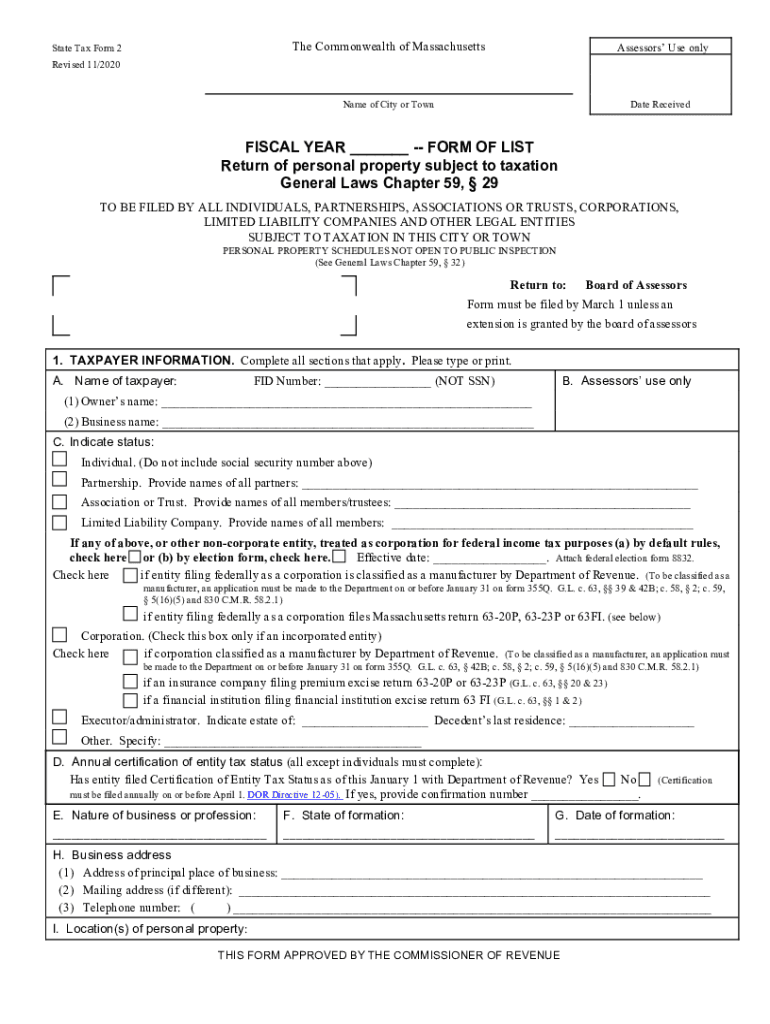

Ma Personal Property Tax Form

Ma Personal Property Tax Form - The commissioner of revenue is responsible for issuing certain forms used by taxpayers to apply for local tax abatements and exemptions and file. This form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability. 59, §§ 38a or 41 must file a. Taxpayers should use these forms and guides to apply for local tax abatements and exemptions and file property returns. For more information about personal property and your. Pipeline and telephone and telegraph companies that own taxable personal property subject to central valuation under g.l. Welcome to city of boston personal property online filing of the form of list/state tax form 2.

The commissioner of revenue is responsible for issuing certain forms used by taxpayers to apply for local tax abatements and exemptions and file. Taxpayers should use these forms and guides to apply for local tax abatements and exemptions and file property returns. This form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability. Pipeline and telephone and telegraph companies that own taxable personal property subject to central valuation under g.l. 59, §§ 38a or 41 must file a. Welcome to city of boston personal property online filing of the form of list/state tax form 2. For more information about personal property and your.

59, §§ 38a or 41 must file a. Pipeline and telephone and telegraph companies that own taxable personal property subject to central valuation under g.l. Taxpayers should use these forms and guides to apply for local tax abatements and exemptions and file property returns. This form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability. For more information about personal property and your. The commissioner of revenue is responsible for issuing certain forms used by taxpayers to apply for local tax abatements and exemptions and file. Welcome to city of boston personal property online filing of the form of list/state tax form 2.

