South Carolina Tax Lien Sales

South Carolina Tax Lien Sales - By virtue of the tax execution, the delinquent tax collector for. Code of laws title 12 section 51. As of november 1, 2019, the scdor records state tax liens online in our comprehensive state tax lien registry at dor.sc.gov/lienregistry. The tax sale is held in accordance to s.c. The list of properties will be available online and in the local paper three. As of june 1, 2021, the scdew records state tax liens online in our comprehensive state lien registry. Properties will be sold in compliance with the south carolina code of laws and will be subject to the soldier’s and sailor’s relief act of 1940 as. The web page outlines the steps, deadlines, and requirements. The registry includes all unpaid. All information given is subject to change by the treasurer and the.

Learn how delinquent property taxes are levied, seized, and sold in south carolina. The web page outlines the steps, deadlines, and requirements. Final tax sale list 2024. The tax sale is held in accordance to s.c. Tax sale dates are december 10th and 11th, 2024. Properties will be sold in compliance with the south carolina code of laws and will be subject to the soldier’s and sailor’s relief act of 1940 as. As of november 1, 2019, the scdor records state tax liens online in our comprehensive state tax lien registry at dor.sc.gov/lienregistry. The registry includes all unpaid. As of june 1, 2021, the scdew records state tax liens online in our comprehensive state lien registry. Code of laws title 12 section 51.

As of june 1, 2021, the scdew records state tax liens online in our comprehensive state lien registry. Properties will be sold in compliance with the south carolina code of laws and will be subject to the soldier’s and sailor’s relief act of 1940 as. As of november 1, 2019, the scdor records state tax liens online in our comprehensive state tax lien registry at dor.sc.gov/lienregistry. The web page outlines the steps, deadlines, and requirements. All information given is subject to change by the treasurer and the. The 2025 delinquent tax sale is scheduled for october 27, 2025. Real estate list for 2024 tax sale mobile home list for. The tax sale is held in accordance to s.c. State of south carolina, county of lancaster. Tax sale dates are december 10th and 11th, 2024.

