Property Tax Exemption California Form

Property Tax Exemption California Form - A person filing for the first time on a. Obtain the claim form from the county assessor’s office where the property. California property tax laws provide two alternatives by which the homeowners’ exemption, up to a maximum of $7,000 of assessed value, may be. Obtain forms from either the county assessor or the clerk of the board in the county where the property is located).

Obtain forms from either the county assessor or the clerk of the board in the county where the property is located). A person filing for the first time on a. Obtain the claim form from the county assessor’s office where the property. California property tax laws provide two alternatives by which the homeowners’ exemption, up to a maximum of $7,000 of assessed value, may be.

California property tax laws provide two alternatives by which the homeowners’ exemption, up to a maximum of $7,000 of assessed value, may be. A person filing for the first time on a. Obtain forms from either the county assessor or the clerk of the board in the county where the property is located). Obtain the claim form from the county assessor’s office where the property.

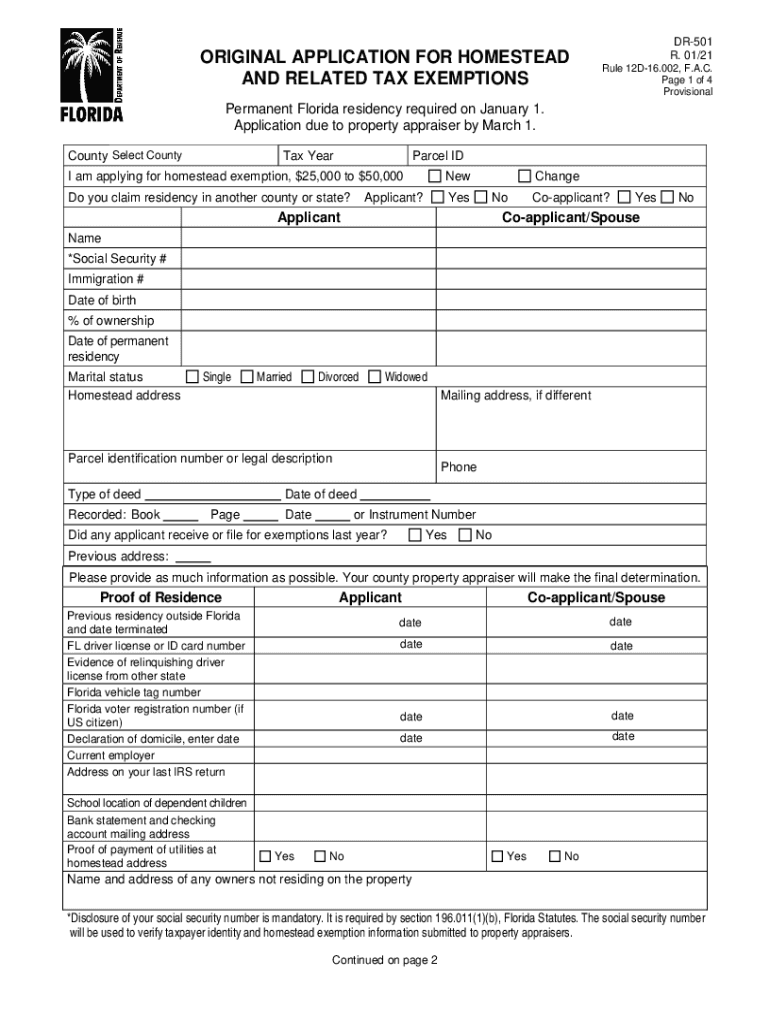

Homestead Exemption Florida Deadline 20212024 Form Fill Out and Sign

California property tax laws provide two alternatives by which the homeowners’ exemption, up to a maximum of $7,000 of assessed value, may be. Obtain forms from either the county assessor or the clerk of the board in the county where the property is located). Obtain the claim form from the county assessor’s office where the property. A person filing for.

