Release Of Lien Of Estate Tax

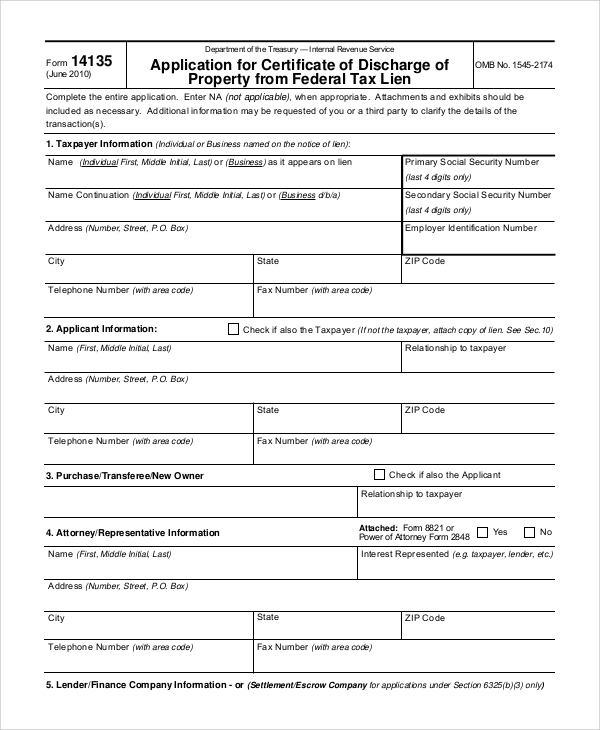

Release Of Lien Of Estate Tax - To obtain a federal estate tax release of lien where the lien has been recorded, use a form 4422, application for certificate discharging. Before you sell real property of a deceased person’s estate, you may need the irs to remove or discharge that property from an. An executor, beneficiary, or purchaser can apply for a discharge of property from estate tax lien if an estate is required to file form 706 or form. In june 2016, practitioners began to report that without notice, and with limited written guidance, the irs had begun imposing additional. If an estate is subject to federal estate tax and the executors are preparing to close a sale of real estate held by the estate,.

In june 2016, practitioners began to report that without notice, and with limited written guidance, the irs had begun imposing additional. An executor, beneficiary, or purchaser can apply for a discharge of property from estate tax lien if an estate is required to file form 706 or form. Before you sell real property of a deceased person’s estate, you may need the irs to remove or discharge that property from an. If an estate is subject to federal estate tax and the executors are preparing to close a sale of real estate held by the estate,. To obtain a federal estate tax release of lien where the lien has been recorded, use a form 4422, application for certificate discharging.

An executor, beneficiary, or purchaser can apply for a discharge of property from estate tax lien if an estate is required to file form 706 or form. If an estate is subject to federal estate tax and the executors are preparing to close a sale of real estate held by the estate,. In june 2016, practitioners began to report that without notice, and with limited written guidance, the irs had begun imposing additional. Before you sell real property of a deceased person’s estate, you may need the irs to remove or discharge that property from an. To obtain a federal estate tax release of lien where the lien has been recorded, use a form 4422, application for certificate discharging.

