Nys Property Tax Relief Check 2023 Schedule

Nys Property Tax Relief Check 2023 Schedule - For tax years beginning on or after january 1, 2021, if you are eligible, you may claim the real property tax relief credit on your residence. The credit amount allowed is the excess real property tax on line 11 multiplied by the applicable rate you calculated on line 12. View property tax credit checks. Eligible homeowners received property tax relief credits in 2017, 2018, and 2019. Share sensitive information only on official, secure websites. If you itemize your deductions, see how to report your property tax credits. However, by law, the program expired after.

Share sensitive information only on official, secure websites. If you itemize your deductions, see how to report your property tax credits. For tax years beginning on or after january 1, 2021, if you are eligible, you may claim the real property tax relief credit on your residence. View property tax credit checks. The credit amount allowed is the excess real property tax on line 11 multiplied by the applicable rate you calculated on line 12. However, by law, the program expired after. Eligible homeowners received property tax relief credits in 2017, 2018, and 2019.

View property tax credit checks. However, by law, the program expired after. For tax years beginning on or after january 1, 2021, if you are eligible, you may claim the real property tax relief credit on your residence. If you itemize your deductions, see how to report your property tax credits. Eligible homeowners received property tax relief credits in 2017, 2018, and 2019. Share sensitive information only on official, secure websites. The credit amount allowed is the excess real property tax on line 11 multiplied by the applicable rate you calculated on line 12.

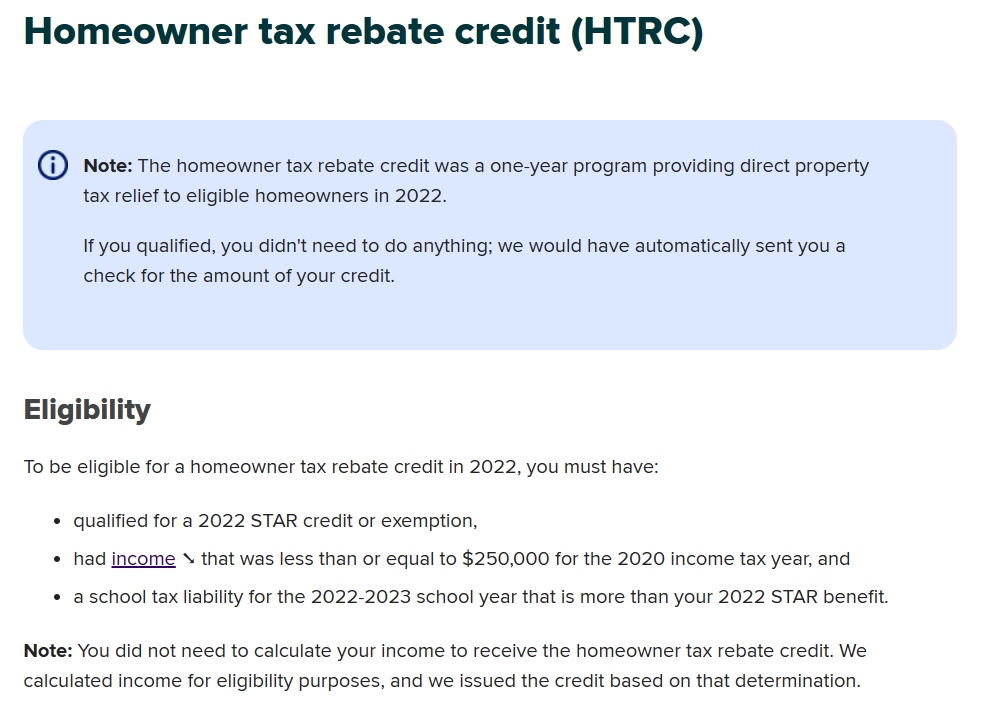

2023 Nys Property Tax Rebate Checks

However, by law, the program expired after. The credit amount allowed is the excess real property tax on line 11 multiplied by the applicable rate you calculated on line 12. View property tax credit checks. Eligible homeowners received property tax relief credits in 2017, 2018, and 2019. For tax years beginning on or after january 1, 2021, if you are.

Nys Property Tax Rebate Checks 2023 Eligibility & Application Process

The credit amount allowed is the excess real property tax on line 11 multiplied by the applicable rate you calculated on line 12. For tax years beginning on or after january 1, 2021, if you are eligible, you may claim the real property tax relief credit on your residence. If you itemize your deductions, see how to report your property.

NYS Property Tax Rebate 2023 Eligibility Criteria And Application

Share sensitive information only on official, secure websites. View property tax credit checks. For tax years beginning on or after january 1, 2021, if you are eligible, you may claim the real property tax relief credit on your residence. However, by law, the program expired after. The credit amount allowed is the excess real property tax on line 11 multiplied.

