Maine Tax Exemption Form

Maine Tax Exemption Form - To view pdf or word documents, you will need the free document readers. This affidavit is to be retained in the records of the seller to document the qualification of exemption of any sale claimed exempt under 36 m.r.s.a. Completed forms must be filed with your local assessor by april 1. The forms below are not specific to a particular tax type or program. You can apply for a maine sales tax exemption in the maine tax portal by clicking. Information regarding the ptdz sales and use tax exemptions can be found in instructional bulletin no. Each type of organization has a different application form. Forms filed after april 1 of any year will apply to the subsequent year tax. See all sales tax forms, certificates and.

Completed forms must be filed with your local assessor by april 1. See all sales tax forms, certificates and. Each type of organization has a different application form. This affidavit is to be retained in the records of the seller to document the qualification of exemption of any sale claimed exempt under 36 m.r.s.a. You can apply for a maine sales tax exemption in the maine tax portal by clicking. Forms filed after april 1 of any year will apply to the subsequent year tax. The forms below are not specific to a particular tax type or program. Information regarding the ptdz sales and use tax exemptions can be found in instructional bulletin no. To view pdf or word documents, you will need the free document readers.

To view pdf or word documents, you will need the free document readers. This affidavit is to be retained in the records of the seller to document the qualification of exemption of any sale claimed exempt under 36 m.r.s.a. Each type of organization has a different application form. You can apply for a maine sales tax exemption in the maine tax portal by clicking. See all sales tax forms, certificates and. Forms filed after april 1 of any year will apply to the subsequent year tax. The forms below are not specific to a particular tax type or program. Information regarding the ptdz sales and use tax exemptions can be found in instructional bulletin no. Completed forms must be filed with your local assessor by april 1.

