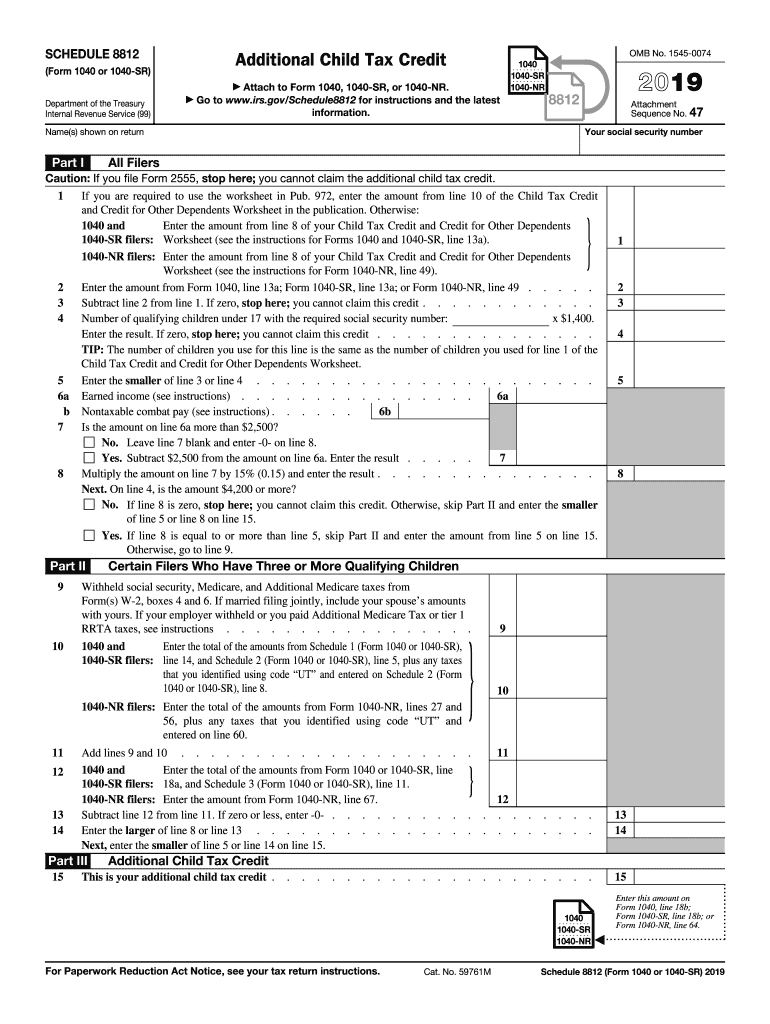

Schedule 8812 Line 5 Worksheet 2021

Schedule 8812 Line 5 Worksheet 2021 - 15% times the net amount of your earned. You can manually fill out the worksheet from. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. Your additional child tax credit will be computed for you using the following formula: Unfortunately, turbotax does not show the line 5 worksheet for their calculations.

Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. Your additional child tax credit will be computed for you using the following formula: Unfortunately, turbotax does not show the line 5 worksheet for their calculations. 15% times the net amount of your earned. You can manually fill out the worksheet from.

You can manually fill out the worksheet from. Your additional child tax credit will be computed for you using the following formula: Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. 15% times the net amount of your earned. Unfortunately, turbotax does not show the line 5 worksheet for their calculations.

Schedule 8812 Line 5 Worksheet

Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. 15% times the net amount of your earned. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Your additional child tax credit will be computed for you using the following formula: You.