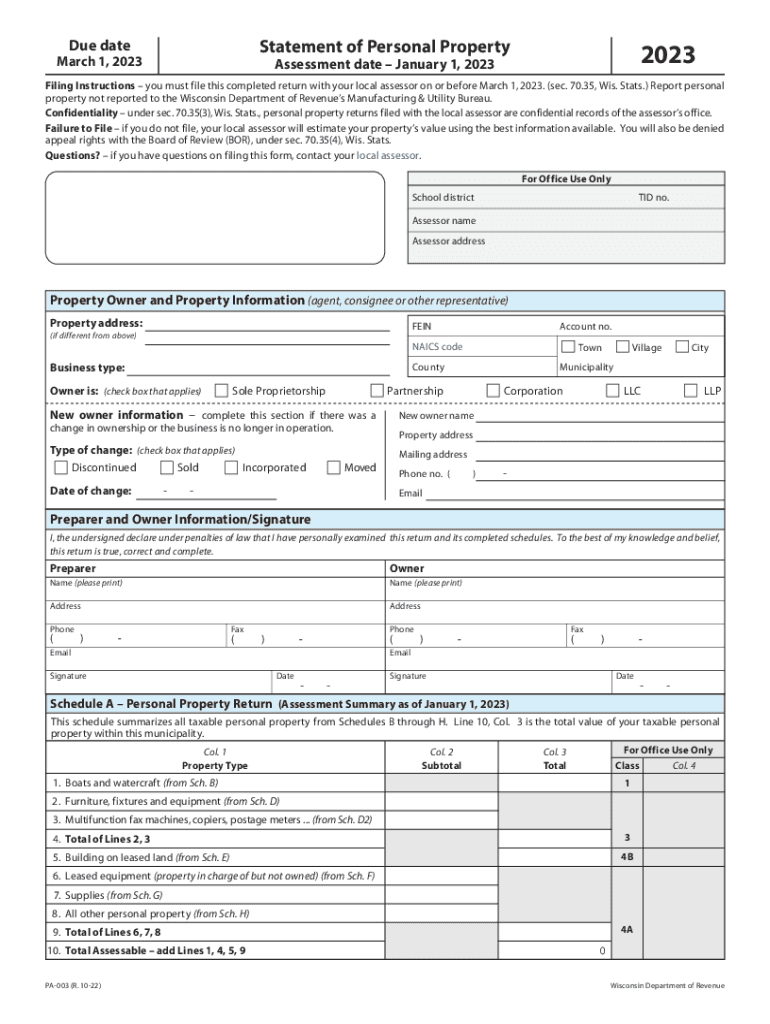

Statement of Personal Property 20232024 Form Fill Out and Sign

Taxpayers should use these forms and guides to apply for local tax abatements and exemptions and file property returns. 59, §§ 38a or 41 must file a. Welcome to city of boston personal property online filing of the form of list/state tax form 2. The commissioner of revenue is responsible for issuing certain forms used by taxpayers to apply for.

Was your ANCHOR property tax application accepted? Here’s how you can

Welcome to city of boston personal property online filing of the form of list/state tax form 2. Taxpayers should use these forms and guides to apply for local tax abatements and exemptions and file property returns. For more information about personal property and your. The commissioner of revenue is responsible for issuing certain forms used by taxpayers to apply for.