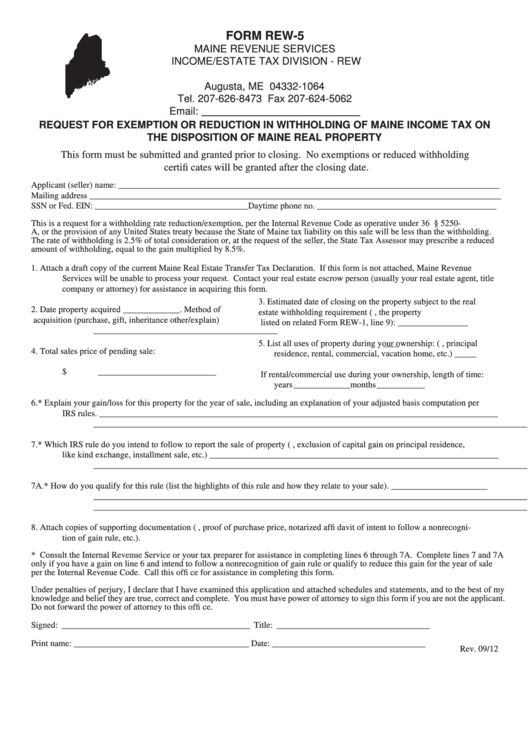

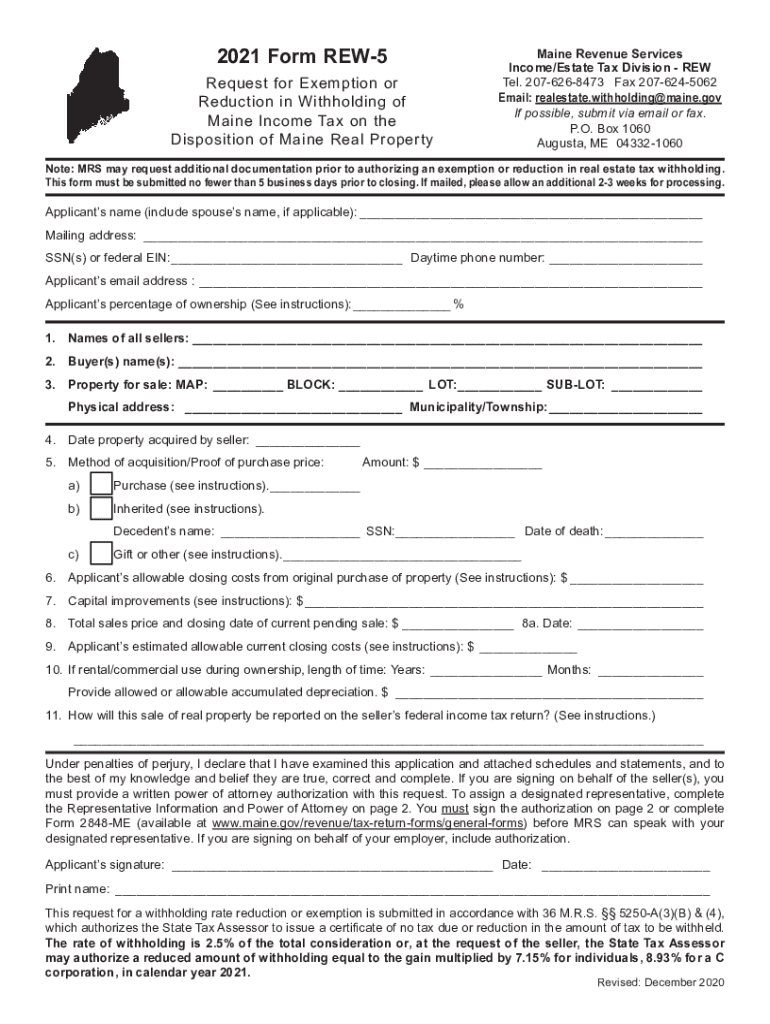

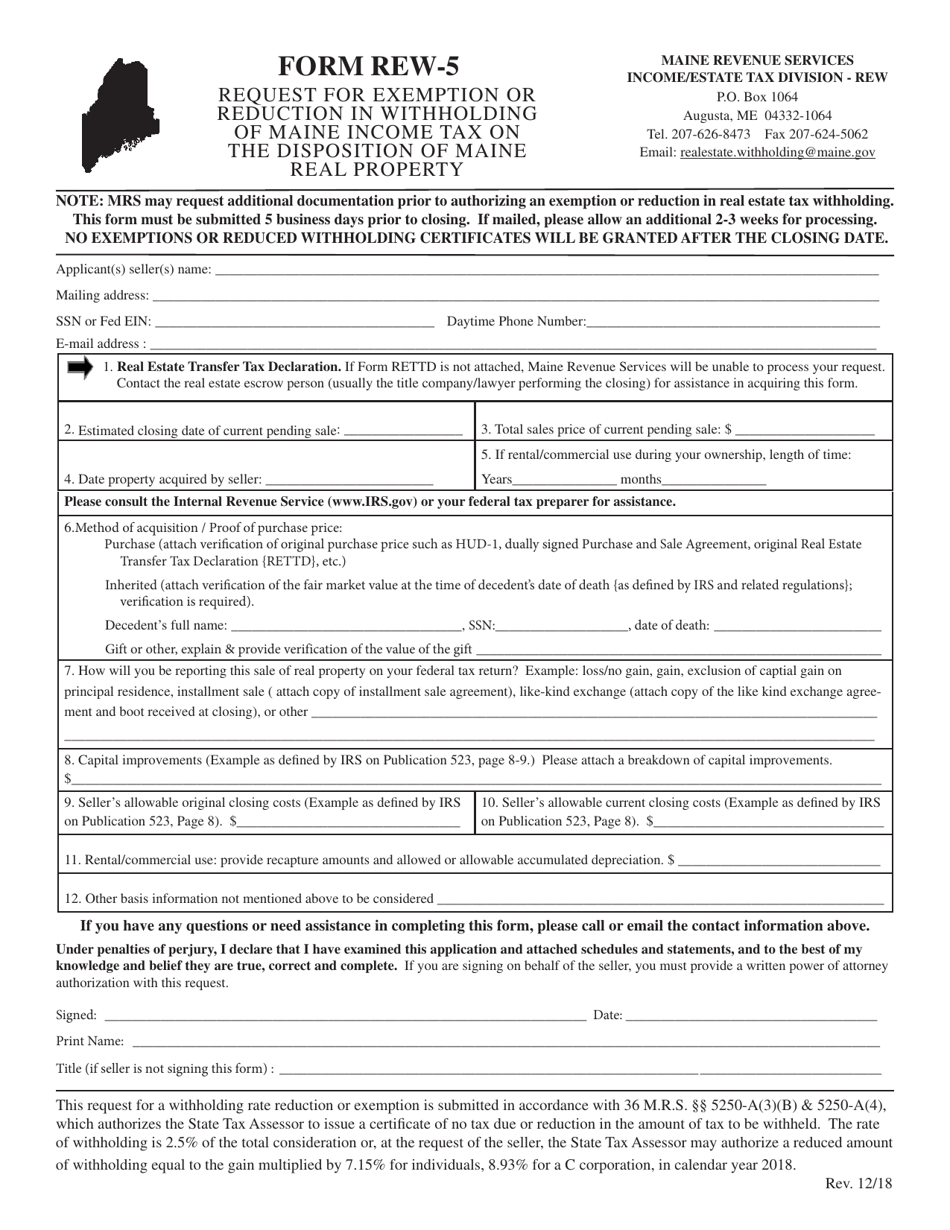

Form Rew5 Request For Exemption Or Reduction In Withholding Of Maine

Forms filed after april 1 of any year will apply to the subsequent year tax. See all sales tax forms, certificates and. You can apply for a maine sales tax exemption in the maine tax portal by clicking. Information regarding the ptdz sales and use tax exemptions can be found in instructional bulletin no. The forms below are not specific.

