Local Pa Tax Rates

Local Pa Tax Rates - You can click on any city or county for more details, including. We have information on the local income tax rates in 12 localities in pennsylvania. For detailed and historic tax information, please see the tax compendium. We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. For instance, a $52 tax. Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax (eit) and local services tax (lst). The first two (2) digits of a psd code represent the tax. Here is a link where you can enter the name of the municipality where you live and it will give you a list of taxes and rates for that. View and sort psd codes & eit rates by county, municipality, and school district. Common level ratio factor (clr) for real estate valuation.

Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax (eit) and local services tax (lst). You can click on any city or county for more details, including. We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. For instance, a $52 tax. For detailed and historic tax information, please see the tax compendium. We have information on the local income tax rates in 12 localities in pennsylvania. Municipality and school district tax rates. View and sort psd codes & eit rates by county, municipality, and school district. Common level ratio factor (clr) for real estate valuation. The first two (2) digits of a psd code represent the tax.

Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax (eit) and local services tax (lst). Common level ratio factor (clr) for real estate valuation. View and sort psd codes & eit rates by county, municipality, and school district. Municipality and school district tax rates. We have information on the local income tax rates in 12 localities in pennsylvania. Here is a link where you can enter the name of the municipality where you live and it will give you a list of taxes and rates for that. We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. The first two (2) digits of a psd code represent the tax. For instance, a $52 tax. You can click on any city or county for more details, including.

Incorrect formula on Local PA tax return for Part Year Resident? r/tax

Common level ratio factor (clr) for real estate valuation. Municipality and school district tax rates. For instance, a $52 tax. Here is a link where you can enter the name of the municipality where you live and it will give you a list of taxes and rates for that. You can click on any city or county for more details,.

