K 5 Form

K 5 Form - Once the form is completed, it may be filed electronically by clicking the. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. The development and use of paperless formats. It may be filed electronically by.

The development and use of paperless formats. Once the form is completed, it may be filed electronically by clicking the. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. It may be filed electronically by.

Once the form is completed, it may be filed electronically by clicking the. The development and use of paperless formats. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. It may be filed electronically by.

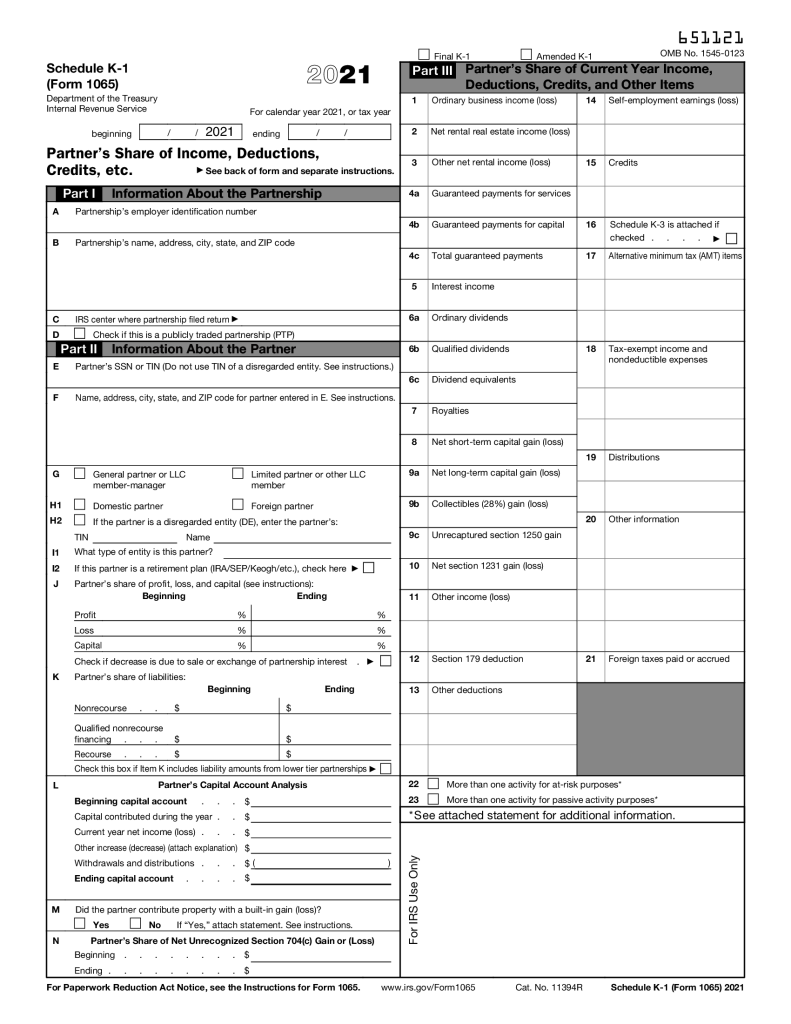

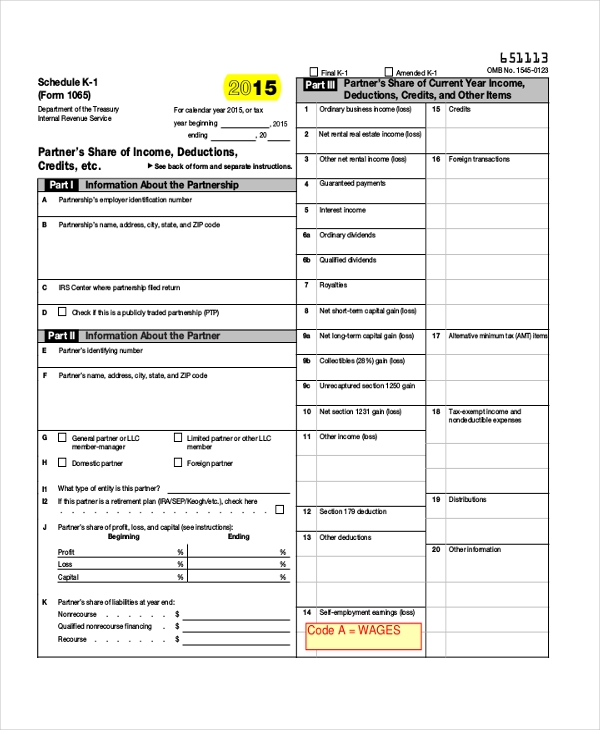

Printable K 1 Form Fillable Form 2024

It may be filed electronically by. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. The development and use of paperless formats. Once the form is completed, it may be filed electronically by clicking the.

