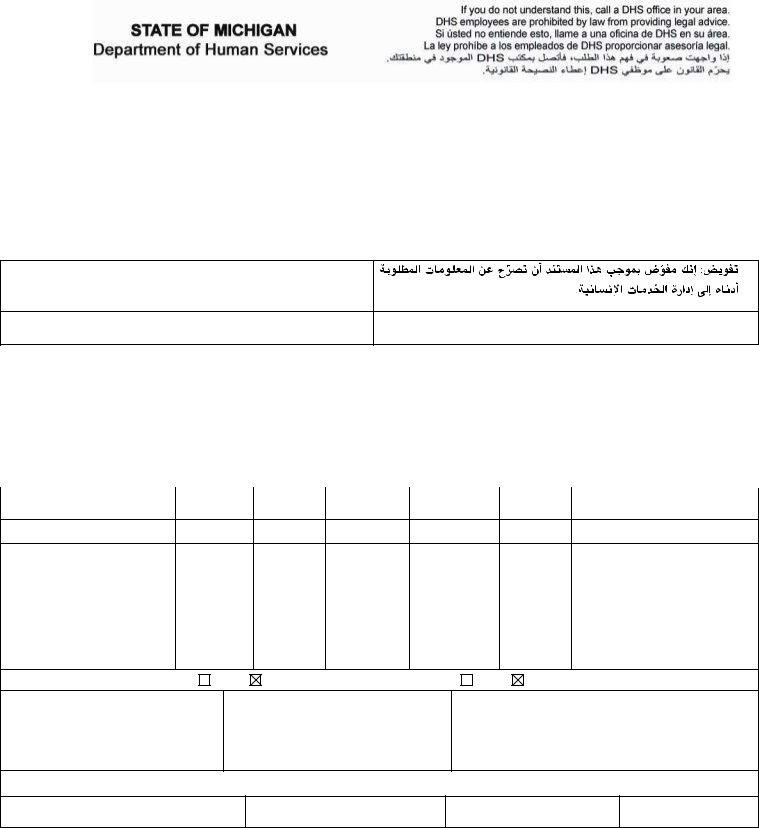

Dhs 20 Form ≡ Fill Out Printable PDF Forms Online

This must be done regardless of the. Check box on line 23 for alternate tax rate calculation and enclose a complete copy of this. Find federal tax forms (e.g. Any corporation doing business and having gross income in indiana must file a corporate income tax return. Check box if you file.

Form screening srq 20 PDF

Find federal tax forms (e.g. General information electronic filing for certain corporations for all taxable years ending after december 31, 2022, a corporation with more. 1099, 1040) from the irs. Find the proper forms for individual, corporate, and business taxes. Check box on line 23 for alternate tax rate calculation and enclose a complete copy of this.