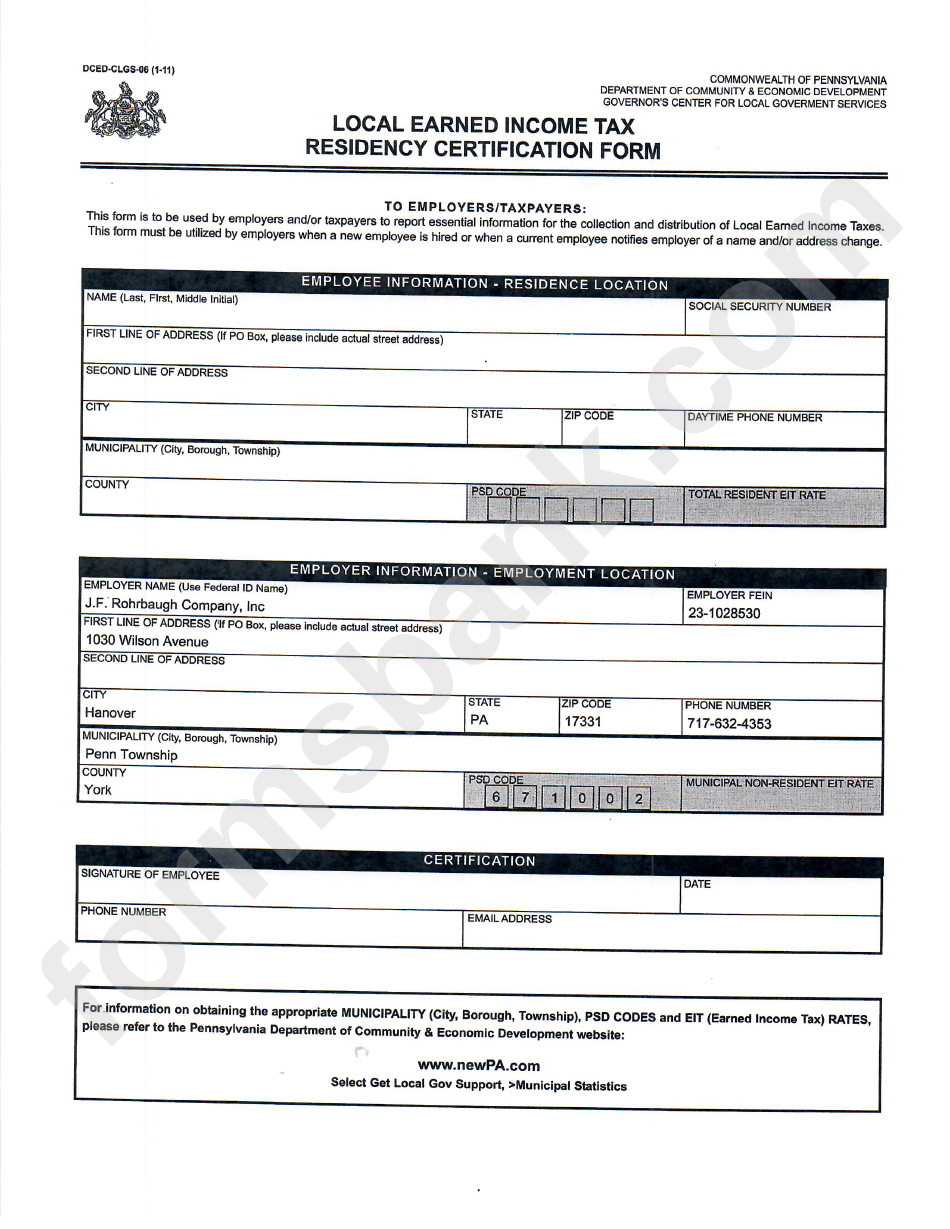

Printable Pa Local Tax Form Printable Forms Free Online

For instance, a $52 tax. You can click on any city or county for more details, including. Municipality and school district tax rates. We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. View and sort psd codes & eit rates by county, municipality, and school district.

Where Could Interest and Tax Rates Be Headed? SouthPark Capital Tax

Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax (eit) and local services tax (lst). Municipality and school district tax rates. For detailed and historic tax information, please see the tax compendium. Here is a link where you can enter the name of the municipality where you live and it will give.

Trust tax rates KTS Chartered Accountants

Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax (eit) and local services tax (lst). You can click on any city or county for more details, including. For instance, a $52 tax. Municipality and school district tax rates. View and sort psd codes & eit rates by county, municipality, and school district.

The World's Highest Corporate Tax Rates 2010

View and sort psd codes & eit rates by county, municipality, and school district. Municipality and school district tax rates. Here is a link where you can enter the name of the municipality where you live and it will give you a list of taxes and rates for that. For instance, a $52 tax. We have information on the local.

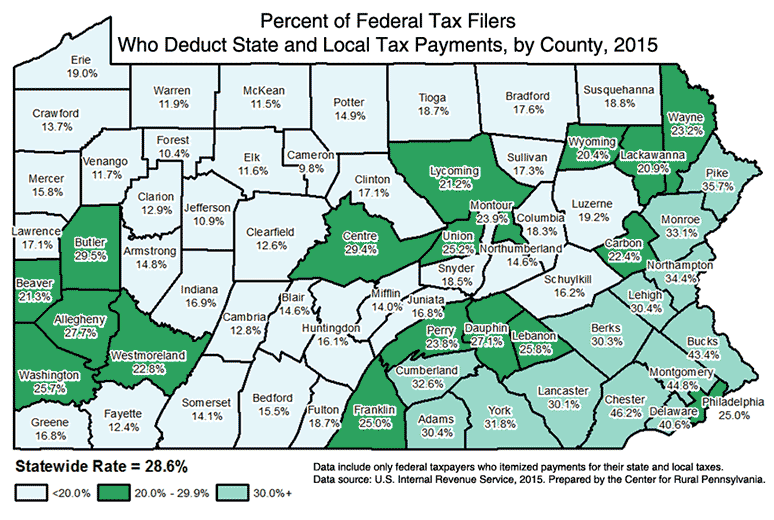

DataGrams Center for Rural PA

For detailed and historic tax information, please see the tax compendium. Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax (eit) and local services tax (lst). View and sort psd codes & eit rates by county, municipality, and school district. Here is a link where you can enter the name of the.

State and Local Sales Tax Rates in 2014 Tax Foundation

View and sort psd codes & eit rates by county, municipality, and school district. We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. For instance, a $52 tax. The first two (2) digits of a psd code represent the tax. Employers with worksites located in pennsylvania are required.

Pa Local Tax Form 2023 Printable Forms Free Online

We have information on the local income tax rates in 12 localities in pennsylvania. Common level ratio factor (clr) for real estate valuation. For detailed and historic tax information, please see the tax compendium. Municipality and school district tax rates. We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to.

State and Local Sales Tax Rates Midyear 2013 Tax Foundation

We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. The first two (2) digits of a psd code represent the tax. You can click on any city or county for more details, including. For instance, a $52 tax. Municipality and school district tax rates.

Cumberland County Pa Local Earned Tax Return

View and sort psd codes & eit rates by county, municipality, and school district. The first two (2) digits of a psd code represent the tax. For instance, a $52 tax. You can click on any city or county for more details, including. We recommend you contact the county, municipality and/or school district provided as a match for the address.

The First Two (2) Digits Of A Psd Code Represent The Tax.

Here is a link where you can enter the name of the municipality where you live and it will give you a list of taxes and rates for that. You can click on any city or county for more details, including. For instance, a $52 tax. We have information on the local income tax rates in 12 localities in pennsylvania.

View And Sort Psd Codes & Eit Rates By County, Municipality, And School District.

For detailed and historic tax information, please see the tax compendium. We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. Common level ratio factor (clr) for real estate valuation. Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax (eit) and local services tax (lst).

.png)

.png)