Notice Of Federal Tax Lien Search

Notice Of Federal Tax Lien Search - Notices of federal tax lien. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. If you don't pay your federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to identify a. Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the.

Notices of federal tax lien. If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to identify a. If you don't pay your federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure.

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. If you don't pay your federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt. Notices of federal tax lien. If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to identify a.

Understanding a Notice of Federal Tax Lien and What to Do About It

If you don't pay your federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt. If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to identify a. For general lien information, taxpayers may refer to the.

What Is A Notice of Federal Tax Lien? Casey Tax Law

If you don't pay your federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt. Notices of federal tax lien. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Notice of federal tax lien.

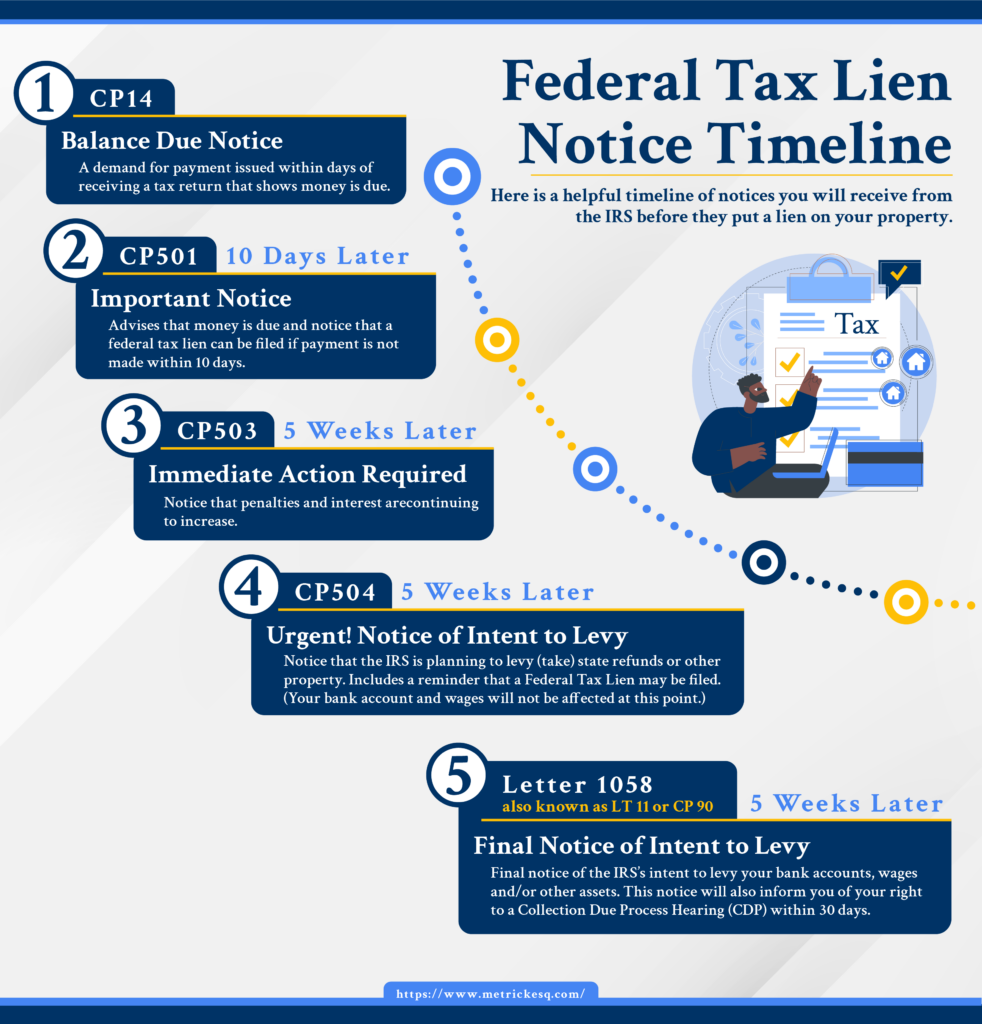

Federal Tax Lien Notice Timeline Ira J. Metrick, Esq.

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Notices of federal tax lien. If you don't pay your federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt. If you have missed irs.

Federal Tax Lien Release NFTL Release

If you don't pay your federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt. Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the. If you have missed irs notices or are unsure about your status,.

Federal tax lien on foreclosed property laderdriver

For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state.

Free Federal Tax Lien Search Enter Any Name To Begin

For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Notices of federal tax lien. If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to identify a. If a property owner fails to pay federal taxes, the irs files a.

IRS Notice Federal Tax Lien Colonial Tax Consultants

Notices of federal tax lien. If you don't pay your federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt. If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to identify a. Notice of federal tax.