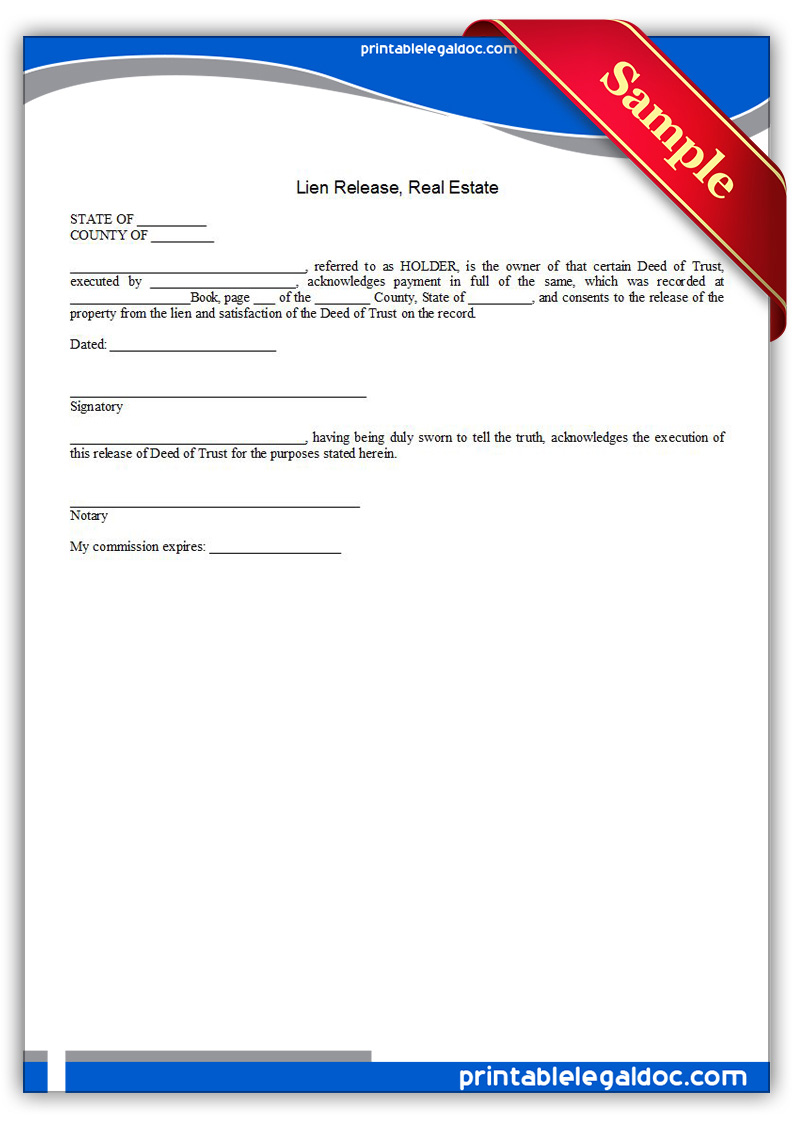

Free Printable Lien Release, Real Estate Form (GENERIC)

An executor, beneficiary, or purchaser can apply for a discharge of property from estate tax lien if an estate is required to file form 706 or form. To obtain a federal estate tax release of lien where the lien has been recorded, use a form 4422, application for certificate discharging. In june 2016, practitioners began to report that without notice,.

What is a property Tax Lien? Real Estate Articles by

An executor, beneficiary, or purchaser can apply for a discharge of property from estate tax lien if an estate is required to file form 706 or form. In june 2016, practitioners began to report that without notice, and with limited written guidance, the irs had begun imposing additional. If an estate is subject to federal estate tax and the executors.

