Ohio Tax Withholding Form 2023

Ohio Tax Withholding Form 2023 - You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one. Get a form ohio business taxes obg login. Employers are required to electronically file and pay ohio employer and school district withholding taxes either through the gateway or through the. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. The ohio department of taxation provides a searchable. This form is used to report and withhold ohio income tax from wages, tips, other compensation, and reportable winnings. Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates. Access the forms you need to file taxes or do business in ohio. September 1, 2021 through october 31, 2023.

This form is used to report and withhold ohio income tax from wages, tips, other compensation, and reportable winnings. Access the forms you need to file taxes or do business in ohio. Get a form ohio business taxes obg login. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. The ohio department of taxation provides a searchable. Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates. September 1, 2021 through october 31, 2023. You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one. Employers are required to electronically file and pay ohio employer and school district withholding taxes either through the gateway or through the.

This form is used to report and withhold ohio income tax from wages, tips, other compensation, and reportable winnings. Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. Get a form ohio business taxes obg login. September 1, 2021 through october 31, 2023. You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one. The ohio department of taxation provides a searchable. Access the forms you need to file taxes or do business in ohio. Employers are required to electronically file and pay ohio employer and school district withholding taxes either through the gateway or through the.

Federal Withholding Tax Table 2024 Calculator Lola Sibbie

Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. Employers are required to electronically file and pay ohio employer and school district withholding taxes either through the gateway or through the. You must withhold ohio income tax from the compensation that the.

Ohio Estimated Tax Payments 2024 Due Dates And Times Elsie

September 1, 2021 through october 31, 2023. Employers are required to electronically file and pay ohio employer and school district withholding taxes either through the gateway or through the. This form is used to report and withhold ohio income tax from wages, tips, other compensation, and reportable winnings. Access the forms you need to file taxes or do business in.

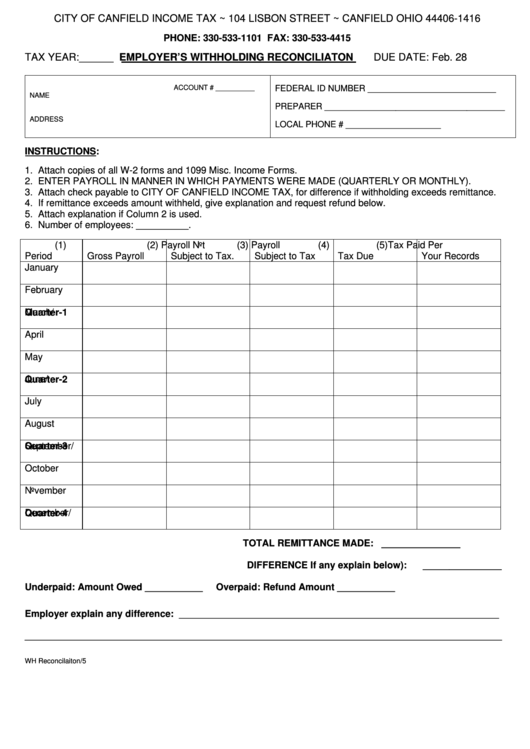

Ashtabula Ohio Tax Withholding Forms

You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one. September 1, 2021 through october 31, 2023. Access the forms you need to file taxes or do business in ohio. Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates..