IRS Notice Federal Tax Lien Colonial Tax Consultants

If you don't pay your federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with.

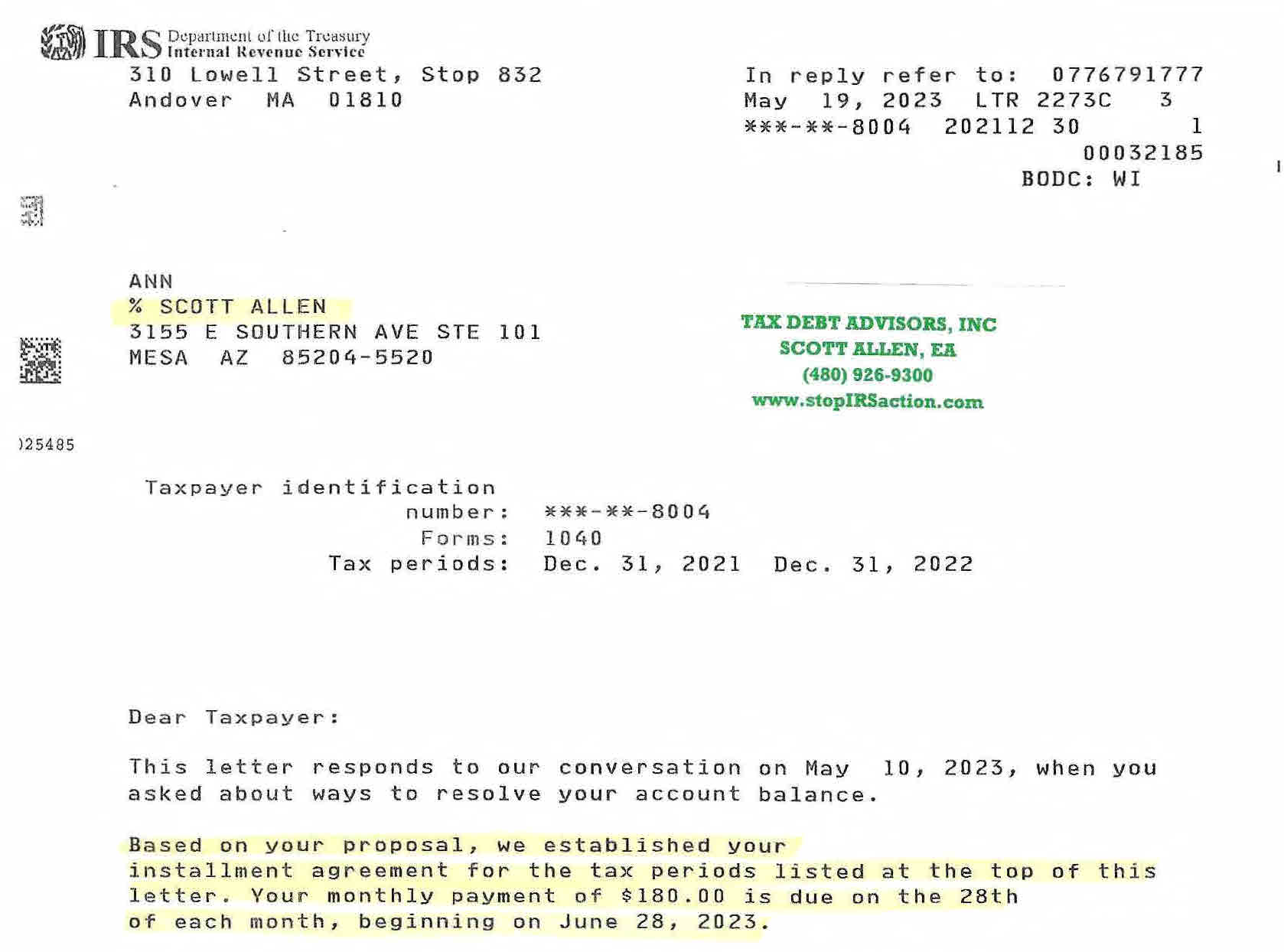

Mesa AZ Notice of Federal Tax lien? Tax Debt Advisors

Notices of federal tax lien. Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. If you don't pay your federal taxes, the irs files a notice of federal tax lien.

What is a Notice of Federal Tax Lien? Heartland Tax Solutions

If you don't pay your federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Notices of federal tax lien. If a property owner fails to pay federal taxes, the irs files a notice.

If You Have Missed Irs Notices Or Are Unsure About Your Status, There Are A Few Sources You Can Refer To In Order To Identify A.

If you don't pay your federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt. Notice of federal tax lien filed (in public records) document filed with the local recording office that identifies tax liabilities owed by the. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Notices of federal tax lien.