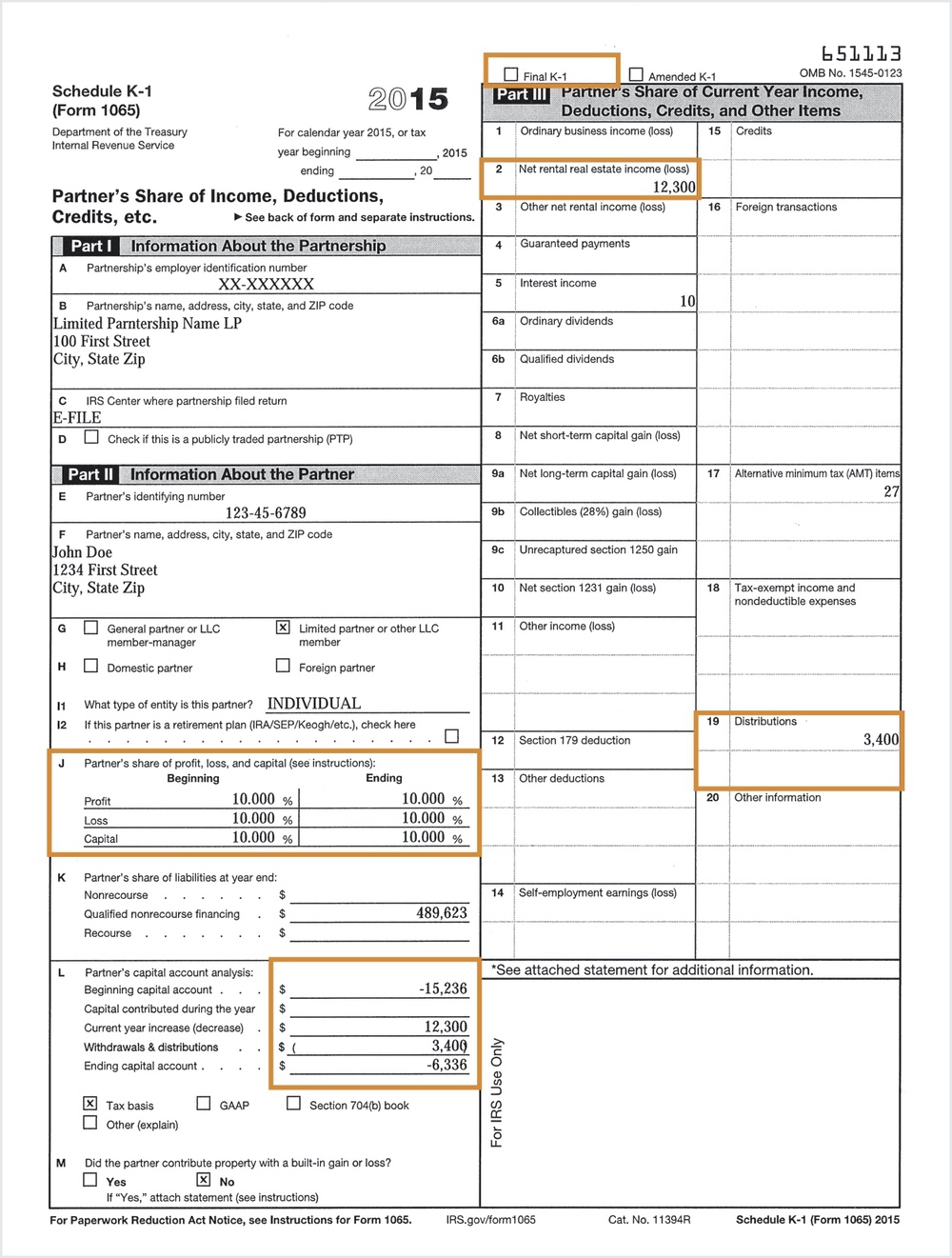

Printable K 1 Tax Form

The development and use of paperless formats. Once the form is completed, it may be filed electronically by clicking the. It may be filed electronically by. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically.

