Reo Foreclosures Meaning

Reo Foreclosures Meaning - Learn how reo properties are acquired, sold, and what. Real estate owned, or reo, is a term used in the united states to describe a class of property owned by a lender—typically a bank,. Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful. Reo is a term for property owned by a lender after a failed foreclosure auction.

Reo is a term for property owned by a lender after a failed foreclosure auction. Learn how reo properties are acquired, sold, and what. Real estate owned, or reo, is a term used in the united states to describe a class of property owned by a lender—typically a bank,. Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful.

Real estate owned, or reo, is a term used in the united states to describe a class of property owned by a lender—typically a bank,. Reo is a term for property owned by a lender after a failed foreclosure auction. Learn how reo properties are acquired, sold, and what. Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful.

Foreclosures Information Mortgage Las Vegas

Real estate owned, or reo, is a term used in the united states to describe a class of property owned by a lender—typically a bank,. Learn how reo properties are acquired, sold, and what. Reo is a term for property owned by a lender after a failed foreclosure auction. Reo, short for real estate owned, refers to property owned by.

Foreclosures 910Lifestyle

Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful. Reo is a term for property owned by a lender after a failed foreclosure auction. Learn how reo properties are acquired, sold, and what. Real estate owned, or reo, is a term used in the united states to describe a.

Kauai Foreclosures, Kauai REO, August 2020

Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful. Reo is a term for property owned by a lender after a failed foreclosure auction. Learn how reo properties are acquired, sold, and what. Real estate owned, or reo, is a term used in the united states to describe a.

Kauai REO, Kauai Foreclosures, December, 2015 List.

Learn how reo properties are acquired, sold, and what. Reo is a term for property owned by a lender after a failed foreclosure auction. Real estate owned, or reo, is a term used in the united states to describe a class of property owned by a lender—typically a bank,. Reo, short for real estate owned, refers to property owned by.

REO Foreclosures HUD Homes City Group Properties

Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful. Real estate owned, or reo, is a term used in the united states to describe a class of property owned by a lender—typically a bank,. Learn how reo properties are acquired, sold, and what. Reo is a term for property.

What Are REO Foreclosures and How Do I Buy Them Cheap? PropertyOnion

Learn how reo properties are acquired, sold, and what. Real estate owned, or reo, is a term used in the united states to describe a class of property owned by a lender—typically a bank,. Reo is a term for property owned by a lender after a failed foreclosure auction. Reo, short for real estate owned, refers to property owned by.

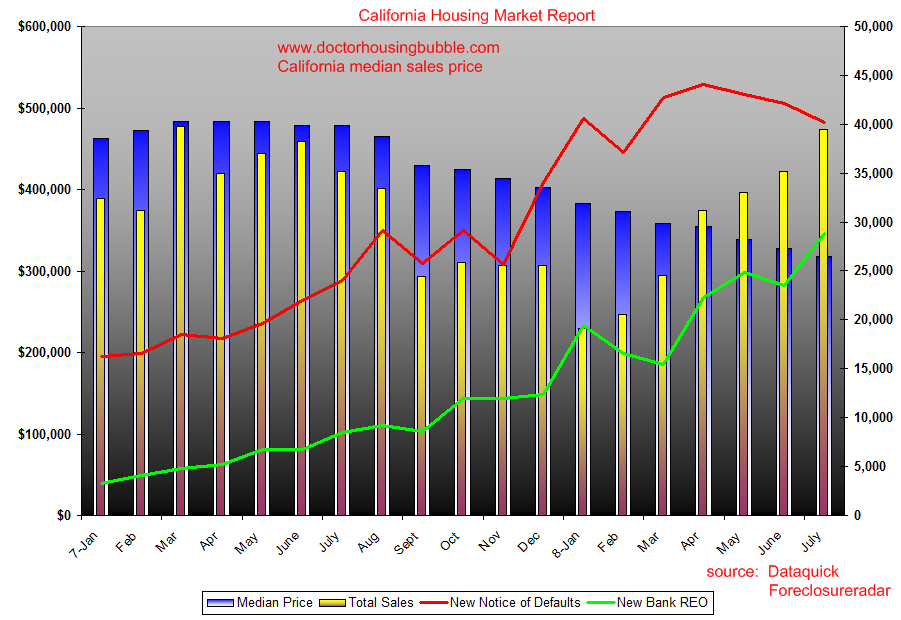

California Foreclosures Foreclosures and Charting the REO Trend. Lord

Learn how reo properties are acquired, sold, and what. Reo is a term for property owned by a lender after a failed foreclosure auction. Real estate owned, or reo, is a term used in the united states to describe a class of property owned by a lender—typically a bank,. Reo, short for real estate owned, refers to property owned by.

Explore Reo Meaning, Origin & Popularity

Reo is a term for property owned by a lender after a failed foreclosure auction. Learn how reo properties are acquired, sold, and what. Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful. Real estate owned, or reo, is a term used in the united states to describe a.

Foreclosure Center

Real estate owned, or reo, is a term used in the united states to describe a class of property owned by a lender—typically a bank,. Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful. Learn how reo properties are acquired, sold, and what. Reo is a term for property.

Types Of Foreclosures Two Common Foreclosures

Learn how reo properties are acquired, sold, and what. Real estate owned, or reo, is a term used in the united states to describe a class of property owned by a lender—typically a bank,. Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful. Reo is a term for property.

Real Estate Owned, Or Reo, Is A Term Used In The United States To Describe A Class Of Property Owned By A Lender—Typically A Bank,.

Reo is a term for property owned by a lender after a failed foreclosure auction. Learn how reo properties are acquired, sold, and what. Reo, short for real estate owned, refers to property owned by a lender—often a bank or mortgage company—after an unsuccessful.