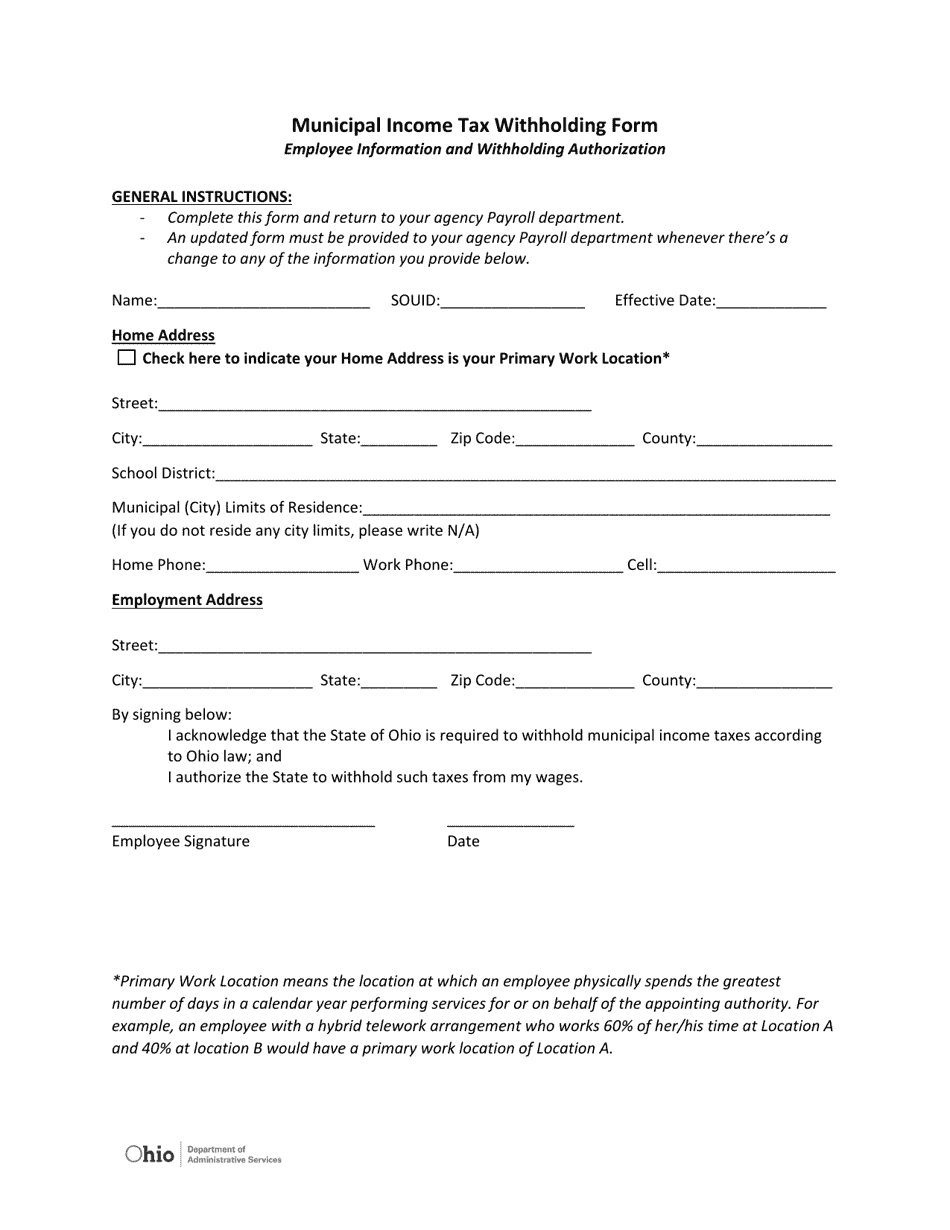

Ohio Municipal Tax Withholding Form Fill Out, Sign Online and

This form is used to report and withhold ohio income tax from wages, tips, other compensation, and reportable winnings. September 1, 2021 through october 31, 2023. Get a form ohio business taxes obg login. Access the forms you need to file taxes or do business in ohio. The ohio department of taxation provides a searchable.

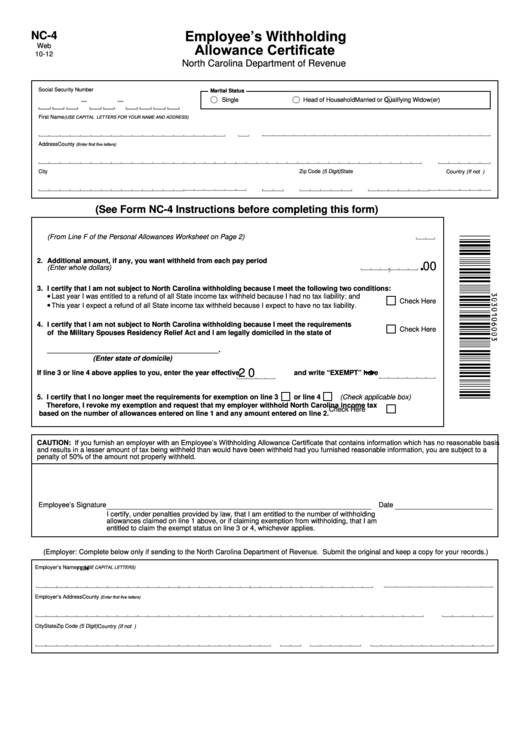

Ohio Department Of Taxation Employee Withholding Form

Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. The ohio department of taxation provides a searchable. Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates. Employers are required to electronically file and pay ohio.