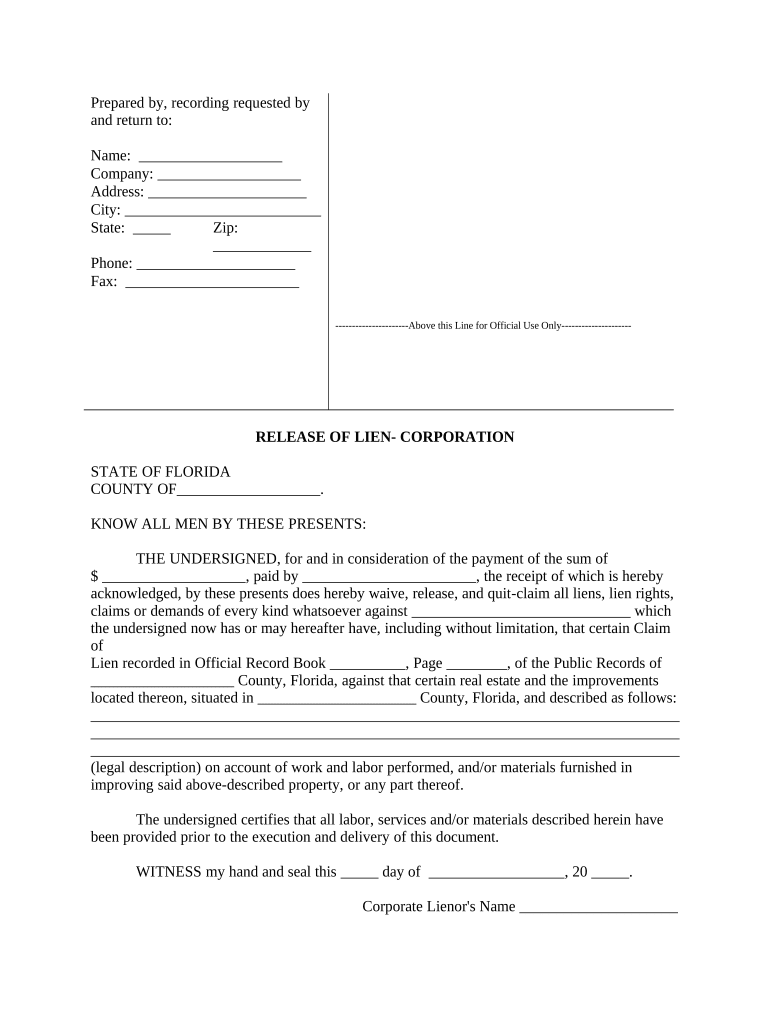

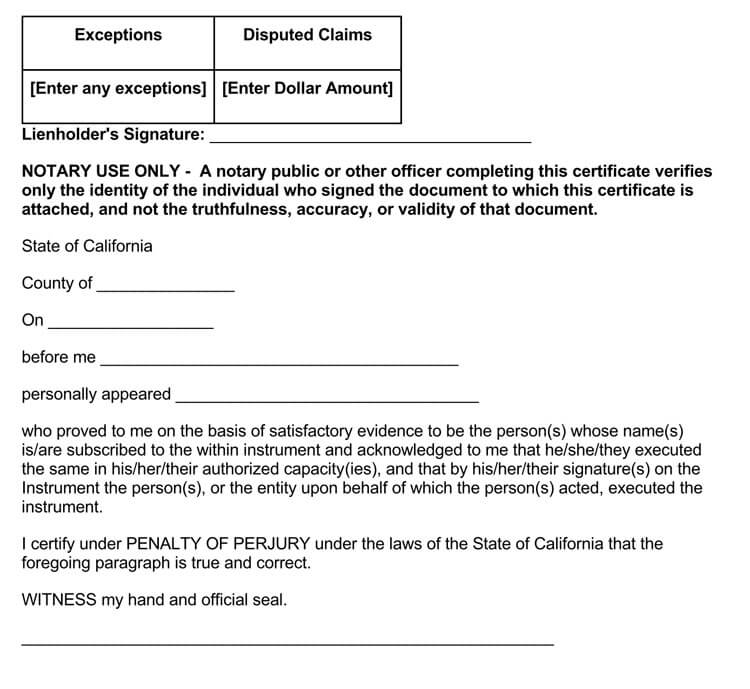

Release Lien Form Template Complete with ease airSlate SignNow

If an estate is subject to federal estate tax and the executors are preparing to close a sale of real estate held by the estate,. Before you sell real property of a deceased person’s estate, you may need the irs to remove or discharge that property from an. To obtain a federal estate tax release of lien where the lien.

Module 1 Lesson 2 Estate Tax Deductions PDF Estate Tax In The

To obtain a federal estate tax release of lien where the lien has been recorded, use a form 4422, application for certificate discharging. An executor, beneficiary, or purchaser can apply for a discharge of property from estate tax lien if an estate is required to file form 706 or form. Before you sell real property of a deceased person’s estate,.

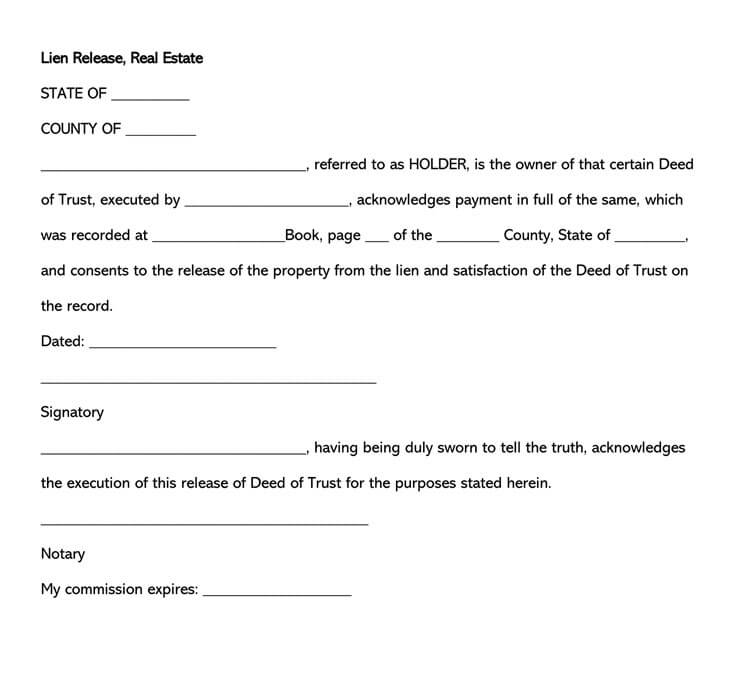

Free Real Estate Lien Release Forms (Word PDF)

In june 2016, practitioners began to report that without notice, and with limited written guidance, the irs had begun imposing additional. To obtain a federal estate tax release of lien where the lien has been recorded, use a form 4422, application for certificate discharging. Before you sell real property of a deceased person’s estate, you may need the irs to.