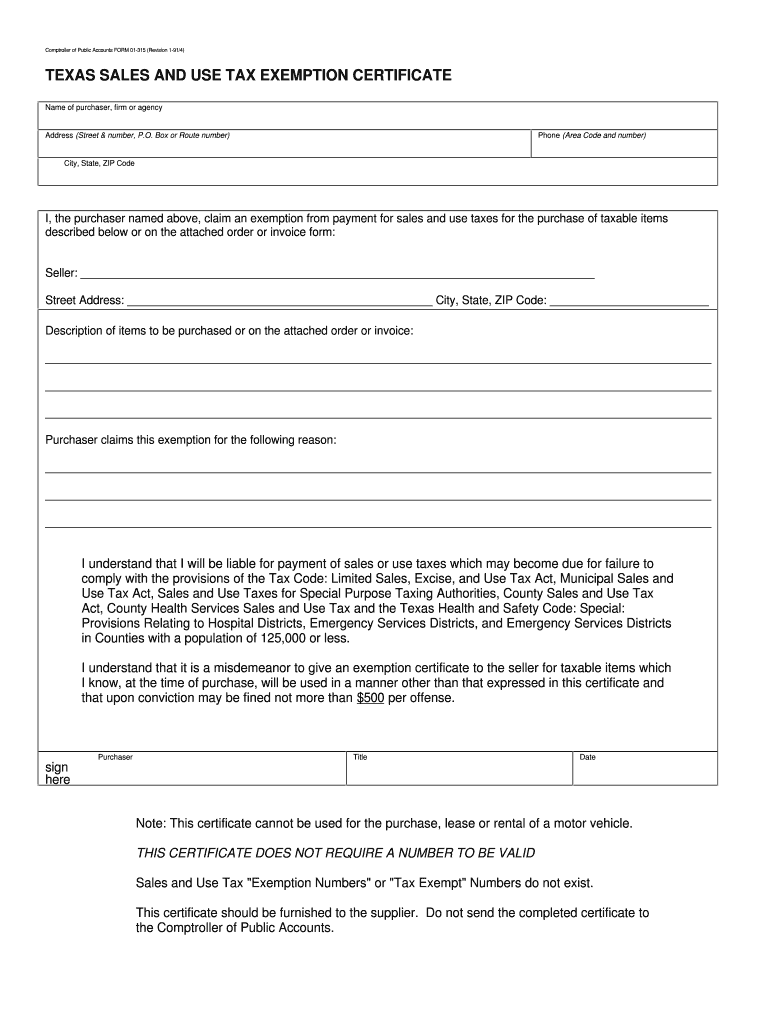

Texas Fillable Tax Exemption Form Fill Out And Sign Printable PDF

A person filing for the first time on a. Obtain forms from either the county assessor or the clerk of the board in the county where the property is located). Obtain the claim form from the county assessor’s office where the property. California property tax laws provide two alternatives by which the homeowners’ exemption, up to a maximum of $7,000.