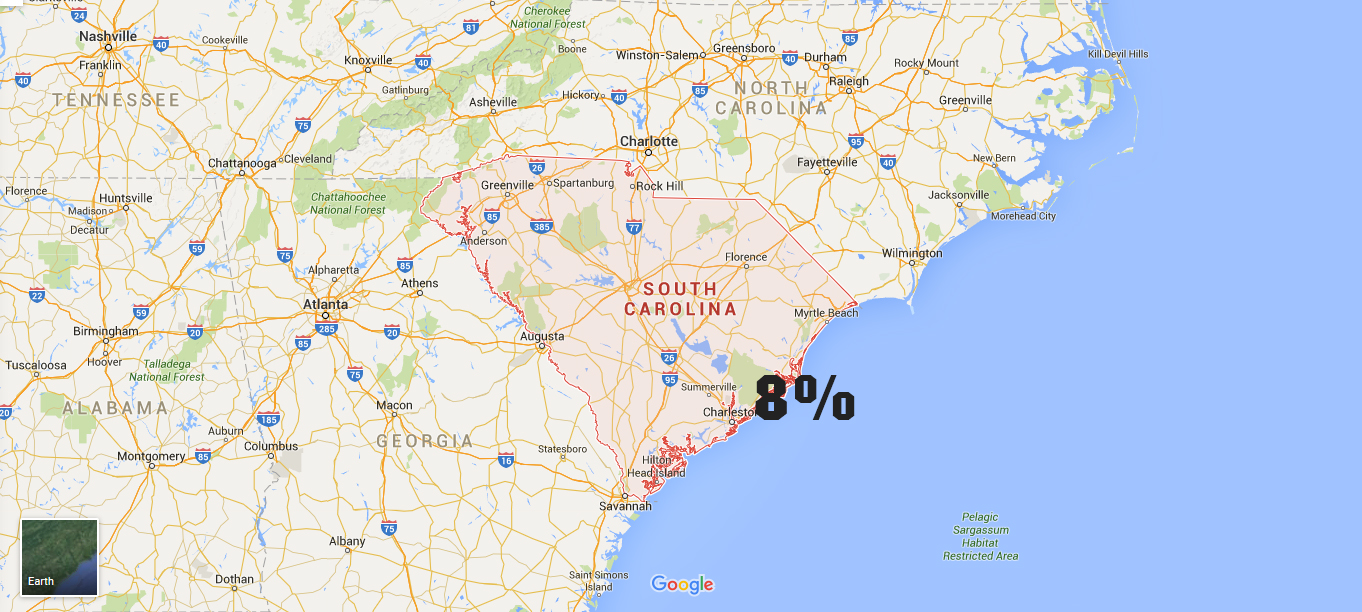

South Carolina Sales Tax Rates By City & County 2024

By virtue of the tax execution, the delinquent tax collector for. As of june 1, 2021, the scdew records state tax liens online in our comprehensive state lien registry. The tax sale is held in accordance to s.c. Real estate list for 2024 tax sale mobile home list for. Code of laws title 12 section 51.

Tax Lien Investing Tips Which States have tax sales in the next 30

As of june 1, 2021, the scdew records state tax liens online in our comprehensive state lien registry. Real estate list for 2024 tax sale mobile home list for. Tax sale dates are december 10th and 11th, 2024. Learn how delinquent property taxes are levied, seized, and sold in south carolina. All information given is subject to change by the.

South Carolina Tax Lien and Deed Investing Book Buying Real Estate

Learn how delinquent property taxes are levied, seized, and sold in south carolina. By virtue of the tax execution, the delinquent tax collector for. All information given is subject to change by the treasurer and the. State of south carolina, county of lancaster. The tax sale is held in accordance to s.c.