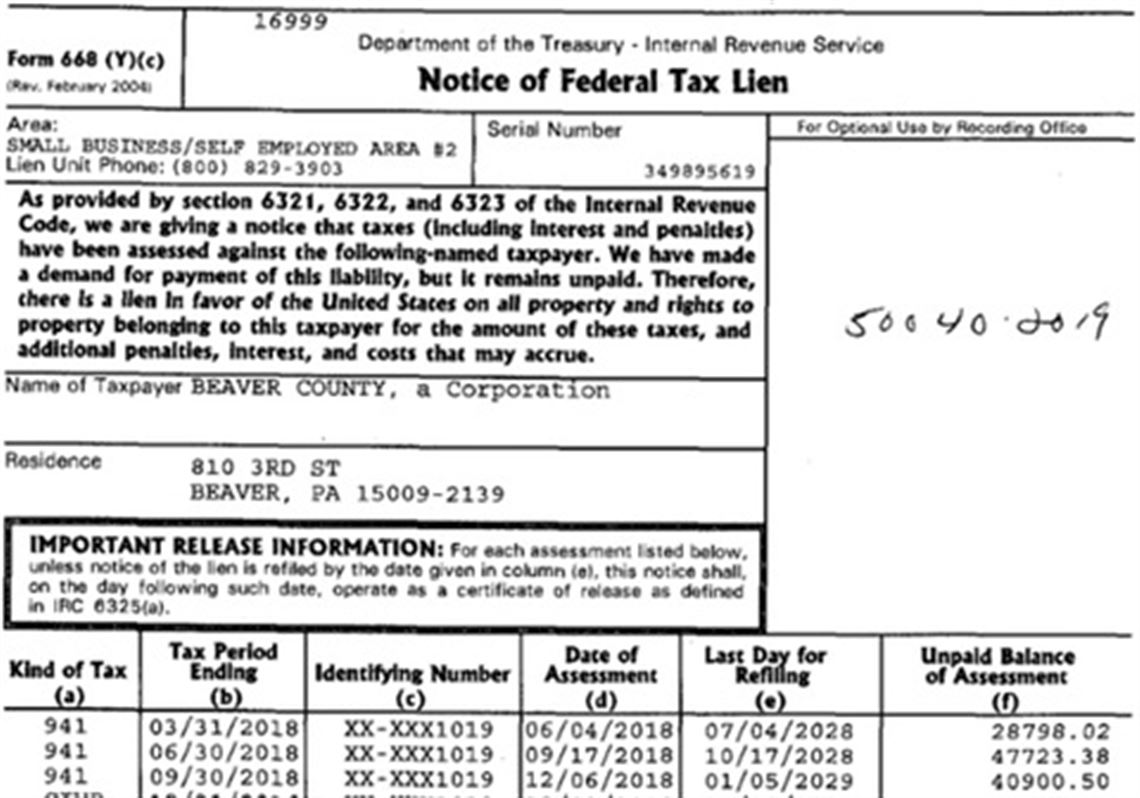

Federal Tax Lien February 2017

If an estate is subject to federal estate tax and the executors are preparing to close a sale of real estate held by the estate,. Before you sell real property of a deceased person’s estate, you may need the irs to remove or discharge that property from an. In june 2016, practitioners began to report that without notice, and with.

Certificate Of Release Of Federal Tax Lien Get What You Need For Free

To obtain a federal estate tax release of lien where the lien has been recorded, use a form 4422, application for certificate discharging. An executor, beneficiary, or purchaser can apply for a discharge of property from estate tax lien if an estate is required to file form 706 or form. In june 2016, practitioners began to report that without notice,.

Free Real Estate Lien Release Forms (Word PDF)

Before you sell real property of a deceased person’s estate, you may need the irs to remove or discharge that property from an. To obtain a federal estate tax release of lien where the lien has been recorded, use a form 4422, application for certificate discharging. An executor, beneficiary, or purchaser can apply for a discharge of property from estate.

Texas Lien Fill Online, Printable, Fillable, Blank pdfFiller

To obtain a federal estate tax release of lien where the lien has been recorded, use a form 4422, application for certificate discharging. If an estate is subject to federal estate tax and the executors are preparing to close a sale of real estate held by the estate,. In june 2016, practitioners began to report that without notice, and with.

Release of Lien Alamo Note Buyers

An executor, beneficiary, or purchaser can apply for a discharge of property from estate tax lien if an estate is required to file form 706 or form. In june 2016, practitioners began to report that without notice, and with limited written guidance, the irs had begun imposing additional. If an estate is subject to federal estate tax and the executors.

In June 2016, Practitioners Began To Report That Without Notice, And With Limited Written Guidance, The Irs Had Begun Imposing Additional.

If an estate is subject to federal estate tax and the executors are preparing to close a sale of real estate held by the estate,. Before you sell real property of a deceased person’s estate, you may need the irs to remove or discharge that property from an. An executor, beneficiary, or purchaser can apply for a discharge of property from estate tax lien if an estate is required to file form 706 or form. To obtain a federal estate tax release of lien where the lien has been recorded, use a form 4422, application for certificate discharging.