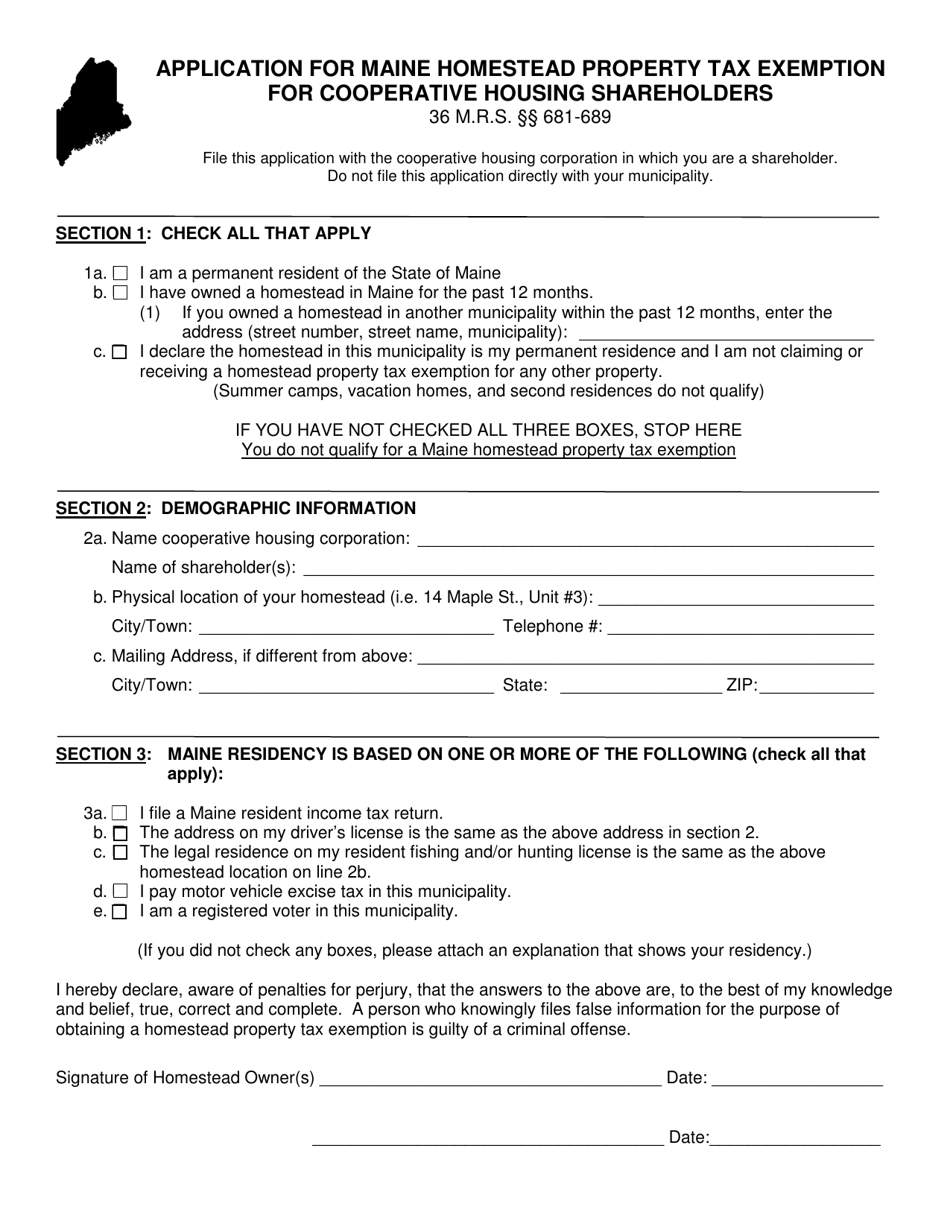

Maine Application for Maine Homestead Property Tax Exemption for

Forms filed after april 1 of any year will apply to the subsequent year tax. Each type of organization has a different application form. Completed forms must be filed with your local assessor by april 1. To view pdf or word documents, you will need the free document readers. The forms below are not specific to a particular tax type.

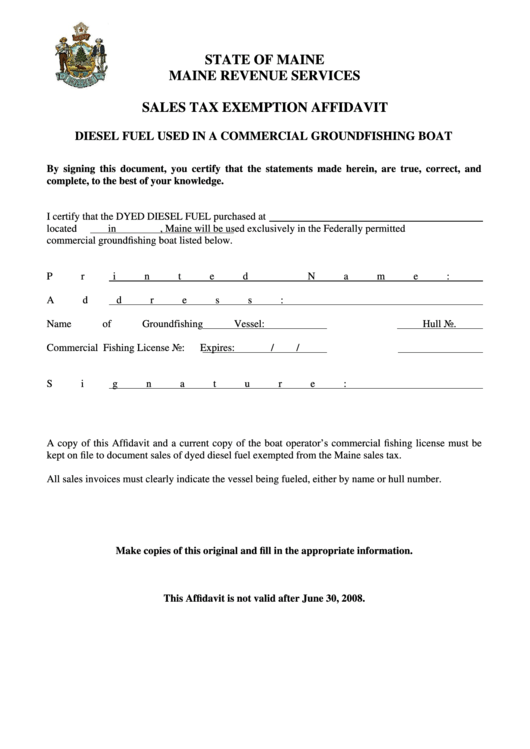

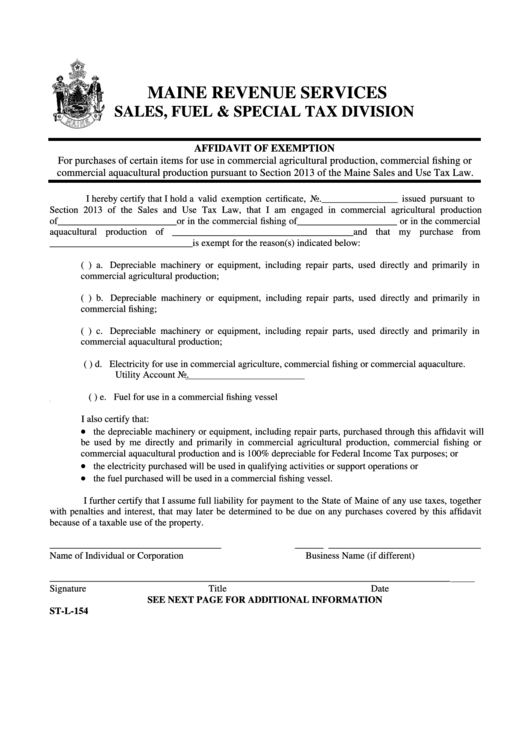

Sales Tax Exemption Affidavit Maine Revenue Services printable pdf

Information regarding the ptdz sales and use tax exemptions can be found in instructional bulletin no. To view pdf or word documents, you will need the free document readers. This affidavit is to be retained in the records of the seller to document the qualification of exemption of any sale claimed exempt under 36 m.r.s.a. Each type of organization has.

