Mississippi State Tax Lien

Mississippi State Tax Lien - Tax forfeited property online account instructions page 1 of 8 1. The tax lien sale is held online beginning the last monday of august each year and runs until all delinquent parcels have been sold. Under warrants issued for the tax liens enrolled in the tax lien registry, any property, real or personal, within the state of mississippi is subject to. Visit the secretary of state’s website (www.sos.ms.gov), and click the. When homeowners don't pay their property taxes, the overdue amount becomes a lien on the property. Beginning january 1, 2015, the mississippi department of revenue (the “department”) began enrolling tax liens for.

Beginning january 1, 2015, the mississippi department of revenue (the “department”) began enrolling tax liens for. Visit the secretary of state’s website (www.sos.ms.gov), and click the. The tax lien sale is held online beginning the last monday of august each year and runs until all delinquent parcels have been sold. Tax forfeited property online account instructions page 1 of 8 1. Under warrants issued for the tax liens enrolled in the tax lien registry, any property, real or personal, within the state of mississippi is subject to. When homeowners don't pay their property taxes, the overdue amount becomes a lien on the property.

Tax forfeited property online account instructions page 1 of 8 1. Under warrants issued for the tax liens enrolled in the tax lien registry, any property, real or personal, within the state of mississippi is subject to. When homeowners don't pay their property taxes, the overdue amount becomes a lien on the property. The tax lien sale is held online beginning the last monday of august each year and runs until all delinquent parcels have been sold. Beginning january 1, 2015, the mississippi department of revenue (the “department”) began enrolling tax liens for. Visit the secretary of state’s website (www.sos.ms.gov), and click the.

Investing in Tax Lien Seminars and Courses

Visit the secretary of state’s website (www.sos.ms.gov), and click the. When homeowners don't pay their property taxes, the overdue amount becomes a lien on the property. Beginning january 1, 2015, the mississippi department of revenue (the “department”) began enrolling tax liens for. Under warrants issued for the tax liens enrolled in the tax lien registry, any property, real or personal,.

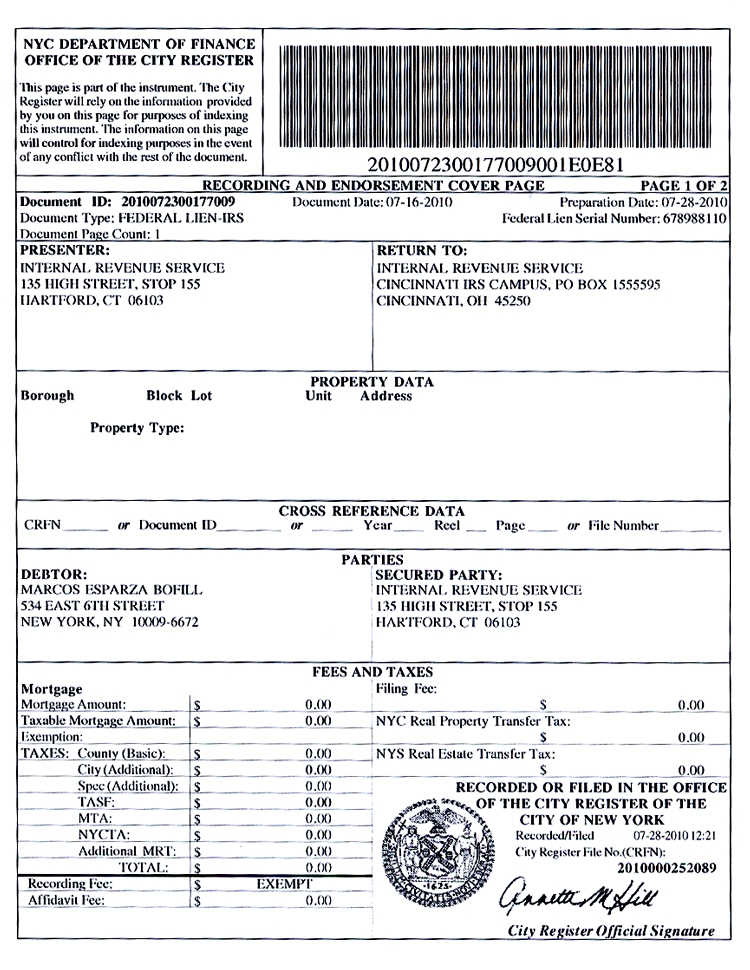

Understanding Notice of Federal Tax Lien and What to Do About It

Beginning january 1, 2015, the mississippi department of revenue (the “department”) began enrolling tax liens for. The tax lien sale is held online beginning the last monday of august each year and runs until all delinquent parcels have been sold. Under warrants issued for the tax liens enrolled in the tax lien registry, any property, real or personal, within the.