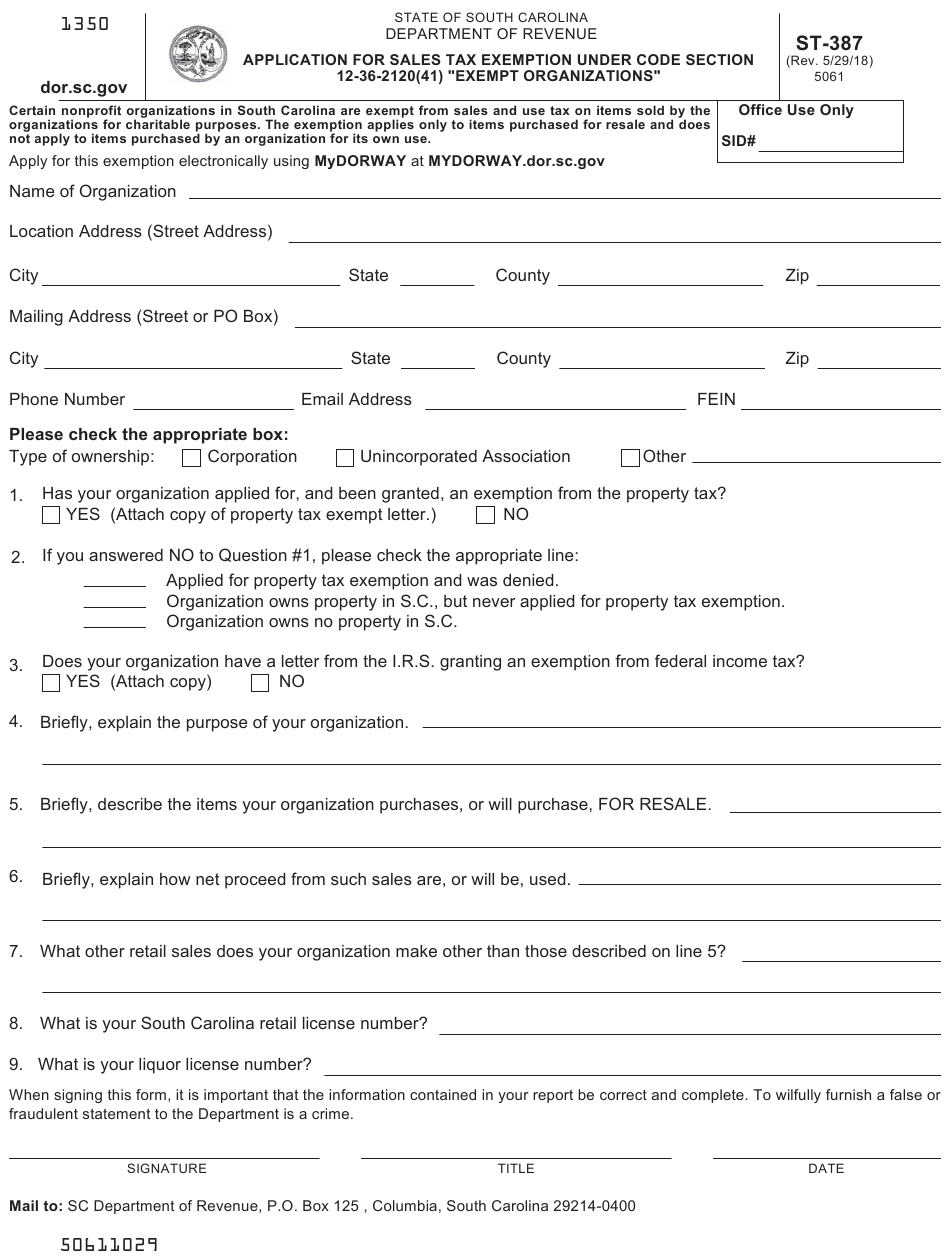

South Carolina State Sales Tax Exemption Form

Properties will be sold in compliance with the south carolina code of laws and will be subject to the soldier’s and sailor’s relief act of 1940 as. As of november 1, 2019, the scdor records state tax liens online in our comprehensive state tax lien registry at dor.sc.gov/lienregistry. By virtue of the tax execution, the delinquent tax collector for. The.

Sc property tax exemption Fill out & sign online DocHub

The list of properties will be available online and in the local paper three. Code of laws title 12 section 51. The web page outlines the steps, deadlines, and requirements. Learn how delinquent property taxes are levied, seized, and sold in south carolina. Tax sale dates are december 10th and 11th, 2024.

Tax Lien Investment In South Carolina Brightside Tax Relief

The registry includes all unpaid. Real estate list for 2024 tax sale mobile home list for. As of november 1, 2019, the scdor records state tax liens online in our comprehensive state tax lien registry at dor.sc.gov/lienregistry. State of south carolina, county of lancaster. The 2025 delinquent tax sale is scheduled for october 27, 2025.

South carolina tax exempt form st 9 Fill out & sign online DocHub

By virtue of the tax execution, the delinquent tax collector for. Final tax sale list 2024. The registry includes all unpaid. Properties will be sold in compliance with the south carolina code of laws and will be subject to the soldier’s and sailor’s relief act of 1940 as. The web page outlines the steps, deadlines, and requirements.

NC Tax Lien Sales Essential Insights for Investors

Learn how delinquent property taxes are levied, seized, and sold in south carolina. The web page outlines the steps, deadlines, and requirements. Tax sale dates are december 10th and 11th, 2024. Properties will be sold in compliance with the south carolina code of laws and will be subject to the soldier’s and sailor’s relief act of 1940 as. The 2025.

South Carolina Sales Tax Tax Rate Guides Sales Tax USA

Properties will be sold in compliance with the south carolina code of laws and will be subject to the soldier’s and sailor’s relief act of 1940 as. By virtue of the tax execution, the delinquent tax collector for. The tax sale is held in accordance to s.c. The list of properties will be available online and in the local paper.

South Carolina Tax Liens

All information given is subject to change by the treasurer and the. Tax sale dates are december 10th and 11th, 2024. The tax sale is held in accordance to s.c. Learn how delinquent property taxes are levied, seized, and sold in south carolina. Code of laws title 12 section 51.

The Tax Sale Is Held In Accordance To S.c.

As of november 1, 2019, the scdor records state tax liens online in our comprehensive state tax lien registry at dor.sc.gov/lienregistry. The list of properties will be available online and in the local paper three. By virtue of the tax execution, the delinquent tax collector for. The 2025 delinquent tax sale is scheduled for october 27, 2025.

All Information Given Is Subject To Change By The Treasurer And The.

Real estate list for 2024 tax sale mobile home list for. Properties will be sold in compliance with the south carolina code of laws and will be subject to the soldier’s and sailor’s relief act of 1940 as. The web page outlines the steps, deadlines, and requirements. Code of laws title 12 section 51.

Final Tax Sale List 2024.

State of south carolina, county of lancaster. Learn how delinquent property taxes are levied, seized, and sold in south carolina. Tax sale dates are december 10th and 11th, 2024. As of june 1, 2021, the scdew records state tax liens online in our comprehensive state lien registry.