Ohio State Withholding Form

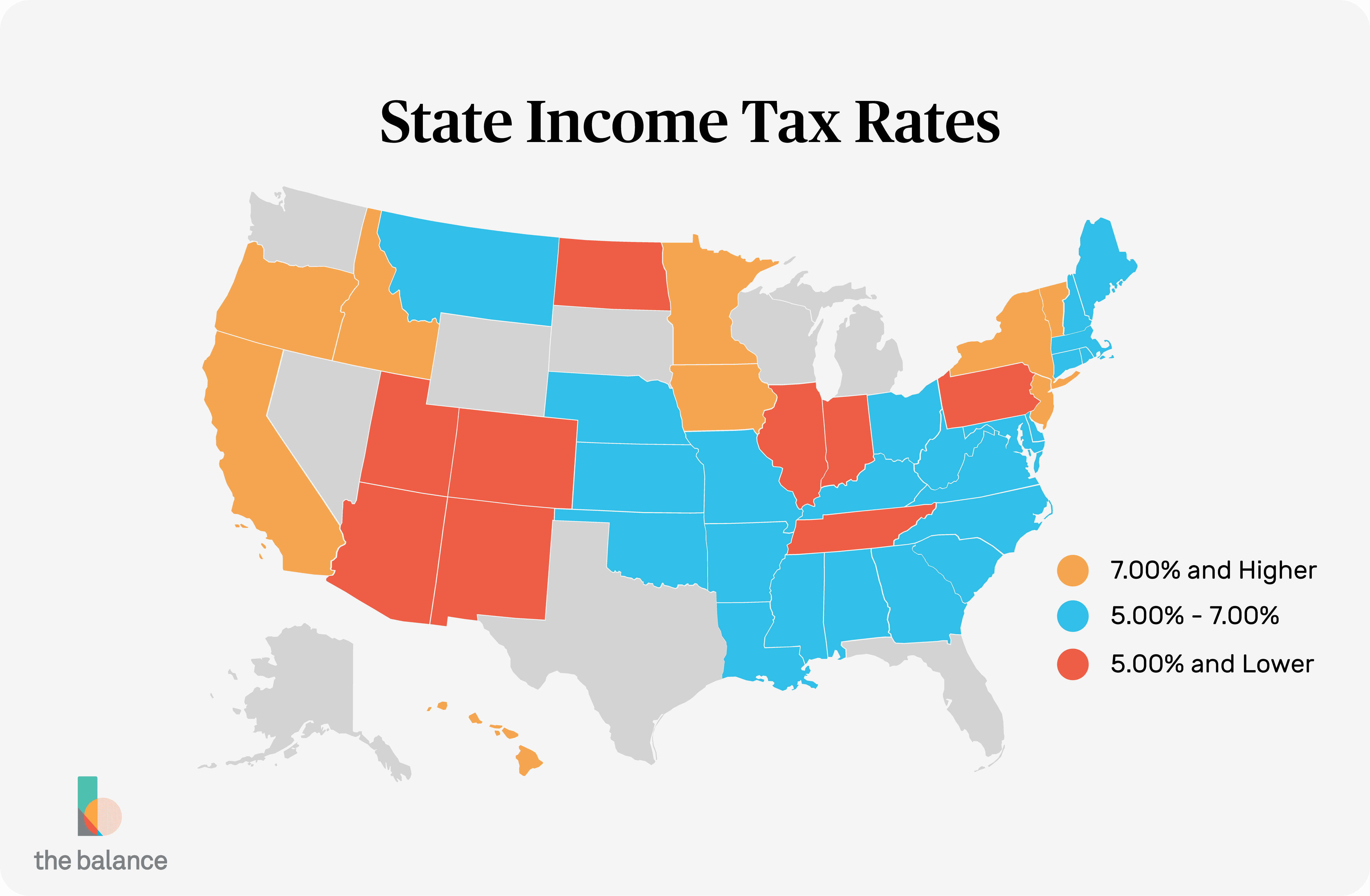

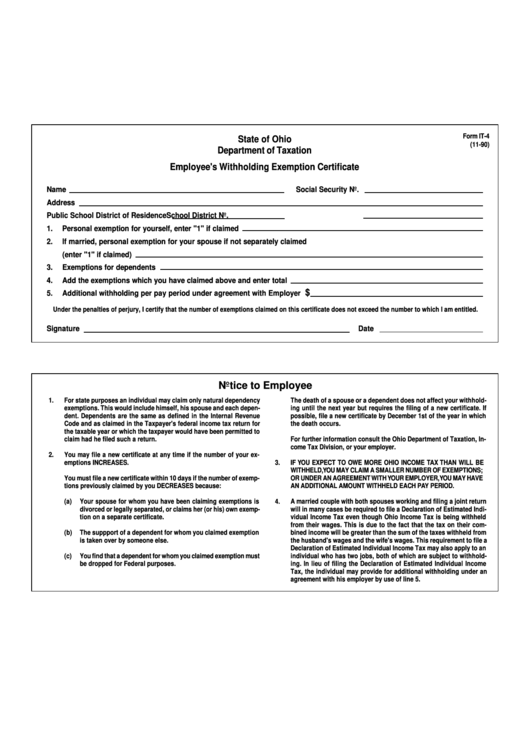

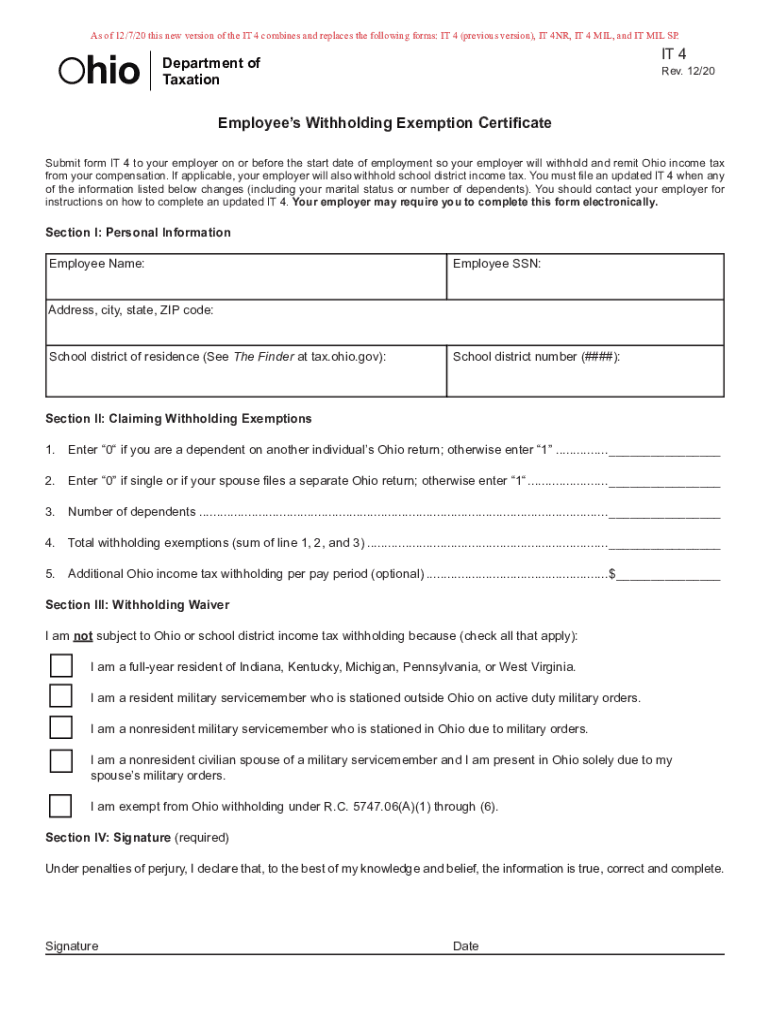

Ohio State Withholding Form - You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one. The department of taxation recently revised form it 4, employee’s withholding exemption certificate. The ohio department of taxation provides a searchable. Access the forms you need to file taxes or do business in ohio. Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. More details on employer withholding are available below. Each employee must complete an ohio form it 4, employee’s withholding exemption certificate, or the employer shall withhold tax from the. This updated form, or an electronic. The federation of tax administrators maintains. Request a state of ohio income tax form be mailed to you.

Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. This updated form, or an electronic. Each employee must complete an ohio form it 4, employee’s withholding exemption certificate, or the employer shall withhold