Tax Lien New York State Tax Lien

Under warrants issued for the tax liens enrolled in the tax lien registry, any property, real or personal, within the state of mississippi is subject to. Beginning january 1, 2015, the mississippi department of revenue (the “department”) began enrolling tax liens for. Tax forfeited property online account instructions page 1 of 8 1. When homeowners don't pay their property taxes,.

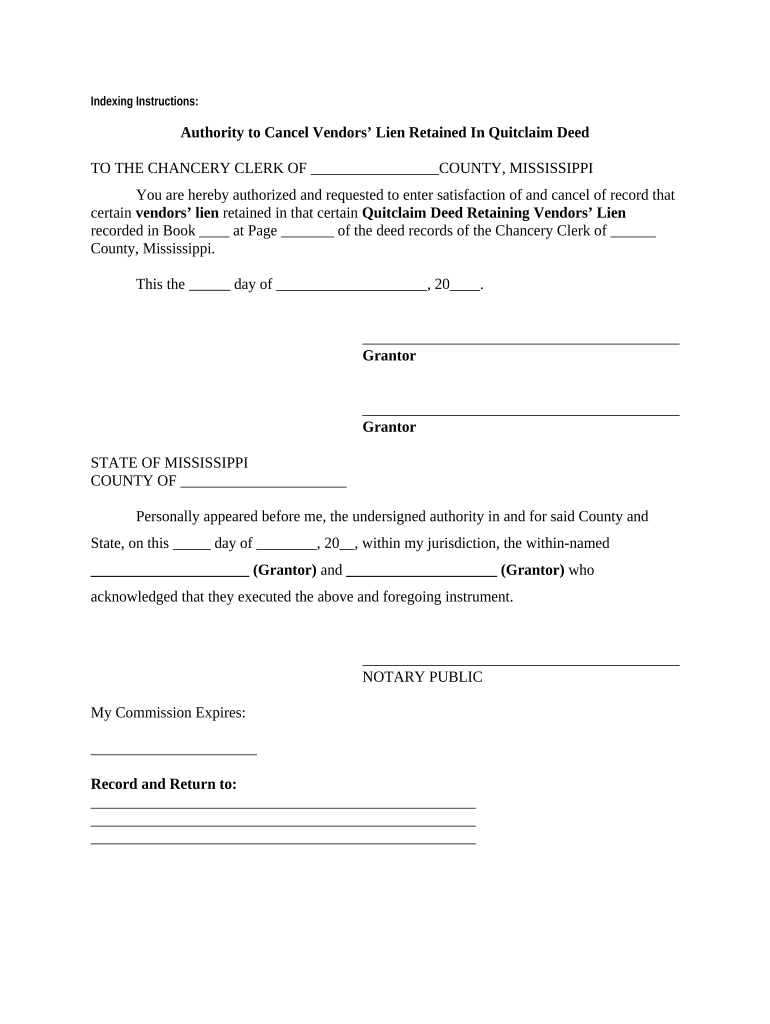

Tax Lien Mississippi State Tax Lien

Under warrants issued for the tax liens enrolled in the tax lien registry, any property, real or personal, within the state of mississippi is subject to. Visit the secretary of state’s website (www.sos.ms.gov), and click the. When homeowners don't pay their property taxes, the overdue amount becomes a lien on the property. Tax forfeited property online account instructions page 1.