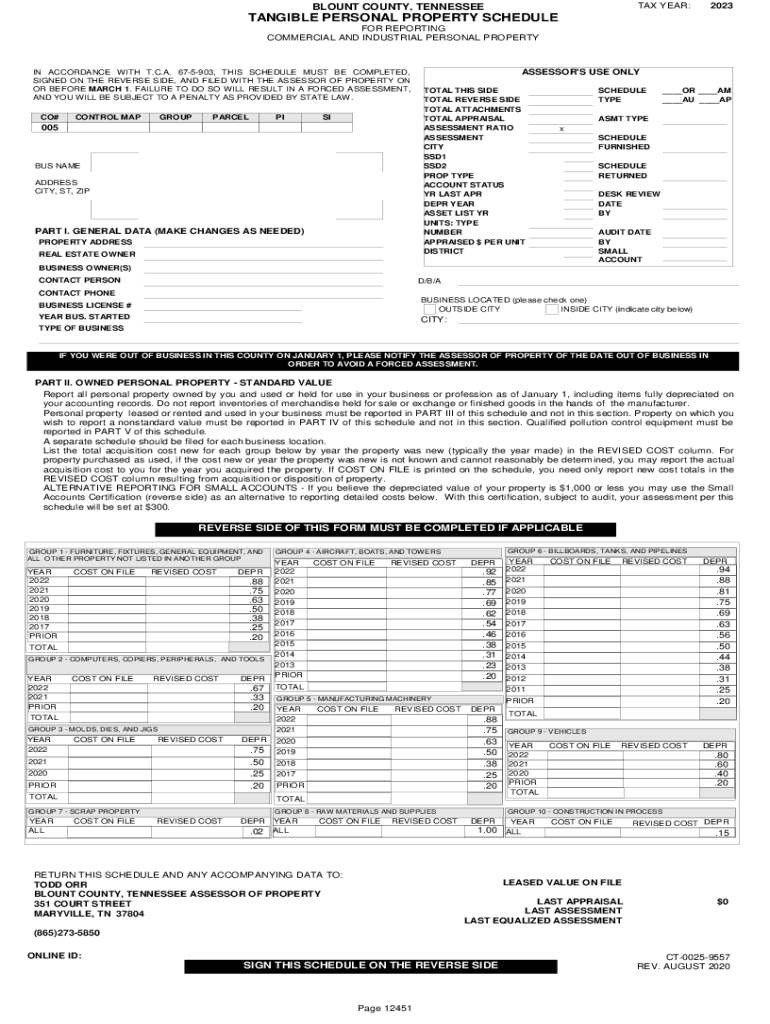

Tangible Personal Property Schedule Complete with ease airSlate SignNow

Taxpayers should use these forms and guides to apply for local tax abatements and exemptions and file property returns. This form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability. Welcome to city of boston personal property online filing of the form of list/state tax form 2. For more.