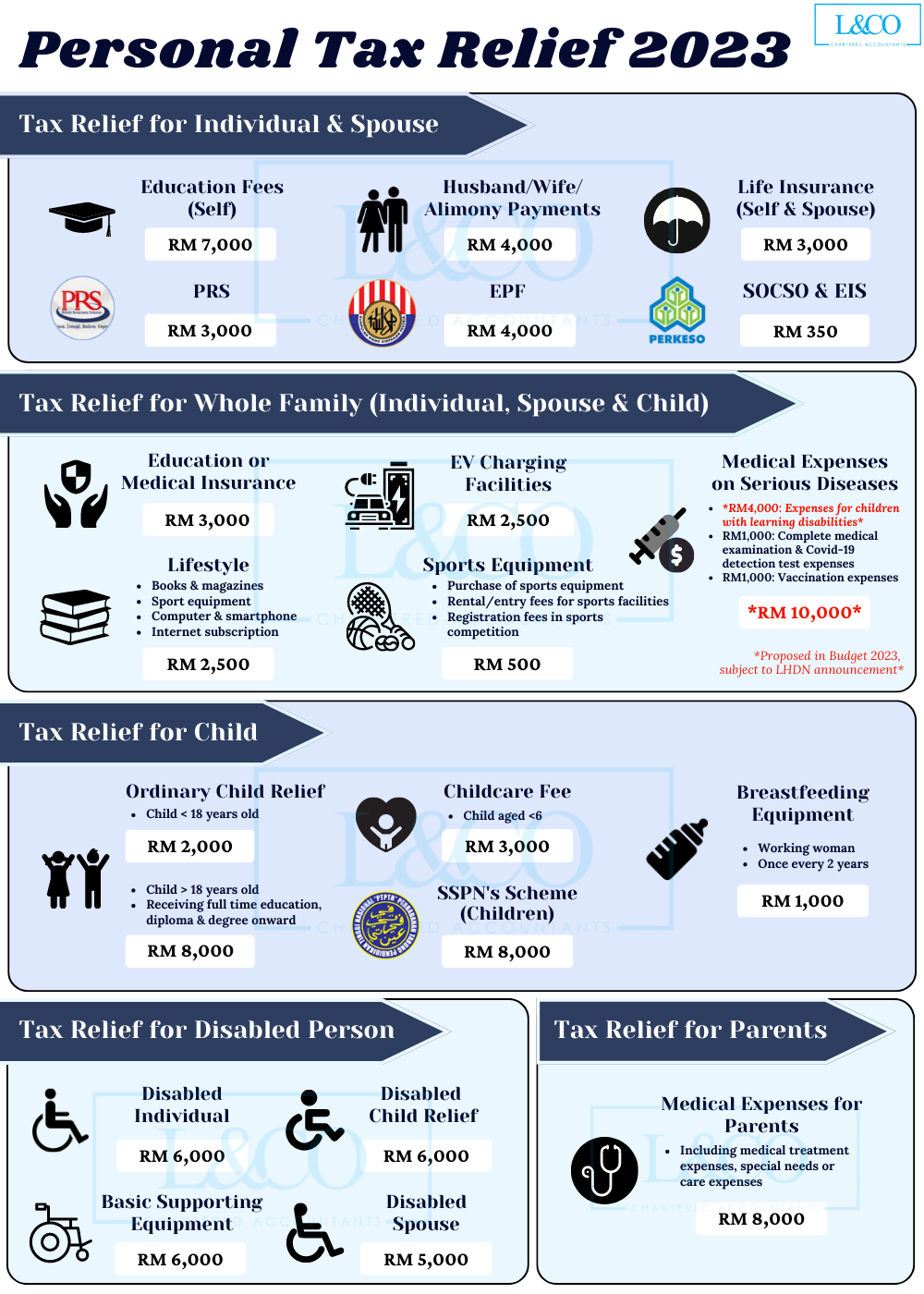

2023 Tax Relief oh 2023 Tax Relief KLSE malaysia

The credit amount allowed is the excess real property tax on line 11 multiplied by the applicable rate you calculated on line 12. If you itemize your deductions, see how to report your property tax credits. Share sensitive information only on official, secure websites. View property tax credit checks. However, by law, the program expired after.

Tax Relief 2023

Eligible homeowners received property tax relief credits in 2017, 2018, and 2019. The credit amount allowed is the excess real property tax on line 11 multiplied by the applicable rate you calculated on line 12. View property tax credit checks. For tax years beginning on or after january 1, 2021, if you are eligible, you may claim the real property.

Nys Tax Relief 2024 Randa Carolyne

Eligible homeowners received property tax relief credits in 2017, 2018, and 2019. View property tax credit checks. However, by law, the program expired after. The credit amount allowed is the excess real property tax on line 11 multiplied by the applicable rate you calculated on line 12. If you itemize your deductions, see how to report your property tax credits.

Personal Tax Relief Y.A. 2023 L & Co Accountants

For tax years beginning on or after january 1, 2021, if you are eligible, you may claim the real property tax relief credit on your residence. If you itemize your deductions, see how to report your property tax credits. View property tax credit checks. However, by law, the program expired after. The credit amount allowed is the excess real property.

New York Issued 2 1 Million Property Tax Rebate Checks In Late Summer

View property tax credit checks. For tax years beginning on or after january 1, 2021, if you are eligible, you may claim the real property tax relief credit on your residence. Eligible homeowners received property tax relief credits in 2017, 2018, and 2019. If you itemize your deductions, see how to report your property tax credits. However, by law, the.