tax from the. Archived tax forms (prior to 2006). Access the forms you need to file taxes or do business in ohio. The department of taxation recently revised form it 4, employee’s withholding exemption certificate. You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one. The ohio department of taxation provides a searchable. More details on employer withholding are available below. The federation of tax administrators maintains.

The ohio department of taxation provides a searchable. Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. The federation of tax administrators maintains. The department of taxation recently revised form it 4, employee’s withholding exemption certificate. Request a state of ohio income tax form be mailed to you. Each employee must complete an ohio form it 4, employee’s withholding exemption certificate, or the employer shall withhold tax from the. Access the forms you need to file taxes or do business in ohio. This updated form, or an electronic. You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one. Archived tax forms (prior to 2006).

State Of Ohio State Tax Withholding Form

The ohio department of taxation provides a searchable. Archived tax forms (prior to 2006). This updated form, or an electronic. The federation of tax administrators maintains. Request a state of ohio income tax form be mailed to you.

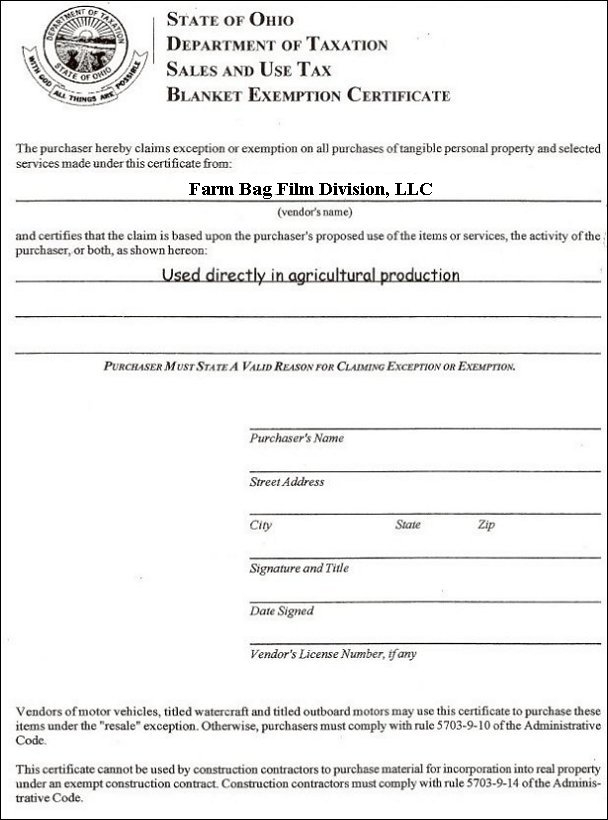

Top Ohio Withholding Form Templates free to download in PDF format

You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one. Archived tax forms (prior to 2006). The federation of tax administrators maintains. Each employee must complete an ohio form it 4, employee’s withholding exemption certificate, or the employer shall withhold tax from the. Ohio form it.

Ohio Tax Withholding Form 2023 Printable Forms Free Online

The department of taxation recently revised form it 4, employee’s withholding exemption certificate. Archived tax forms (prior to 2006). The federation of tax administrators maintains. You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one. More details on employer withholding are available below.