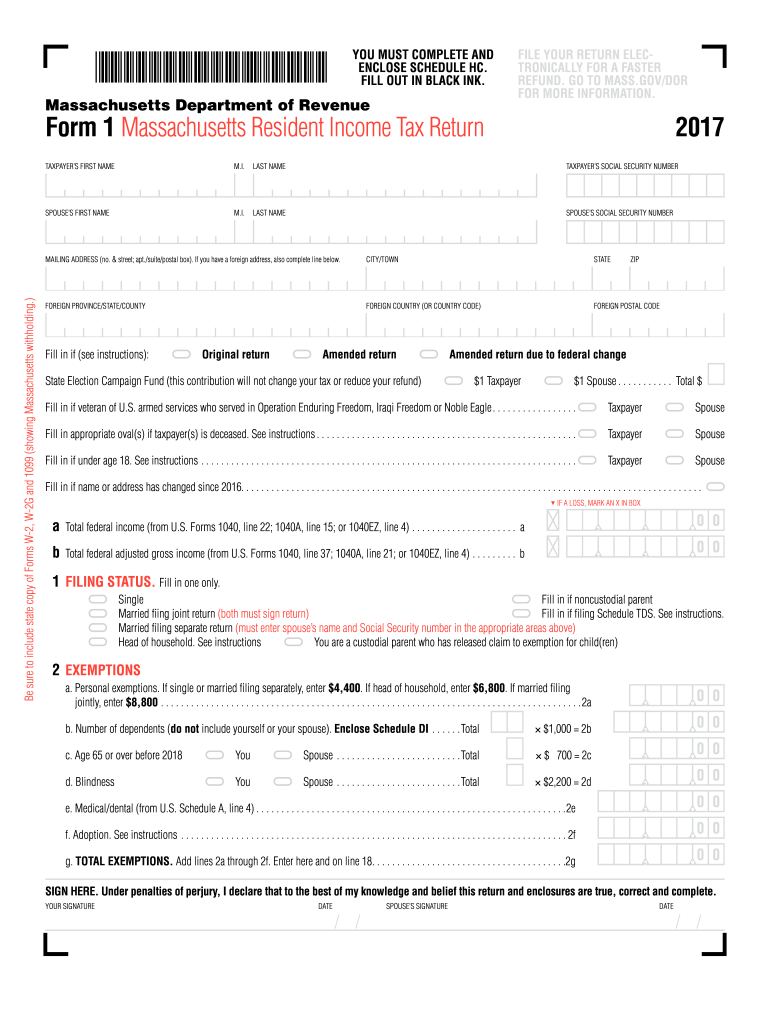

MA Form 1 2017 Fill out Tax Template Online US Legal Forms

This form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability. The commissioner of revenue is responsible for issuing certain forms used by taxpayers to apply for local tax abatements and exemptions and file. Welcome to city of boston personal property online filing of the form of list/state tax.

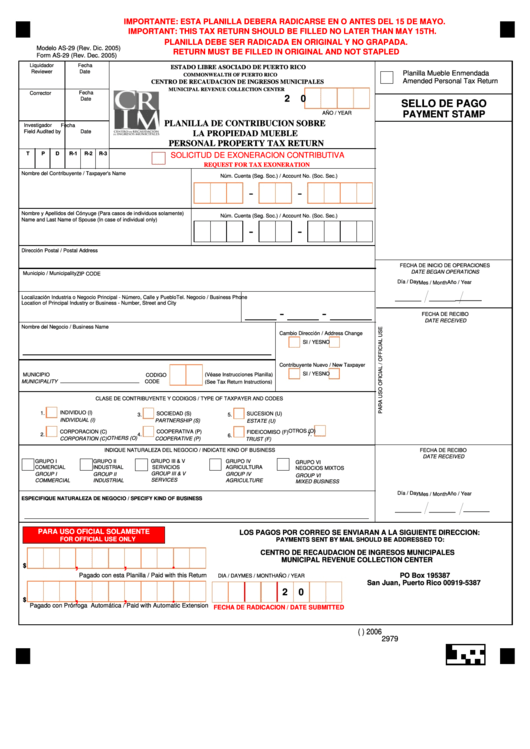

Form As29 Personal Property Tax Return printable pdf download

59, §§ 38a or 41 must file a. Taxpayers should use these forms and guides to apply for local tax abatements and exemptions and file property returns. The commissioner of revenue is responsible for issuing certain forms used by taxpayers to apply for local tax abatements and exemptions and file. For more information about personal property and your. This form.

20202024 MA State Tax Form 2 Fill Online, Printable, Fillable, Blank

For more information about personal property and your. This form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability. 59, §§ 38a or 41 must file a. The commissioner of revenue is responsible for issuing certain forms used by taxpayers to apply for local tax abatements and exemptions and.

How Do I Get A Property Tax Form.from.my County

Taxpayers should use these forms and guides to apply for local tax abatements and exemptions and file property returns. Welcome to city of boston personal property online filing of the form of list/state tax form 2. This form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability. For more.

Fillable Business Personal Property Tax Return Form Printable Pdf

59, §§ 38a or 41 must file a. This form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability. Welcome to city of boston personal property online filing of the form of list/state tax form 2. The commissioner of revenue is responsible for issuing certain forms used by taxpayers.