Tax Relief For 2023

The credit amount allowed is the excess real property tax on line 11 multiplied by the applicable rate you calculated on line 12. Eligible homeowners received property tax relief credits in 2017, 2018, and 2019. If you itemize your deductions, see how to report your property tax credits. However, by law, the program expired after. For tax years beginning on.

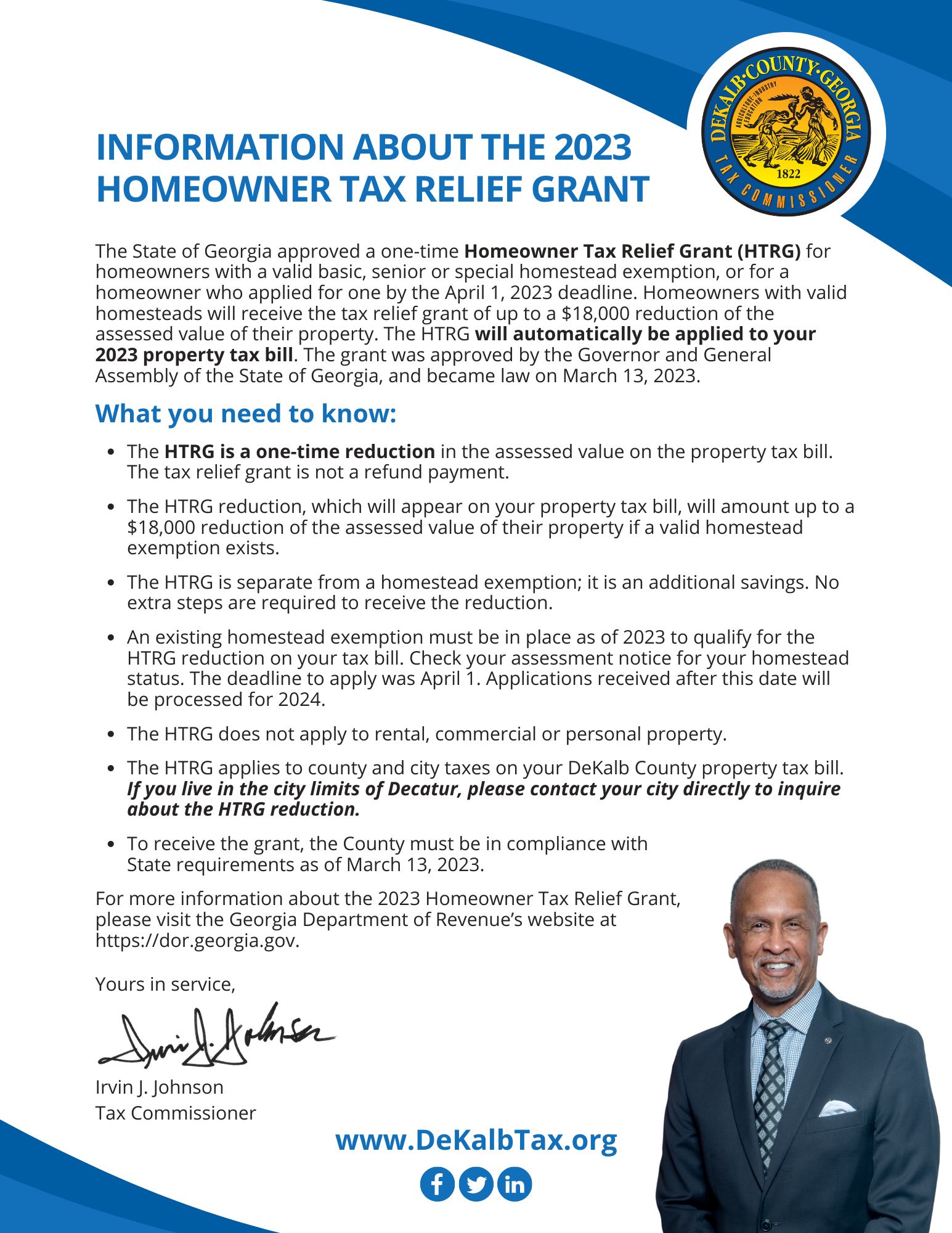

2023 Homeowner Tax Relief Grant DeKalb Tax Commissioner

View property tax credit checks. However, by law, the program expired after. For tax years beginning on or after january 1, 2021, if you are eligible, you may claim the real property tax relief credit on your residence. Eligible homeowners received property tax relief credits in 2017, 2018, and 2019. The credit amount allowed is the excess real property tax.

For Tax Years Beginning On Or After January 1, 2021, If You Are Eligible, You May Claim The Real Property Tax Relief Credit On Your Residence.

Share sensitive information only on official, secure websites. View property tax credit checks. However, by law, the program expired after. The credit amount allowed is the excess real property tax on line 11 multiplied by the applicable rate you calculated on line 12.

Eligible Homeowners Received Property Tax Relief Credits In 2017, 2018, And 2019.

If you itemize your deductions, see how to report your property tax credits.