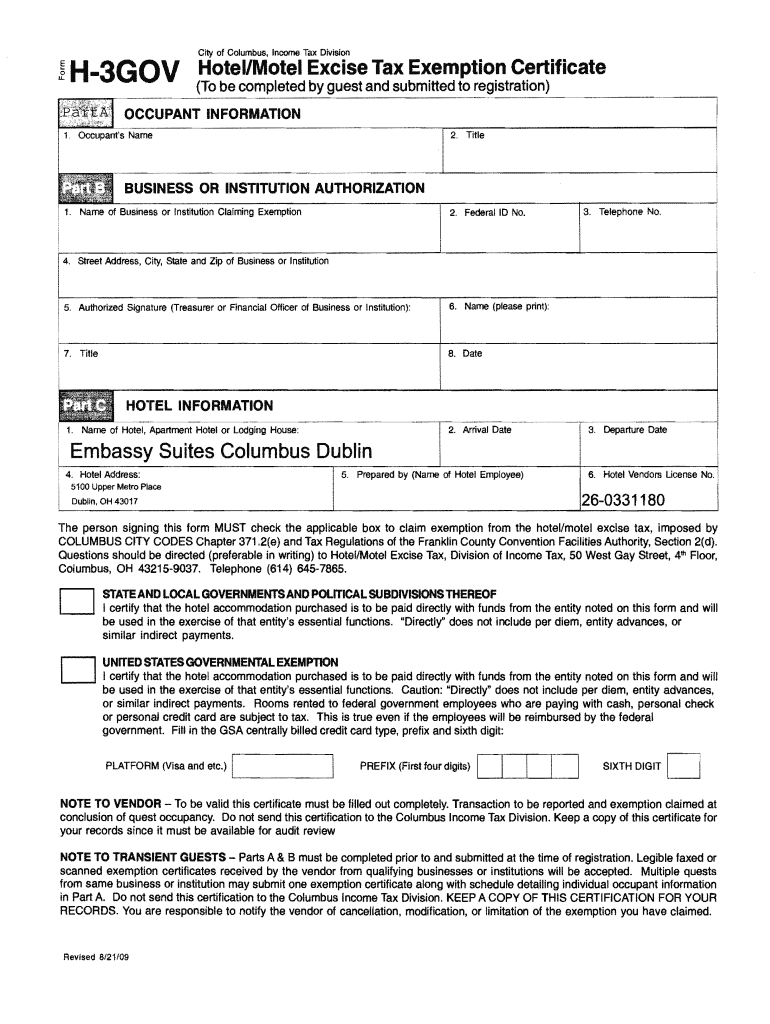

Online Ohio State Tax Withholding Form

Request a state of ohio income tax form be mailed to you. More details on employer withholding are available below. You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one. The department of taxation recently revised form it 4, employee’s withholding exemption certificate. Access the forms.