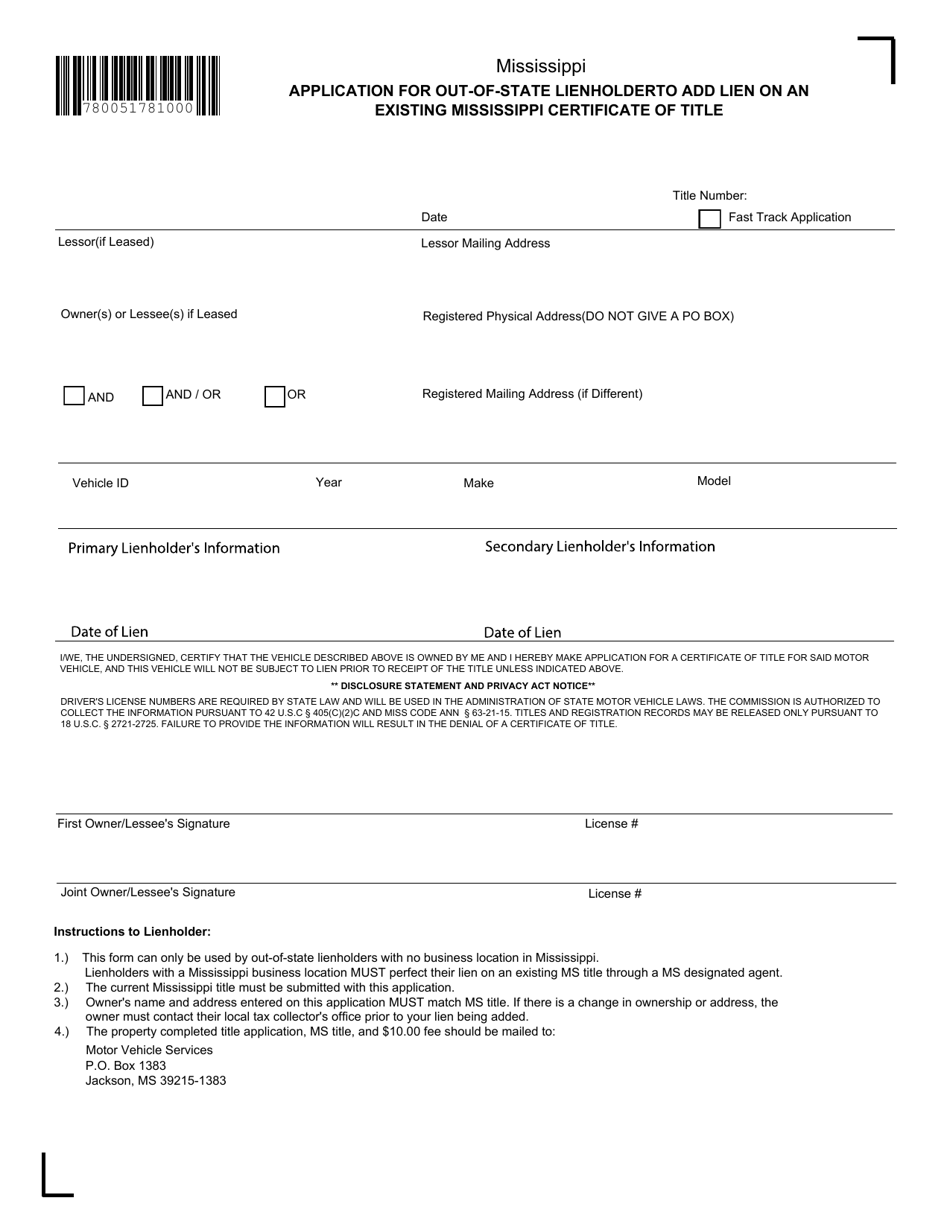

Mississippi Application for OutofState Lienholder to Add Lien on an

Beginning january 1, 2015, the mississippi department of revenue (the “department”) began enrolling tax liens for. Tax forfeited property online account instructions page 1 of 8 1. When homeowners don't pay their property taxes, the overdue amount becomes a lien on the property. Visit the secretary of state’s website (www.sos.ms.gov), and click the. Under warrants issued for the tax liens.

mississippi lien Doc Template pdfFiller

Tax forfeited property online account instructions page 1 of 8 1. When homeowners don't pay their property taxes, the overdue amount becomes a lien on the property. Under warrants issued for the tax liens enrolled in the tax lien registry, any property, real or personal, within the state of mississippi is subject to. The tax lien sale is held online.

How to File a Mississippi Mechanics Lien A StepbyStep Guide

The tax lien sale is held online beginning the last monday of august each year and runs until all delinquent parcels have been sold. Visit the secretary of state’s website (www.sos.ms.gov), and click the. When homeowners don't pay their property taxes, the overdue amount becomes a lien on the property. Beginning january 1, 2015, the mississippi department of revenue (the.

IRS Federal and State Tax Lien Help — Genesis Tax Consultants

Under warrants issued for the tax liens enrolled in the tax lien registry, any property, real or personal, within the state of mississippi is subject to. The tax lien sale is held online beginning the last monday of august each year and runs until all delinquent parcels have been sold. When homeowners don't pay their property taxes, the overdue amount.

Federal Tax Lien IRS Lien Call the best tax lawyer!

Under warrants issued for the tax liens enrolled in the tax lien registry, any property, real or personal, within the state of mississippi is subject to. The tax lien sale is held online beginning the last monday of august each year and runs until all delinquent parcels have been sold. Beginning january 1, 2015, the mississippi department of revenue (the.

Tips On Dealing With A State Tax Lien Legal News Letter

Under warrants issued for the tax liens enrolled in the tax lien registry, any property, real or personal, within the state of mississippi is subject to. When homeowners don't pay their property taxes, the overdue amount becomes a lien on the property. Visit the secretary of state’s website (www.sos.ms.gov), and click the. The tax lien sale is held online beginning.

Under Warrants Issued For The Tax Liens Enrolled In The Tax Lien Registry, Any Property, Real Or Personal, Within The State Of Mississippi Is Subject To.

Visit the secretary of state’s website (www.sos.ms.gov), and click the. Tax forfeited property online account instructions page 1 of 8 1. When homeowners don't pay their property taxes, the overdue amount becomes a lien on the property. The tax lien sale is held online beginning the last monday of august each year and runs until all delinquent parcels have been sold.