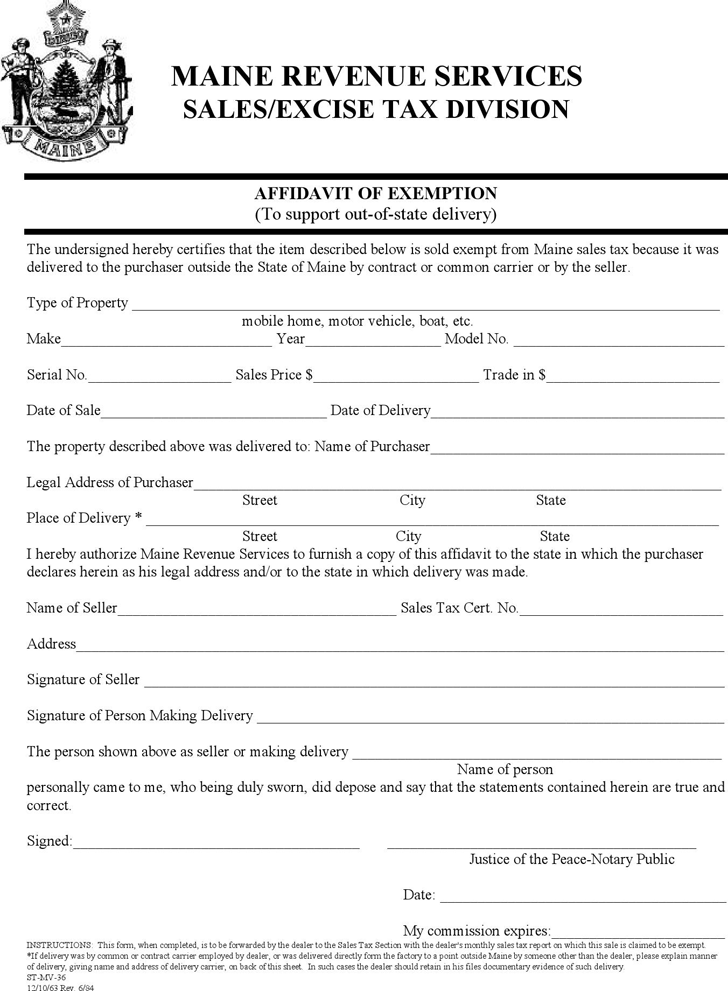

Free Maine Affidavit of Exemption Form pdf 29KB 1 Page(s)

Completed forms must be filed with your local assessor by april 1. To view pdf or word documents, you will need the free document readers. You can apply for a maine sales tax exemption in the maine tax portal by clicking. This affidavit is to be retained in the records of the seller to document the qualification of exemption of.