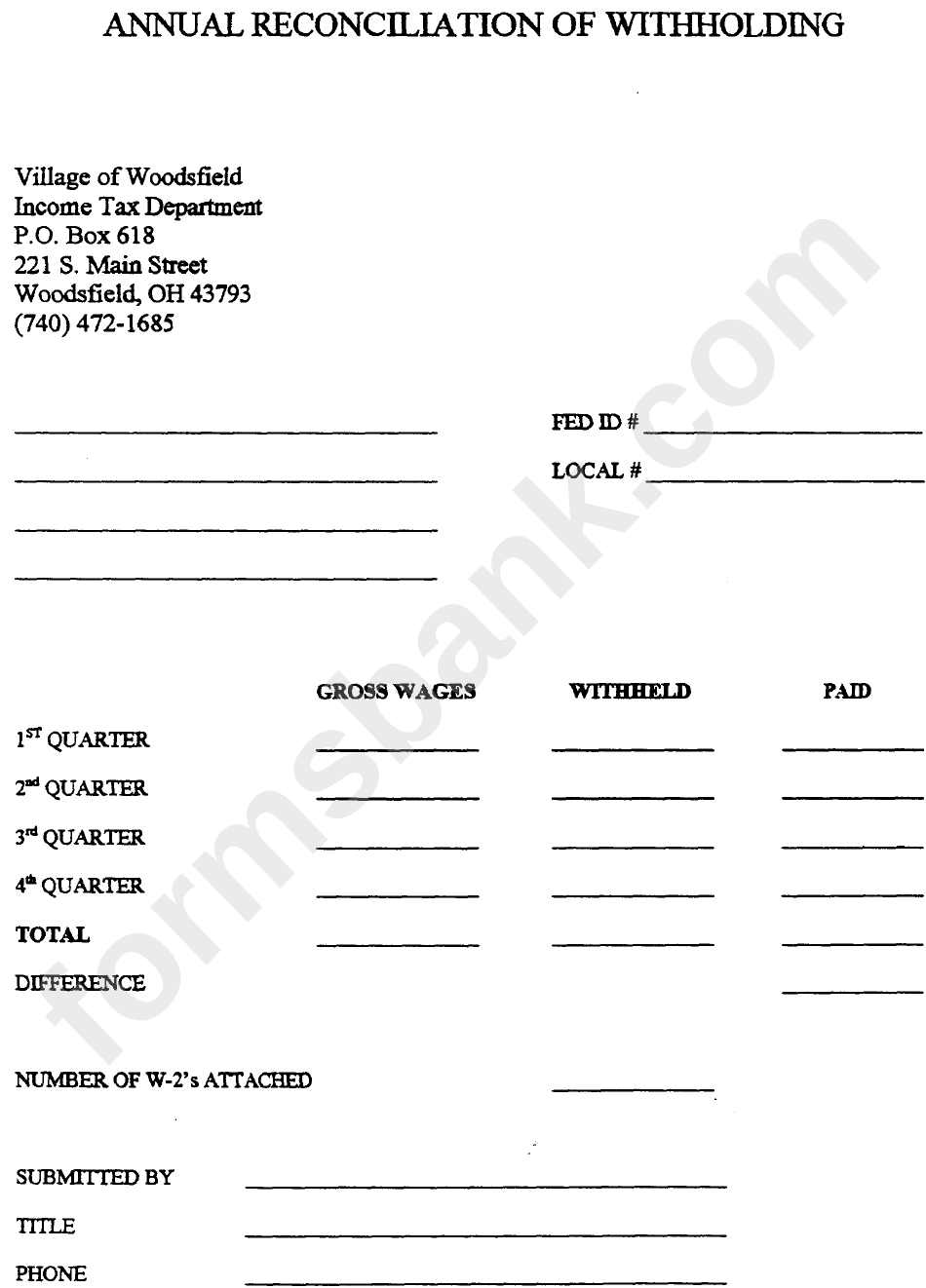

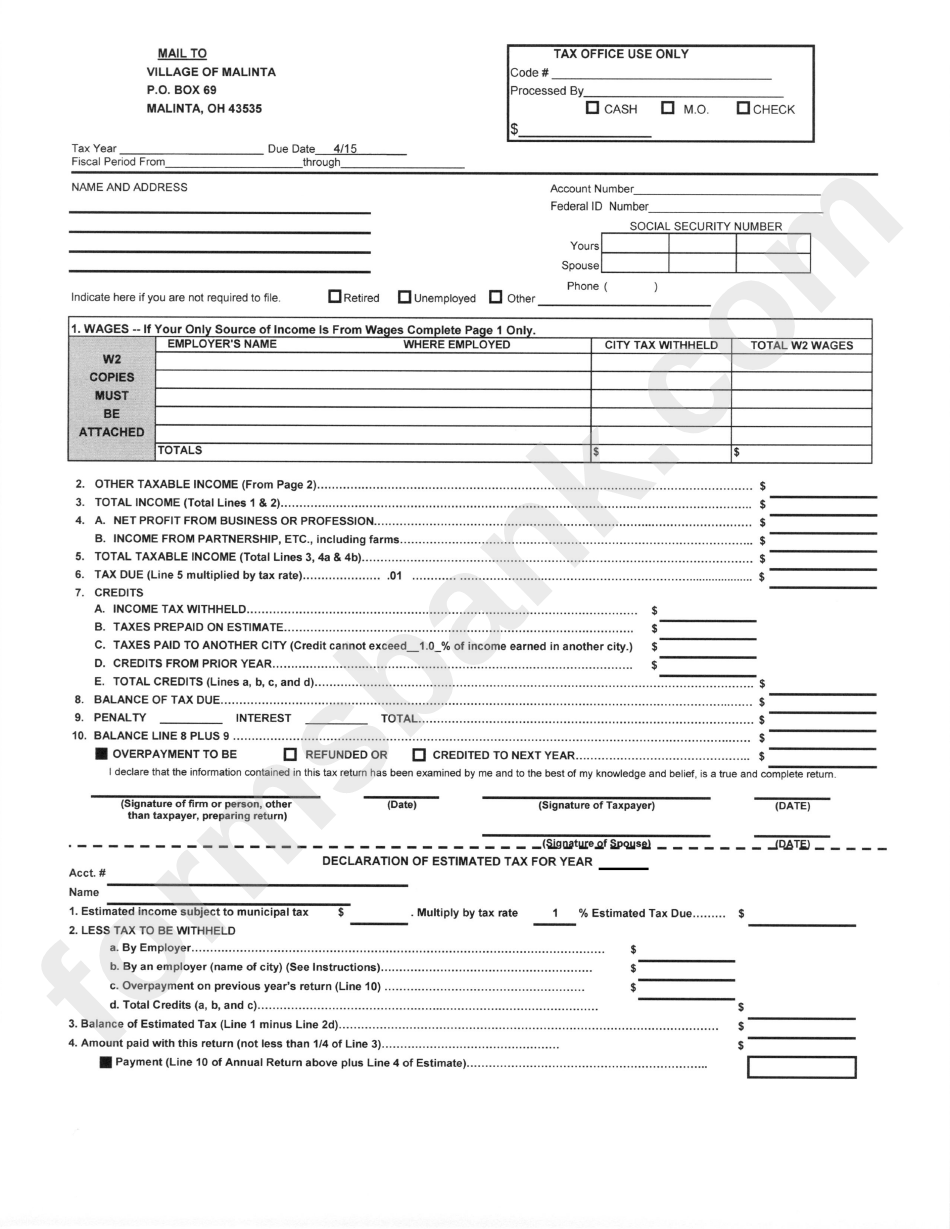

Annual Reconciliation Form Of Withholding State Of Ohio printable pdf

More details on employer withholding are available below. Each employee must complete an ohio form it 4, employee’s withholding exemption certificate, or the employer shall withhold tax from the. This updated form, or an electronic. Access the forms you need to file taxes or do business in ohio. Archived tax forms (prior to 2006).

Ohio Department Of Taxation Employee Withholding Form

Request a state of ohio income tax form be mailed to you. Archived tax forms (prior to 2006). Access the forms you need to file taxes or do business in ohio. The federation of tax administrators maintains. You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of.

Ohio State Tax Forms Printable Printable Form 2024

This updated form, or an electronic. The ohio department of taxation provides a searchable. Access the forms you need to file taxes or do business in ohio. Request a state of ohio income tax form be mailed to you. You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal.