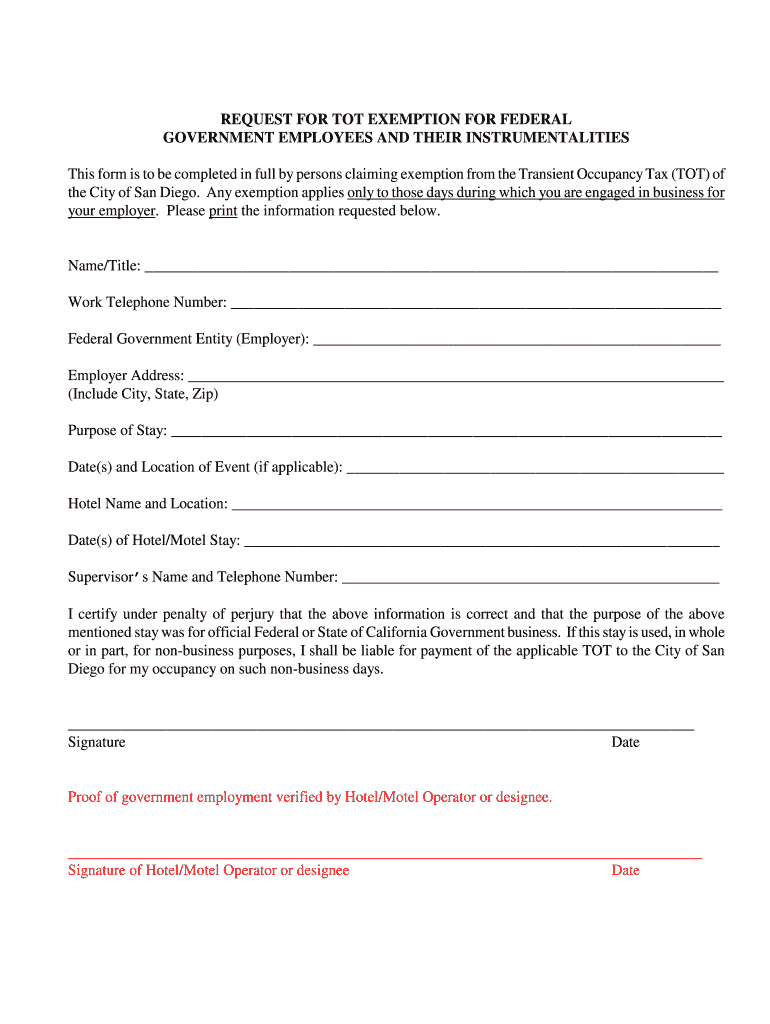

FREE 10 Sample Tax Exemption Forms In PDF

California property tax laws provide two alternatives by which the homeowners’ exemption, up to a maximum of $7,000 of assessed value, may be. Obtain the claim form from the county assessor’s office where the property. A person filing for the first time on a. Obtain forms from either the county assessor or the clerk of the board in the county.