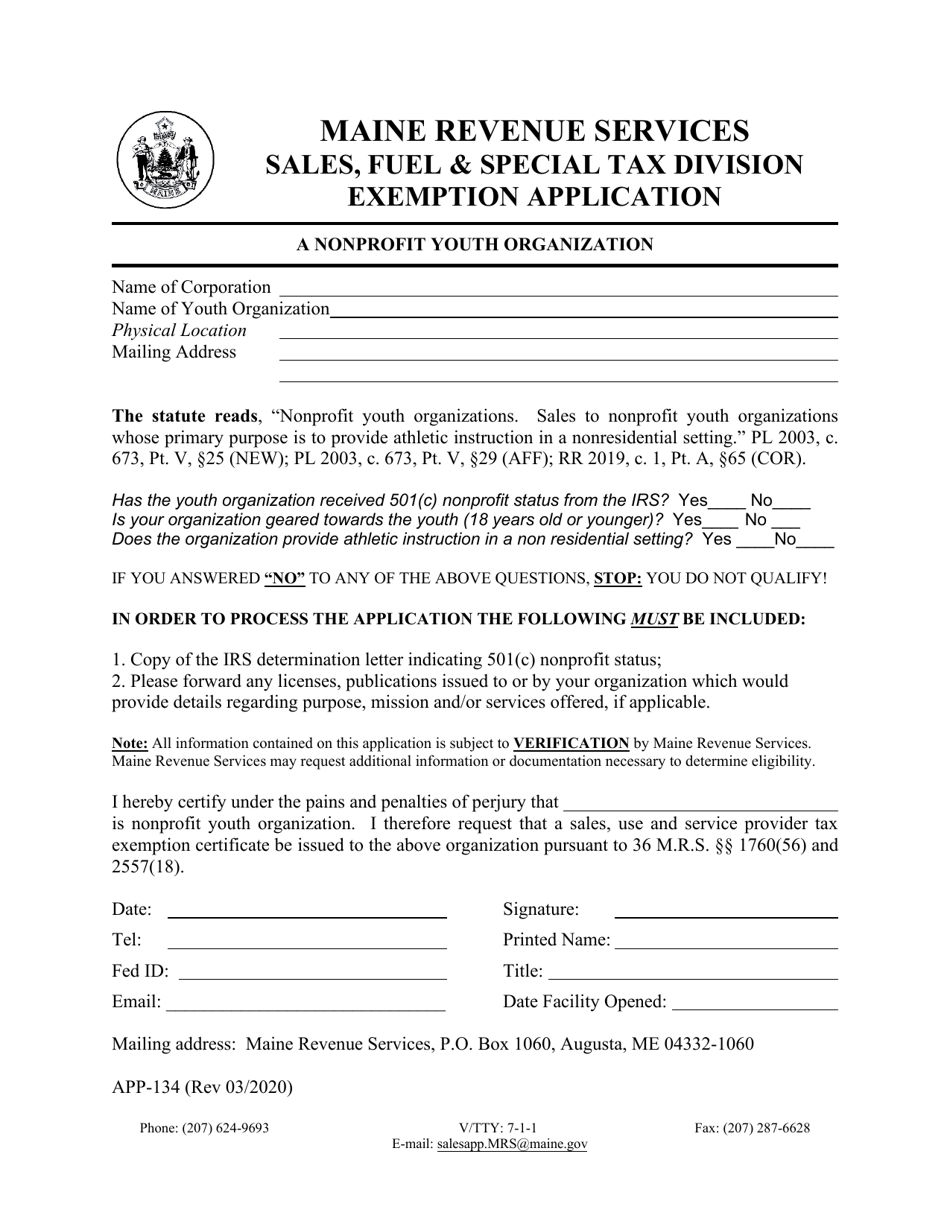

Form APP134 Fill Out, Sign Online and Download Fillable PDF, Maine

See all sales tax forms, certificates and. Information regarding the ptdz sales and use tax exemptions can be found in instructional bulletin no. You can apply for a maine sales tax exemption in the maine tax portal by clicking. Completed forms must be filed with your local assessor by april 1. This affidavit is to be retained in the records.