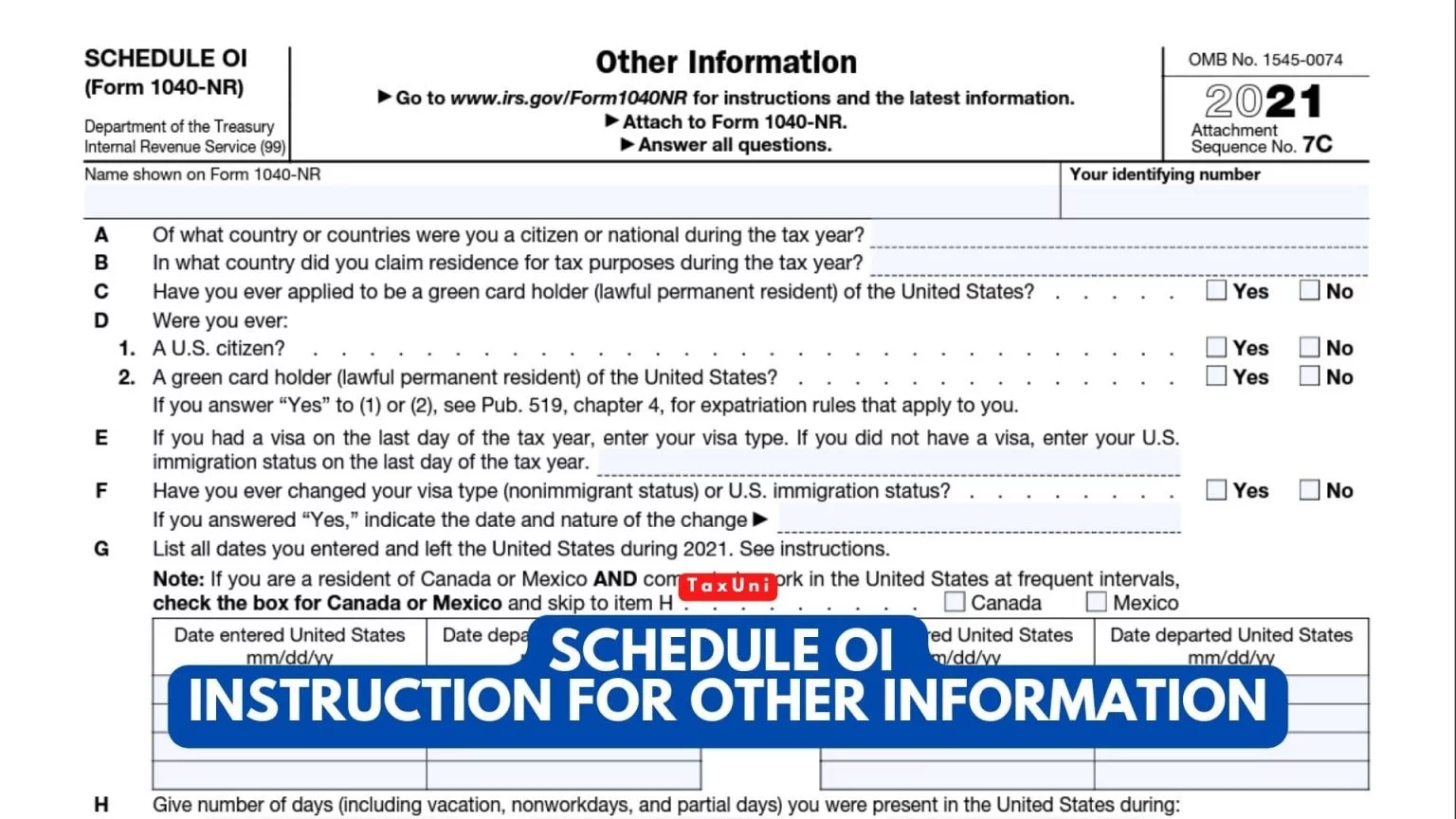

Online Ohio State Tax Withholding Form

Access the forms you need to file taxes or do business in ohio. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. Employers are required to electronically file and pay ohio employer and school district withholding taxes either through the gateway or.

Arizona State Tax Withholding Form 2024 Elyssa Terrye

September 1, 2021 through october 31, 2023. The ohio department of taxation provides a searchable. This form is used to report and withhold ohio income tax from wages, tips, other compensation, and reportable winnings. Access the forms you need to file taxes or do business in ohio. Submit form it 4 to your employer on or before the start date.

Ohio Employee Tax Withholding Form 2022 2023

Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates. You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one. Employers are required to electronically file and pay ohio employer and school district withholding taxes either through the gateway or.

Ohio Tax Booklet 2024 Dyna Natala

Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. This form is used to report and withhold ohio income tax from wages, tips, other compensation, and reportable winnings. Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023).

Ohio State Tax 2024 Cori Giulietta

You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one. Employers are required to electronically file and pay ohio employer and school district withholding taxes either through the gateway or through the. September 1, 2021 through october 31, 2023. Get a form ohio business taxes obg.

The Ohio Department Of Taxation Provides A Searchable.

You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one. This form is used to report and withhold ohio income tax from wages, tips, other compensation, and reportable winnings. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. Access the forms you need to file taxes or do business in ohio.

Get A Form Ohio Business Taxes Obg Login.

September 1, 2021 through october 31, 2023. Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates. Employers are required to electronically file and pay ohio employer and school district withholding taxes either through the gateway or through the.