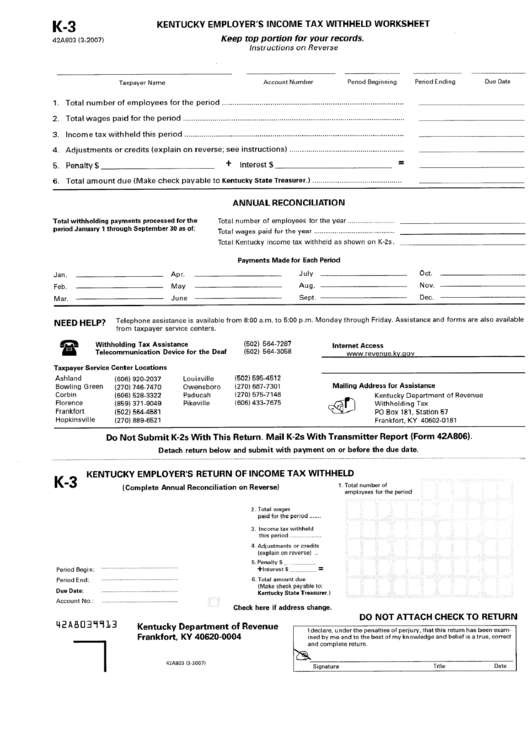

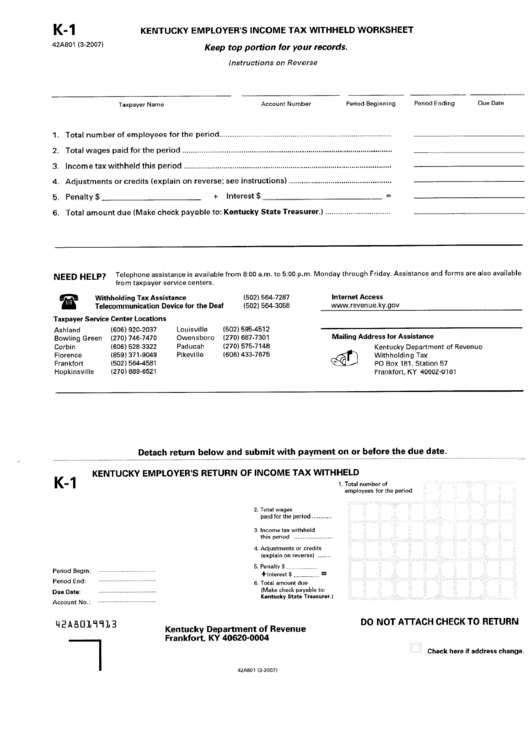

Form K3 Kentucky Employer'S Tax Withheld Worksheet Kentucky

Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. It may be filed electronically by. Once the form is completed, it may be filed electronically by clicking the. The development and use of paperless formats.

Fillable Online K 5 Fax Email Print pdfFiller

The development and use of paperless formats. It may be filed electronically by. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. Once the form is completed, it may be filed electronically by clicking the.