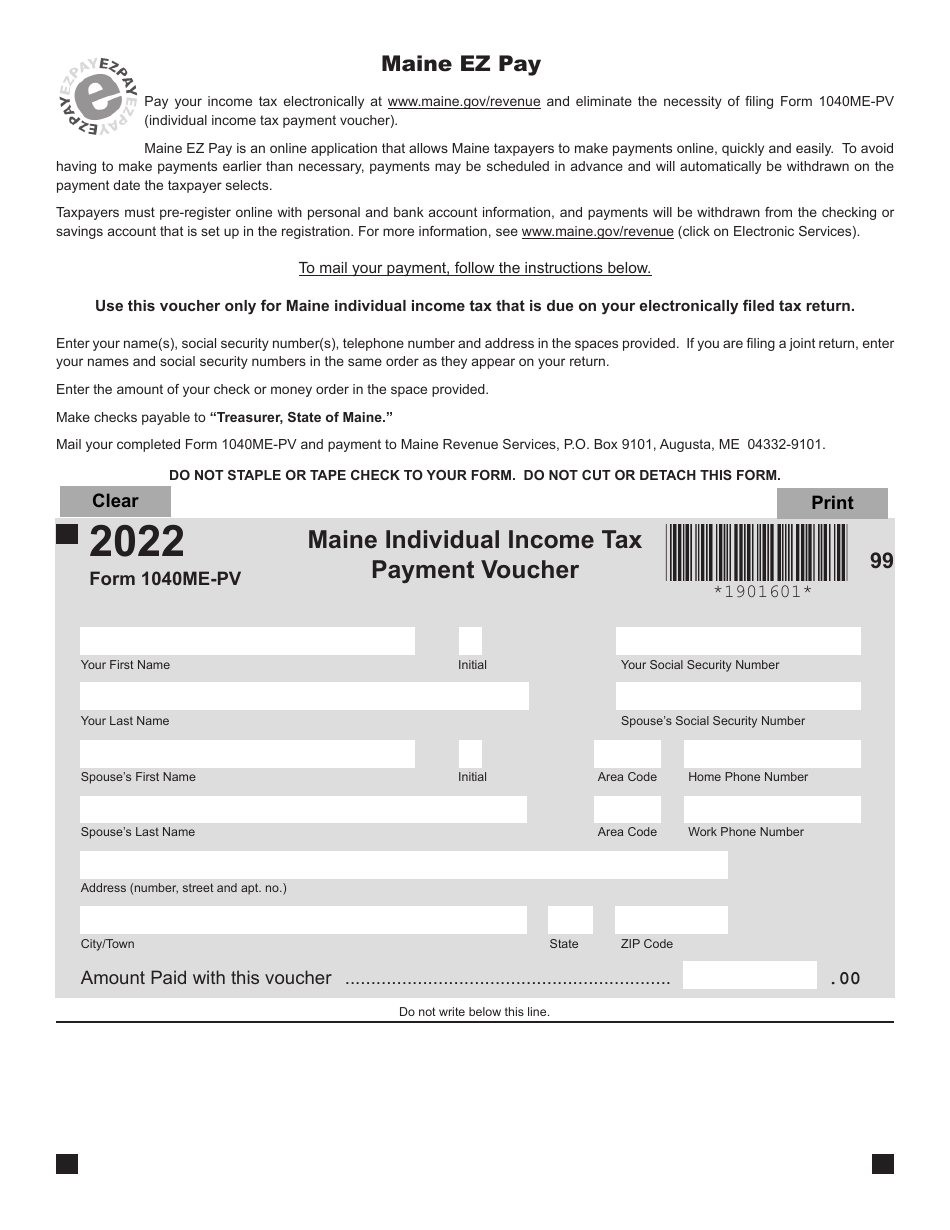

Form 1040MEPV Download Fillable PDF or Fill Online Maine Individual

Forms filed after april 1 of any year will apply to the subsequent year tax. Each type of organization has a different application form. See all sales tax forms, certificates and. Completed forms must be filed with your local assessor by april 1. The forms below are not specific to a particular tax type or program.

Sales Tax Exempt Certificate Fill Online, Printable, Fillable, Blank

Information regarding the ptdz sales and use tax exemptions can be found in instructional bulletin no. This affidavit is to be retained in the records of the seller to document the qualification of exemption of any sale claimed exempt under 36 m.r.s.a. Completed forms must be filed with your local assessor by april 1. To view pdf or word documents,.

State Of Maine Seat Belt Exemption Form

You can apply for a maine sales tax exemption in the maine tax portal by clicking. To view pdf or word documents, you will need the free document readers. This affidavit is to be retained in the records of the seller to document the qualification of exemption of any sale claimed exempt under 36 m.r.s.a. The forms below are not.

Form REW5 Fill Out, Sign Online and Download Printable PDF, Maine

Each type of organization has a different application form. Completed forms must be filed with your local assessor by april 1. You can apply for a maine sales tax exemption in the maine tax portal by clicking. The forms below are not specific to a particular tax type or program. See all sales tax forms, certificates and.

Form StL154 Affidavit Of Exemption Maine Revenue Services

Completed forms must be filed with your local assessor by april 1. You can apply for a maine sales tax exemption in the maine tax portal by clicking. Information regarding the ptdz sales and use tax exemptions can be found in instructional bulletin no. Forms filed after april 1 of any year will apply to the subsequent year tax. To.

See All Sales Tax Forms, Certificates And.

Information regarding the ptdz sales and use tax exemptions can be found in instructional bulletin no. This affidavit is to be retained in the records of the seller to document the qualification of exemption of any sale claimed exempt under 36 m.r.s.a. You can apply for a maine sales tax exemption in the maine tax portal by clicking. To view pdf or word documents, you will need the free document readers.

Each Type Of Organization Has A Different Application Form.

The forms below are not specific to a particular tax type or program. Forms filed after april 1 of any year will apply to the subsequent year tax. Completed forms must be filed with your local assessor by april 1.