Orlando Local Sales Tax Rate

Orlando Local Sales Tax Rate - The 6.5% sales tax rate in orlando consists of 6% florida state sales tax and 0.5% orange county sales tax. 725 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. There is no applicable city tax or. Click for sales tax rates, orlando sales tax calculator, and printable sales tax table from. The current sales tax rate in orlando, fl is 6.5%. The local sales tax rate in orange county is 0.5%, and the maximum rate (including florida and city sales taxes) is 7.5% as of january 2025. The orlando sales tax rate is 0%. Look up the current rate for a specific address using the same geolocation technology that powers the avalara. There are a total of 366.

The orlando sales tax rate is 0%. The current sales tax rate in orlando, fl is 6.5%. Click for sales tax rates, orlando sales tax calculator, and printable sales tax table from. There are a total of 366. Look up the current rate for a specific address using the same geolocation technology that powers the avalara. 725 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. The local sales tax rate in orange county is 0.5%, and the maximum rate (including florida and city sales taxes) is 7.5% as of january 2025. There is no applicable city tax or. The 6.5% sales tax rate in orlando consists of 6% florida state sales tax and 0.5% orange county sales tax.

The local sales tax rate in orange county is 0.5%, and the maximum rate (including florida and city sales taxes) is 7.5% as of january 2025. There are a total of 366. The orlando sales tax rate is 0%. The 6.5% sales tax rate in orlando consists of 6% florida state sales tax and 0.5% orange county sales tax. Look up the current rate for a specific address using the same geolocation technology that powers the avalara. The current sales tax rate in orlando, fl is 6.5%. There is no applicable city tax or. Click for sales tax rates, orlando sales tax calculator, and printable sales tax table from. 725 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%.

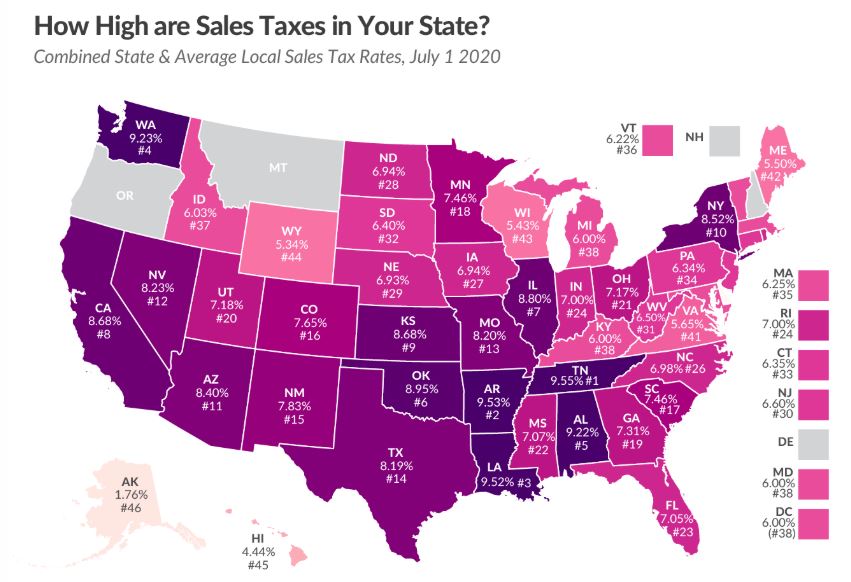

Louisiana has nation’s highest combined state and local sales tax rate

The orlando sales tax rate is 0%. The 6.5% sales tax rate in orlando consists of 6% florida state sales tax and 0.5% orange county sales tax. 725 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. The current sales tax rate in orlando, fl is.

Kansas has 9th highest state and local sales tax rate The Sentinel

The local sales tax rate in orange county is 0.5%, and the maximum rate (including florida and city sales taxes) is 7.5% as of january 2025. There is no applicable city tax or. The current sales tax rate in orlando, fl is 6.5%. There are a total of 366. The orlando sales tax rate is 0%.

NY Sales Tax Chart

The current sales tax rate in orlando, fl is 6.5%. The local sales tax rate in orange county is 0.5%, and the maximum rate (including florida and city sales taxes) is 7.5% as of january 2025. Click for sales tax rates, orlando sales tax calculator, and printable sales tax table from. 725 rows florida has state sales tax of 6%,.

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas

Look up the current rate for a specific address using the same geolocation technology that powers the avalara. 725 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. Click for sales tax rates, orlando sales tax calculator, and printable sales tax table from. The orlando sales.

Nebraska Sales Tax Rate Finder

Click for sales tax rates, orlando sales tax calculator, and printable sales tax table from. There is no applicable city tax or. There are a total of 366. The 6.5% sales tax rate in orlando consists of 6% florida state sales tax and 0.5% orange county sales tax. The orlando sales tax rate is 0%.

Midwest State and Sales Tax Rates Iowans for Tax Relief

725 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. The local sales tax rate in orange county is 0.5%, and the maximum rate (including florida and city sales taxes) is 7.5% as of january 2025. Look up the current rate for a specific address using.

Sales Tax Rate Chart 2012 Rating Log

The local sales tax rate in orange county is 0.5%, and the maximum rate (including florida and city sales taxes) is 7.5% as of january 2025. There is no applicable city tax or. Click for sales tax rates, orlando sales tax calculator, and printable sales tax table from. The current sales tax rate in orlando, fl is 6.5%. Look up.

Washington's combined statelocal sales tax rate ranks 5th in the

There is no applicable city tax or. 725 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. There are a total of 366. The current sales tax rate in orlando, fl is 6.5%. Look up the current rate for a specific address using the same geolocation.

Record Taxable Sales with GST

725 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. The 6.5% sales tax rate in orlando consists of 6% florida state sales tax and 0.5% orange county sales tax. There are a total of 366. The local sales tax rate in orange county is 0.5%,.

Combined State and Average Local Sales Tax Rates Tax Foundation

The current sales tax rate in orlando, fl is 6.5%. There are a total of 366. 725 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. The orlando sales tax rate is 0%. Look up the current rate for a specific address using the same geolocation.

The 6.5% Sales Tax Rate In Orlando Consists Of 6% Florida State Sales Tax And 0.5% Orange County Sales Tax.

There is no applicable city tax or. 725 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. The orlando sales tax rate is 0%. The local sales tax rate in orange county is 0.5%, and the maximum rate (including florida and city sales taxes) is 7.5% as of january 2025.

There Are A Total Of 366.

Look up the current rate for a specific address using the same geolocation technology that powers the avalara. The current sales tax rate in orlando, fl is 6.5%. Click for sales tax rates, orlando sales tax calculator, and printable sales tax table from.

.png)