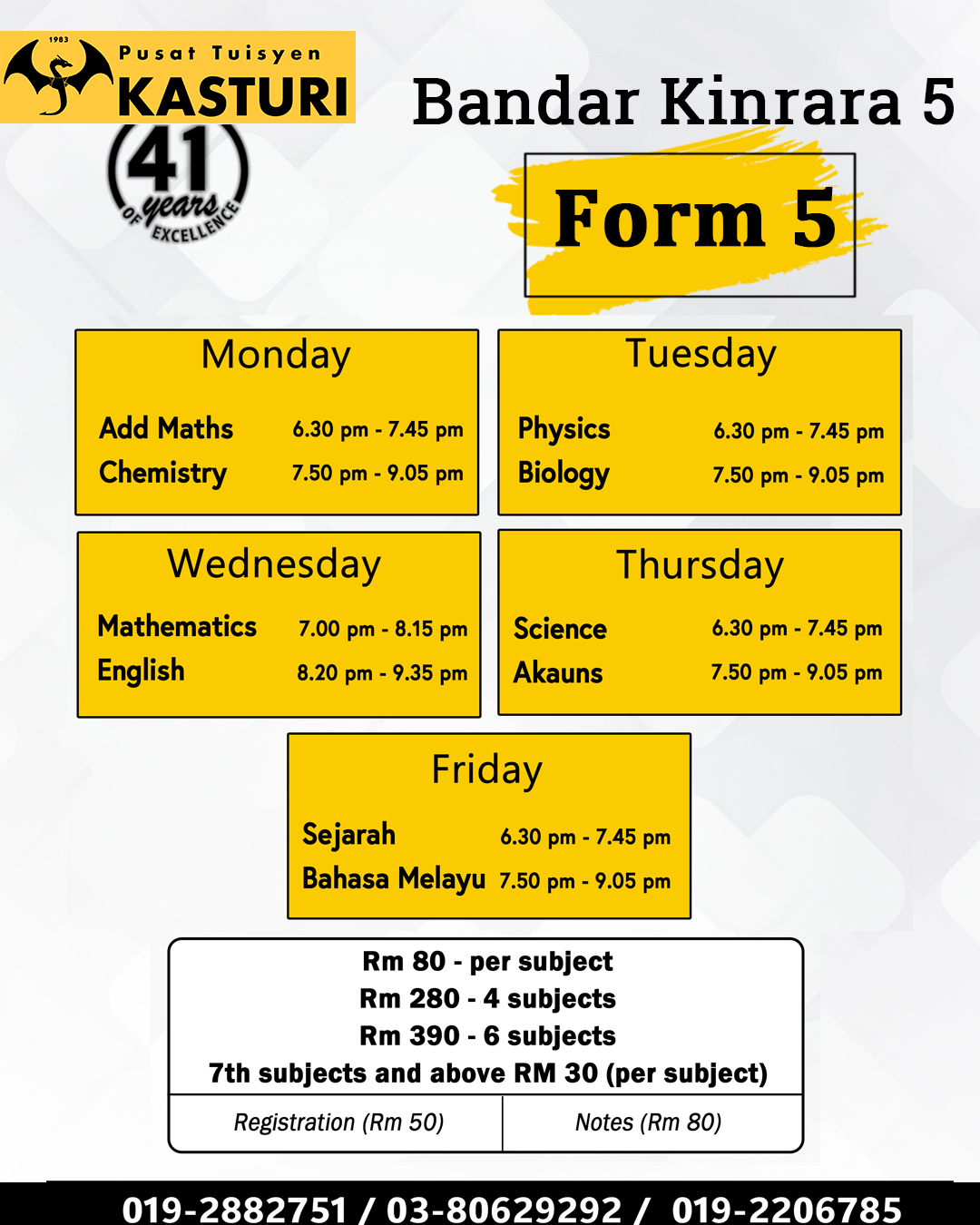

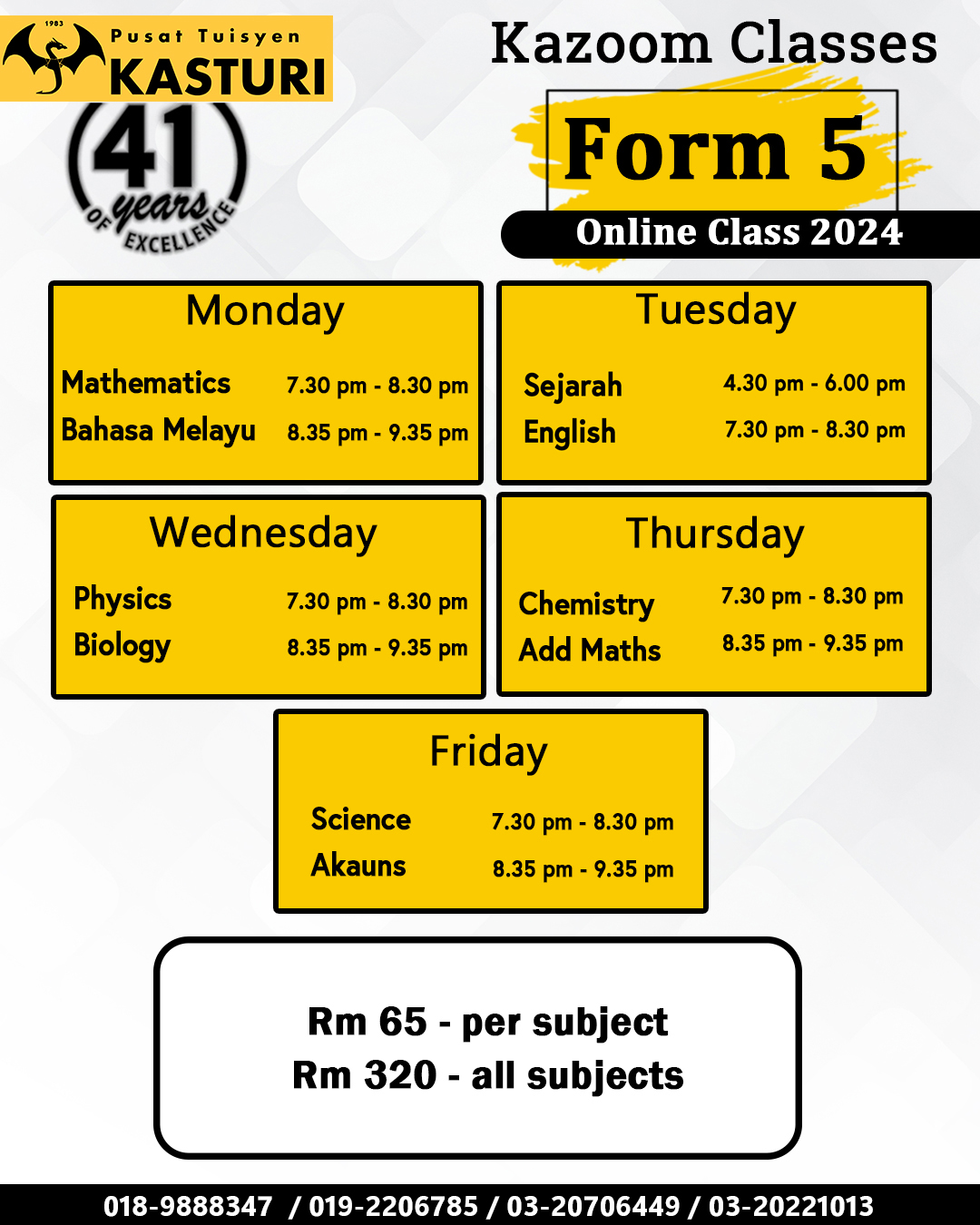

Form 5 Kasturi Academy

Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. The development and use of paperless formats. Once the form is completed, it may be filed electronically by clicking the. It may be filed electronically by.

Schedule K10 Form 10 Five Awesome Things You Can Learn From Schedule K

It may be filed electronically by. Once the form is completed, it may be filed electronically by clicking the. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. The development and use of paperless formats.

Form 5 Kasturi Academy

It may be filed electronically by. The development and use of paperless formats. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. Once the form is completed, it may be filed electronically by clicking the.

810K5 10 QUIZ OVERSIZED RESPONSE (500/PKG) Scantron Corporation

The development and use of paperless formats. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. Once the form is completed, it may be filed electronically by clicking the. It may be filed electronically by.

Schedule K1 Form 1065 Self Employment Tax Employment Form

Once the form is completed, it may be filed electronically by clicking the. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. It may be filed electronically by. The development and use of paperless formats.

Ky State Tax Withholding Form

The development and use of paperless formats. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. It may be filed electronically by. Once the form is completed, it may be filed electronically by clicking the.

The Development And Use Of Paperless Formats.

Once the form is completed, it may be filed electronically by clicking the. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. It may be filed electronically by.