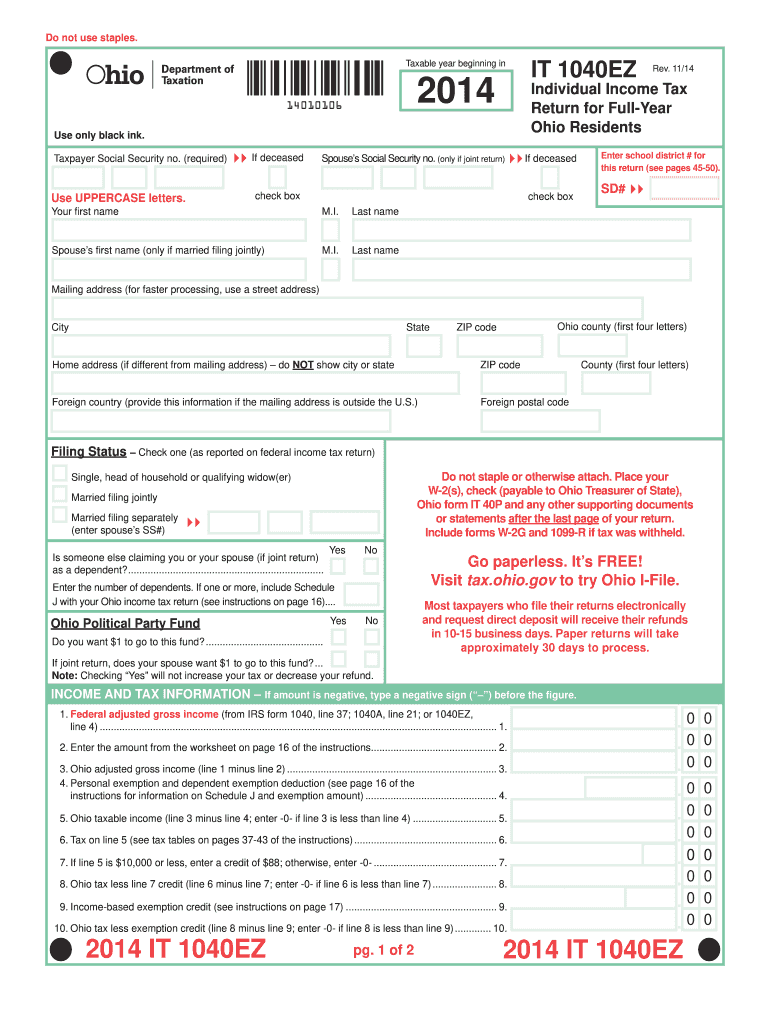

Ohio Tax 20142024 Form Fill Out and Sign Printable PDF Template

Archived tax forms (prior to 2006). Access the forms you need to file taxes or do business in ohio. This updated form, or an electronic. Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. Each employee must complete an ohio form it 4, employee’s withholding exemption certificate, or the employer.

Ohio State Withholding Form It 501

More details on employer withholding are available below. Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. Access the forms you need to file taxes or do business in ohio. Request a state of ohio income tax form be mailed to you. The federation of tax administrators maintains.

Ohio State Withholding Tax Form 2022

The federation of tax administrators maintains. More details on employer withholding are available below. The department of taxation recently revised form it 4, employee’s withholding exemption certificate. Each employee must complete an ohio form it 4, employee’s withholding exemption certificate, or the employer shall withhold tax from the. You must withhold ohio income tax from the compensation that the employee.

You Must Withhold Ohio Income Tax From The Compensation That The Employee Earned In Ohio, Unless The Employee Is A Legal Resident Of One.

Access the forms you need to file taxes or do business in ohio. This updated form, or an electronic. The ohio department of taxation provides a searchable. Request a state of ohio income tax form be mailed to you.

More Details On Employer Withholding Are Available Below.

Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. Each employee must complete an ohio form it 4, employee’s withholding exemption certificate, or the employer shall withhold tax from the. The department of taxation recently revised form it 4, employee’s withholding exemption certificate. The federation of tax administrators maintains.