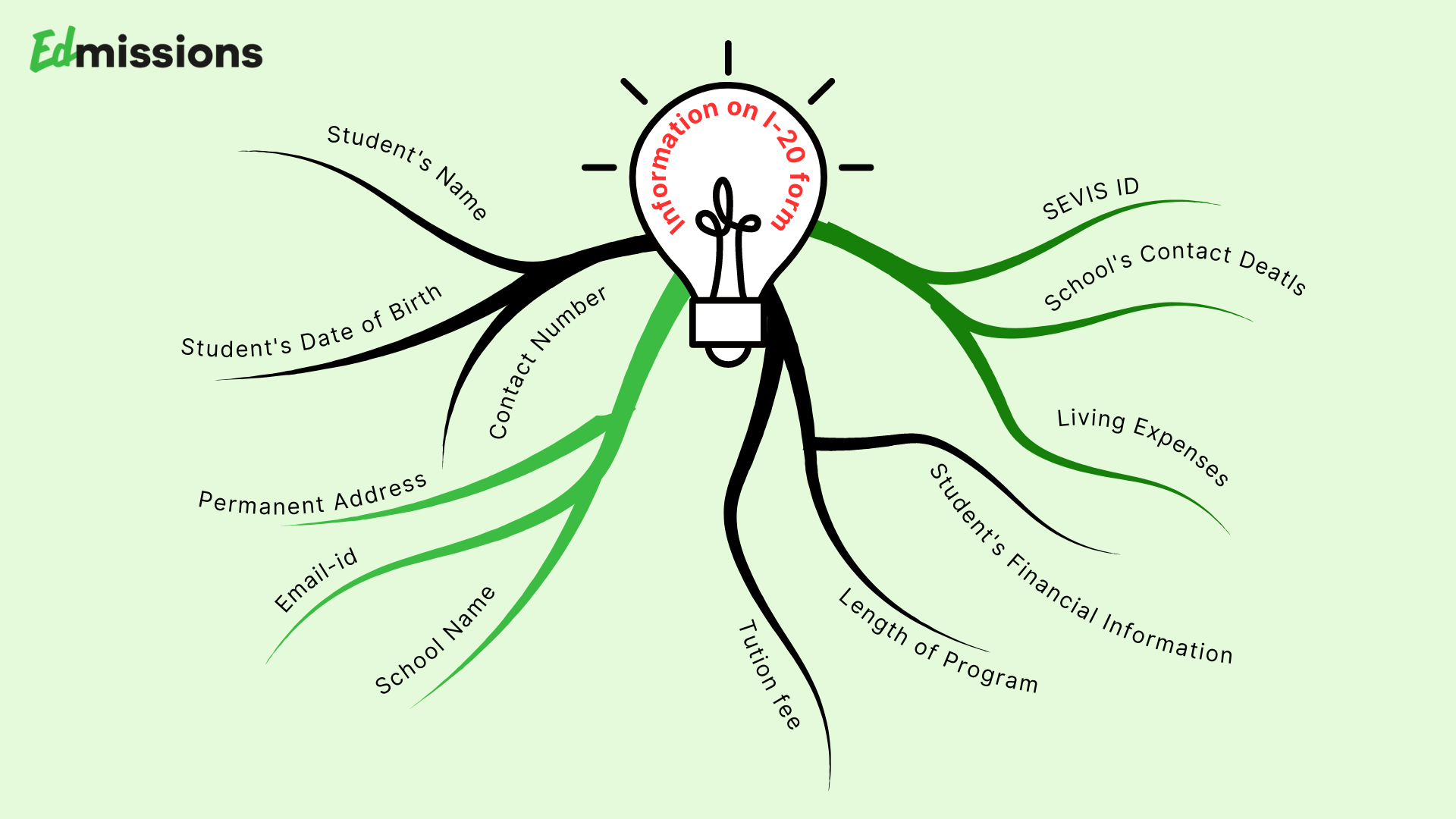

What is the i20 Form? Role in US Student Visa, the Application Process

General information electronic filing for certain corporations for all taxable years ending after december 31, 2022, a corporation with more. In general, all of the taxpayer’s. Check box if the corporation paid any quarterly estimated tax using diferent federal employer identification numbers. Find federal tax forms (e.g. Check box on line 23 for alternate tax rate calculation and enclose a.

Why is Form 20 required while buying a car Requirements, How to apply

Check box if the corporation paid any quarterly estimated tax using diferent federal employer identification numbers. General information electronic filing for certain corporations for all taxable years ending after december 31, 2022, a corporation with more. Any corporation doing business and having gross income in indiana must file a corporate income tax return. Find the proper forms for individual, corporate,.

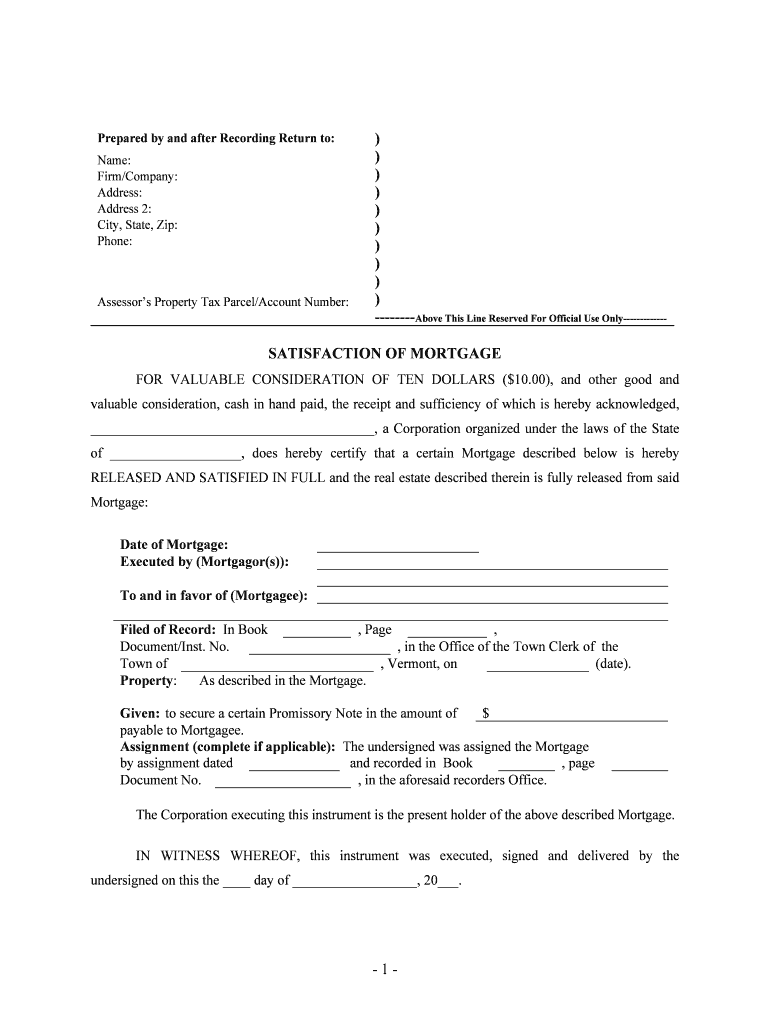

Undersigned on This the Day of , 20 Form Fill Out and Sign Printable

Check box on line 23 for alternate tax rate calculation and enclose a complete copy of this. Any corporation doing business and having gross income in indiana must file a corporate income tax return. Find the proper forms for individual, corporate, and business taxes. Check box if you file. 1099, 1040) from the irs.

1099, 1040) From The Irs.

In general, all of the taxpayer’s. This must be done regardless of the. General information electronic filing for certain corporations for all taxable years ending after december 31, 2022, a corporation with more. Check box if the corporation paid any quarterly estimated tax using diferent federal employer identification numbers.

Find Federal Tax Forms (E.g.

Find the proper forms for individual, corporate, and business taxes. Check box if you file. Check box on line 23 for alternate tax rate calculation and enclose a complete copy of this. Any corporation doing business and having gross income in indiana must file a corporate income tax return.