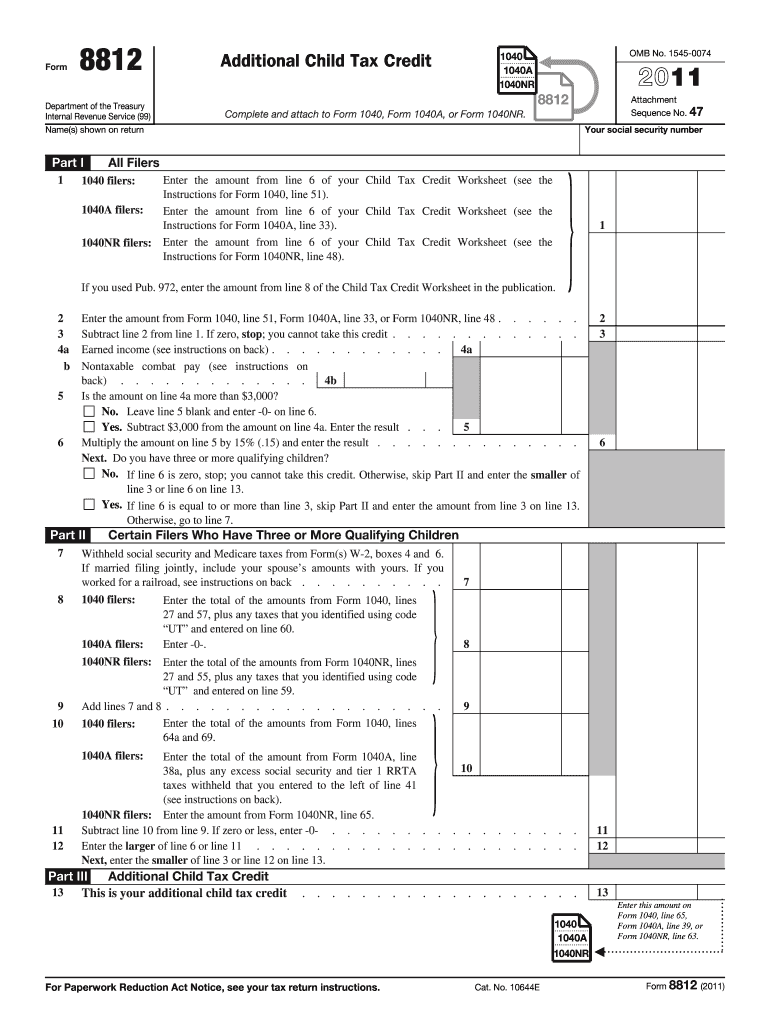

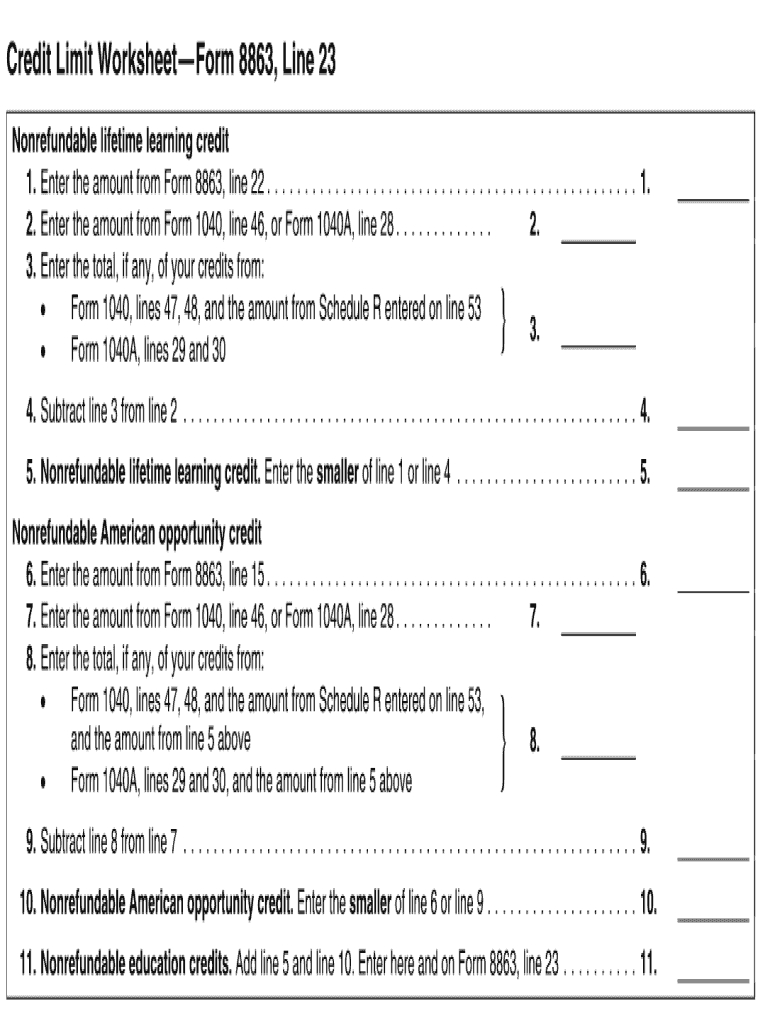

2021 Irs Form 8812 Credit Limit Worksheet A

You can manually fill out the worksheet from. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. 15% times the net amount of your earned. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. Your additional child tax credit will be.

8812 Credit Limit Worksheet A

Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. Your additional child tax credit will be computed for you using the following formula: You can manually fill out the worksheet from. 15% times the net amount of your earned. Unfortunately, turbotax does not show.

Form 8812 Line 5 Worksheet

Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. Your additional child tax credit will be computed for you using the following formula: 15% times the net amount of your earned. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. You.