Loudoun County Personal Property Tax Form

For more information about personal property and your. The commissioner of revenue is responsible for issuing certain forms used by taxpayers to apply for local tax abatements and exemptions and file. Taxpayers should use these forms and guides to apply for local tax abatements and exemptions and file property returns. 59, §§ 38a or 41 must file a. This form.

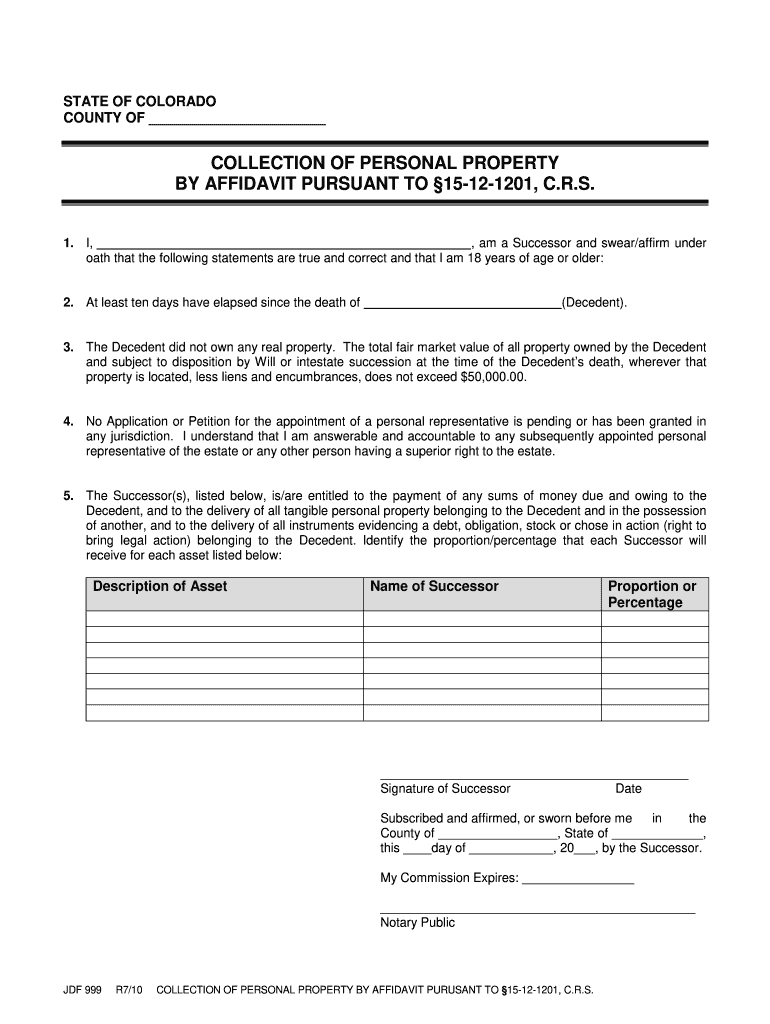

Affidavit of Collection of Personal Property airSlate SignNow

The commissioner of revenue is responsible for issuing certain forms used by taxpayers to apply for local tax abatements and exemptions and file. 59, §§ 38a or 41 must file a. Pipeline and telephone and telegraph companies that own taxable personal property subject to central valuation under g.l. For more information about personal property and your. This form of list.

This Form Of List (State Tax Form 2) Must Be Filed Each Year By All Individuals, Partnerships, Associations, Trusts, Corporations, Limited Liability.

59, §§ 38a or 41 must file a. Pipeline and telephone and telegraph companies that own taxable personal property subject to central valuation under g.l. The commissioner of revenue is responsible for issuing certain forms used by taxpayers to apply for local tax abatements and exemptions and file. For more information about personal property and your.

Welcome To City Of Boston Personal Property Online Filing Of The Form Of List/State Tax Form 2.

Taxpayers should use these forms and guides to apply for local tax abatements and exemptions and file property returns.