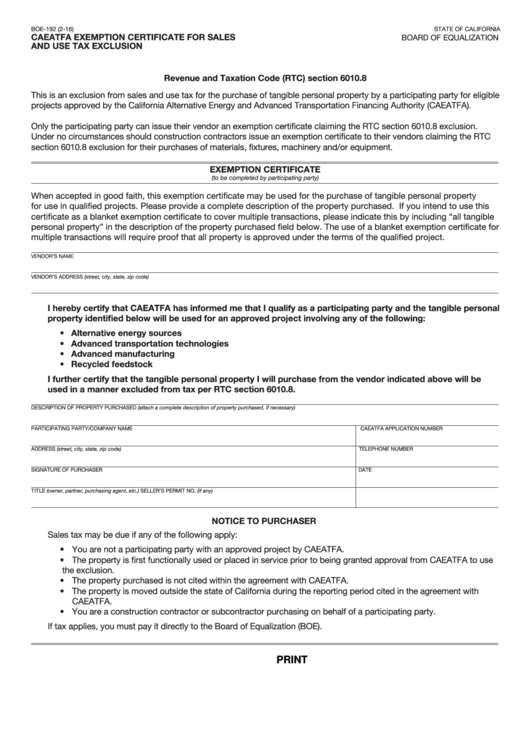

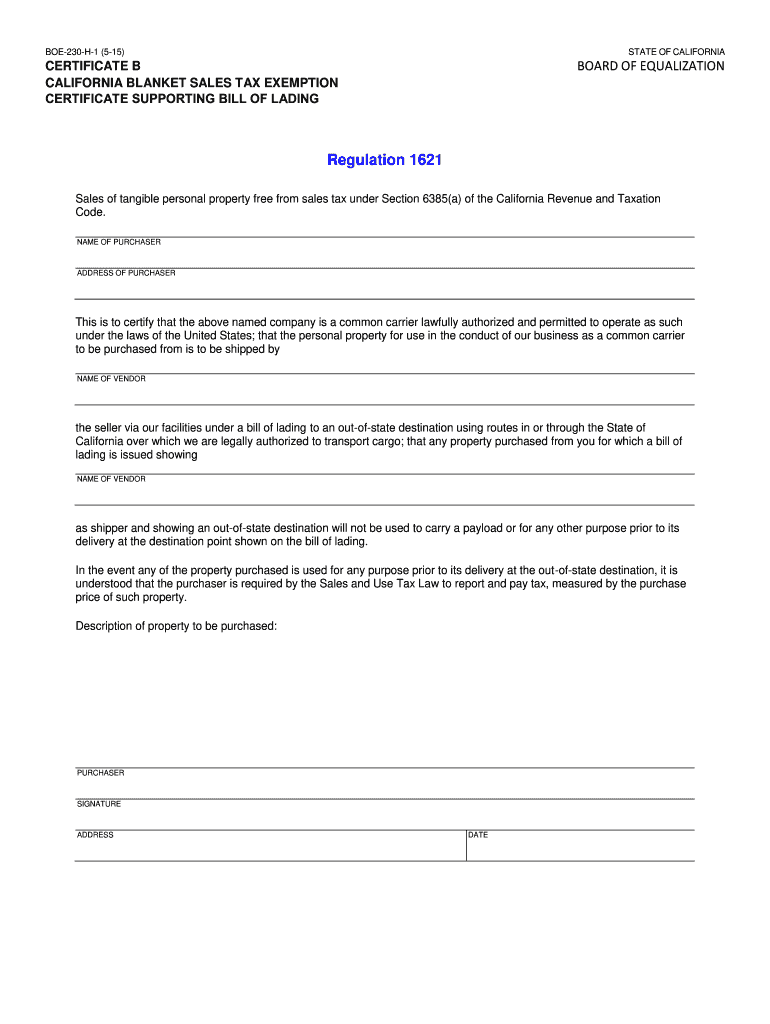

Sales And Use Tax Exemption Form California

Obtain the claim form from the county assessor’s office where the property. A person filing for the first time on a. Obtain forms from either the county assessor or the clerk of the board in the county where the property is located). California property tax laws provide two alternatives by which the homeowners’ exemption, up to a maximum of $7,000.

Senior Citizen Property Tax Exemption California Form Riverside County

California property tax laws provide two alternatives by which the homeowners’ exemption, up to a maximum of $7,000 of assessed value, may be. Obtain forms from either the county assessor or the clerk of the board in the county where the property is located). A person filing for the first time on a. Obtain the claim form from the county.

How To Fill Out A Texas Franchise Tax Form

Obtain the claim form from the county assessor’s office where the property. A person filing for the first time on a. Obtain forms from either the county assessor or the clerk of the board in the county where the property is located). California property tax laws provide two alternatives by which the homeowners’ exemption, up to a maximum of $7,000.

California ag tax exemption form Fill out & sign online DocHub

California property tax laws provide two alternatives by which the homeowners’ exemption, up to a maximum of $7,000 of assessed value, may be. A person filing for the first time on a. Obtain the claim form from the county assessor’s office where the property. Obtain forms from either the county assessor or the clerk of the board in the county.

HomeOwners Exemption Form Homeowner Property Tax San Diego County

Obtain forms from either the county assessor or the clerk of the board in the county where the property is located). California property tax laws provide two alternatives by which the homeowners’ exemption, up to a maximum of $7,000 of assessed value, may be. A person filing for the first time on a. Obtain the claim form from the county.

Property Tax Exemption California r/VeteransBenefits

Obtain forms from either the county assessor or the clerk of the board in the county where the property is located). Obtain the claim form from the county assessor’s office where the property. A person filing for the first time on a. California property tax laws provide two alternatives by which the homeowners’ exemption, up to a maximum of $7,000.

California Taxexempt Form 2023

A person filing for the first time on a. Obtain forms from either the county assessor or the clerk of the board in the county where the property is located). Obtain the claim form from the county assessor’s office where the property. California property tax laws provide two alternatives by which the homeowners’ exemption, up to a maximum of $7,000.

A Person Filing For The First Time On A.

California property tax laws provide two alternatives by which the homeowners’ exemption, up to a maximum of $7,000 of assessed value, may be. Obtain the claim form from the county assessor’s office where the property. Obtain forms from either the county assessor or the clerk of the board in the county where the property is located).