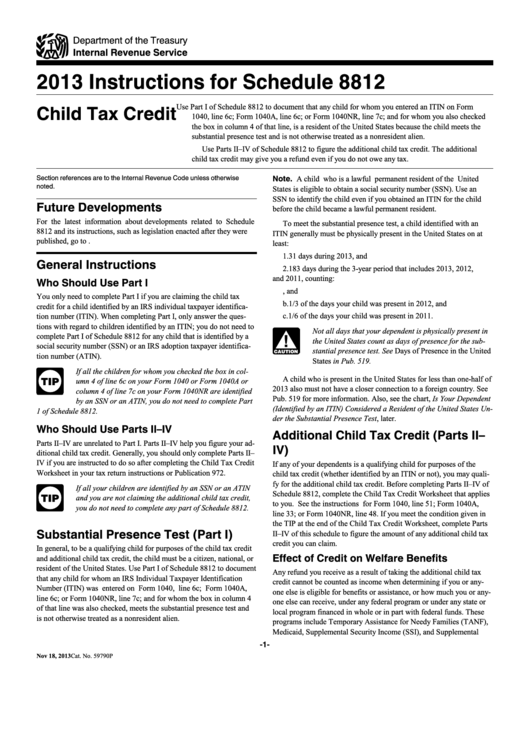

8812 for 20202024 Form Fill Out and Sign Printable PDF Template

Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Your additional child tax credit will be computed for you using the following formula: Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. You can manually fill out the worksheet from. 15%.

Schedule 8812 walkthrough (Credits for Qualifying Children and Other

You can manually fill out the worksheet from. Your additional child tax credit will be computed for you using the following formula: 15% times the net amount of your earned. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments.

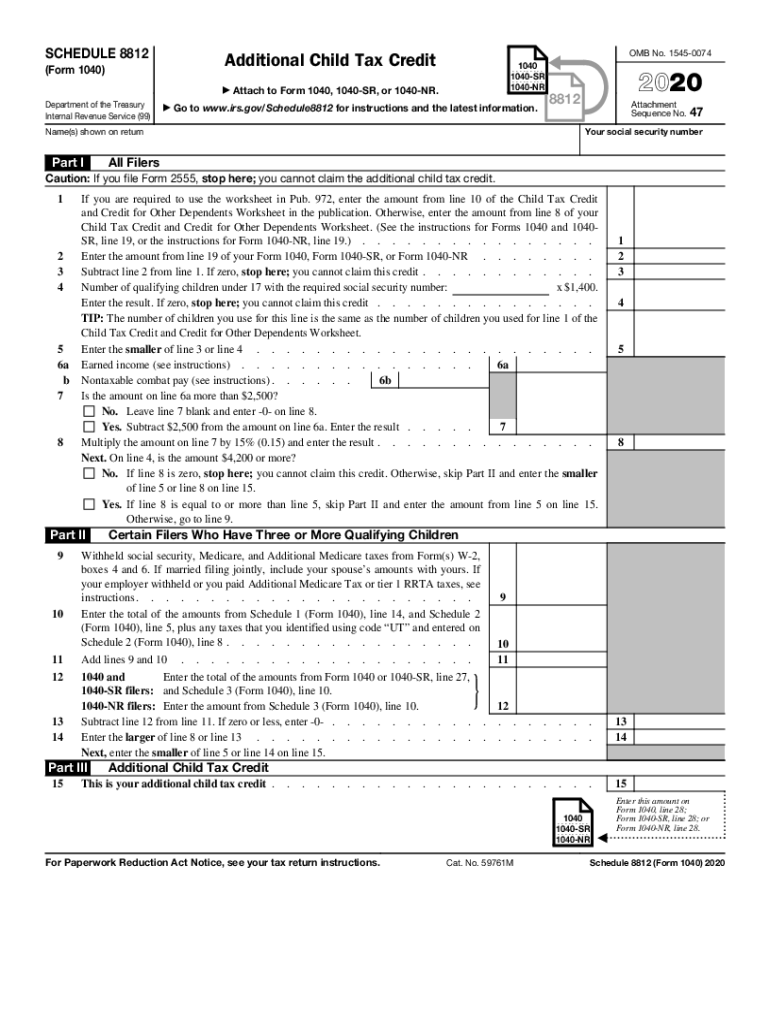

Fillable Online Child Tax Credit Form 8812 Line 5 worksheet Fax Email

Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Your additional child tax credit will be computed for you using the following formula: Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. You can manually fill out the worksheet from. 15%.

2021 Irs Form 8812 Line 5 Worksheet Form example download

15% times the net amount of your earned. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. You can manually fill out the worksheet from. Your additional child tax credit will be.

8812 Credit Limit Worksheet A

You can manually fill out the worksheet from. Your additional child tax credit will be computed for you using the following formula: Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure. 15%.

Schedule 8812 Line 5 Worksheet

15% times the net amount of your earned. Your additional child tax credit will be computed for you using the following formula: You can manually fill out the worksheet from. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments.

You Can Manually Fill Out The Worksheet From.

15% times the net amount of your earned. Unfortunately, turbotax does not show the line 5 worksheet for their calculations. Your additional child tax credit will be computed for you using the following formula: Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure.